Construction work is now underway for the world’s largest sailing cruise ships which are being developed for Accor’s Orient Express to provide a new level of luxury in cruising. The first steel has been cut for the first of two ships on order in France and today additional details were announced for the vessel’s propulsion system.

French hospitality company Accor Group announced its intent to enter the cruise business in January 2023 signing a letter of intent with Chantiers de l’Atlantique for the construction of two of the world’s largest sailing ships. The order was confirmed last fall and on March 28 the first steel was cut for the vessel which will be named Orient Express Corinthian. She is the first of two ships ordered for the Orient Express brand and the company also has an option for two additional vessels.

“This ship, a technological marvel which will revolutionize the world of luxury cruising, will represent the quintessence of Chantiers de l’Atlantique’s know-how and will be a benchmark from an environmental point of view,” said Arnaud Le Joncour, Commercial Director of Chantiers de l’Atlantique and Program Director during the steel cutting ceremony.

Known as Silenseas, the concept was first profiled in 2018 by Chantiers de l’Atlantique. The order calls for vessels that will measure approximately 722 feet (220 meters) and be 22,300 gross tons. They will have 54 luxury suites, with an average of 70 square meters of space. There will be a monumental 900 square meter Presidential Suite as well as two swimming pools, two restaurants, and a speakeasy bar.

During the ceremonial steel cut last month in France for the cruise sail cruise ship (Chantiers)

The ships will be the first equipped with the SolidSail system which will consist of three 1,500 square meter rigid sails. The masts will be mounted on three separate tilting and rotating balestron rigging to increase the efficiency of sail propulsion.

Brunvoll reports that it will be supplying a propulsion system consisting of a twin-screw configuration with a controllable pitch propeller with a diameter of 3.9 meters (12.7 feet). The propellers will have direct electrical drive, where Brunvoll will supply their Thrust-OD Box, which works as a thrust bearing with a hydraulic system for the controllable pitch propellers. The propellers are designed to be fully feathering to limit drag while sailing.

“This project confirms Brunvoll being one of the front-runners concerning propulsion design and main propulsion efficiency where our skilled hydrodynamicists have been working closely together with Chantiers de l’Atlantique on the development and assessment of different propulsion solutions for these spectacular vessels,” said Arnfinn Brautaset, Sales Manager at Brunvoll.

Last fall it was reported that Wärtsilä will supply its new 25DF dual-fuel (LNG) engine for the new sail-assisted cruise ships. The vessels will need an alternate power system from when sailing is not possible and to meet the “safe return at sea” regulations. Wärtsilä reported that its engines would feature a two-stage turbocharging system, common rail fuel injection, and cylinder-wise combustion control. This will enable unparalleled power density and efficiency across the full operating range, delivering low fuel consumption and reduced emissions.

Ingeteam will design and manufacture five motors and five converters for each vessel’s propulsion systems. Two motors will drive the main propulsion plus the three transverse thrusters, together with the frequency converters for all of them, which will provide optimum onboard comfort thanks to their low vibration and noise. Ingeteam said it will also develop two propulsion remote controls, to enable maximum propulsion management and efficiency with SolidSail technology, and also provide connections for shore power.

The first cruise ship, Orient Express Corinthian, is scheduled for delivery in March 2026. The second ship is scheduled for September 2027. Accord’s decision to enter the luxury cruise market follows similar efforts by Four Seasons which has ordered two yacht cruise ships from Fincantieri and Aman which is building a luxury yacht cruise ship with T. Mariotti. The Ritz Carlton Yacht Collection launched its first ship in 2023 and is building two larger cruise ships at Chantiers de l’Atlantique.

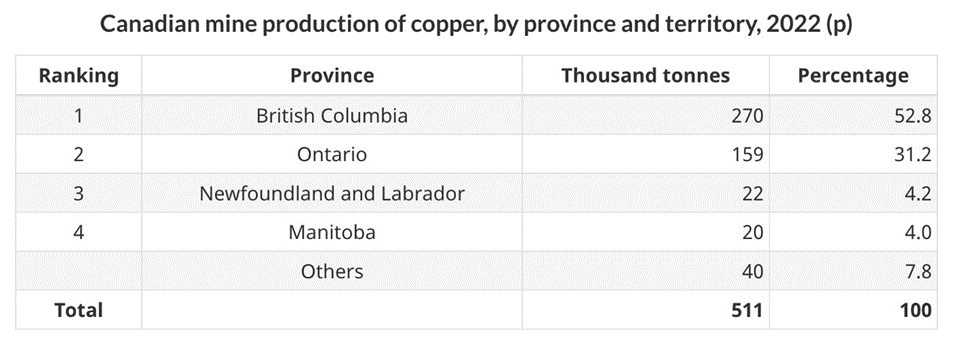

Source: Natural Resources Canada

Source: Natural Resources Canada