Bloomberg News | September 24, 2024

Image courtesy of Liebherr.

Fortescue Ltd., the world’s fourth-biggest iron ore miner, will pay $2.8 billion to replace two-thirds of its fleet of haulage trucks and equipment in Western Australia with electric versions, as it seeks to cut diesel consumption and meet ambitious emissions-reduction targets.

The miner will buy 475 emissions-free machines, including 360 autonomous battery-electric trucks, from Germany’s Liebherr Group, it said in a statement Wednesday. The fleet, which was developed using Fortescue’s battery technology, will service its sprawling iron ore operations in the remote Pilbara region and is aimed at reducing costs in the longer term.

Perth-based Fortescue, led by executive chairman and billionaire Andrew Forrest, has plans to decarbonize its entire iron ore mining operations by 2030. Reducing industrial pollution from mining is a significant challenge, with Fortescue consuming 631 million liters of diesel last financial year alone.

“You will watch the breath sucked out from CEOs’ chests when they realize this is a $2.8 billion order,” Forrest said in a phone interview after the announcement. “This is the future of heavy industry. And it’s zero emissions.”

Fortescue shares surged as much as 6.4% in Sydney after the announcement, and closed 4.7% higher to A$18.85 apiece. Since reaching a record high early this year, they have tumbled about 37%, as falling demand in China for iron ore has pressured prices of the steelmaking material.

The deal with Liebherr also includes purchasing 55 electric excavators and 60 battery-powered dozers, the company said in its statement, adding that the technology “will be available to the rest of the mining industry in the near future.”

Emissions from “stationary energy”, which includes emissions from direct combustion of fuels in mining, accounts for more than 20% of Australia’s air pollution, according to the government. Pollution from the global industry sector is continuing to increase faster than any other segment, according to researcher Systems Change Lab.

Earlier this month, fellow iron ore major Rio Tinto Group announced it would develop seed farms in Australia to test biofuel as a replacement to diesel.

(By Paul-Alain Hunt)

Reuters | September 25, 2024 |

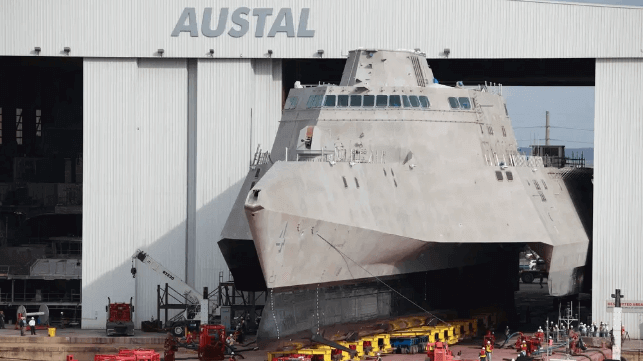

Cat Dynamic Energy Transfer system prototype under development at Caterpillar Tucson Proving Ground. Credit: Caterpillar

BHP Group said on Thursday it plans to test US-based equipment manufacturer Caterpillar’s new technology, which transfers energy to diesel-electric and battery-electric large mining trucks while they are working on a mine site.

Caterpillar launched its Cat Dynamic Energy Transfer (DET) system earlier this month, saying that the use of this technology would lead to lower operating costs for miners and a reduction in greenhouse gas emissions

The DET system can also charge the batteries of electric trucks while they are under operation, providing extra speed and upgraded efficiency.

Mining giant BHP would become the first to try this new system, starting planned trials at its iron ore and copper businesses, including at its Escondida operations in Chile.

BHP, in 2021, had announced a collaboration with Caterpillar to work towards zero-emission mining truck deployment at its sites to cut back on its emissions of operational greenhouse gas.

(By Rajasik Mukherjee; Editing by Alan Barona)