KR's Latest Decarbonization Magazine Reveals Key Decarbonization Insights

[By: Korean Register]

KR (Korean Register) has released insightful analysis of Carbon Intensity Indicator (CII) ratings across its fleet in the fall edition of KR Decarbonization Magazine, offering crucial insights for maritime companies navigating the industry's green transition.

First launched in 2022, the KR Decarbonization Magazine is a quarterly publication designed to provide clients with timely insights into decarbonization strategies. The magazine aims to assist the maritime sector in navigating increasingly stringent greenhouse gas regulations introduced by the International Maritime Organization (IMO) and the European Union (EU).

The latest issue provides an in-depth analysis of CII ratings across KR-classed vessels, revealing industry-wide decarbonization trends. It also includes a comprehensive overview of cutting-edge advancements in liquefied hydrogen carriers.

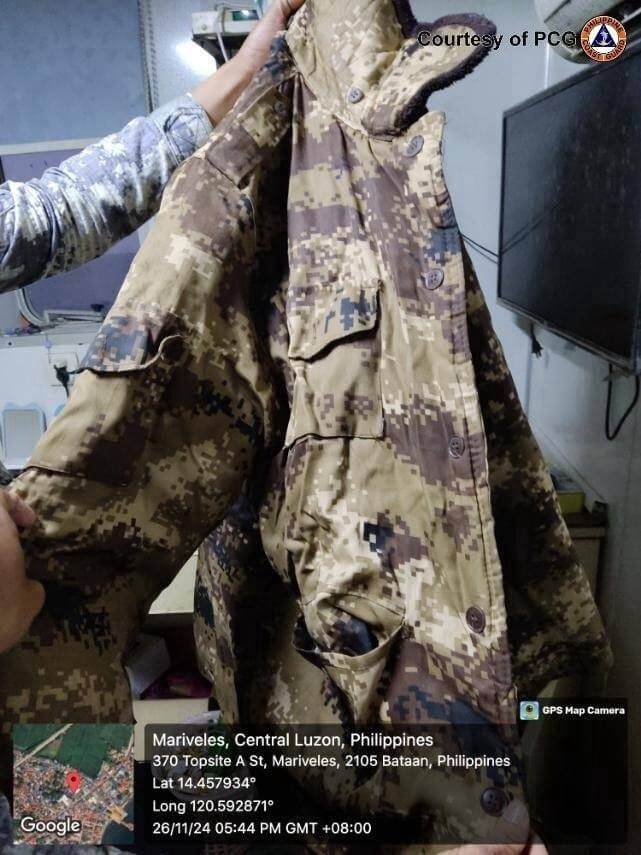

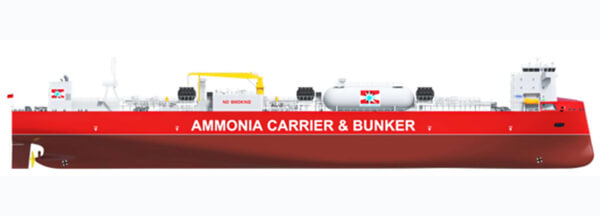

The issue features an exclusive interview with HD Hyundai Heavy Industries' Executive Vice President RHEE Sangkee on the development of ammonia-powered vessels. RHEE outlines the significant technical advances in ammonia engine development, safety protocols, and exhaust gas aftertreatment systems. His insights provide shipping companies with essential guidance on ammonia's viability as a marine fuel, including key considerations for vessel operations, current development milestones, and future implementation timelines. The interview offers valuable perspectives for maritime stakeholders considering ammonia-powered solutions as part of their decarbonization strategy.

SONG Kanghyun, Head of KR’s Decarbonization and Ship R&D Center, commented, “With the IMO’s mid-term measures advancing rapidly, as seen at the 28th MEPC meeting, the time has come for the industry to adopt practical and actionable strategies. KR remains committed to supporting the maritime industry in addressing the decarbonization challenges through proactive and innovative approaches.”

The full magazine is available on the dedicated KR Decarbonization Magazine website (http://kr-decarbonization.co.

The products and services herein described in this press release are not endorsed by The Maritime Executive.

Auramarine and Quadrise Join Forces to Support Maritime Decarbonisation

[By: Auramarine]

Auramarine Ltd., the leading fuel supply systems pioneer for the marine and other industries and Quadrise Plc, the supplier of innovative clean energy solutions have announced a collaboration agreement to develop innovative solutions that will support maritime decarbonisation The purpose of the co-operation is to leverage the expertise of both companies in emulsion fuels, biofuels and fuel supply systems, providing innovative solutions for marine customers that support them in meeting decarbonisation and sustainability targets.

Quadrise will provide its expertise in MSAR®; (Multiphase Superfine Atomized Residue) and bioMSAR™ fuels. MSAR®; is a more environmentally friendly emulsion fuel that offers a lower-cost and is a cleaner alternative to heavy fuel oil (HFO) used in the marine and power generation industries. The Quadrise oil-in-water emulsion technology blends residual oils, water and additives to create a lower cost synthetic fuel oil that is more efficient. bioMSAR™ is the renewable biofuel version of MSAR®; incorporating sustainable components such as water-based glycerin and other lower-cost biofuels.

Auramarine will provide its expertise in designing and installing fuel supply systems (including Quadrise’s blend-on-board technology) for the conversion of marine vessels to support the use of Quadrise fuels. Auramarine’s vast experience in retrofits and modular fuel supply systems will enable it to find markets for Quadrise’s fuel technology on a wider scale and across multiple vessel types. Auramarine’s retrofit solutions do not require dry docking which makes implementation easier and more efficient, which provides further value to ship owners.

As part of the co-operation, Quadrise and Auramarine will work together to combine their resources and networks, jointly developing and promoting new sales opportunities that offer a comprehensive value proposition to the shipping industry to help them comply with new environmental regulations.

Commenting on the development, John Bergman, CEO of Auramarine, said: "We are pleased to announce this collaboration agreement with Quadrise, who are driving a positive shift in the marine sector with their proven emulsion technology to improve efficiency, lower emissions and supply new sustainable fuels. The current uptake of future fuels needs to be accelerated to meet decarbonisation targets within the maritime industry and new, viable innovations are essential to delivering this. By combining our strengths and expertise, we are confident that this partnership will drive further innovation and create significant value for our customers and other stakeholders.”

Jason Miles, CEO of Quadrise, continued: "We are delighted to sign this collaboration agreement with Auramarine, who have extensive experience and an enviable track record in the design, supply and servicing of fuel systems for conventional and future fuels. This collaboration is in line with our strategy of working with new channel partners to decarbonise shipping, adding the necessary expertise, network and resources of Auramarine in marine fuel systems to accelerate the implementation of MSAR®; and bioMSAR™ fuel conversions globally."

The products and services herein described in this press release are not endorsed by The Maritime Executive.

Value Group New €2 Million Investment from Energy Transition Fund Rotterdam

[By: Value Group]

Rotterdam-based sustainability innovator Value Group (Value Maritime and Value Carbon) announces that it has secured Energietransitiefonds Rotterdam (‘ETF-R’) as an investor. The fund’s investment will drive the further development of the Value Hub for CO2 offloading and processing in Rotterdam. The technology captures CO2, stores it, and allows it to be effectively reused or stored elsewhere. In the Port of Rotterdam, the maritime industry benefits from emissions reduction enabled by the technology.

Carbon care

Value Maritime, part of the Value Group, is the innovative developer and installer of one of the first commercially viable hybrid CO2 capture and exhaust gas cleaning systems, known as Filtree. This system not only captures and stores CO2 but also cleans sulphur, ultra-fine particulate matter, and CO2 from ships’ exhaust emissions as well as oil residue and particulate matter from the vessels’ washing water. As a result, the Filtree System supports compliance with current and future environmental regulations.

The key to the Filtree System is its integrated carbon capture feature which allows ships to store the CO2 they collect onboard in dedicated fixed tanks or non-fixed battery containers. These onboard storage facilities can then be sustainably offloaded in port for reuse or further storage, managed by Value Maritime’s sister company, Value Carbon.

Value Group Co-Founder and Director Maarten Lodewijks says, “With InnovationQuarter as a new shareholder, Value Group gains a strong strategic partner to accelerate the development of our Value Hub in Rotterdam for CO2 offloading and processing. This partnership not only strengthens the realisation of this Value Hub as a blueprint for future Value Hubs but also drives the ongoing expansion and innovation of our patented Carbon Capture technology.”

Accelerating CO2 handling

With ETF-R’s €2 million investment and further active support from InnovationQuarter, Value Group aims to accelerate the development of its Value Hub in Rotterdam. The Value Hub will manage the CO2 offloading from ships and ensure efficient, sustainable processing.

Meanwhile, a pilot programme in Westland greenhouses demonstrates the technology's practical application. Captured CO2 is released during the day to enhance photosynthesis and plant growth, showcasing a sustainable solution for agriculture.

InnovationQuarter/ ETF-R Senior Investment Manager Reinaud Struycken says, “We are very happy to be able to invest in a sustainable company that supports the reduction of CO2 emissions in Rotterdam and beyond. Their innovative 'catch & release' technology perfectly aligns with our vision for a cleaner and more sustainable Rotterdam. They serve as a prime example of how carbon capture and storage technology can benefit this and other sectors. ETF-R is looking forward to helping Value Group grow.”

Value Group

The Value Group unites two innovative sister companies—Value Maritime and Value Carbon—working together to drive decarbonisation across shipping and industry.

Since 2017, Value Maritime has been at the forefront of maritime sustainability, helping dozens of shipowners and operators boost competitiveness through significant emissions reductions and cost savings. Its cutting-edge technology is designed to reduce the environmental footprint of shipping, contributing to a more sustainable future for the entire maritime industry. The goal is to help transform the way the sector operates, combining cleaner solutions with tangible financial benefits.

Meanwhile, Value Carbon focuses on land-based carbon management, addressing the entire carbon value chain. From carbon capture and handling to innovative reuse strategies, it aims to create efficient systems for storage and “catch and release” initiatives, all with a focus on generating both environmental and financial dividends. Together, the mission is clear: to help our clients achieve valuable emission reductions through sustainable, innovative technologies, backed by a team that is committed to making a real impact.

Rotterdam Energy Transition Fund

The ‘Energietransitiefonds Rotterdam’ is a €100 million investment fund of the City of Rotterdam. The fund finances innovative companies and large sustainable projects that can contribute to Rotterdam's energy transition and circular economy. With the fund, the city aims to reduce CO2 emissions, improve air quality and reduce the use of raw materials. InnovationQuarter acts as fund manager for the Rotterdam Energy Transition Fund.

InnovationQuarter

InnovationQuarter is the regional economic development agency for South Holland. InnovationQuarter manages funds worth more than €300 million. We finance disruptive startups and scale-ups that contribute to a cleaner, smarter, and healthier world. High risk, but also high impact.

The products and services herein described in this press release are not endorsed by The Maritime Executive.

.jpg)