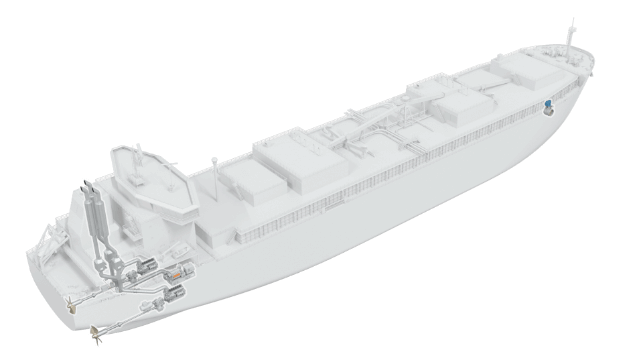

Wärtsilä Propulsion Package to Power Largest Methanol Cement Carrier Vessel

[By: Wärtsilä]

Technology group Wärtsilä’s focus on supporting the marine industry’s efforts to decarbonise operations continues to drive concrete steps forward. The latest order is to supply a complete propulsion package for a 38,000 DWT methanol-ready cement carrier vessel. When built, this will be the world’s largest vessel of its type, and the first with a methanol-ready notation. The order has been placed by NovaAlgoma, a joint venture between the Italian Swiss-based, Nova Marine Group and the Canadian Algoma Central Corporation. The ship is being built at the Zhejiang Xinle Shipbuilding Co.,Ltd, and is expected to be launched in late 2026. The order was booked by Wärtsilä in Q4 2024.

“This highly valuable new entry demonstrates the Group’s fleet development strategy and aims to address the significant increase in cement demand,” says Vincenzo Romeo, CEO of Nova Marine Group. “This will be the largest and most eco-friendly cement carrier ever built and is a tangible sign of our strong efforts towards a green fleet. Having Wärtsilä as the technology and solution provider supports our fleet’s effective transition towards decarbonisation.”

The Wärtsilä scope of supply includes two Wärtsilä 32 engines, one Wärtsilä 25 auxiliary engine, two gearboxes, two controllable pitch propellers, one tunnel thruster, three selective catalytic reduction (SCR) exhaust after-treatment systems, the propulsion control system, two shaft generators (PTO/PTI) and engine accessory items. The equipment is scheduled for delivery commencing in November 2025.

"Nova and Wärtsilä share a joint commitment to decarbonise shipping operations within the maritime industry,” comments Roger Holm, President of Wärtsilä Marine & Executive Vice President at Wärtsilä Corporation. “With this integrated package we are taking a holistic approach to the operation of this innovative vessel. This will allow us to support Nova with its sustainability goals around minimising emissions and ensuring the most efficient energy utilisation during operations.”

The Wärtsilä 32 engine is the result of the company’s long-established expertise. It is designed for efficient and easy maintenance in combination with long maintenance-free operating periods. It’s excellent fuel flexibility means it can easily be upgraded to operate with methanol. The Wärtsilä 25 engine’s modularity then offers maximised flexibility, while the engine’s efficiency and fuel economy deliver minimised emissions. In addition, Wärtsilä’s propulsion solutions deliver high efficiency, helping vessels to achieve their compliance targets. This is achieved in combination with a gearbox that reduces propeller speed meaning that a larger propeller diameter is utilised to maximise propulsive efficiency.

The products and services herein described in this press release are not endorsed by The Maritime Executive