Gold price steady as Trump’s remarks fan uncertainty across markets

Bloomberg News | January 6, 2025

Gold has a bright future under Trump administration. Credit: Adobe Stock by couperfield.

Gold was steady as traders weighed risks to global trade under the incoming US administration, with President-elect Donald Trump denying a report he might moderate plans for across-the-board tariffs.

Bullion held near $2,634 an ounce, after ending slightly lower in the previous two sessions. The uncertainty about the hotly anticipated policy moves helped lift 10-year Treasuries yields to the highest level since May on Monday, while the dollar fell. That was mixed for gold, which typically faces a headwind from higher yields, but support from a weaker US currency.

Bullion surged 27% last year in a record-breaking run that was propelled in part by US monetary easing, though the rally lost momentum after Trump’s US election victory buoyed the dollar. Bulls are now facing the prospect of less impressive gains this year, with Goldman Sachs Group Inc. pushing back a target for gold hitting $3,000 to mid-2026 on expectations for fewer Federal Reserve cuts.

Against that backdrop, hedge funds’ bullish wagers fell to the lowest in six months, Commodity Futures Trading Commission data showed.

Spot gold eased 0.1% to $2,633.61 an ounce at 8:23 a.m. in Singapore. The Bloomberg Dollar Spot Index was flat, after a 0.6% loss in the previous session. Silver, palladium and platinum were steady.

Traders are looking ahead to Friday’s US jobs report, which is expected to show a moderating yet still-healthy labor market. The data are unlikely to alter the view that the Fed will take a more cautious approach to cutting rates in 2025 amid renewed concerns about inflation. Minutes of the Fed’s December meeting are also due this week.

(By Sybilla Gross)

Illegal gold mining forces Ghana to close water treatment plant

Bloomberg News | January 7, 2025 |

Credit: AeroVision Gh | Shutterstock

Ghana’s top water utility shut down the treatment plant that serves its biggest mining hub following a surge in illegal gold mining that’s polluted the river that supplies the facility.

Ghana Water Co. last week shuttered the plant that produces 75% of potable water for Tarkwa and its neighboring areas in the country’s west “due to massive galamsey activities on River Bonsa,” it said Tuesday, using a local term for illegal gold mining.

Surging gold prices have spurred an illicit rush in Africa’s biggest producer of the metal, enabled by lax regulations. Major operators such as the AngloGold Ashanti Plc, Gold Fields Ltd. and Newmont Corp run large-scale operations in Ghana, but it’s the largely informal, small-scale gold-mining sector that authorities blame for the environmental damage.

The ecological burden became a campaign issue in the run-up to Dec. 7 elections that unseated the incumbent administration at the constituency and national levels. Ghana is inaugurating its new president, John Mahama, later Tuesday.

(By Yinka Ibukun)

Nippon Steel’s thwarted bid sets up tougher rivalry with Chinese mills

Bloomberg News | January 7, 2025 |

Steel mill in Hebei province, China. Stock image.

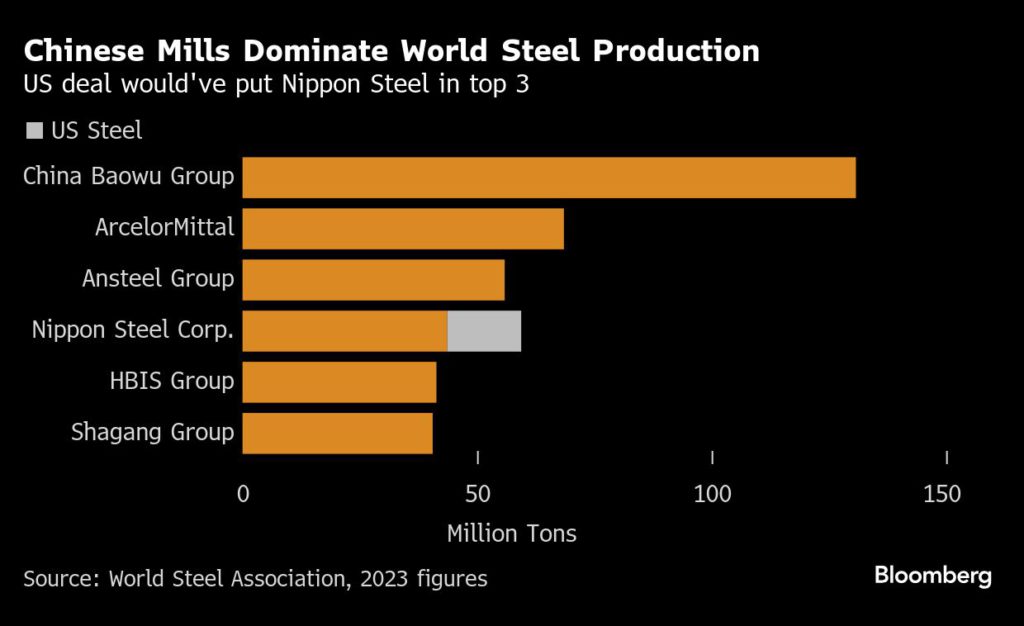

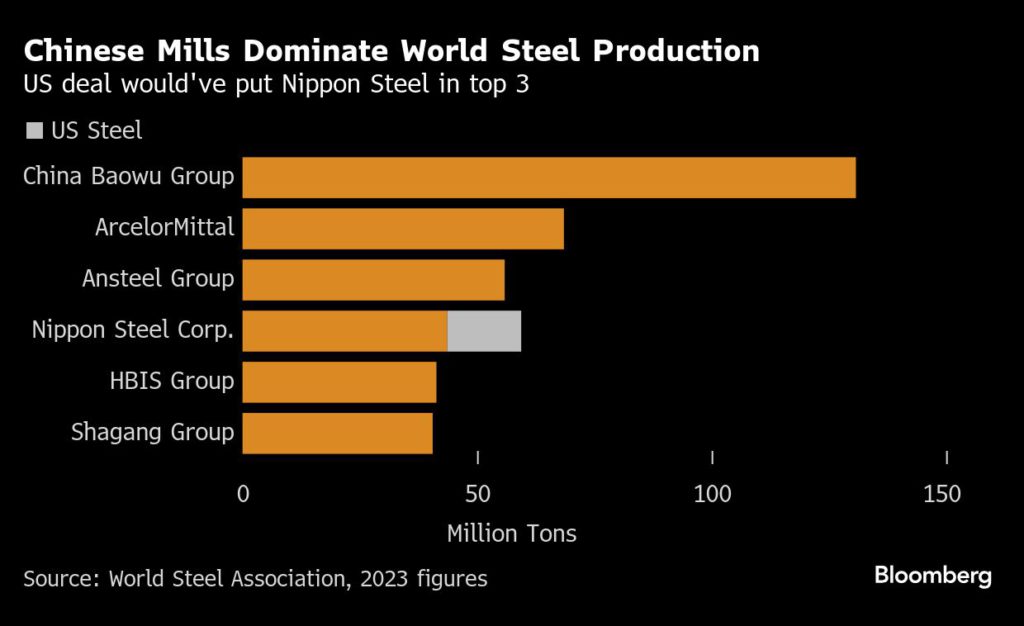

Nippon Steel Corp.’s thwarted bid to expand in the US could mean tougher competition for Chinese mills in an already saturated global market.

Creating an entity to compete more effectively with China, the world’s biggest producer and consumer of steel, was touted as a key rationale behind the Japanese firm’s proposal to purchase United States Steel Corp. The two companies have jointly filed lawsuits in a last-ditch effort to preserve the deal, which was blocked by President Joe Biden last week.

But buying US Steel would have funneled billions of dollars of Japanese investment into a country that China doesn’t really sell to. If its legal maneuvers fail, Nippon Steel will be obliged to find other other avenues for growth that could involve funding a more intense rivalry in markets that Chinese mills do care about.

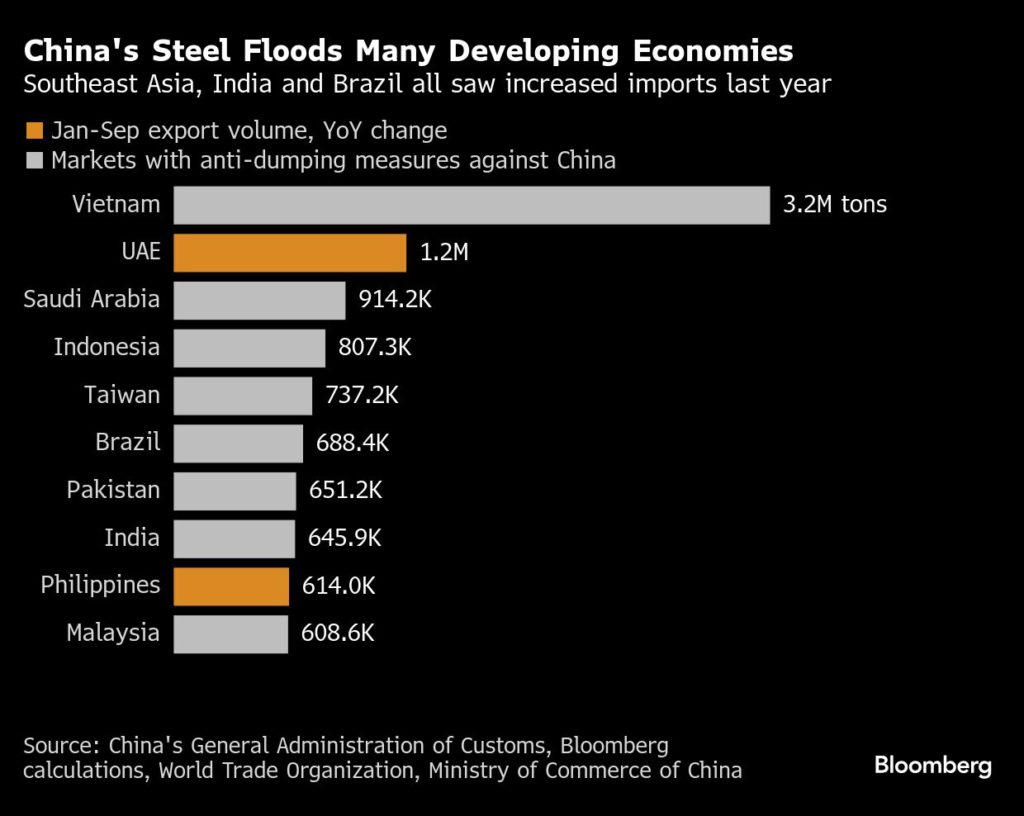

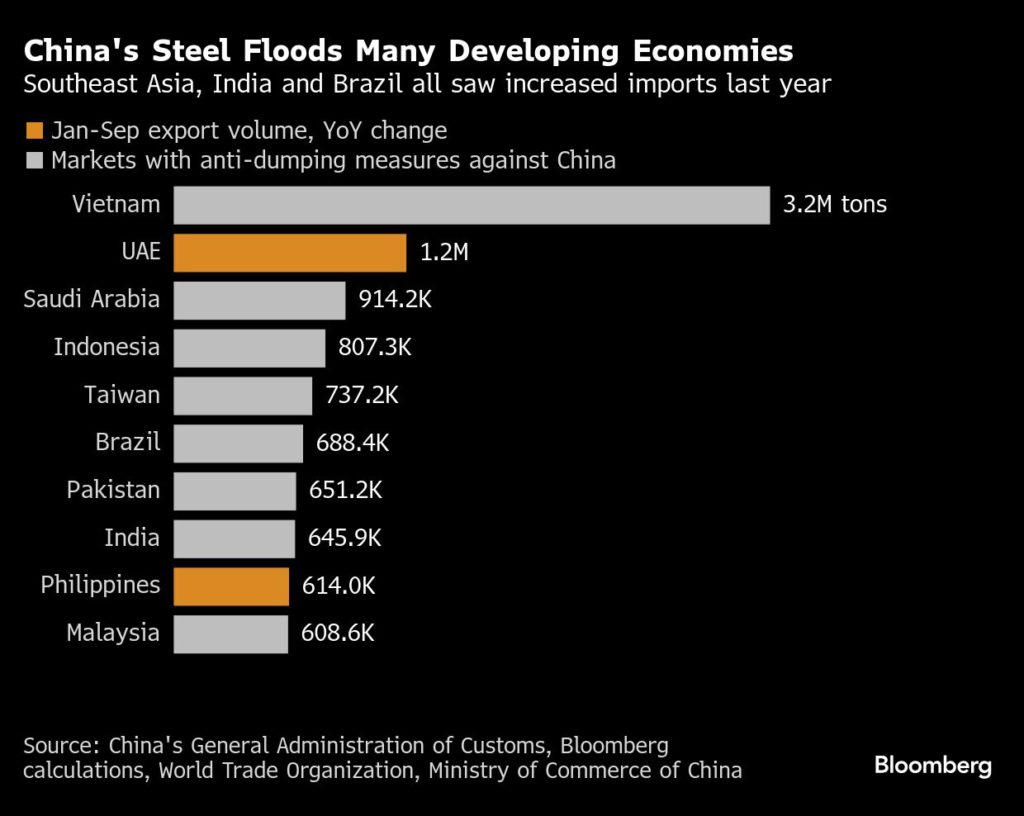

Chinese exports have surged over the past couple of years as steelmakers have been forced to sidestep the country’s property crisis and look overseas to clear their mounting surplus. That’s put world prices under sustained pressure, creating much of the momentum for Nippon Steel’s US foray as Japan’s biggest mill sought to decisively break out of its own moribund domestic market.

Although the end of Nippon Steel’s US ambitions won’t have a big direct impact on China’s steelmakers, it’s likely to shift the Japanese firm’s focus “to other markets where there may be more competition with Chinese mills,” said Tomas Gutierrez, an analyst at Kallanish Commodities Ltd.

The potential battlegrounds range from Southeast Asia to India and Brazil. Those are all markets where Nippon Steel has existing partnerships, including with the world’s second biggest mill ArcelorMittal SA, or has flagged as targets for expansion. They also include some of the countries that have seen the biggest increases in Chinese steel imports this year.

India holds great promise for steelmakers, given the growth potential from its ongoing urbanization and infrastructure buildout. The government is also keen on raising domestic output and is one of many countries to impose anti-dumping measures on Chinese imports, which makes Nippon Steel’s foothold there even more valuable.

“Nippon Steel’s expansion in the country, including joint ventures such as its collaboration with ArcelorMittal, poses a challenge to Chinese steel exports,” said Lawrence Zhang, principal consultant in steel and raw materials at Wood Mackenzie Ltd.

Brazil offers another opportunity to reduce China’s market share, said Zhang, with the added bonus that the Japanese firm’s local partnerships in the country “often involve access to Brazil’s iron ore reserves, essential for Nippon Steel’s operations globally.”

(By Yihui Xie and Katharine Gemmell)

British Columbia’s EAB upholds $104k fine against Teck Coal for workplace injury

British Columbia’s Environmental Appeal Board (EAB) upheld last week a C$140,000 (US$97,500) fine against Teck Coal for “severe and life-altering” injuries

By Staff Writer January 8, 2025

Teck had four steelmaking coal operations in the Elk Valley of British Columbia, Canada. (Image courtesy of Teck.)

British Columbia's Environmental Appeal Board (EAB) upheld last week a C$140,000 (US$97,500) fine against Teck Coal for "severe and life-altering" injuries a contract mechanic suffered working at its Elkford operations in 2019.

The mechanic was installing a wheel on a truck in a workshop at a mine site operated by Teck Coal, which had contracted MAXAM Explosives Inc. for explosives-related services, equipment, and supplies required for blasting at its Greenhills mine, according to the EAB ruling.

In 2022, Teck appealed a determination of administrative penalty, and British Columbia’s chief inspector of mines investigated the incident.

The inspector “concluded that the Appellant (Teck Coal) failed to ensure that the Mechanic was adequately trained in the safe removal and installation of wheels as required to service trucks used in the mixing and delivery of explosives,” court documents read.

As such, Teck Coal was found to have contravened the Health, Safety and Reclamation Code for Mines in BC.

Teck Resources, Canada’s largest diversified miner, last year sold its British Columbia-based steelmaking coal unit to Swiss commodities giant Glencore in one of the biggest deals in the industry.

The deal closed last summer, with Glencore paying nearly US$7 billion for Teck’s 77% stake in the coal business.

India to sign mining pact with Mongolia soon, govt source says

Reuters | January 9, 2025 |

India’s Prime Minister Narendra Modi. (Image by the World Economic Forum, Flickr.)

India is expected to sign a preliminary agreement with Mongolia soon in the area of geology and exploration, a senior Indian government official with direct knowledge of the matter said.

Landlocked Mongolia is rich in deposits of copper and coking coal, and India is mostly dependent on imports to meet rising demand for the red metal used in power, construction and electrical vehicles as well as coking coal for steelmaking.

“India’s cabinet has approved the MoU (memorandum of understanding) and both countries are expected to sign it soon,” the source said, declining to be identified as the deliberations are not yet public.

India’s federal mines ministry did not respond to a Reuters email seeking comment.

Mongolia’s Ministry of Mining and Heavy Industry did not immediately respond to a Reuters email seeking comments.

Companies such as Adani, Hindalco and Vedanta have expressed an interest in sourcing copper from Mongolia, the source said. All three companies did not respond to emails from Reuters seeking comment.

Both Indian and Mongolian officials are working out supply routes for Indian companies to source copper and coking coal, with India preferring the route from Vladivostok in Russia despite the longer distance, the official said.

“China is convenient but we prefer the route from Russia,” the official said.

Relations between Asian giants India and China were strained after a deadly military clash on their disputed border in 2020 but have been on the mend since they reached an agreement in October to pull back troops from their last two stand-off points in the western Himalaya mountains.

Unlike China, India has traditionally maintained close ties with Russia.

Resource-rich Mongolia can offer superior grades of coking coal, industry officials say.

In November, India’s JSW Steel and state-run Steel Authority of India (SAIL) were in talks with Mongolian authorities to import two shipments of coking coal, Reuters reported.

(By Neha Arora; Editing by Christian Schmollinger)

Korea Zinc in talks with US buyers to supply antimony, chairman says

Reuters | January 9, 2025

Computer circuitry. (Reference image from Pxhere).

Korea Zinc chairman Yun B. Choi said on Thursday that it is in preliminary talks with some US entities to supply antimony, after China’s export ban to the US disrupted the market for the mineral used in semiconductors.

Choi told reporters at a briefing that the company was interested in long-term contracts, and was talking with US traders and others, without naming any of the entities.

Antimony prices are set to hit record levels after China banned exports of the mineral to the United States.

Beijing’s curbs have heightened trade tensions and intensified a global race to secure critical minerals and loosen China’s dominance in the market.

Korea Zinc is the world’s largest zinc smelter but also produces about 3,500 tonnes of antimony ingots annually, some of which is shipped to Japan and the Netherlands.

Korea Zinc produces zinc, lead, copper, nickel and other metals with its own technology in South Korea and with supply chains that “do not involve China in any critical way”, Choi said.

That is expected to be an advantage over the next few years even if incoming US President Donald Trump changes the Inflation Reduction Act (IRA), Choi said.

He expects the market for zinc refining to be its “worst” historically in 2025 due to tight ore supply and said Korea Zinc may be the only smelter making money from zinc.

Korea Zinc plans a special shareholders’ meeting on Jan. 23 to discuss the appointment of directors proposed by Young Poong and private equity firm MBK Partners, which hold the largest stake in Korea Zinc, amid an escalating fight for control of the company.

(By Joyce Lee; Editing by Sam Holmes)

Brazil offers $815 million to back strategic minerals projects

ALL CAPITALI$M IS STATE CAPITALI$M

Bloomberg News | January 8, 2025

Chapada Diamantina, Bahia, Brazil. (Stock image)

Brazil is offering about $815 million in financing for projects aimed at boosting development of strategic minerals within the South American nation.

BNDES and government funding agency Finep, earmarked 5 billion reais in financial backing for companies, including credit lines and equity investments. The support can be used to develop supply chains of minerals including lithium, rare earth elements, nickel, graphite and silicon, as well as investments in manufacturing batteries, photo-voltaic cells and magnets used in products such as electric vehicles and wind turbines.

Western nations have been ramping up efforts to bolster critical minerals to reduce reliance on China, the dominant supplier of many metals seen as critical to technology. Brazil, with its significant mineral reserves, is seeking to position itself as a supplier of raw materials while developing a supply chain for value-added metal products.

Such financing could generate 25 billion to 50 billion reais in investments for such projects, according to a Tuesday statement on the announcement. BNDES President Aloizio Mercadante said they’re looking for partnerships between domestic and foreign entities, from miners to technology holders.

“The call is an important step forward in the mineral sector for achieving the Brazilian government’s goals of expanding the industry’s production capacity in the context of sustainable and technological development of the new industrial policy and the ecological transformation plan,” he said in the statement.

(By Mariana Durao)

China becomes world’s second-largest holder of lithium reserves, Xinhua reports

Reuters | January 8, 2025

Salt lake in Qinghai province, China. Stock image.

China’s lithium reserves have risen from 6% to 16.5% of the global total, making it the world’s second-largest holder of lithium reserves, state media reported on Wednesday.

The world’s top consumer of the battery metal relies heavily on lithium imports, and Beijing has pushed for more domestic exploration in recent years.

Lithium is widely used in rechargeable batteries for electronic devices, electric vehicles, and renewable energy storage systems, as well as in ceramics, glass, and pharmaceutical applications.

The newly discovered mines include a 2 800-km-long spodumene mine in the Xikunsong-Pan-Ganzi region in Tibet, and some lithium salt lakes in the Qinghai-Tibet Plateau, Xinhua News Agency said in the report.

With the discovered salt lakes, China now also hosts the world’s third-largest salt lake resources, after the lithium triangle in South America and western America, the report said.

Salt lake is a low-cost lithium source.

The most active lithium carbonate contract on the Guangzhou Futures Exchange in China stood at 77,420 yuan ($10,559.91) per ton on Wednesday, up by 0.4% week-on-week.

Gemfields faces 21% tax as Zambia reinstates export duty

Cecilia Jamasmie | January 8, 2025

The 5,655-carat emerald, dubbed Inkalamu (the “Lion Emerald”) found at Kagem in 2018. (Image courtesy of Gemfields Group.)

Shares in Gemfields (LON: GEM) (JSE: GML) fell on Wednesday after the coloured gemstones miner said it faces a high tax bill in Zambia following the government’s decision to re-introduce a 15% export duty on emeralds.

The export tax, reinstated on January 1, was suspended in 2019 following months of negotiations between the government and emerald producers. Its return, Gemfields said, has added to an already substantial tax load. The company’s 75%-owned local subsidiary, Kagem Mining, will now shoulder an effective revenue tax of 21%, which includes the existing 6% mineral royalty tax.

Gemfields criticized the move, stating there was no prior consultation or notice regarding the tax’s reintroduction.

“The company will engage with the Zambian government to seek the re-introduction of the suspension of this export duty or to remove it from the legislation given the impact on sector sustainability and investment attractiveness,” Gemfields said in a statement.

The company’s shares were last trading 4.30% lower in London at 6.7p each. They lost 12% of their value in Johannesburg, leaving the miner and marketer with a market capitalization of 2 billion South African rand, or about $106 million.

Zambia, the world’s second largest emerald producer after Colombia, first implemented the 15% export duty in early 2019 and it ceased to apply on January 1, 2020.

In 2023, when no export duty was in place, Kagem Mining paid approximately 31% of its revenues to the Zambian government through mineral royalties, corporate taxes, and dividends, according to Gemfields.

“Gemfields understands that several additional measures have also been introduced in other areas of the Zambian economy to enhance Zambian government revenues in 2025,” the group said.

Zambia’s government is targeting a gross domestic product (GDP) growth rate of 6.6%, an inflation rate between 6% and 8%, and a budget deficit of 3.1% of GDP, according to data from PwC. Revenue projections include a 26% increase in domestic revenues and grants, with tax revenues anticipated to grow by 20%.

Beyond Zambia, Gemfields owns the luxury jewellery brand Fabergé and holds a 75% stake in the Montepuez ruby mine in Mozambique.

Indonesia nickel move may cut global supply by 35%, Macquarie says

Tsingshan mine at Indonesia’s Morowali Industrial Park (IMIP) – Image courtesy of Nickel Mines Ltd

Potential cuts to Indonesian nickel mine output could remove more than a third of global supply from the market, according to Macquarie Group Ltd., presenting a significant upside risk to prices.

The Indonesian government is weighing deep cuts to nickel mine quotas from 272 million tons in 2024 to as low as 150 million tons this year, Bloomberg reported last month. That would be 40% lower than Macquarie’s base case, leading to a drastic reduction in output of the battery metal.

The bank views cuts of that scale as highly unlikely, but notes lower-than-expected mine output in the world’s largest producer presents another upside risk for prices. It still sees the market in a small oversupply this year, it said in a note on Wednesday.

Nickel slumped to a second straight annual loss in 2024 due to booming Indonesian output and weakening demand from battery-makers and the stainless steel sector. This year, traders are eying China’s efforts to stimulate its economy, as well as the impact of the incoming US administration’s tariff policy.

Indonesian mine output remains the key swing factor for prices, according to Macquarie. Ore supply in the country that accounts for more than half of global nickel production struggled to keep up with demand last year due to government restrictions, leading to record imports from the Philippines.

(By Eddie Spence)