Houthis Develop General Cargo Handling at Ras Isa

Satellite imagery taken over the Ras Isa coastal area of Yemen on November 5 suggests that the Houthis have, in recent weeks, expanded capacity to handle general cargo.

Until recently, Ras Isa was a very rudimentary port that only handled oil product tankers. Small to medium-sized tankers were typically moored with sterns towards the beach. Flexible piping was then used directly from ships and hauled across the beach into a limited fixed pipeline network connecting into a small nearby tank farm.

There was very little that could be destroyed at Ras Isa in recent air attacks, but the remains of the hijacked car carrier Galaxy Leader (IMO: 9237307), which was targeted by Israel on July 6 because its radar was being used to cover ship movements on the Red Sea, remains a hulk on the beach. No doubt in due course it will be put to use by the Houthis as a pontoon.

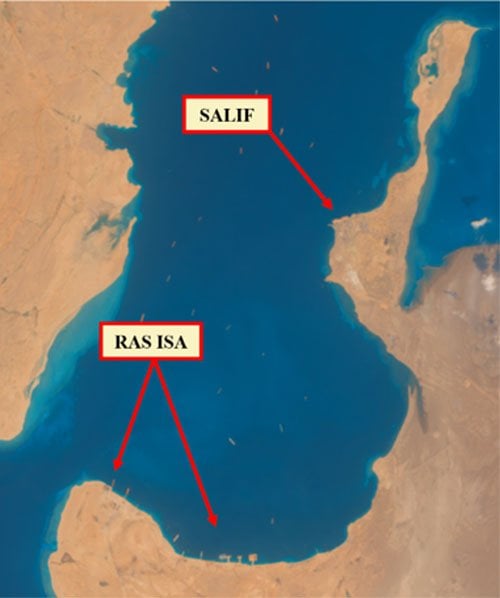

General cargo was normally handled at the nearby port of Salif, five miles to the north on the opposite side of the bay, which has berthing for two vessels. Salif also had a more substantial oil products tank farm, which can be fed by tankers coming alongside in the port. The facilities in Salif were damaged in Israeli and American attacks in April, May, and July, with traffic severely disrupted for several weeks after each attack. In contrast, however, to the attacks mounted on Hodeidah, the oil storage facilities in Salif appear to remain relatively undamaged.

The imagery taken this week shows that Salif is fully back in action. Two bulk carriers can be seen tied up at the dockside, identified by VesselFinder as the 29,990GT MV Paras (Marshall Islands, IMO 9277656) and the 24,109GT MV Kashkar (Panama, IMO 9285029). Both these ships shuttle regularly between Salif and Djibouti.

The ports of Salif and Ras Isa, on the West coast of Houthi-controlled Yemen, November 5, with ships in the anchorage between (Sentinel-2/CJRC)

At Ras Isa, however, not only are tankers back, but new jetty facilities have been built. Three tankers can be seen, as before, unloading over the beach, identified by VesselFinder as Sofia K (Panama, IMO 9299123), Charminar (Comoros, IMO 9318022), and Dorin (Gambia, IMO 9260055). All three of these 50,000GT coastal tankers are sanctioned. The significant increase in tanker activity, more than seen hitherto in this area, can be attributed to a diversion of traffic from Hodeidah, where oil product handling facilities were more substantially damaged. But in addition, there are two new T-shaped jetties at Ras Isa, which were quickly built in July, and a third jetty connecting to an artificial island, which has also been expanded. Small coastal vessels have been seen at all three of these jetties in recent weeks, and two Comoros-registered cargo ships, MV Yasc-1 (IMO 9071648) and MV Elif Ipek (IMO 7615359), appeared to be alongside yesterday at these new facilities.

In addition to the vessels noted in the two ports, at least 17 vessels are at anchor in the waters between Salif and Ras Isa, presumably awaiting allocation of berths in port.

In accordance with UN Security Council Resolution 2216 (2015), all ships entering either Salif or Ras Isa should have sought clearance beforehand from the United Nations Verification and Inspection Mechanism (UNVIM) in Djibouti. UNVIM does not appear to have a presence in either Salif or Ras Isa to ascertain whether or not ships entering port have received the necessary UNVIM clearance. Multiple instances continue to occur, often uncovered when illicit cargoes are intercepted by National Resistance Forces who operate in the Bab el Mandeb sea area, of vessels either not having sought clearance, or which have made false manifest declarations.