Circle K owner seeking takeover of 7-Eleven parent company

Circle K is owned by Canadian company Alimentation Couche-Tard and have submitted a “friendly, non-binding proposal” to buyout the 7-Eleven chain of stores.

Circle K owner Alimentation Couche-Tard has approached the parent company of the 7-Eleven convenience store chain for a possible takeover in the latest in a series of ambitious plans by a company that was built on making one deal after another.

Couche-Tard confirmed Monday that it has made a “friendly, non-binding proposal” to Japan’s Seven & i Holdings which had a stock market value of about $38bn (€28.9bn) as of Monday’s close in Tokyo.

There’s no guarantee any agreement can be reached, the company cautioned — and there are significant barriers to completing such a massive deal.

One of those barriers could be US antitrust regulators, who are likely to challenge any deal over concerns it would lead to higher prices for consumers and weaken the job market, the Financial Times reported Tuesday, citing two people briefed on the matter.

But if the Canadian company can pull it off, it would be the fulfilment of a dream for founder and Executive Chairman Alain Bouchard, who has been eyeing 7-Eleven for decades.

Mr Bouchard made his first approach around 2005, looking for a deal with the Japanese company for its US business, according to a biography published several years ago. The idea was shot down quickly.

Mr Bouchard moved on, targeting a series of convenience store and gas station deals in the US and Europe before eventually turning his sights on Carrefour SA in 2021. Negotiations on a $20bn offer for the supermarket chain died in the morass of French politics, but last year the company landed a smaller deal in Europe, acquiring about 2,200 stores from TotalEnergies SE for €3.1bn.

Today the company has about 16,700 stores spread in 31 countries and territories — 75% of which were added through acquisitions.

The Circle K owner still sees more opportunities in the US. Less than an hour after confirming its proposal to Seven & i, the company announced the acquisition of 270 GetGo retail and fueling locations from Pittsburgh-based Giant Eagle.

Couche-Tard is now the second-largest US operator with more than 7,100 locations, representing about 5% of convenience stores, and another 2,100 in Canada. The acquisition of 7-Eleven’s 13,000 locations in those two countries has the potential to raise competition concerns.

A spokesperson for Couche-Tard declined to comment beyond the company’s Monday morning statement.

BBC News

7-Eleven is the world's biggest convenience store chain

When the owner of 7-Eleven announced this week that it had received a buyout offer from a Canadian rival it triggered shockwaves in Japan.

A Japanese company of this size has never been bought by a foreign firm.

Historically, companies from Japan were more likely to buy overseas businesses.

7-Eleven is the world's biggest convenience store chain, with 85,000 outlets across 20 countries and territories.

And it's been especially successful at selling itself as an option for a quick and cheap yet tasty meal, and in places where there is already an abundance of that, such as Japan and Thailand.

"We have more stores than McDonald's or Starbucks," the chief executive of Seven & i Holdings, Ryuichi Isaka, told BBC News before the firm received the buyout offer.

Around a quarter of those 85,000 shops are in Japan, while there are roughly 10,000 in the US.

A big player

In comparison, Quebec-based Alimentation Couche-Tard, which operates the Circle K chain, has almost 17,000 stores in 31 countries and territories. More than half of its outlets are in North America.

The approach valued Seven & i at more than $30bn (£23bn) before news of the preliminary offer emerged.

7-Eleven's shares jumped by over 20% on Monday, before giving up some of those gains the following day.

Analysts point to the Japanese yen's weakness against the US dollar and other major currencies for helping to make Seven & i affordable.

Along with the weakness of the yen, efforts by the Japanese government to promote mergers and acquisitions appear to be working, said Manoj Jain from Hong Kong-based hedge fund Maso Capital.

Alimentation Couche-Tard operates the Circle K chain

7-Eleven has been keen to capitalise on the popularity of the food it sells - a wide range, including rice balls, sandwiches, cooked pasta, fried chicken and dumplings.

While in much of the world convenience stores are where people grab a bar of chocolate or a bag of crisps in an emergency, in Japan, shops like 7-Eleven are popular with visitors searching for culinary delights.

These 7-Eleven dishes have turned the chain into a social media sensation in Asia.

Dropping into a 7-Eleven store has even been touted as one of the top things to do in Thailand, where its ham and cheese toastie has become a TikTok hit.

British singer Ed Sheeran is among the celebrities who have helped raise 7-Eleven's profile - a video of him trying snacks from a store in Thailand went viral.

Mr Isaka has been aiming to repeat that success in the US and European markets as the company came under pressure from investors to sell some of its businesses and focus on the 7-Eleven brand.

The firm has been updating its strategy so more stores could follow the approach of its Japanese shops.

"What we found is that stores which sell fresh food are attracting many more shoppers," Mr Isaka said.

"We want to grow with high quality - not just increase the quantity. We want to make sure customers are happy, and increase sales of each store whilst increasing the number of stores," he added.

Seven & i has also been on a shopping spree. In January, it bought more than 200 stores in the US from petrol station chain Sunoco for around $1bn (£770m).

In April, it bought back more than 750 stores from a franchisee in Australia.

For most of its almost century-long history 7-Eleven was an American brand.

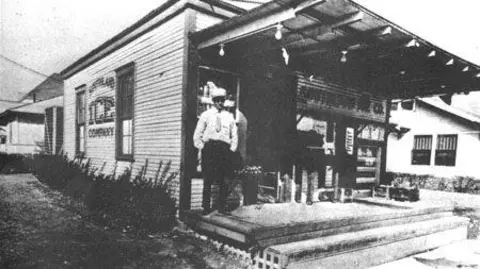

Starting out in 1927 selling blocks of ice that were used to keep fridges cool, it later stocked essential items like eggs, milk and bread.

At the time, the stores were open between 07:00 and 23:00 - hence the name.

The first 7-Eleven store opened in Texas in 1927

As the business grew, 7-Eleven began offering franchises outside the US.

In 1974, Japanese retail firm Ito-Yokado struck a deal to open the country's first 7-Eleven. In 1991, it bought a 70% stake in the chain's US parent company.

The founder of Ito-Yokado, Masatoshi Ito, who died in 2023 at the age of 98, is often credited with transforming 7-Eleven into a global empire.

Ito-Yokado was renamed Seven & i Holdings in 2005 with the "i" in its name being a nod to Ito-Yokado and Mr Ito, who was by then the company's honorary chairman.

Now, as the the company decides whether it will remain under Japanese ownership or return to its North American roots, experts are wondering whether more of Japan's big firms could become takeover targets.

There is now a "greater willingness of Japanese boards and management teams to accept offshore capital and be receptive to foreign approaches,” Mr Jain said.

More foreign investors may now be encouraged to pursue their interest in Japanese companies, he added.

No comments:

Post a Comment