DW

January 3, 2025

US President Joe Biden has vetoed Nippon Steel's $14.9-billion takeover bid for its American rival, US Steel. Amid bipartisan opposition to the merger, DW asks why US politicians and regulators are concerned.

US President Joe Biden has vetoed Nippon Steel's $14.9-billion takeover bid for its American rival, US Steel. Amid bipartisan opposition to the merger, DW asks why US politicians and regulators are concerned.

US Steel is facing declining revenues and profitability due to competition from foreign rivals

After months of opposition, US President Joe Biden on Friday blocked the proposed buyout of the United States Steel Corporation, or US Steel, by Japan's Nippon Steel.

The second-largest US steelmaker had previously approved the $14.9-billion (€14.5-billion) takeover bid, saying it would help protect the ailing firm from intense competition from abroad, including China.

Nippon Steel had hoped the acquisition would help hike its global steel output by nearly a third, to 85 million tons.

Image: Gene J. Puskar/AP Photo/picture alliance

After months of opposition, US President Joe Biden on Friday blocked the proposed buyout of the United States Steel Corporation, or US Steel, by Japan's Nippon Steel.

The second-largest US steelmaker had previously approved the $14.9-billion (€14.5-billion) takeover bid, saying it would help protect the ailing firm from intense competition from abroad, including China.

Nippon Steel had hoped the acquisition would help hike its global steel output by nearly a third, to 85 million tons.

Nippon Steel, headquartered in Chiyoda, Tokyo, is Japan's largest steelmaker

Image: Richard A. Brooks/AFP

However, the merger became a significant issue for Democrats and Republicans in November's US presidential election, as Pennsylvania, where US Steel is headquartered, was a critical swing state.

In an attempt to protect American jobs, the United Steelworkers union fiercely opposed the transaction.

Why Biden has blocked the deal

Biden has cited national security concerns and risks to key supply chains as his main reasons for vetoing the purchase.

"This acquisition would place one of America's largest steel producers under foreign control and create risk for our national security and our critical supply chains," Biden said in a statement. "That is why I am taking action to block this deal."

The president previously said that critical industries, like the steel sector, must remain under the control of domestic players.

In December, the Committee on Foreign Investment in the United States (CFIUS) — which reviews mergers and acquisitions of US firms by foreign entities — failed to reach a consensus on whether to approve the deal and referred the decision to Biden, who leaves office on January 20.

The panel, led by Treasury Secretary Janet Yellen, warned the buyout could lead to a cut in US steel output, which would cause supply shortages, affecting the transport and energy sectors the most.

CFIUS warned the deal could scupper Washington's attempt to quash the dumping of cheap steel from China, where heavy industries receive massive subsidies from the Beijing government.

However, the merger became a significant issue for Democrats and Republicans in November's US presidential election, as Pennsylvania, where US Steel is headquartered, was a critical swing state.

In an attempt to protect American jobs, the United Steelworkers union fiercely opposed the transaction.

Why Biden has blocked the deal

Biden has cited national security concerns and risks to key supply chains as his main reasons for vetoing the purchase.

"This acquisition would place one of America's largest steel producers under foreign control and create risk for our national security and our critical supply chains," Biden said in a statement. "That is why I am taking action to block this deal."

The president previously said that critical industries, like the steel sector, must remain under the control of domestic players.

In December, the Committee on Foreign Investment in the United States (CFIUS) — which reviews mergers and acquisitions of US firms by foreign entities — failed to reach a consensus on whether to approve the deal and referred the decision to Biden, who leaves office on January 20.

The panel, led by Treasury Secretary Janet Yellen, warned the buyout could lead to a cut in US steel output, which would cause supply shortages, affecting the transport and energy sectors the most.

CFIUS warned the deal could scupper Washington's attempt to quash the dumping of cheap steel from China, where heavy industries receive massive subsidies from the Beijing government.

According to US newspaper The Washington Post, the committee was also concerned Nippon Steel could shift production to its sites in Brazil, Mexico and India after gaining control of US Steel.

Senior White House advisers had reportedly tried to persuade Biden to proceed with the purchase, as it would represent a sizable investment in an ailing US company. They also thought a veto could hurt ties with Japan, one of Washington's closest allies in the Indo-Pacific.

Both Biden and former President Donald Trump implemented protectionist policies in recent years to safeguard the US steel sector against a global oversupply, which has driven down prices. The measures included 25% tariffs on imported steel, while China was singled out for unfair trade practices.

Biden's veto is unlikely to be overturned by President-elect Trump, who campaigned on reviving US heavy industry, and last month wrote on his Truth Social social messaging platform that he was "totally against the once great and powerful US Steel being bought by a foreign company."

Trump has promised to use a mix of more tariffs and tax incentives to protect the US steel sector.

What have Japan, Nippon Steel said about veto?

In a last-ditch attempt to get the deal approved, Nippon Steel proposed giving Washington a say in any potential production cuts at US Steel, Reuters news agency reported earlier this week, citing a source familiar with the deal.

In December, Nippon Steel defended the merger, promising "significant" investments in US Steel's facilities and employees to "ensure a vibrant future for American steelmaking." The firm said it remained "confident that the acquisition will protect and grow US Steel, creating the best steelmaker with world-leading capabilities for the benefit of American workers and customers."

Nippon Steel has pledged over $2.7 billion in capital investment for US Steel's facilities in Pennsylvania and Gary, Indiana, and offered to move its US headquarters to Pittsburgh, where US Steel is based. It has also promised to honor existing agreements with unions.

Nippon Steel promised to invest $2.7 billion in the US, including the Edgar-Thomson plant, the world's oldest integrated steel mill

Image: Gene J. Puskar/AP/dpa/picture alliance

In November, Japanese Prime Minister Shigeru Ishiba urged Biden to approve the merger to avoid weakening ties between the two countries.

Both Nippon Steel and US Steel have insisted the deal poses no national security concerns and vowed to pursue legal action, claiming US officials failed to follow proper procedures while reviewing the acquisition.

What could be the impact of Biden's decision?

While it may preserve the independence of US Steel, Biden's veto could leave the steelmaker struggling to secure the capital and technology needed to modernize.

It would leave the firm unable to compete against larger, better-funded global steelmakers like ArcelorMittal or Chinese rivals.

US Steel could now face difficulties finding a buyer for the entire company. A cash and stock deal in August 2023 by rival Cleveland-Cliffs was worth around half of the amount of the Nippon Steel bid. At the time, US Steel rejected the union-backed deal, and a few months later approved the Nippon Steel merger plan.

By blocking the acquisition, Biden is also signaling to other international investors that they may face political and regulatory hurdles when bidding for US firms deemed critical for national security.

The decision is also likely to widen China's grip on the global steel sector and could even prompt the European Union to seek foreign investments from the likes of Nippon Steel for its steel players.

Edited by: Uwe Hessler

What’s next after Biden blocked the $15bn Nippon Steel/US Steel deal?

Reuters | January 4, 2025 |

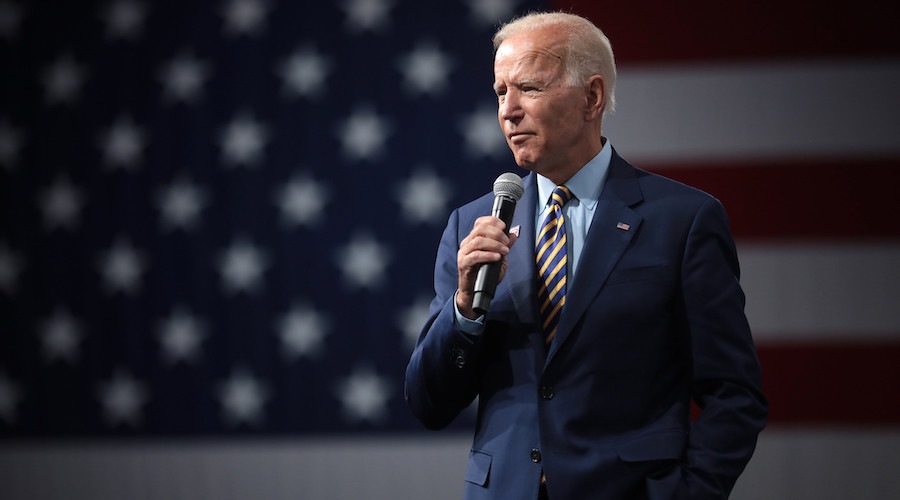

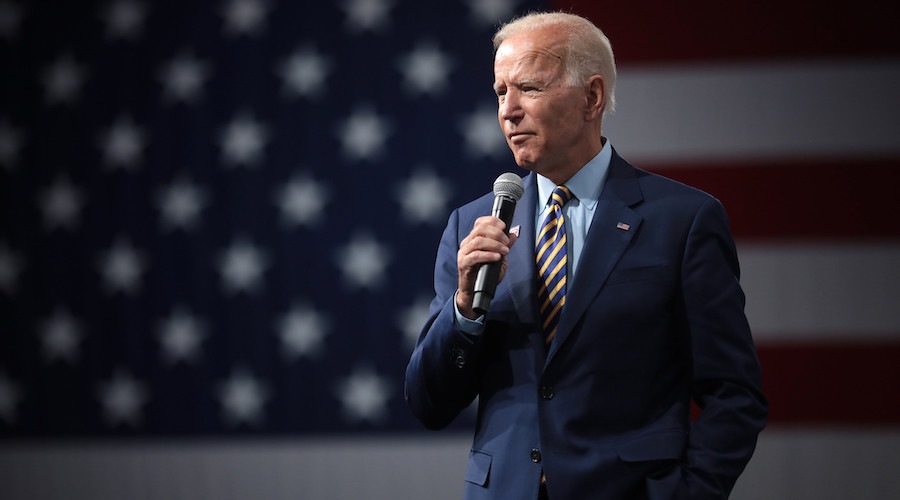

US president Joe Biden. (Image by Gage Skidmore, Flickr)

US President Joe Biden blocked Nippon Steel’s proposed $14.9 billion purchase of US Steel citing national security concerns, in a potentially fatal blow to the deal after a year-long review.

Biden, President-elect Donald Trump and an influential labor union opposed the effort by Japan’s top steelmaker to acquire the iconic American firm, which would have created the world’s third-largest steelmaker, according to World Steel Association data.

The path forward is unclear. The companies could sue the US government, another buyer could swoop in for US Steel, or Republicans who favor the deal could urge Trump to find a way to approve it.

Here is what could come next:

The deal itself

The proposed deal has not yet been terminated by the companies even after Biden blocked the deal.

In a joint statement, Nippon and US Steel called Biden’s decision “unlawful,” and Nippon Steel may file a lawsuit against the US government challenging the procedures behind the decision, Japan’s Nikkei business daily reported on Saturday.

David Burritt, US Steel’s chief executive, said on Friday “we intend to fight President Biden’s political corruption.”

Some lawyers, such as Nick Wall, M&A partner at Allen & Overy, have said a legal challenge would be tough.

Nippon Steel argued it made numerous concessions, including offering to move its headquarters to Pittsburgh, to meet the demands of CFIUS, the Committee on Foreign Investment in the United States, the panel that decides on whether foreign purchases of US companies should go forward.

CFIUS was split over a decision and did not make a recommendation on the deal.

“If they go to court most of the decisions by the various CFIUS agencies will be made public,” said Brett Lambert, a former senior Pentagon official under Barack Obama, citing the rare move to forward a split decision to the president.

If the deal does not go through, Nippon Steel would have to pay a $565 million break-up fee.

US Steel’s future

Pittsburgh-based US Steel had warned that mills could close and thousands of jobs would be at risk without the deal. US Steel’s profits have dropped for nine straight quarters amid a global industry downturn, but it still sports a forward price-to-earnings ratio of 12.87, more expensive than US peers, according to LSEG data.

The United Steelworkers union, which opposed the deal, has called the company’s warnings baseless, saying Friday that it is clear that US Steel’s recent financial performance shows it “can easily remain a strong and resilient company.”

Other suitors could emerge. US-based Cleveland-Cliffs, which previously bid for the company, could come back with a lower offer. However, its market value is now smaller than that of US Steel.

“One would suspect that Nucor and Cleveland Cliffs will be in discussions with US Steel, but based on presidential messages one would think the US government may come to its aid and invest in its infrastructure,” said Jay Woods, chief global strategist at Freedom Capital Markets.

Trump’s position

Trump, who takes office on Jan. 20, has repeatedly vowed to block the sale, a view he shared with Biden.

“I am totally against the once great and powerful US Steel being bought by a foreign company, in this case Nippon Steel of Japan,” he wrote on his Truth Social platform last month. “As president, I will block this deal from happening. Buyer Beware!!!”

Trump’s transition team did not comment on Friday. However, several current and former Republican officeholders on Friday criticized Biden’s decision, saying it would cost investment in the US.

US-Japanese relations

Some analysts warned that blocking the deal could sour relations between the United States and Japan, which Biden had worked on improving to counter the threat of China’s economic and military rise.

Japan is the top US investor in the US and its biggest business lobby has raised concerns about political pressure on the deal, a view the White House rejected.

“It would have helped us rebuild our competitiveness and counter China. To do this effectively, we need our friends, particularly Japan,” Wendy Cutler, who served as a senior trade negotiator under former President Barack Obama, wrote on social media platform X.

Trump’s stance on trade could add to that unease when he returns to office, as he has already threatened heavy tariffs on key allies Canada, Mexico and Europe.

(By John Geddie, Andrea Shalal, David Shepardson, Alexandra Alper, Aatreyee Dasgupta and David Gaffen; Editing by Sonali Paul)

Biden’s veto of US Steel deal raises multitude of new questions

Bloomberg News | January 3, 2025 |

Rolls of galvanized steel sheet. Stock image.

US President Joe Biden’s decision to block Nippon Steel Corp.’s $14.1 billion takeover of United States Steel Corp. has sparked fresh uncertainty for the American icon that’s been at the heart of a domestic political firestorm in the US and fueled tensions with long-time diplomatic ally Japan.

Biden announced his formal decision on Friday after the case was referred to him by a US security review panel and US Steel shares fell in response, trading well below Nippon Steel’s $55 per share offer for the firm, which traces its roots back to 1901 when J. Pierpont Morgan merged a collection of assets with Andrew Carnegie’s Carnegie Steel Co.

There are a number of avenues the company might now go down to secure its future as Donald Trump prepares to take the reins of the US government from Biden.

Here’s a look at what could happen.

Can Biden’s decision be challenged?

It’s a high bar. US statute makes it clear that American presidents are granted the power to kill a deal they deem a threat to national security, and the codification of that law means it is unlikely to be an attractive case for the Supreme Court, were appeals to reach that level.

The Committee on Foreign Investment in the United States, a secretive panel that scrutinizes proposals by foreign entities to purchase companies or property in the US, was unable to reach a decision on the deal, sending it to the White House for final word.

However, US Steel and Nippon Steel might argue on procedural grounds. Cfius sent a letter to the companies in late August, saying that the deal posed a threat to national security. The companies intervened with a 100-plus page letter and a meeting in Washington with the Cfius panel, which granted an extension.

The chain of events was unusual. Companies are typically given a warning that a deal has problems that need mitigation, and then are given time to address those issues. In this case, there wasn’t the same warning time given, which could leave the door open for litigation. Though, it still may be a tough uphill climb to win a case.

What’s next?

US Steel and Nippon Steel on Friday issued a joint statement saying that Biden’s move “reflects a clear violation of due process and the law governing Cfius,” and that the companies “will take all appropriate action to protect their legal rights.”

“We believe that President Biden has sacrificed the future of American steelworkers for his own political agenda,” the statement said. “We are committed to taking all appropriate action to protect our legal rights to allow us to deliver the agreed upon value of $55.00 per share for US Steel’s stockholders upon closing.”

Bloomberg News previously reported that US Steel and Nippon Steel were likely to jointly file lawsuits related to the deal. While it’s not clear exactly what the lawsuits will look like, they would probably challenge various parties that the companies believed worked against the best interests of their shareholders.

What were some of the reactions?

Pennsylvania Governor Josh Shapiro, a Democrat who didn’t publicly advocate for or against the deal, issued a muted statement, saying he expects “any other potential buyers to demonstrate the strong commitments to capital investment and protecting and growing Pennsylvania jobs that Nippon Steel placed on the table.” He called on US Steel to refrain from threatening the jobs of current union workers and keep the headquarters in the state.

“This matter is far from over – we must find a long-term solution that protects the future of steelmaking in Western Pennsylvania and the workers who built US Steel and built this country,” he said.

JPMorgan Analyst Bill Peterson wrote in note that there are “limited avenues moving forward” as foreign ownership for US Steel is “seemingly off the table.”

“Despite Japan being both a close ally and the largest foreign investor in the US, we view the deal’s demise as a clear deterrent for foreign entrants interested in buying entry into the US steel market,” Peterson wrote.

Are there break fees?

Nippon Steel’s deal to buy US Steel included a $565 million break fee for the American company. And, yes, it still must be paid despite the transaction being killed by the government.

What does the blocked deal mean for US-Japan relations?

The deal is a strain on ties with a key ally — and one crucial in the US race against China. Japan’s previous prime minister, hosted by Biden earlier this year as the issue swirled, had largely distanced himself from the tensions. The decision also sends a message that no US ally or industry is immune to a potential national security investigation, and it’s a sign of a continued bipartisan move to treat steel as a strategic sector.

Some experts have warned of a chilling effect for foreign companies looking to acquire US assets, given that the fees — legal, banking and others — might be enough to dissuade competitive offers from non-US bidders who may not want to risk going through a process that could end up empty handed.

President-elect Donald Trump said in a Truth Social post that he would fast track approval for any country will to invest $1 billion inside US borders. But Trump has also said he would have also blocked Nippon Steel’s bid amid worries over the steelmaker being foreign owned.

What other options can US Steel pursue?

Beyond legal actions, there will be other options for US Steel’s board to evaluate. It will likely re-consider whether to sell all or parts of the company.

Cleveland-Cliffs offered a losing bid last year for $54 per share in cash and stock, which was broadly as seen as inferior to the all-cash $55 per share offer Nippon Steel put in. But it’s unclear if Cleveland-Cliffs or other bidders are ready to come back to the table.

The board may also consider splitting the company into parts, which was discussed during the bidding process in 2023. That option would likely mean a split between legacy assets and newer facilities.

Of course, there’s a scenario where US Steel doesn’t put anything on the selling block and goes back to the way it was operating before the saga began.

But chief executive officer David Burritt had warned that if the deal with Nippon Steel were to fall through that US Steel might need to shutter plants and consider moving its headquarters, currently in Pittsburgh. That would all be contingent on board approval.

What’s does this mean for the steel union?

Biden’s decision is a significant win for David McCall, president of United Steelworkers. McCall had been staunchly critical of the deal from the day it was announced and successfully earned the support of Biden early on in the saga. The question remains how the union’s rank-and-file members, many of whom supported the takeover, will feel about McCall and his leadership team’s relentless push against Nippon Steel’s bid.

In a statement Friday, the United Steelworkers said Biden’s decision was “the right move for our members and our national security.”

What’s next for Nippon Steel?

The takeover would have made Nippon Steel the world’s No. 3 steelmaker, with the transaction aimed at reducing its dependence on the waning Japanese market and helping it compete with the big mills in China. Now, Nippon Steel could bolster efforts in other growth markets. Analysts have pointed to India as one possibility.

(By Joe Deaux and Josh Wingrove)

Reuters | January 4, 2025 |

US president Joe Biden. (Image by Gage Skidmore, Flickr)

US President Joe Biden blocked Nippon Steel’s proposed $14.9 billion purchase of US Steel citing national security concerns, in a potentially fatal blow to the deal after a year-long review.

Biden, President-elect Donald Trump and an influential labor union opposed the effort by Japan’s top steelmaker to acquire the iconic American firm, which would have created the world’s third-largest steelmaker, according to World Steel Association data.

The path forward is unclear. The companies could sue the US government, another buyer could swoop in for US Steel, or Republicans who favor the deal could urge Trump to find a way to approve it.

Here is what could come next:

The deal itself

The proposed deal has not yet been terminated by the companies even after Biden blocked the deal.

In a joint statement, Nippon and US Steel called Biden’s decision “unlawful,” and Nippon Steel may file a lawsuit against the US government challenging the procedures behind the decision, Japan’s Nikkei business daily reported on Saturday.

David Burritt, US Steel’s chief executive, said on Friday “we intend to fight President Biden’s political corruption.”

Some lawyers, such as Nick Wall, M&A partner at Allen & Overy, have said a legal challenge would be tough.

Nippon Steel argued it made numerous concessions, including offering to move its headquarters to Pittsburgh, to meet the demands of CFIUS, the Committee on Foreign Investment in the United States, the panel that decides on whether foreign purchases of US companies should go forward.

CFIUS was split over a decision and did not make a recommendation on the deal.

“If they go to court most of the decisions by the various CFIUS agencies will be made public,” said Brett Lambert, a former senior Pentagon official under Barack Obama, citing the rare move to forward a split decision to the president.

If the deal does not go through, Nippon Steel would have to pay a $565 million break-up fee.

US Steel’s future

Pittsburgh-based US Steel had warned that mills could close and thousands of jobs would be at risk without the deal. US Steel’s profits have dropped for nine straight quarters amid a global industry downturn, but it still sports a forward price-to-earnings ratio of 12.87, more expensive than US peers, according to LSEG data.

The United Steelworkers union, which opposed the deal, has called the company’s warnings baseless, saying Friday that it is clear that US Steel’s recent financial performance shows it “can easily remain a strong and resilient company.”

Other suitors could emerge. US-based Cleveland-Cliffs, which previously bid for the company, could come back with a lower offer. However, its market value is now smaller than that of US Steel.

“One would suspect that Nucor and Cleveland Cliffs will be in discussions with US Steel, but based on presidential messages one would think the US government may come to its aid and invest in its infrastructure,” said Jay Woods, chief global strategist at Freedom Capital Markets.

Trump’s position

Trump, who takes office on Jan. 20, has repeatedly vowed to block the sale, a view he shared with Biden.

“I am totally against the once great and powerful US Steel being bought by a foreign company, in this case Nippon Steel of Japan,” he wrote on his Truth Social platform last month. “As president, I will block this deal from happening. Buyer Beware!!!”

Trump’s transition team did not comment on Friday. However, several current and former Republican officeholders on Friday criticized Biden’s decision, saying it would cost investment in the US.

US-Japanese relations

Some analysts warned that blocking the deal could sour relations between the United States and Japan, which Biden had worked on improving to counter the threat of China’s economic and military rise.

Japan is the top US investor in the US and its biggest business lobby has raised concerns about political pressure on the deal, a view the White House rejected.

“It would have helped us rebuild our competitiveness and counter China. To do this effectively, we need our friends, particularly Japan,” Wendy Cutler, who served as a senior trade negotiator under former President Barack Obama, wrote on social media platform X.

Trump’s stance on trade could add to that unease when he returns to office, as he has already threatened heavy tariffs on key allies Canada, Mexico and Europe.

(By John Geddie, Andrea Shalal, David Shepardson, Alexandra Alper, Aatreyee Dasgupta and David Gaffen; Editing by Sonali Paul)

Biden’s veto of US Steel deal raises multitude of new questions

Bloomberg News | January 3, 2025 |

Rolls of galvanized steel sheet. Stock image.

US President Joe Biden’s decision to block Nippon Steel Corp.’s $14.1 billion takeover of United States Steel Corp. has sparked fresh uncertainty for the American icon that’s been at the heart of a domestic political firestorm in the US and fueled tensions with long-time diplomatic ally Japan.

Biden announced his formal decision on Friday after the case was referred to him by a US security review panel and US Steel shares fell in response, trading well below Nippon Steel’s $55 per share offer for the firm, which traces its roots back to 1901 when J. Pierpont Morgan merged a collection of assets with Andrew Carnegie’s Carnegie Steel Co.

There are a number of avenues the company might now go down to secure its future as Donald Trump prepares to take the reins of the US government from Biden.

Here’s a look at what could happen.

Can Biden’s decision be challenged?

It’s a high bar. US statute makes it clear that American presidents are granted the power to kill a deal they deem a threat to national security, and the codification of that law means it is unlikely to be an attractive case for the Supreme Court, were appeals to reach that level.

The Committee on Foreign Investment in the United States, a secretive panel that scrutinizes proposals by foreign entities to purchase companies or property in the US, was unable to reach a decision on the deal, sending it to the White House for final word.

However, US Steel and Nippon Steel might argue on procedural grounds. Cfius sent a letter to the companies in late August, saying that the deal posed a threat to national security. The companies intervened with a 100-plus page letter and a meeting in Washington with the Cfius panel, which granted an extension.

The chain of events was unusual. Companies are typically given a warning that a deal has problems that need mitigation, and then are given time to address those issues. In this case, there wasn’t the same warning time given, which could leave the door open for litigation. Though, it still may be a tough uphill climb to win a case.

What’s next?

US Steel and Nippon Steel on Friday issued a joint statement saying that Biden’s move “reflects a clear violation of due process and the law governing Cfius,” and that the companies “will take all appropriate action to protect their legal rights.”

“We believe that President Biden has sacrificed the future of American steelworkers for his own political agenda,” the statement said. “We are committed to taking all appropriate action to protect our legal rights to allow us to deliver the agreed upon value of $55.00 per share for US Steel’s stockholders upon closing.”

Bloomberg News previously reported that US Steel and Nippon Steel were likely to jointly file lawsuits related to the deal. While it’s not clear exactly what the lawsuits will look like, they would probably challenge various parties that the companies believed worked against the best interests of their shareholders.

What were some of the reactions?

Pennsylvania Governor Josh Shapiro, a Democrat who didn’t publicly advocate for or against the deal, issued a muted statement, saying he expects “any other potential buyers to demonstrate the strong commitments to capital investment and protecting and growing Pennsylvania jobs that Nippon Steel placed on the table.” He called on US Steel to refrain from threatening the jobs of current union workers and keep the headquarters in the state.

“This matter is far from over – we must find a long-term solution that protects the future of steelmaking in Western Pennsylvania and the workers who built US Steel and built this country,” he said.

JPMorgan Analyst Bill Peterson wrote in note that there are “limited avenues moving forward” as foreign ownership for US Steel is “seemingly off the table.”

“Despite Japan being both a close ally and the largest foreign investor in the US, we view the deal’s demise as a clear deterrent for foreign entrants interested in buying entry into the US steel market,” Peterson wrote.

Are there break fees?

Nippon Steel’s deal to buy US Steel included a $565 million break fee for the American company. And, yes, it still must be paid despite the transaction being killed by the government.

What does the blocked deal mean for US-Japan relations?

The deal is a strain on ties with a key ally — and one crucial in the US race against China. Japan’s previous prime minister, hosted by Biden earlier this year as the issue swirled, had largely distanced himself from the tensions. The decision also sends a message that no US ally or industry is immune to a potential national security investigation, and it’s a sign of a continued bipartisan move to treat steel as a strategic sector.

Some experts have warned of a chilling effect for foreign companies looking to acquire US assets, given that the fees — legal, banking and others — might be enough to dissuade competitive offers from non-US bidders who may not want to risk going through a process that could end up empty handed.

President-elect Donald Trump said in a Truth Social post that he would fast track approval for any country will to invest $1 billion inside US borders. But Trump has also said he would have also blocked Nippon Steel’s bid amid worries over the steelmaker being foreign owned.

What other options can US Steel pursue?

Beyond legal actions, there will be other options for US Steel’s board to evaluate. It will likely re-consider whether to sell all or parts of the company.

Cleveland-Cliffs offered a losing bid last year for $54 per share in cash and stock, which was broadly as seen as inferior to the all-cash $55 per share offer Nippon Steel put in. But it’s unclear if Cleveland-Cliffs or other bidders are ready to come back to the table.

The board may also consider splitting the company into parts, which was discussed during the bidding process in 2023. That option would likely mean a split between legacy assets and newer facilities.

Of course, there’s a scenario where US Steel doesn’t put anything on the selling block and goes back to the way it was operating before the saga began.

But chief executive officer David Burritt had warned that if the deal with Nippon Steel were to fall through that US Steel might need to shutter plants and consider moving its headquarters, currently in Pittsburgh. That would all be contingent on board approval.

What’s does this mean for the steel union?

Biden’s decision is a significant win for David McCall, president of United Steelworkers. McCall had been staunchly critical of the deal from the day it was announced and successfully earned the support of Biden early on in the saga. The question remains how the union’s rank-and-file members, many of whom supported the takeover, will feel about McCall and his leadership team’s relentless push against Nippon Steel’s bid.

In a statement Friday, the United Steelworkers said Biden’s decision was “the right move for our members and our national security.”

What’s next for Nippon Steel?

The takeover would have made Nippon Steel the world’s No. 3 steelmaker, with the transaction aimed at reducing its dependence on the waning Japanese market and helping it compete with the big mills in China. Now, Nippon Steel could bolster efforts in other growth markets. Analysts have pointed to India as one possibility.

(By Joe Deaux and Josh Wingrove)

No comments:

Post a Comment