Global Nuclear Power Hits Record High as Asia Surges Ahead

- Global nuclear generation reached 2,817 TWh in 2024, surpassing the previous record from 2021, with most growth coming from non-OECD countries.

- Asia Pacific, led by China’s 13% annual growth rate, now accounts for over 28% of global nuclear output, marking a major geopolitical and energy shift.

- While Eastern Europe, the UAE, and select other nations expand nuclear capacity, Western Europe and North America face stagnation, retirements, or policy-driven phaseouts.

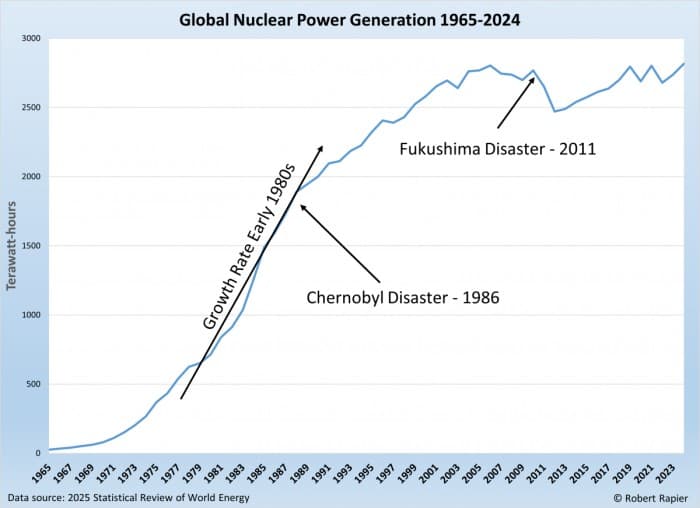

Nuclear power has always been a paradox. It can produce massive amounts of low-carbon electricity, yet it must constantly battle the headwinds of politics and public perception.

The latest Statistical Review of World Energy shows that while nuclear generation is growing globally—setting a new record high in 2024—the trend is anything but uniform. Some countries are charging ahead, while others are stepping back.

Global Output: Modest Growth, Unevenly Shared

In 2024, global nuclear generation reached 2,817 terawatt-hours, a modest uptick from 2023, but surpassing the previous all-time high set in 2021.

Over the past decade, output has grown at a 2.6% annual rate—slow, but a clear recovery from the post-Fukushima slump. That growth is heavily skewed toward non-OECD countries, which are building new capacity at a faster pace (3.0% annual growth) than the flat-to-declining trend in OECD nations (2.5%).

Asia Pacific: The New Center of Gravity

The most dramatic shift is happening in Asia Pacific, now responsible for over 28% of global nuclear output—over double its share from a decade ago:

- As with renewables, China is in a league of its own, with output soaring from 213 TWh in 2014 to more than 450 TWh in 2024—an annual growth rate near 13%.

- India and South Korea also posted steady gains, though on a smaller scale.

This marks a clear geopolitical shift. Nuclear power is no longer dominated by Western democracies, but by countries with state-driven, long-term infrastructure agendas.

North America: Stable, but Aging

The United States still leads the world in nuclear output at roughly 850 TWh annually (29.2% of the world’s total nuclear output), but beneath the stability is a slow attrition of older plants and a lack of new construction.

But the U.S. had its biggest nuclear milestone in decades in 2023 and 2024 with the startup of Vogtle Unit 3, followed by Unit 4. Located in Georgia, Vogtle is the first newly built nuclear power plant in the United States in more than 30 years, and its completion marks the end of a long, costly construction saga plagued by delays and budget overruns. Together, the two new reactors added more than 2,200 megawatts of capacity—enough to power over a million homes—and provide a rare example of nuclear expansion in a country where most growth has come from extending the lives of existing plants.

Canada’s output has slipped from 106 TWh in 2016 to 85 TWh in 2024, reflecting plant refurbishments and changing policies. Mexico, a small player, has seen big year-to-year swings, which may indicate operational challenges

Europe: A Story of Contrasts

Western Europe is drifting away from nuclear:

- France, long the gold standard for nuclear reliability, has seen output fall from 442 TWh in 2016 to just 338 TWh last year, hampered by maintenance issues and political uncertainty.

- Germany is now at zero after completing its nuclear phase-out.

- Belgium, Switzerland, and Sweden are split between retirements and life extensions.

In Eastern Europe, the picture is brighter. The Czech Republic, Hungary, and Slovakia are increasing output, while Ukraine has managed to maintain over 50 TWh annually despite wartime disruptions.

Emerging Regions: Small Shares, Big Moves

In Latin America, Brazil and Argentina are holding steady around 15–25 TWh, with Brazil inching higher. Africa’s only nuclear producer, South Africa, remains flat at about 13 TWh. The Middle East has a new entrant in the UAE, which ramped from zero in 2019 to over 40 TWh in 2024 thanks to the Barakah plant—an impressive buildout in such a short time.

The Outliers

- Japan has restarted some reactors, but its output remains far below pre-Fukushima levels—84 TWh last year versus more than 300 TWh in 2010.

- Taiwan is phasing out nuclear, with production falling from 42 TWh in 2016 to just 12 TWh in 2024.

- Pakistan and Iran continue steady, if modest, growth.

Final Thoughts

The global nuclear landscape is diverging. Some countries are doubling down, driven by the twin imperatives of energy security and climate action, while others are walking away. The center of gravity is moving away from traditional Western producers toward nations prepared to back nuclear with long-term capital and policy support.

For investors, the next wave of growth is likely to come from Asia and the Middle East, not the historical powerhouses of Europe and North America. That shift carries environmental upside as well—especially in China, the world’s largest carbon emitter. Every gigawatt China moves from coal to nuclear represents a major win in the fight to reduce carbon emissions

Google, Kairos Power, TVA announce collaboration

_99967.jpg)

The power purchase agreement between the Tennessee Valley Authority (TVA) and Kairos Power will deliver up to 50 MW of "reliable, 24/7 energy" to the TVA grid that powers Google data centres in Tennessee and Alabama, the companies said. This is the first such agreement signed by a US utility to buy electricity from an advanced, Gen IV reactor, as well as being the first deployment under the 2024 deal between Kairos Power and Google to enable 500 MW of new, advanced nuclear capacity to come online by 2035 in support of Google’s load growth.

Hermes 2 will be a power-producing demonstration reactor built alongside the Hermes Low-Power Demonstration Reactor which is currently under construction at Oak Ridge, Tennessee. The US Nuclear Regulatory Commission issued construction permits for Hermes 2, two 35 MWt molten salt-cooled reactors with a shared power generation system, in November 2024.

To accelerate the delivery of clean energy to Google, Kairos Power said it now intends to increase Hermes 2's output from 28 MWe to 50 MWe "generated by a single reactor," with operations scheduled to begin in 2030.

The agreement will see Google receive the clean energy attributes from the plant through the TVA system to further decarbonise its data centre operations in Montgomery County, Tennessee, and Jackson County, Alabama, and support future growth in the region. The collaboration demonstrates TVA's commitment to integrating innovative, firm energy sources to proactively support the development of new clean generation within its service territory, the companies said.

"To power the future, we need to grow the availability of smart, firm energy sources," said Google’s Global Head of Data Center Energy Amanda Peterson Corio. "This collaboration with TVA, Kairos Power, and the Oak Ridge community will accelerate the deployment of innovative nuclear technologies and help support the needs of our growing digital economy while also bringing firm carbon-free energy to the electricity system. Lessons from the development and operation of the Hermes 2 plant will help drive down the cost of future reactors, improving the economics of clean firm power generation in the TVA region and beyond."

Kairos Power CEO and co-founder Mike Laufer said the collaboration is an "important enabler" to making advanced nuclear energy commercially competitive. "The re-envisioned Hermes 2 gets us closer to the commercial fleet sooner and could only be made possible by close collaboration with TVA and Google, and a supportive local community," he said.

"Energy security is national security, and electricity is the strategic commodity that is the building block for AI and our nation’s economic prosperity," TVA President and CEO Don Moul said, adding that the first-of-a-kind agreement "is the start of an innovative way of doing business. By developing a technology, a supply chain, and a delivery model that can build an industry to unleash American energy, we can attract and support companies like Google and help America win the AI race."

"The deployment of advanced nuclear reactors is essential to US AI dominance and energy leadership," US Energy Secretary Chris Wright said. "The Department of Energy has assisted Kairos Power with overcoming technical, operational, and regulatory challenges as a participant in the Advanced Reactor Demonstration Program, and DOE will continue to help accelerate the next American nuclear renaissance."

Western Uranium focuses on Colorado mill

Western Uranium & Vanadium Corp confirmed it has begun delivering ore from its Sunday Mine Complex in Colorado for processing at Energy Fuels' White Mesa mill, but sees the development of its own Mustang processing facility as critical to its plans for in-house yellowcake production.

_81216.jpg)

Deliveries of ore to White Mesa - currently the only operating conventional uranium mill in the USA - began in June, Western said in its mid-year update. The company began mining and stockpiling ore at the past-producing Sunday Mine Complex in 2023, and finalised an ore purchase agreement with EnergyFuels for the delivery of up to 25,000 short tons of uranium-bearing ore over a one-year period. About 792 tons of material was delivered to the Utah mill in June and July, mostly from stockpiled material.

The company intends to bring yellowcake production in-house, and is prioritising the development of the former Pinon Ridge Mill site in Colorado, which it purchased in 2024. It began baseline data collection for the project - renamed as the Mustang Mineral Processing Plant - in January, and expects to begin preparing a radioactive materials licence application in the first quarter of 2026. The development of the Mustang plant is being prioritised over plans for a new mill - the Maverick Minerals Processing Plant - in Utah due to Mustang's close proximity to the Sunday complex and lower hauling costs in comparison to Maverick, the company said.

Western said it intends to continue to rehabilitate additional areas in the Sunday Mine Complex, which could further expand capacity. It is also considering "less capital intensive" opportunities to increase production capacity, including re-permitting the Topaz Mine, rehabilitating the Sage Mine, reassessing the Van 4 Mine for decline/portal access rather than utilising the previously reclaimed shaft, and additional development of the mines that are part of its joint venture with privately owned company Rimrock Exploration and Development Inc. A project to advance permitting of the San Rafael Project is also under way with the next step being the installation of monitor wells, the company said, adding "Progress has been made on each of these initiatives. Opportunities to acquire additional uranium properties are also being considered."

Western Uranium & Vanadium is headquartered in Nucla, Colorado, and is listed in Canada and the USA. Its uranium and vanadium mineral assets are located across western Utah and eastern Colorado.

X-energy, U.S. military to advance microreactor technology

_43077.jpg)

The company - a subsidiary of X-energy LLC - said the agreement supports continued design and development for the X-energy XENITH microreactor under the Advanced Nuclear Power for Installations (ANPI) programme, an initiative led by the Defense Innovation Unit (DIU) in partnership with the Department of the Air Force.

The programme, launched last year, is designed to accelerate the deployment of next-generation microreactor technologies to provide resilient, secure power at military installations, and enables governmental sponsors like the Department of the Air Force to engage with X-energy under a flexible contracting mechanism that allows for faster development and deployment of commercial nuclear systems.

X-energy said the agreement aligns with President Donald Trump's Executive Order on Deploying Advanced Nuclear Reactor Technologies for National Security, issued in May this year, which directs the Department of Defense (DOD) to deploy an advanced reactor at a military installation before the end of the decade. As part of this effort, X-energy was selected to demonstrate commercial microreactors that can deliver resilient and secure energy to power critical defense infrastructure and remote microgrids.

X-energy's XENITH is a 3-10 MWe high-temperature gas-cooled microreactor first developed for DOD's Project Pele, a mobile microreactor initiative led by the Strategic Capabilities Office. The design was selected to continue into an enhanced engineering phase, focused on achieving preliminary design maturity and initiating pre-licensing engagement with the US Nuclear Regulatory Commission for both military and commercial applications.

Steam generator installation begins at Haiyang 4

_53678.jpg)

Steam generators are heat exchangers which convert heat generated by the reactor core into steam, which is transported to the conventional island via the main steam pipeline. The steam generator drives the steam turbine, which then drives the generator to generate electricity.

The first of the two steam generators for Haiyang 4 - each with a diameter of nearly 6 metres, a length of about 24 metres, and a net weight of over 630 tonnes - was hoisted into place within the reactor building on 13 August in an operation lasting 3 hours and 22 minutes.

(Image: CNNC)

State Power Investment Corporation (SPIC) said the installation of the first steam generator - the heaviest and largest components of the nuclear island reactor's primary circuit - has "laid a solid foundation for the connection of the main circuit of the nuclear island reactor and the capping of the reactor building".

SPIC noted that, based on the construction experience of Haiyang unit 3, workers "formulated improvement measures, established a daily meeting system to sort out various prerequisites, used mature and reliable laser 3D measurement and modeling technology to carry out installation simulation, carried out special prerequisite supervision and inspection, and strictly controlled on-site safety and quality during the hoisting process to ensure the precise positioning of the steam generator."

(Image: CNNC)

The construction of two CAP1000 reactors - the Chinese version of the Westinghouse AP1000 - as units 3 and 4 of the Haiyang plant was approved by the country's State Council on 20 April 2022.

The first safety-related concrete was poured for the nuclear island of Haiyang unit 3 in July 2022, with that for unit 4 being poured in April 2023. The two units are scheduled to be fully operational in 2027.

"XENITH delivers reliable, clean power anywhere it's needed, from remote communities to critical military installations, with the simplicity of factory-built deployment and the reliability of 20-year uninterrupted operation," according to X-energy. "Deployed in months, not years, XENITH provides energy independence where traditional power infrastructure falls short."

In addition to XENITH, X-energy is advancing the deployment of its Xe-100 high-temperature gas-cooled reactor as a grid-scale energy solution for utilities, industrial customers, and hyperscalers. The company is also constructing a first-in-the-nation advanced nuclear fuel fabrication facility to manufacture its proprietary TRISO-X fuel.

X-energy was among eight potential microreactor suppliers selected by DOD in April this year as eligible to seek funding as part of the ANPI programme.

Earlier this month, California-based Radiant - one of the other companies selected - said an agreement it has signed with the DIU and the Department of the Air Force was the first-ever deal designed to deliver a mass-manufactured nuclear microreactor to a US military base. The company is developing the 1 MWe Kaleidos high-temperature gas-cooled portable microreactor. Radiant says it plans to test its first reactor in 2026, with initial customer deployments beginning in 2028.

Equinix signs further agreements with SMR developers

_96509.jpg)

"Equinix is taking a diversified portfolio approach to the global energy challenge by tapping into innovative power technologies and working directly with utilities to strengthen the grid," the California-headquartered company said. "Looking ahead, the company is supporting the development of advanced nuclear technologies that can deliver reliable, clean power in the future.

"Next generation nuclear technologies can offer a pathway to faster nuclear deployments due to their simplified design and robust safety features. Equinix sees safe, efficient and reliable nuclear energy as a promising solution to help power both data centres and the broader grid."

California-headquartered Equinix has now announced a preorder agreement with Radiant for the purchase of twenty 1 MWe Kaleidos high-temperature gas-cooled portable microreactors. The Kaleidos will use a graphite core and TRISO (tri-structural isotropic) fuel.

Radiant was one of eight technology developers selected earlier this year as potential microreactor suppliers made eligible to receive funding under the Advanced Nuclear Power for Installations programme: an initiative launched in 2024 by the Defense Innovation Unit in collaboration with the Department of the Army and the Department of the Air Force, with the goal of "working to design, license, build, and operate one or more microreactor nuclear power plants on military installations".

Earlier this week, Radiant was among 11 advanced reactor projects that the US Department of Energy announced as its initial selection for the Nuclear Reactor Pilot Program, which aims to see at least three of them achieve criticality in less than one year from now.

"Kaleidos offers a reliable, long-lasting energy source that can be transported anywhere it's needed, installed in days, and deployed safely alongside existing equipment and integrated with on-site transmission infrastructure," Equinix said.

In a post on X (formerly Twitter), Radiant said: "We're proud to share that Equinix, the world leader in digital infrastructure, has signed a deal and submitted deposits for the purchase of 20 Kaleidos microreactors. This is not only the largest deal to date for us, it's the largest deal to date for any mass-manufactured reactor."

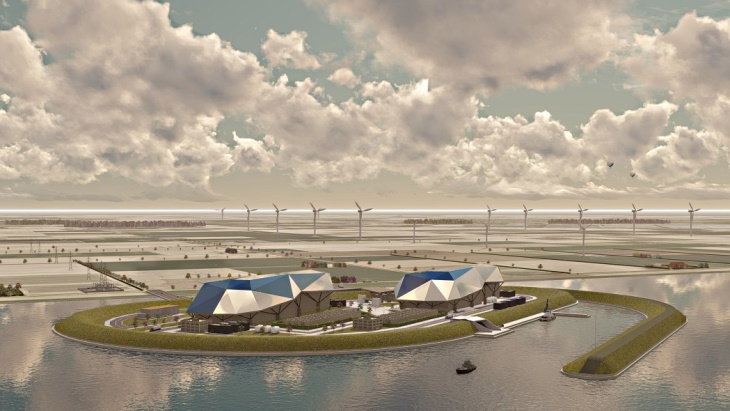

Dutch power purchase agreement

Equinix also announced the signing of a Letter of Intent with ULC-Energy for a power purchase agreement up to 250 MWe to power data centres in the Netherlands.

In August 2022, Rolls-Royce SMR of the UK signed an exclusive agreement with ULC-Energy to collaborate on the deployment of Rolls-Royce SMR power plants in the Netherlands. ULC-Energy - established in 2021 and based in Amsterdam - aims to accelerate decarbonisation in the Netherlands by developing nuclear energy projects that efficiently integrate with residential and industrial energy networks in the country.

(Image: ULC-Energy)

"Our partnership with ULC-Energy marks an important milestone in Equinix's mission to support sustainable growth in the Netherlands," said Michiel Eielts, Managing Director for Equinix in the Netherlands. "By securing Rolls-Royce SMR capacity, we're not only ensuring reliable and clean energy for our data centres but also contributing to a resilient energy future that benefits local communities, supports economic development, and helps reduce the environmental impact of digital infrastructure."

ULC-Energy CEO Dirk Rabelink said: "Small modular reactors (SMRs) are ideally suited to power increasing demand for data centres. They can deliver clean baseload electricity safely, reliably, and affordably. ULC-Energy has developed a deployment model that leverages the SMR's capability to address data centre energy requirements whilst also providing a realistic and affordable solution to support the increasing regional grid and energy challenges. The SMR-powered data centre will enable a clean digital solution and will be a strategic regional energy asset benefitting many local stakeholders."

Equinix has previously signed agreements with other SMR developers. In April 2024, it signed an agreement to procure 500 MW of energy from US company Oklo's next-generation fission Aurora powerhouses. It has also signed a pre-order power agreement for 500 MWe with French molten salt reactor developer Stellaria to power its European data centres.

"The potential challenges to powering reliable and sustainable digital infrastructure are considerable," said Ali Ruckteschler, Senior Vice President and Chief Procurement Officer at Equinix. "However, Equinix has always been at the forefront of energy innovation, signing the data centre industry's first agreement with a SMR provider and pioneering the use of fuel cells a decade ago. Powering AI infrastructure responsibly is a global priority. With Equinix's operational expertise, trusted supply chain, and close partnerships with the US and global governments and utilities, we are poised to deliver safe, secure and reliable AI solutions for our customers and the communities we serve."

No comments:

Post a Comment