Who Will Benefit the Most From Argentina’s Shale Oil Boom?

- Argentina’s state-run YPF has transformed into Latin America’s leading shale developer, producing nearly half the nation’s oil from Vaca Muerta.

- Vaca Muerta’s low breakeven costs and vast reserves have positioned Argentina as South America’s third-largest oil producer and a rising exporter.

- With $36 billion in planned investments through 2030, YPF projects production and free cash flow will more than double, strengthening Argentina’s economy.

In a shock development, crisis-prone Argentina, South America’s second-largest economy, recently emerged as the continent’s third-largest oil producer. The surge in unconventional hydrocarbon output from Vaca Muerta, one of the world's top five shale formations, is driving significant growth in oil and natural gas production. Argentina’s national oil company YPF is leading the shale play’s development and shaping up to be one of the best run state state-owned energy companies in Latin America. Despite being nationalized in April 2012, YPF’s hydrocarbon output is soaring ever higher while operating costs are falling, giving earnings and profitability a solid boost.

Markets shunned YPF after President Cristina Fernandez de Kirchner seized 51% of the company from Spanish energy major Repsol in April 2012 as Argentina struggled with an energy shortfall and enormous trade deficit. Within days, YPF's share price plummeted to a quarter of its value prior to nationalization, as the effects of this event impacted markets and investor confidence. At the time, there were concerns the fiscal and economic issues associated with Argentina’s federal government could impact the company’s finances and operations.

Surprisingly, this did not occur with YPF taking the lead to develop the 8.6-million-acre Vaca Muerta shale, which, despite being discovered in 1927, was not fully evaluated until 2011. There are several reasons for this, the key being Repsol’s reticence to invest considerable capital in exploration activities in Argentina at a time when heavy-handed regulation sharply impacted profitability. It was the lack of development during a period of economic difficulty that saw the government decide to nationalize YPF.

For years, Buenos Aires saw the Vaca Muerta's oil reserves as a key opportunity to strengthen Argentina’s troubled economy. The Vaca Muerta formation holds about 16 billion barrels of recoverable shale oil and 308 trillion cubic feet of natural gas, making it the world's second-largest shale gas and fourth-largest shale oil resource. This is the largest unconventional hydrocarbon deposit of its kind found in South America. The Vaca Muerta was first likened to the Eagle Ford shale, but extensive development shows that it ranks among the world's top-quality shale plays. Industry analysts now say the Vaca Muerta possesses characteristics comparable to the Permian shale, the largest U.S. oil basin producing about six million barrels per day.

Analysts point to the Vaca Muerta’s key geological data, notably high reservoir pressure and superior shale thickness, which makes the formation superior to many U.S. shale plays. Data from Argentina’s Ministry of Economy shows that the Vaca Muerta is the largest hydrocarbon-producing shale region in South America and is among the notable unconventional hydrocarbon formations worldwide. For the first half of 2025, the Vaca Muerta pumped 449,299 barrels of shale oil and 2.8 billion cubic feet of shale gas daily. These figures demonstrate that the Vaca Muerta, excluding Argentina’s conventional hydrocarbon production, is exceeding the hydrocarbon output of numerous South American oil producers.

YPF secured prime shale assets in Vaca Muerta early, while private energy firms remained skeptical of the area, especially after the company’s nationalization at the hands of a fiscally unsound Peronist government. For this reason, the state-controlled energy major is now the leading driller developing South America’s largest shale play.

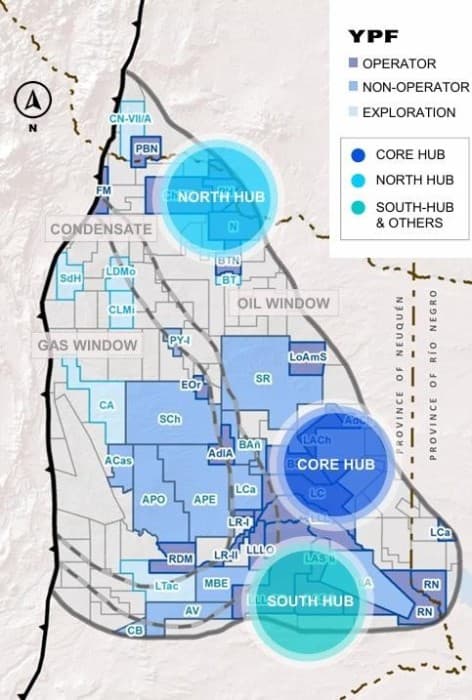

YPF Vaca Muerta Acreage

Source: YPF Investor Presentation June 2025.

YPF now holds the most petroleum acreage and produces the highest volume of hydrocarbons in Vaca Muerta. According to government data, for the first half of 2025, YPF lifted 243,183 barrels of shale oil and 695 million cubic feet of shale gas per day, representing year-over-year increases of 18% and 7%, respectively. For the same period, YPF’s total production reached 343,228 barrels of crude oil per day (71% weighted to shale) and 904 million cubic feet of natural gas daily (77% weighted to shale). Argentina’s state oil firm produces 46% of the nation's oil and 29% of its natural gas.

By 2024, YPF held 1.1 billion barrels of proven hydrocarbon reserves, with 78% (854 million barrels) being shale oil. The company’s proven reserves consist of 56% crude oil, 44% natural gas, and 6% natural gas liquids, with an overall reserve life is 5.6 years, while reserves in the Vaca Muerta are projected to last 8.3 years. YPF’s reserves are growing at a steady clip, expanding by a notable 19% over the last five years as development of the Vaca Muerta has proceeded. In fact, YPF’s shale hydrocarbon reserves of 854 million barrels are more than double the 356 million barrels reported for 2020.

YPF plans to boost shale oil and gas reserves and output, investing $5 billion in 2025 with $3.6 billion earmarked for upstream operations, predominantly to the company’s Vaca Muerta assets. This forms part of a $36 billion five-year investment plan starting in 2025, where nearly 80% of all spending will be directed at upstream operations. YPF recently announced plans to sell stakes in 16 conventional oil blocks to focus on developing the Vaca Muerta, which will boost shale investment and accelerate reserves and production growth.

Vaca Muerta is attractive to energy companies because of its low oil breakeven price of $36 per barrel. This amount is below the $55 to $75 per barrel estimated for Argentina’s mature conventional oil fields and other petroleum-producing regions in South America. YPF reported in its second quarter 2025 results that overall lifting costs were $15.30 per barrel, which falls to $4.60 a barrel for the company’s Vaca Muerta operations. The integrated energy major anticipates that lifting costs will fall significantly overthe coming years to $5 per barrel by 2027 as it transitions to a pure shale hydrocarbon producer. Indeed, according to YPF CEO Horacio Marín, the company’s shale operations are profitable at a Brent price of $40 per barrel.

Argentina’s national oil company expects production to reach nearly 2.1 million barrels of oil equivalent by 2030. By the end of this decade, petroleum output, which is mainly shale oil, is projected to reach 820,000 barrels per day, with natural gas hitting 1.1 million barrels of oil equivalent and natural gas liquids making up the remaining 170,000 barrels per day. YPF projects that 48% of the oil and 40% of the natural gas produced will be exported. Those numbers indicate a substantial bump in earnings is imminent, with projected 2025 EBITDA of $5.3 billion expected to more than double to $11 billion by 2029. All-important free cash flow is expected to rise significantly, reaching $3.1 billion over the same period.

YPF is now a prominent state-controlled South American energy company, following its nationalization. The integrated energy major stands to gain from the rapid development of the Vaca Muerta shale and expansion of hydrocarbon infrastructure. This also benefits Argentina, with the shale play shaping up to be the economic silver bullet long coveted by Buenos Aires. Rising oil and natural gas production means higher energy exports and fewer imports, reducing the risk of a damaging trade deficit. According to government data, petroleum exports in 2024 reached $5.5 billion, representing a 41% increase from $3.9 billion in 2023, contributing to a 2024 trade surplus of $19 billion against a $7 billion deficit a year prior.

By Matthew Smith for Oilprice.com

No comments:

Post a Comment