Copper market to feel impact of accident in Chile as plants shut

El Teniente is the world’s largest underground copper operation. Credit: Codelco

El Teniente is the world’s largest underground copper operation. Credit: CodelcoCodelco stopped processing ore at its biggest copper mine in Chile after a deadly tunnel collapse last Thursday prompted a halt of underground activities.

The El Teniente complex ran out of stockpiled ore and had to put its plants, including the Caletones smelter, on care and maintenance, the state-owned company said Tuesday. About 5,000 workers were brought in to the ground-level facilities to check that equipment isn’t damaged and is ready to restart.

That means ripples from last week’s collapse that killed six workers will start to reach global markets soon. The shutdowns will reduce output of the metal used in wiring, electronics and construction by about 30,000 metric tons a month, a quarter of Codelco’s production.

“The situation is very delicate and an investigation is underway,” said Michael Cuoco, head of metals at StoneX Financial Inc. “As long as it’s ongoing, I find it extremely unlikely that the mine will be able to reopen.”

Copper prices haven’t delivered a major reaction to the Chilean outage so far, with investors also grappling with the fallout from US tariffs. The metal on the London Metal Exchange rose 0.4% by 10:04 a.m. London time to $9,680.50 a ton.

Codelco is committed to resuming operations as soon as conditions allow, it said in a filing on Monday. The company is convening an international panel of experts to audit the mine and establish what happened.

The main union at El Teniente is hoping to have an agreement in place in the coming days that would allow a gradual return to work in areas not directly affected by the collapse. Still, any resumption would have to be cleared by mines regulator Sernageomin.

(By James Attwood)

Codelco stopped processing ore at its biggest copper mine in Chile after a deadly tunnel collapse last Thursday prompted a halt of underground activities.

The El Teniente complex ran out of stockpiled ore and had to put its plants, including the Caletones smelter, on care and maintenance, the state-owned company said Tuesday. About 5,000 workers were brought in to the ground-level facilities to check that equipment isn’t damaged and is ready to restart.

That means ripples from last week’s collapse that killed six workers will start to reach global markets soon. The shutdowns will reduce output of the metal used in wiring, electronics and construction by about 30,000 metric tons a month, a quarter of Codelco’s production.

“The situation is very delicate and an investigation is underway,” said Michael Cuoco, head of metals at StoneX Financial Inc. “As long as it’s ongoing, I find it extremely unlikely that the mine will be able to reopen.”

Copper prices haven’t delivered a major reaction to the Chilean outage so far, with investors also grappling with the fallout from US tariffs. The metal on the London Metal Exchange rose 0.4% by 10:04 a.m. London time to $9,680.50 a ton.

Codelco is committed to resuming operations as soon as conditions allow, it said in a filing on Monday. The company is convening an international panel of experts to audit the mine and establish what happened.

The main union at El Teniente is hoping to have an agreement in place in the coming days that would allow a gradual return to work in areas not directly affected by the collapse. Still, any resumption would have to be cleared by mines regulator Sernageomin.

(By James Attwood)

Why did copper escape US tariffs when aluminum did not?

A US decision last week to exempt refined copper metal from import duties is in contrast to an earlier move to levy steep duties on aluminum, and highlights the central importance of electricity costs and the lobbying dynamics shaping US policy.

The United States stunned the copper market with its decision to only tax imports of semi-finished products such as wire, tube and sheet. Copper prices on Comex are down more than 20% since the announcement on Wednesday.

Since June, aluminum metal shipped to the US, where smelters face higher electricity bills than copper producers, has attracted 50% tariffs.

Taxes on metal production are part of a broader US effort to revive domestic smelting capacity and cut reliance on imports.

US aluminum producer Century Aluminum has been vocal in its support of tariffs that it says are essential to protect what remains of the US aluminum smelting industry.

“Century Aluminum Company applauds President Trump’s unwavering defence of the nation’s domestic production of critical metals by increasing aluminum tariffs to 50%,” the company said in a June release.

The waiver for refined copper reflects its importance to US manufacturing and the influence of the industry, including major producer Freeport-McMoRan, which earlier this year said a global trade war would undermine US copper production.

“A global trade war could result in slower economic growth,” Freeport said in a submission to a US government request for comment on its investigation into copper import tariffs.

“Slower growth in the US or globally would negatively impact copper prices, which could threaten the viability of the domestic copper industry due to its elevated cost structure.”

The case for tariffs on US aluminum imports includes the energy proportion of smelting costs in the United States. Macquarie’s ballpark estimate for energy costs for producing primary aluminum and copper is 50% and 30% respectively.

“There is no economic case for building any greenfield aluminum smelting capacity without substantial intervention. Even then, intervention may not be sufficient,” said Macquarie analyst Marcus Garvey.

Analysts say one major difficulty for potential investors in US aluminum smelting capacity is getting long-term power purchase agreements at competitive prices, when power costs are higher in the US compared with other producing countries such as United Arab Emirates, Bahrain and the world’s biggest producer China.

The cost of electricity is the main reason why there are only four active US aluminum smelters down from 23 in 1995.

According to US Geological Survey, the United States produced 3.35 million metric tons of primary aluminum in 1995, 1.6 million tons in 2015 and 670,000 tons last year.

(By Pratima Desai; Editing by Barbara Lewis)

Trump’s copper tariffs apply to $15 billion of goods so far

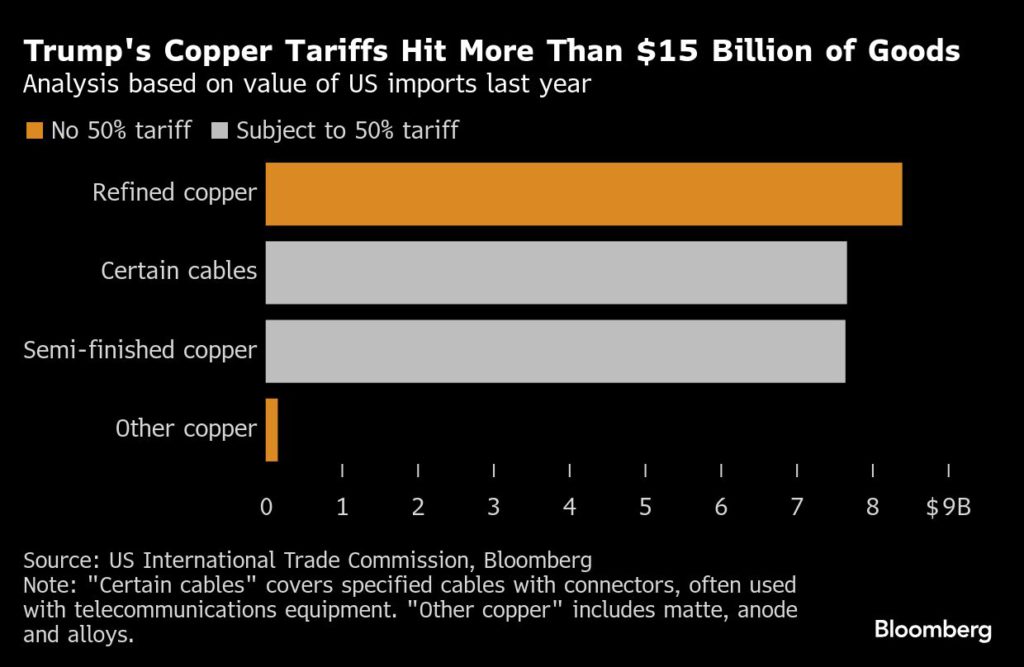

US President Donald Trump’s first wave of copper tariffs will hit imports valued at more than $15 billion last year, highlighting the potential inflationary impact on American buyers.

Details of the 50% import duties sparked turmoil in the global copper market last week — including a record slump for US futures — because Trump handed a surprise exemption to key forms of the wiring metal. But that still leaves significant trade volumes subject to tariffs.

On Monday, the US Federal Register published a list of exactly what will fall under the 50% levy. It includes semi-processed products — like wires, tubes and rods — worth $7.7 billion last year, plus cabling typically used for phone or internet connections with almost the same value, according to Bloomberg News calculations.

And it doesn’t stop there. The White House ordered officials to come up with a plan in 90 days to slap tariffs on an array of other copper-intensive manufactured goods. Trump dramatically expanded the scope of US aluminum and steel tariffs earlier this year by adding derivative products.

The US copper market is scrambling to understand the implications of Trump’s tariffs, which the president said will help boost domestic output of semi-processed and copper-containing products. He stopped short of tariffs on refined metal — an omission that shocked investors but reflects deep US reliance on imports and a pushback by key American buyers, who feared the duties would drive up costs significantly.

Still, the US took in at least 600,000 tons of semi-finished copper last year, according to the US International Trade Commission. About 35% came from Canada, followed by Germany, South Korea and Mexico each at less than 10%. Refined copper, spared from the levies, amounted to about 900,000 tons and was worth about $8.4 billion.

Tariffs will be levied according to the value of the copper content. That means the “semis” that are almost pure copper will attract a much higher effective duty rate than, say, internet cables where the copper wiring is only a part of the product.

No comments:

Post a Comment