Beijing has threatened to take corresponding measures to safeguard its own rights and interests, after Donald Trump threatened 100% US tariffs over China's limits on rare earth exports.

China has accused Washington of "double standards" on Sunday after US President Donald Trump announced an additional 100% US tariffs on imports from the world's second largest economy.

"The relevant US statement is a typical example of 'double standards'," a spokesperson for the Chinese Ministry of Commerce said in a statement. "Should the US persist in its course, China will resolutely take corresponding measures to safeguard its legitimate rights and interests," the statement read.

This comes in response to Trump threatening a new 100% tariff on Chinese goods and export controls on all critical software, starting November 1, in addition to existing 30% tariffs.

Trump, in a post on his Truth Social platform, said that he had learnt that China had taken an "extraordinarily aggressive position on trade in sending an extremely hostile letter to the world."

It came a day after Beijing introduced new export limits on rare earth minerals. China is the world's largest supplier of these materials, which are crucial for tech production.

The new US tariffs threaten to restart a trade war first launched earlier this year. Shortly after Trump took office both nations started exchanging exponentially high tariffs which were eventually paused after several rounds of negotiations.

China defends rare earth control measures

Beijing justified its position on restricting exports, saying China's measures are necessary given the military applications of medium and heavy rare earth metals amid the "current turbulent global situation and frequent military conflicts."

China has long used rare earths — the minerals essential for electronic, automotive and defense systems — as strategic leverage against the US.

Beijing added that it had notified relevant countries and regions before the announcement of the measures.

The Commerce Ministry's statement assured global tech companies and stakeholders that the export measures will have "extremely limited impact" on production and supply chains.

China said it is willing to strengthen dialogue and exchanges on export controls to safeguard supply chains further.

Speaking of its ties with the US, Beijing accused Washington of continuously adding new restrictions against China since the trade talks in Madrid.

It said China's position on tariff wars has been consistent.

"We do not want to fight, but we are not afraid to fight," the Ministry of Commerce said.

Edited by: Rana Taha

Iranian Oil Exports to China Come Under Renewed Pressure

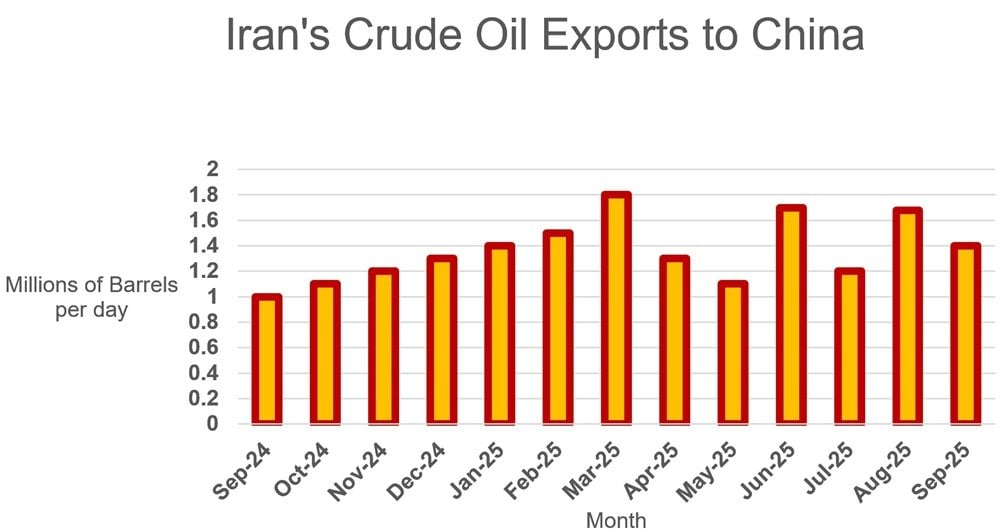

Iranian oil exports to China, which over the previous three months averaged 1.52m bpd, fell to 1.4m bpd in September. From January to August, the average monthly figure was 1.45m bpd, so the figure for September shows a fall below this average, and Vortexa estimate that the figure for October is already set to fall further.

Despite the pressure Iran is under, and the setbacks it has suffered politically this year, Iranian exports of oil in 2025 have until recently held up well. Iran’s sanctions evasion system, much of it orchestrated by commercial entities controlled by the IRGC, have been adept at staying ahead of controls. There are multiple indications however that Iran is about to face a series of difficulties which will jeopardize its capacity to financially underwrite its confrontational political position.

Iranian crude exports to China estimated from Kpler and Vortexa analysis (CJRC)

The imposition on September 28 of snap-back sanctions against Iran, triggered by a mechanism in the 2015 nuclear agreement, broadens the nature of sanctions that can be imposed on Iran, but also does so with the full authority of the United Nations. Critically, China has in the past respected UN-imposed sanctions, in contrast to the way it has prevaricated - alongside other BRICS nations - over some nationally imposed sanctions. The UN’s authority is now behind the sanctions package. China may still demur, in particular because it is now engaged in a tariff war with the United States, and casts the United States as the leader of nations seeking to curb Iran. But BRICS nations, also under pressure from Trump tariff threats, are more likely than hitherto to conform; they will be much warier about being seen to support sanctions-breakers, for example by bunkering or allowing dark fleet vessels to dock.

As if to emphasize that new pressures will be applied, the US Treasury announced one of its largest packages of anti-Iranian sanctions enhancements on October 9. Targeting those both crude oil and LNG-associated, 100 individuals, entities, and vessels were listed. Those targeted fall into three groups.

1) Commodity and oil trading entities, including:

- Turkey-based ABY Plastik, Dina Petrokimya, Yesil Basak and Mikroteknik.

- UAE-based Chemix, Erbium Trading LLC, Golden International LLC and Soft Air.

- India-based BK Sales, CJ Shah, Chemovick, Haresh Petrochem, Indisol, ModyChem, Paarichem and Shiv Texchem.

- Iran-based Kermanshah Petrochemical.

2) Ship managers, storage and port operators include Foreversun and its Jiangsu terminal on the Yangtze, Dimond Town Shipping in Ajman (UAE) and Istanbul-based Tethis Shipping.

3) Ten dark fleet ships, operated by Dimond Town Shipping and Tethis Shipping, and all registered either in Panama, Palau or the Cook Islands.

It’s not as if the relationship between China and Iran is easy. Chinese companies tend to be in arrears when paying, and transactions fall outside the international commercial courts system, frustrating debt collection. For example, Beijing-based Haokun Energy, sanctioned by the US Treasury in May 2022, is believed to owe $1bn to IRGC-related oil trader Sepehr Energy Jahan Nama Pars.

Inequitable barter arrangements, adopted to avoid US Treasury surveillance of the dollar-based international transaction system, are prone to complications. Under a $2.7bn barter arrangement, for example, Tehran Imam Khomeini Airport was supposed to be expanded, a project abandoned, according to Iran International, immediately post the groundbreaking ceremony in 2023. In May, Haokun Energy paid off a debt of $116m by transferring two ex-Hong Kong Airlines A330 aircraft to Iran, but together valued at only $60m.

Rumored debt exchange for Chinese weapons, air defense systems in particular, have so far failed to materialize. Weapons sales are stymied by the Iranian practice of reverse-engineering and copying Chinese missile technology without license. One success was the bartering of debt for the supply by Hong Kong-registered Lion Commodities Holdings of 58 containers loaded with ammonium perchlorate, sufficient to fuel 250 Iranian or Houthi medium-range missiles; but mysteriously, this consignment caught fire and exploded on April 26, destroying most of the Bandar Abbas dockside container park.

There is scope for a further tightening of the screws. Reports in the Iranian media reflect concerns that with the Gaza war out of the way, the United States will be able to apply more focus to the Iranian issue, and to commence seizures at sea under the new UN sanctions regime. Vessel seizures and cargo confiscations are a more certain way of curbing Iranian exports than chasing after front companies and sanctioning dark fleet tankers, which change their flags and names as soon as they are identified.

No comments:

Post a Comment