Teck slashes copper forecast as Anglo stands firm on $53B merger

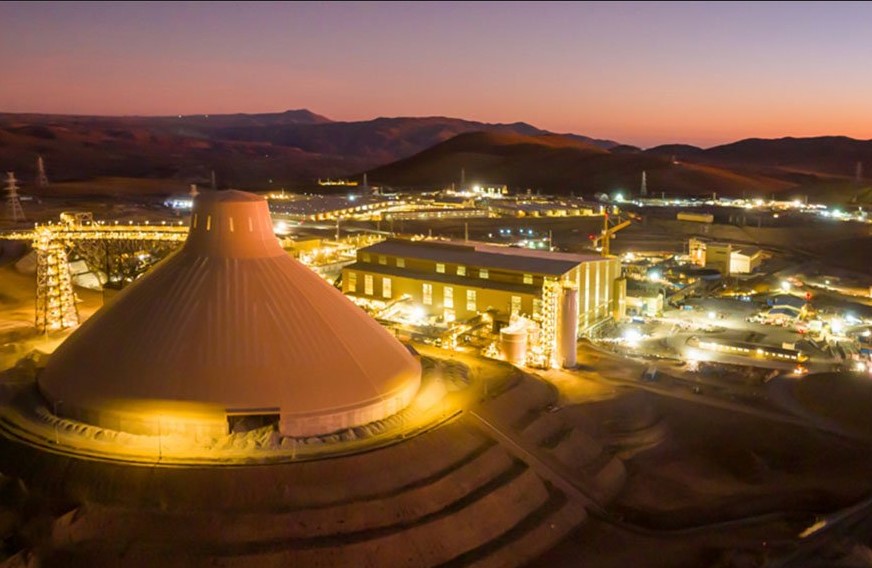

Teck Resources (TSX: TECK.A, TECK.B)(NYSE: TECK) has lowered its copper production guidance for 2025 after persistent setbacks at its Quebrada Blanca (QB) mine in Chile and Highland Valley Copper (HVC) operation in Canada.

The company, which in September agreed to a $53-billion merger with Anglo American (LON: AAL), stressed that the deal’s strategic rationale remains intact.

Teck reported QB copper output of 39,600 tonnes and sales of 43,900 tonnes in the third quarter. Annual production guidance for 2025 has been cut to between 170,000 and 190,000 tonnes, down from 210,000–230,000 tonnes, after extended downtime to raise the tailings dam crest.

Forecasted output for 2026 has also been reduced to 200,000–235,000 tonnes from an earlier 280,000–310,000 tonnes.

The Vancouver-based miner said ongoing tailings management facility (TMF) development continues to restrict output and will cause additional concentrator downtime through 2025, particularly in the third quarter.

Net cash unit costs for 2025 are now projected between $2.65 and $3.00 per pound, up from previous guidance of $2.25–$2.45. Costs are expected to ease to $2.25–$2.70 per pound in 2026 as production improves.

The company added that optimization work at QB, expected to increase throughput by 5–10%, will be delayed beyond 2027–2028 due to continued TMF development and downtime in 2026. Teck warned that if efforts to improve sand drainage or advance TMF construction fall short, production in 2026 and 2027 could face further disruptions.

Teck’s shares jumped on the news, gaining 0.6% in Toronto on Wednesday to trade last at C$59.99 and up 1.6% in New York, reaching $43.12 each. This puts the company’s market value at $21 billion.

QB has long been central to Teck’s growth plans, but the mine has been mired in difficulties since its overhaul, running more than 80% over budget and years behind schedule. In addition to cost overruns, the project has faced pit and plant instability, a ship-loader outage, and waste storage issues.

At Highland Valley Copper in British Columbia, lower grades and maintenance prompted Teck to trim its 2025 copper output guidance to 120,000–130,000 tonnes from 135,000–150,000 tonnes. The company said the rest of its assets should perform broadly in line with earlier forecasts.

Proven approach

Anglo American said in a separate statement that it “fully supported” Teck’s updated outlook, calling the revisions consistent with the findings of its comprehensive operational review.

The mining giant reaffirmed that the merger’s strategic rationale, including synergy estimates and timing, remains unchanged.

Anglo also backed Teck’s more measured approach to QB’s ramp-up, noting that its own technical and project delivery teams had successfully addressed similar issues during the commissioning of Quellaveco in Peru.

Despite QB’s slower expansion, Teck maintained that the mine’s underlying potential “remains intact” and that synergies with Anglo’s nearby Collahuasi mine could unlock additional value.

Teck emphasized that QB is capable of operating at design levels, achieving recovery rates of 86% to 92%, when TMF development is not a constraint.

Teck CEO Jonathan Price said the updated plan reflected “realistic performance assumptions and risk assessments”.

Anglo reaffirmed expectations that the merger will deliver an average annual EBITDA uplift of $1.4 billion from combining QB and Collahuasi, along with $800 million in recurring synergies, creating a stronger, more resilient copper producer.

Copper price hits new high as Teck cuts production forecast

Copper surged to a 16-month high in London Wednesday when Teck Resources (TSX: TECK.A, TECK.B)(NYSE: TECK) lowered its copper production guidance for 2025 after persistent setbacks at its Quebrada Blanca (QB) mine in Chile and Highland Valley Copper (HVC) operation in Canada.

Prices climbed as much as 0.5% to $10,815 per tonne on the London Metal Exchange. The company said it now expects to produce 170,000 to 190,000 tons in 2025, down from its previous target of 210,000 to 230,000 tons. Teck also trimmed annual production targets for the next three years.

The QB project has long frustrated investors, coming in $4 billion over budget and years behind schedule. Current challenges include tailings storage at the high-altitude site in the Andes, as well as damage to key equipment and instability within the mine pit.

So far this year, copper prices have risen about 23%, as mounting supply concerns outweigh weak demand in major industrial economies. Analysts have cut output projections after a series of accidents and operational setbacks at mines in Chile, the Democratic Republic of Congo, and Indonesia, leading many to anticipate sizable supply deficits.

Supply worries intensified after Freeport-McMoRan (NYSE: FCX) declared force majeure at its Grasberg mine in Papua, Indonesia—the world’s second-largest copper operation—following severe flooding that halted production. The company confirmed over the weekend that all seven missing workers were found dead after the discovery of five additional bodies.

“We are in a world of unprecedented copper supply disruptions, and many of these issues are not short-term,” analysts at Jefferies wrote in a note. “Yet another miss at QB just adds more fuel to the fire.”

Citigroup analysts expect copper to climb further, forecasting prices could reach $12,000 per tonne in the first half of next year amid supply cuts and favorable macro trends, including a weaker US dollar. They project prices will gradually ease through 2026 as disrupted mines resume production.

Click on chart for live prices.

On the Chicago Mercantile Exchange, three-month copper futures rose 1.15% to $11,343 per tonne ($5.156 per pound).

(With files from Bloomberg)

No comments:

Post a Comment