AU

Booming gold prices are hiding China’s deflationary pain for now

Gold is a traditional hedge against inflation for investors but in China surging bullion prices are having the opposite effect, providing a temporary respite from deflationary pressures.

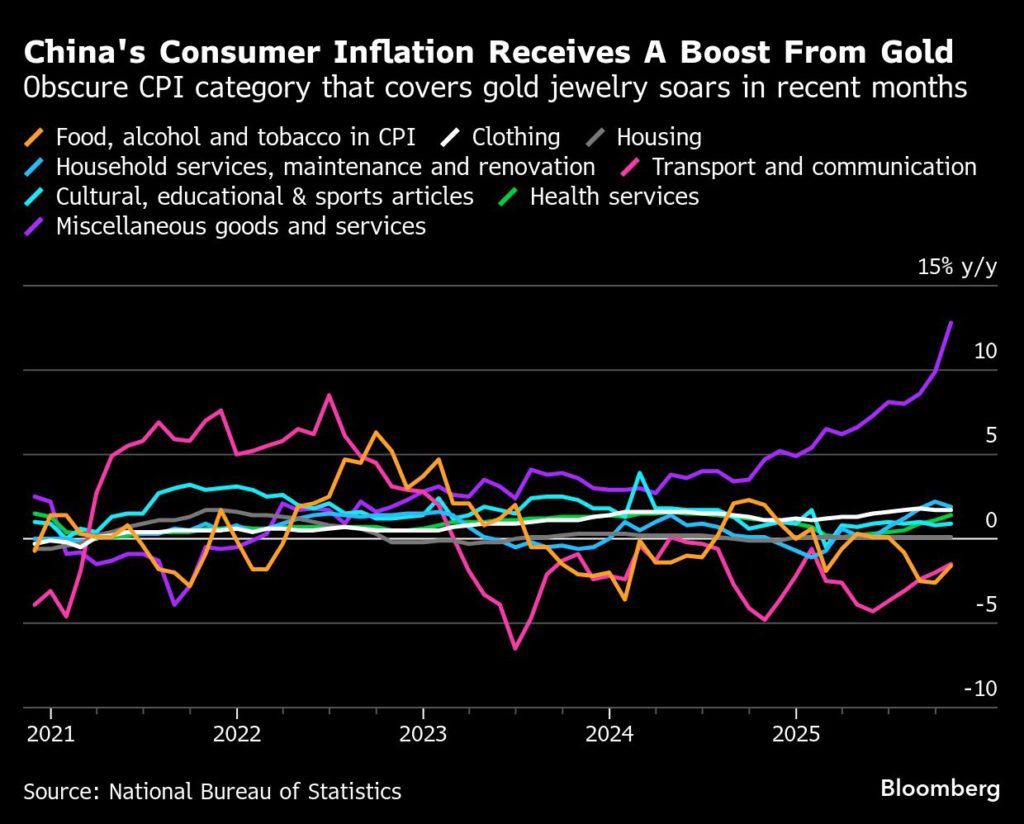

Core inflation last month saw its fastest increase in almost two years, unexpectedly helping the broader consumer-price index end a stretch of three months at or below zero. The precious metal in October contributed close to half or more of the 1.2% jump in the core index, which excludes food and energy, according to estimates from Goldman Sachs Group Inc. and Shenwan Hongyuan Group Co.

CPI “gains largely reflect temporary factors, most notably higher gold prices, and don’t suggest to us that China’s deflation problem is going away,” Zichun Huang, China economist at Capital Economics, said in a note on Monday. “We expect supply and demand imbalances to persist, keeping deflationary pressures in place throughout next year.”

Deflation has been gnawing at the economy that demonstrated resilience throughout a second trade war with the US. A reflection of weak demand, lower prices have led to plunging corporate profitability and falling wages.

The situation could even be worse than captured in official data. A Bloomberg News analysis of almost 70 everyday products and services from multiple sources found prices dropped more sharply than the CPI figures indicate.

Bullion is on track for its best yearly surge since 1979 with a gain of more than 50% this year, creating a pocket of inflation in China — one of the world’s biggest gold markets. Gold jewelry has long been a favorite for households as a gift and a store of value.

Seen as a haven at times of rising geopolitical tensions, global gold prices have also benefited from heavy purchases by central banks trying to diversify away from the dollar.

The rally is having an outsized impact on China even though the weighting of gold and platinum jewelry in the consumer basket is less than 1%, according to Citigroup Inc., which puts bullion’s contribution to core CPI and core goods inflation at “a few tenths.” The National Bureau of Statistics reported an increase of around 50% in prices for those types of jewelry in October.

Gold jewelry falls under the obscure CPI category of “miscellaneous goods and services,” which surged a record 12.8% on year in October — far more than any other component. By contrast, food prices declined almost 3%, while items ranging from consumer goods and fuels to housing rentals and traditional Chinese medicine were all stuck in negative territory.

Other seasonal factors — such as holiday spending and a low base of comparison from last year — also had the surprise effect of pushing up both CPI and producer prices last month.

Only two analysts surveyed by Bloomberg correctly predicted that consumer inflation would reach 0.2% in October from a year earlier.

And while factory-gate deflation also eased, it was mainly a result of a low base last year, according to Goldman Sachs. The improvement was also concentrated in some upstream sectors like the mining and processing of metals, showing the limit of capacity curbs in industries such as steel and coal in the face of weak demand.

For many economists, the rosy picture of inflation likely marks a blip. Domestic demand is still weak, with retail sales slowing sharply and investment in decline.

The downward pull of weak domestic spending is frustrating government efforts to curb price wars and overcapacity in the world’s No. 2 economy, which has seen 10 straight quarters of deflation.

To pull out of the spiral, China needs to take bigger steps to stimulate consumption and growth. Despite the so-called “anti-involution” campaign, the risk is that price weakness will linger without a bolder policy response.

“An only modest letup in China’s producer price deflation in October suggests anti-involution policies to curb price wars still have a lot of unfinished business. Consumer prices swinging back to inflation reflect a holiday boost that will fade. In other words, deflationary pressures remain entrenched — and weaker growth in the fourth quarter means there’s little to change the trend.”

— Eric Zhu

While the ruling Communist Party has signaled greater resolve to boost consumption in the coming few years, economists expect officials to favor a gradual approach.

Beijing lacks effective tools to stimulate consumer spending, largely because China’s tax system encourages localities to support investment and production. A focus on developing advanced manufacturing and achieving technological breakthroughs in the face of hostility from the US will also likely keep the supply side of the economy stronger.

While economists have called for bigger fiscal and monetary stimulus, Chinese officials have refused to provide massive aid like they did in past downturns, due to concerns over a build-up of debt in the economy.

“It is too early to conclude the deflation is over,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “The property prices are still on a downward trend. Domestic demand is weak. Meanwhile export momentum seems to be fading as the frontloading ended.”

Barrick hikes dividend, shifts focus to North America as gold prices bolster profit

Barrick Mining on Monday raised its dividend and expanded its share buyback program after reporting an adjusted quarterly profit that beat estimates, as stronger gold prices helped offset a decline in production.

The Canadian miner’s interim CEO Mark Hill told Reuters that its focus in the future will be “firmly on North America … because it is our next growth area and it is the next growth in gold as well, so that is what we are focused on going forward.”

The miner jointly owns Nevada Gold Mines with Newmont and is also looking to develop the Fourmile gold mine in Nevada. Barrick shares rose nearly 6% in early trading on the Toronto Stock Exchange.

Mali issues

Barrick, the third-largest gold miner by production, has had a volatile year, marked by the loss of control of its gold mine in Mali, which led to a $1 billion write-off of the asset, and the exit of Mark Bristow as its chief executive officer.

The Barrick board’s search committee, led by independent director Brett Harvey, is working to find a new president and CEO, the company said in a statement.

In Mali, four of Barrick’s employees are in jail over a dispute with the company over the country’s new mining tax code.

Hill said his main focus is to get those employees out of jail, adding that the company has to change some of the ways it is approaching the issue. Barrick also filed for arbitration against Mali, though the recent hearings over the company’s request for an urgent hearing over the dispute were rejected by the World Bank’s dispute tribunal.

“We agree that arbitration, while an option, it is probably not a preferred option and is not going to resolve (the problem of) the people who are incarcerated in the short term,” Hill said.

Barrick has been locked in a long-running standoff with Mali’s military-led government since it was forced to suspend operations in mid-January. That move followed the government’s decision to block Barrick’s exports for two months, detain some of its executives and seize three tons of bullion.

Gold prices, which are sensitive to geopolitical and financial uncertainty, averaged $3,574.95 per ounce in the third quarter, more than 16% higher than the preceding quarter and 43% above the levels seen a year earlier.

Prices of the precious metal were buoyed by safe-haven demand as uncertainty over US President Donald Trump’s tariff plans and geopolitical tensions stoked inflation concerns.

Barrick said its average realized gold price rose to $3,457 per ounce during the third quarter from $2,494 per ounce a year earlier.

Its quarterly production decreased to 829,000 ounces from 943,000 ounces last year.

The company’s all-in sustaining costs for gold, an industry metric reflecting total expenses, rose to $1,538 per ounce from $1,507 per ounce during the third quarter.

Barrick declared a 25% rise in its quarterly dividend to $1.25 per share and announced that its board had approved a $500 million increase to the existing share repurchase program.

The company earned 58 cents per share on an adjusted basis in the third quarter, compared with analysts’ average expectation of 57 cents per share, according to data compiled by LSEG.

(By Pooja Menon and Divya Rajagopal; Editing by Shreya Biswas and Paul Simao)

No comments:

Post a Comment