Sander Lutz

Thu, December 22, 2022

The Securities and Exchange Commission (SEC) appears to be compiling legal ammunition to take on the beating heart of the global crypto economy: centralized crypto exchanges. And the agency’s unfolding case against FTX reveals arguments that could further that strategy.

On Wednesday, the SEC announced charges against two key allies of disgraced FTX founder Sam Bankman-Fried: Caroline Ellison, former CEO of FTX’s affiliate trading firm Alameda Research, and Gary Wang, an FTX co-founder. In addition to revealing that Ellison and Wang flipped on Bankman-Fried and are now fully cooperating with federal authorities, the complaint divulged that the SEC—in its pursuit of securities fraud charges pertaining to FTX’s sale of its native token FTT—appears to be escalating its assault on crypto assets as a whole.

If so, it's consistent with the agency’s recent, successful suit against blockchain-based content sharing platform LBRY.

It’s no surprise that the SEC charged Ellison and Wang with securities fraud for manipulating the price of FTT, and for offering FTT as an unregistered security. That action follows a plethora of past moves taken by the securities regulator. But the complaint’s language regarding FTT went notably further.

Wednesday’s complaint labeled FTT “an illiquid crypto asset security,” making the subtle—but crucial—point that the SEC views FTT as a security in itself, regardless of the manner in which it was offered or sold. SEC chair Gary Gensler doubled down on that view yesterday while announcing the charges against Ellison and Wang, calling FTT “an exchange crypto security token that was integral to FTX.”

While seemingly semantic, the difference between pursuing an action against a company for offering an asset as a security, and labeling an asset inherently a security in all contexts, marks a shift in the SEC’s decades-long approach to security regulation. The change could mean a potentially substantial escalation in the agency’s efforts to regulate the crypto industry.

If the SEC can get courts to agree that crypto tokens like FTT are securities regardless of how they are offered, the agency would be able to go after more than just the projects that create those tokens. The SEC could target any intermediary that sells those tokens in any context. In such a scenario, major crypto exchanges like Coinbase, Kraken, and Binance would be exposed to immense legal liability, and either permitted to participate in crypto-wary registered exchanges like the New York Stock Exchange, or shut down.

Coinbase Is Backing Ripple Against the SEC

Last month, the SEC defeated blockchain-based publishing platform LBRY in federal court, and got a judge to imply in his ruling that LBRY’s native token LBC could be considered a security.

“What the LBRY decision does is provide a major step forward in the SEC’s quest to label all tokens as securities, and that is indeed a very, very significant thing,” Lewis Cohen, an attorney specializing in crypto and securities regulation, told Decrypt at the time. (Cohen has previously represented Decrypt.)

“The SEC has changed gears,” Cohen said. “Instead of going after projects, they want to go after the marketplaces and intermediaries.”

LBRY Says Company Has Been 'Killed by Legal and SEC Debts'

The SEC’s victory against LBRY, though, occurred in the U.S. District Court for the District of New Hampshire, a jurisdiction without major sway on federal jurisprudence. The SEC’s current case against FTX, meanwhile, is set in the U.S. District Court for the Southern District of New York, the Manhattan-based overseer of Wall Street activity so central to federal finance law that it is regularly referred to as the “Mother Court” by legal professionals.

Prior to FTX’s stunning collapse last month, the next hurdle in the SEC’s apparent quest to take on crypto exchanges looked to be winning its prominent, ongoing case against blockchain payments company Ripple Labs. Experts pondered whether the federal agency would be able to get a judge from the Southern District of New York in that case to label Ripple’s XRP token an inherent security.

There will be no such anticipation hanging over the SEC’s case against FTX; Ellison and Wang have already pled guilty to all charges.

Liam J. Kelly

Thu, December 22, 2022

The most common phrase found in the SEC’s 38-page complaint alleges that various FTX and Alameda employees either “knew, or were reckless in not knowing” what was actually happening between the two companies.

The next most common phrase? “False and misleading,” a phrase that typically comes up in criminal complaints relating to fraud.

And that just about sums up what happened during what the Commission alleges was a “massive, years-long fraud.”

Now, with Alameda Research’s former CEO Caroline Ellison and FTX’s co-founder and former CTO Gary Wang pleading guilty to a suite of charges, the breadth and depth of the companies’ collapse is much clearer.

Here are the key takeaways.

Alameda’s special privileges

The SEC’s complaint, to which the FTX and Alameda duo pleaded guilty, stated that Wang, as well as another engineer Nishad Singh (who has not pleaded guilty), had created “software code” that gave Alameda special access to the exchange users’ funds.

This code’s existence, previously called a sort of bookkeeping “backdoor,” was first reported by Reuters, citing anonymous sources. Bankman-Fried said later that “that is definitely not true,” adding that he didn’t “know exactly what they’re [Reuters] referring to.”

It now appears that this code indeed existed and offered Alameda some serious benefits. It let the trading firm run a negative balance in its account on FTX, provided the firm with “a virtually unlimited ‘line of credit,’” and prevented Alameda from ever being liquidated.

Importantly, both Ellison and Wang acknowledged the existence of these privileges and that Alameda was an exclusive beneficiary of them.

“Defendants were also both aware that the existence of these special privileges, which were put in place at Bankman-Fried’s direction, were hidden from FTX’s investors,” reads the SEC’s complaint.

Unlimited ‘line of credit’

The complaint alleges that the source of Alameda’s “line of credit” was pulled from FTX users thanks to the above-mentioned backdoor code—routed via a series of interconnected subsidiaries, notably one such firm called North Dimension.

Users deposited fiat into what they thought was FTX but were often actually bank accounts controlled by Alameda. In exchange for these deposits, users would receive “e-money” which, according to FTX’s terms of service, users could “redeem all or part of” at any time.

Another key component of the scheme was how this line of credit was labeled. Called “fiat@ftx.com” in the FTX database, it had no connection to Alameda and allowed Alameda to hide this essentially bottomless liability when courting additional loans.

The complaint explains that Ellison and Wang "knew that FTX customer funds were being sent to Alameda-controlled bank accounts and that Alameda’s liability was reflected in the ‘fiat@ftx.com’ account.”

In total, more than $8 billion in FTX customer assets were handed over to Alameda this way to pay back outstanding loans made to the trading firm and fund its trading strategies.

FTT token 'a security'

The asset, which was arguably the first domino to topple the FTX empire, played a key role in the FTX and Alameda operation.

The FTT token was propped up by Ellison’s trading activity under “the direction of Bankman-Fried” to inflate the token’s value and allow Alameda to continue borrowing against it. And though she was actively manipulating the price of the token, the token’s supply remained almost exclusively in the hands of the two firms.

“Defendants and Bankman-Fried knew or were reckless in not knowing, if Alameda or FTX tried to sell Alameda’s [FTT] holdings, market prices for the tokens would fall, thereby driving down the value of Alameda’s deposited collateral at FTX,” the complaint reads.

The complaint continues, defining the FTT token as a security, citing that sales of the token were used to fund FTX’s growth and operations. During the token’s Initial Exchange Offering (IEO), investors were told that the token would be listed at $1, but if they bought it ahead of time, they could scoop up the token at a hefty discount of up to $0.10.

As a refresher, here’s how the Howey Test defines a security: "investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others."

Commingled all the way through

If it wasn’t already clear, claims made by Sam Bankman-Fried that there was a clear separation between the two firms were quite clearly “false or misleading.”

Each instance of commingling, though often executed or designed by Ellison and Wang, respectively, was primarily done under “Bankman-Fried’s direction.”

Even after Sam Trabucco and Ellison became co-CEOs of Alameda, Bankman-Fried still maintained full access to the trading firm’s records and databases, overseeing its investments and operations.

And just as much of the responsibility falls on a single actor, so too were assets and liabilities from both firms treated as one big “personal piggy bank,” whether known or recklessly unknown.

Kyle Barr

Thu, December 22, 2022

Sam Bankman-Fried looking down with his hands behind his back and a U.S. marshal holding his arm.

Sam Bankman-Fried being led away from court after after attending a bail hearing in U.S. court Thursday.

Failed crypto founder Sam Bankman-Fried heard the news no young man wants to hear Thursday: “sorry son, you’re moving back in with your parents.” For all the young people who lived with their folks into their 20s, let’s just hope for his sake that the old man didn’t get rid of his old childhood bed.

New York federal court Judge Gabriel Gorenstein allowed FTX co-founder Bankman-Fried to be released on a $250 million bond, which also included “strict” supervision while forcing him to remain at his parent’s home in California. The bail was secured thanks to a deal between prosecutors and the FTX ex-CEO’s legal team that finally got Bankman-Fried to agree to extradition.

According to CNBC, the judge said the crypto founder, who often goes by his initials SBF, will also need to wear an electronic monitoring bracelet, go in for mandatory mental health counseling, and limit his movements to the Northern District of California. AP reported from the courtroom that Assistant U.S. Attorney Nicolas Roos recommended these strict bail terms calling it “fraud of epic proportions.” He echoed previous statements from U.S. Attorney for the Southern District of New York Damian Williams who called the FTX case “one of the biggest financial frauds in American history.”

SBF has been charged with eight counts of wire fraud and conspiracy to commit securities fraud, money laundering, and violating campaign finance laws—all centered around his crypto exchange FTX. All in all, the charges equate to a max of 115 years in prison, but that total is a bit of a stretch especially noting other recent major fraud convictions.

There’s an open question of how much money SBF has left after the absolute failure of his exchange that was once worth $32 billion. The crypto founder has been pulled off the Bloomberg and Forbes list of richest billionaires. The once-billionaire recently stated his wealth was limited to just $100,000, though the conditions of his bail require he not open any lines of credit larger than $1,000. You can expect he’ll be asking his folks for their credit cards for any major purchases.

Bankman-Fried’s parents, Joseph Bankman and Barbara Fried, are both Stanford University professors, and both were reportedly present in the courtroom. The crypto founder himself was there as well but was flanked by two U.S. marshals. CNBC noted the alleged fraudster’s parents would be required to use equity in their home to satisfy bail.

Reported documents from the Bahamas showed that FTX and his parents bought millions of dollars worth of property, including condominiums. The pair were there with their son in the Bahamas, sitting in during the contested extradition proceedings.

SBF’s next hearing is set for Jan. 3. Any potential trial is likely to get deep into SBF’s alleged dealings. Late on Thursday prosecutors revealed they flipped former execs for Bankman-Fried’s crypto empire, leading to the current charges. FTX co-founder Gary Wang and Caroline Ellison, ex-CEO of SBF’s hedge fund Alameda Research, have pleaded guilty to federal charges including wire fraud, securities fraud, and conspiracy.

Morgan Chittum

Thu, December 22, 2022

SOPA Images / Contributor/ Getty Images

Former Alameda Research CEO Caroline Ellison pinned FTX's downfall on disgraced cofounder Sam Bankman-Fried, SEC documents show.

"Ellison, at Bankman-Fried's direction, caused Alameda to manipulate the price of FTT," the SEC complaint reads.

Prosecutors are accusing Bankman-Fried of using his Alameda trading firm as "his personal piggy bank."

Former Alameda Research CEO Caroline Ellison was directed by disgraced FTX founder Sam Bankman-Fried to manipulate the financials of the crypto-trading firm, according to the US Securities and Exchange Commission.

Ellison, along with FTX cofounder Gary Wang were charged with defrauding investors and have both pleaded guilty, and are cooperating with prosecutors. Bankman-Fried, meanwhile, was released on $250 million bail on Thursday and will live with his parents in Palo Alto, California.

The FTX founder has claimed he didn't "knowingly commingle funds" between Alameda and FTX, but the SEC's complaint this week states that he often directed Ellison to manipulate or misstate the financial position of the trading firm.

'At Bankman-Fried's direction'

The phrase "at Bankman-Fried's direction" is listed 10 times in the 38-page document, most often linked to Ellison.

Ellison was a trader at Alameda during the time Bankman-Fried acted as CEO, but later stepped up as the firm's co-CEO in 2021. Bankman-Fried has a 90% stake in Alameda, while Wang owns the other 10%.

Until last month, Ellison was "responsible for Alameda's day-to-day operation," according to the SEC complaint.

Prosecutors are accusing Ellison of manipulating the price of FTT, the token made up by the exchange and often used as collateral for undisclosed loans by FTX.

"Ellison, at Bankman-Fried's direction, caused Alameda to manipulate the price of FTT by purchasing large quantities of FTT on the open market to prop up its price," the SEC complaint alleges, shifting some of the blame to the former crypto mogul.

Under Bankman-Fried's direction again, Alameda created automated bots to "conduct trades and execute transactions" to purchase FTT at certain prices points, according to the SEC.

"On more than one occasion, Alameda and Ellison, at Bankman-Fried's direction, actively engaged in the trading of FTT with the goal of supporting the price of the token," the complaint says. "On these occasions, Alameda adjusted the trading parameters of its trading bots in order to support the price of FTT."

"This manipulative activity was in furtherance of Defendants' scheme because it allowed Ellison and Alameda to engage in further borrowing, while concealing Alameda's true risk exposure," the complaint reads.

Ellison used funds funneled from FTX customer deposits into Alameda to service debt to third-party lenders and execute speculative trades with very little risk management.

"Defendants knew that none of this was disclosed to FTX equity investors or to the platform's trading customers," per the SEC, referring to both Ellison and Wang.

Ellison would prepare the balance sheets each quarter to show these third-party lenders, but did not state that these "loans," which was just FTX customer money, was from the exchange.

"Instead, Ellison, at Bankman-Fried's direction, combined this liability with loans Alameda had received from third-party lenders to obscure Alameda's intertwined financial relationship with FTX," the complaint reads.

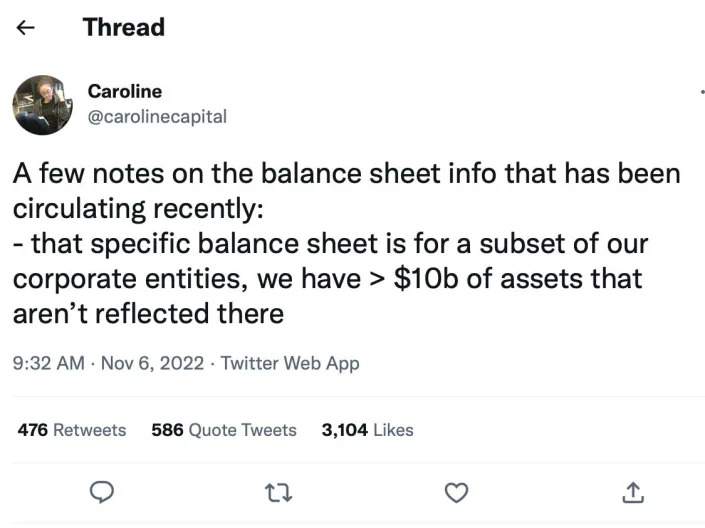

Bankman-Fried even told Ellison to tweet and publicly reassure investors that Alameda was "financially sound" after the bombshell Coindesk report came out.

Ellison tweeted on November 6 that the balance sheet was "for a subset of our corporate entities, we have > $10 billion of assets that aren't reflected there."

Ellison added: "…given the tightening in the crypto credit space this year we've returned most of our loans by now."

"The tweet was designed to provide false reassurance to customers by implying that Alameda had additional assets that meant its financial condition was stronger than the balance sheet suggested," per the complaint. "At the same time, the tweet omitted the fact that the balance sheet did not accurately reflect the significant debt that Alameda owed to FTX."

The complaint reads: "In contrast to the positive message in her tweet, at that point, Ellison knew, or was reckless in not knowing, that Alameda was insolvent."

Despite being co-CEO of Alameda, Ellison usually consulted Bankman-Fried prior to making any big decisions regarding the firm as well.

"Though Ellison made some trading decisions, she frequently consulted with Bankman-Fried, particularly about strategic issues and significant trades," according to the complaint.

Hannah Lang and John McCrank

Thu, December 22, 2022

The logo of FTX is seen at the FTX Arena in Miami

(Reuters) - FTX founder and former Chief Executive Sam Bankman-Fried, who faces U.S. fraud charges over the collapse of FTX, ran his crypto empire with a number of associates.

Two of those are cooperating with federal prosecutors.

Here's a who's who of one-time top officials at Bankman-Fried's crypto empire:

CAROLINE ELLISON

Caroline Ellison, former CEO of Alameda Research, pleaded guilty to defrauding investors in FTX and is cooperating with investigators, according to a prosecutors' statement on Wednesday.

Ellison, 28, grew up in Massachusetts, where both of her parents are economics professors at the Massachusetts Institute of Technology.

She began her career at quantitative trading firm Jane Street after graduating from Stanford University with a degree in mathematics in 2016, she said on a now-offline FTX podcast from July 2020. About a year and a half into that role, Ellison met Bankman-Fried for coffee while visiting the Bay Area, where he first told her about Alameda Research, according to the podcast.

She joined the firm as a trader in 2018 and became co-CEO with Sam Trabucco in October 2021, later becoming the company's sole CEO.

In a Dec. 1 Twitter Spaces event, Bankman-Fried acknowledged that he and Ellison had "been together for a while," but declined to give more details.

Ellison has said she believes in effective altruism, a philanthropic movement popular among Silicon Valley executives.

Ellison did not respond to phone calls or an emailed request for comment.

GARY WANG

Gary Wang co-founded FTX and Alameda Research with Bankman-Fried, and served as FTX's chief technology officer. He and Bankman-Fried met at a math camp in high school and became college roommates, Bankman-Fried wrote in a now-unavailable FTX blog.

Wang worked as a software engineer at Google before co-founding FTX and Alameda, according to an archived webpage for the FTX Future Fund, the company's charitable effort.

In April, Forbes estimated his net worth at $5.9 billion.

"Gary has accepted responsibility for his actions and takes seriously his obligations as a cooperating witness," Ilan Graff, a lawyer for Wang, said in a statement on Wednesday. Graff declined to comment further on Thursday.

NISHAD SINGH

Nishad Singh was a best friend of Bankman-Fried's brother in high school, Bankman-Fried wrote in the deleted blog post. After working for a period at Alameda Research, Singh became FTX's director of engineering in 2019, according to CNBC.

Singh contributed more than $8 million to political campaigns in the 2022 election cycle, all to Democrats, according to OpenSecrets.

He did not respond to an emailed request for comment.

SAM TRABUCCO

Sam Trabucco, the former co-CEO of Alameda Research who stepped down in August but remained as an advisor, met Bankman-Fried in 2010 at a five-week math camp at Mount Holyoke College, according to Insider.

Trabucco graduated from MIT in 2015 with a degree in math and computer science, according to an internet archive of Alameda's website. Before joining Alameda, he worked as a trader at Susquehanna International Group's bond ETF desk.

Trabucco did not respond to an email or a Twitter message requesting comment.

DAN FRIEDBERG

Dan Friedberg, former chief regulatory officer at FTX, was the crypto exchange's "legal advisor from the very beginning," Bankman-Fried wrote in the deleted blog post.

Friedberg is a lawyer who also served as the legal counsel for both FTX and Alameda at times.

He did not respond to an emailed request for comment.

RYAN SALAME

Ryan Salame, the co-CEO of FTX's Bahamian subsidiary, worked for Ernst & Young and Circle Internet Financial before joining FTX Digital Markets in 2021, according to a profile on the University of Massachusetts Amherst's website, where he established a scholarship fund.

Salame was one of the top political donors in the 2022 election cycle donating more than $23 million to Republican campaigns, according to OpenSecrets.

Days before FTX filed for bankruptcy and Bankman-Fried stepped down as CEO, Salame informed the Securities Commission of the Bahamas that client assets held at FTX Digital Markets may have been transferred to Alameda, according to a court filing Wednesday by the agency.

Salame did not respond to a phone call or a LinkedIn message requesting comment.

(Reporting by Hannah Lang in Washington and John McCrank in New York; additional reporting by Angus Berwick in London; editing by Megan Davies and Richard Chang)

An FTX exec bought $6 million of real estate and restaurants in a small Massachusetts town. The crypto giant's collapse has a local official worried about the town's future.

Pete Syme

Thu, December 22, 2022

Ryan Salame.The Berkshire Eagle

Ryan Salame, a co-CEO at FTX, reportedly bought $6 million of restaurants and real estate in Lenox, Massachusetts.

A local official told The Berkshire Eagle she was "concerned" about what FTX's collapse meant for the town.

The newspaper reported last year that Salame owned almost half the town's restaurants.

The 5,000-resident town of Lenox, Massachusetts is closely following the FTX fallout because one of the company's co-CEOs owns a significant portfolio of property in the town.

As first reported by The Berkshire Eagle, Ryan Salame, who was co-CEO at FTX Digital Markets, invested $6 million in restaurants and real estate in Lenox. The same newspaper reported last year that Salame owned almost half the town's restaurants.

FTX has since filed for bankruptcy and its founder, Sam Bankman-Fried, was arrested last week. Bankman-Fried has been accused of funneling customer funds into his trading firm, Alameda, and using some customer money to buy luxury real estate and fund political donations.

Salame received a $55 million loan from Alameda, according to bankruptcy filings, and donated $23 million to mostly Republican political candidates.

Jennifer Nacht, executive director of the Lenox Chamber of Commerce, told The Berkshire Eagle she was "concerned" about what FTX's collapse "means for Lenox."

Salame's company Lenox Eats, and his attorney, Jason Linder, didn't immediately respond to Insider's requests for comment.

Two days before FTX's bankruptcy, Salame alerted authorities about potential wrongdoing at the company, according to court filings. The Wall Street Journal also reported that Salame vomited upon hearing about FTX's impending collapse.

David Hollerith and Alexis Keenan

Wed, December 21, 2022

FTX co-founder and former CTO Gary Wang and former Alameda Research CEO Caroline Ellison have plead guilty to charges related to their roles in fraud that contributed to the collapse of FTX, U.S. Attorney Damian Williams said Wednesday night.

Both Wang and Ellison are cooperating with Justice Department's investigation, Williams said.

Seven charges leveled against Ellison, and those to which she plead guilty include wire fraud and wire fraud conspiracy against FTX customers and FTX's sister hedge fund Alameda Research, conspiracy to commit commodities and securities fraud, and conspiracy to commit money laundering. The charges carry up to 110 years in prison and millions of dollars in in potential penalties.

Wang's charges, to which he also plead guilty, include four counts of wire fraud and wire fraud conspiracy, as well as conspiracy to commit commodities and securities fraud. Penalties for the charges carry up to 50 years in prison, plus fines.

In a separate action, the SEC announced late Wednesday it charged both Wang and Ellison with defrauding FTX investors, saying both were cooperating with its investigation and disclosing both had entered into settlements with the SEC.

Caroline Ellison, 28, ran the crypto hedge fund Alameda Research that was a subsidiary of FTX. Ellison previously worked with former FTX CEO Sam Bankman-Fried at Jane Street.

Gary Wang, 29, was a former college roommate of Bankman-Fried at the Massachusetts Institute of Technology. Wang cofounded FTX with Bankman-Fried in 2019.

FTX co-founder Sam Bankman-Fried is escorted out of the Magistrate's Court on December 21, 2022 in Nassau, Bahamas. (Photo by Joe Raedle/Getty Images)

On Wednesday, a judge approved Bankman-Fried's extradition to the United States after the Bahamas Minister of Foreign Affairs signed off on the order. Williams also confirmed Sam Bankman-Fried’s extradition and transfer to U.S. custody.

"Samuel Bankman-Fried is now in FBI custody and is on his way back to the United States. He will be transported directly to the Southern District of New York, and he will appear in court before a judge in this district as soon as possible," Williams said.

On the night of December 12, the Bahamas Royal Police arrested Bankman-Fried. Until Wednesday, Bankman-Fried was being held in custody at the Fox Hill prison in New Providence, Bahamas.

A spokesperson for Bankman-Fried declined to comment.

“As I said last week, this investigation is very much ongoing and is moving very quickly,” Williams said. “I also said that last week’s announcement would not be our last. And let me be clear once again: Neither is today’s.”

Williams warned those that participated in misconduct at FTX or Alameda to come forward. “Our patience is not eternal,” he said.

A spokesperson for the U.S Attorney’s Office, Southern District of New York did not respond to Yahoo Finance's request for comment.

SEC allegations

According to the SEC’s complaint, from 2019 and 2022, Ellison, at the direction of Bankman-Fried, furthered a scheme to manipulate the price of FTX's token, FTT, "by purchasing large quantities on the open market to prop up its price."

This practice allowed FTX to use FTT as collateral for loans taken out by FTX using its customers' assets to Alameda. The outcome permitted the value of Alameda's balance sheet to be overstated, thereby misleading investors about FTX's exposure, the SEC complaint alleges. The SEC did not respond to Yahoo Finance's request for comment by press time.

During the same time, Bankman-Fried touted FTX as a "safe crypto asset trading platform with sophisticated risk mitigation measures to protect customer assets." FTX's current CEO, John J. Ray III, said in testimony before the U.S. House Financial Services Committee on December 13 that he estimates FTX's losses are in excess of $7 billion dollars.

FTX customer funds were used for Alameda's trading activities, loans to FTX executives, and to fund personal real estate purchases, according to the SEC complaint.

"Between March 2020 and September 2022, Bankman-Fried executed promissory notes for loans from Alameda totaling more than $1.338 billion, including two instances in which Bankman-Fried was both the borrower in his individual capacity and the lender in his capacity as CEO of Alameda," the complaint said. "Ellison knew, or was reckless in not knowing, about these 'loans.'"

As CTO of FTX, Wang created the platform's software code that allowed Alameda to divert FTX customer funds, the SEC alleged. At Alameda, Ellison used the misappropriated funds for the hedge fund's trading activity, according to the SEC's complaint.

The complaint also alleges that even after it was made clear FTX could not make customers whole, Bankman-Fried "directed hundreds of millions of dollars more in FTX customer funds to Alameda" with the knowledge of Ellison and Wang.

"By surreptitiously siphoning FTX’s customer funds onto the books of Alameda, defendants hid the very real risks that FTX’s investors and customers faced," said in SEC's statement on its complaint.

The SEC is seeking monetary penalties and to bar Ellison and Wang from acting as corporate officers or directors. The action also asks for an injunction to stop the defendants from participating directly or indirectly in the issuing, purchasing, offering, or selling traditional and crypto securities.

The SEC said both have reached settlements, subject to court approval.

Beatrice Nolan

Thu, December 22, 2022

Gary Wang is considered to be an elusive figure who keeps a low profile.FTX; Rachel Mendelson/Insider

FTX cofounder Gary Wang was a critical player during the rise and fall of SBF's crypto empire.

Wang also served as FTX's former chief technology officer but kept a low profile.

Here's what we know so far about the elusive figure.

Gary Wang, the cofounder of FTX, has been a mysterious but critical player in the rise and spectacular fall of the crypto empire.

Throughout his time at FTX, Wang maintained a limited online presence and steered clear of media interviews, leaving the limelight to his cofounder, Sam Bankman-Fried.

Wang served as the chief technology officer at FTX until the exchange collapsed in mid-November. He

Here's what else we know about the mysterious cofounder:

A prolific coder with degrees from MIT

Wang reportedly met Bankman-Fried at math camp when the pair were at high school. The future cofounders were also college roommates at MIT and lived together in a Bahamas house that was home to several other FTX employees.

After graduating from MIT with degrees in mathematics and computer science, Wang worked at Google. He was an engineer at the company, building systems to aggregate prices across millions of flights, per Forbes.

When Bankman-Fried cofounded Alameda Research in 2017, Wang reportedly left his role at Google.

Wang later became the chief technology officer at FTX, establishing himself as a key member of the crypto empire's inner circle. The tight group of executives reportedly included Wang, Bankman-Fried, Caroline Ellison, who was formerly Alameda's CEO, and Nishad Singh, FTX's former director of engineering.

The Wall Street Journal reported, citing people familiar with the matter, that Alameda Research's chief executive and senior FTX officials knew that FTX had lent its customers' money to Alameda to help it meet its liabilities.

A reclusive figure

Singh, who was mentored by Wang, once described him as brilliant "beyond belief" in a 2020 podcast cited by the Sydney Morning Herald.

But at FTX, Wang was a somewhat reclusive figure, per reports. The executive's profile picture didn't show his face when it appeared on company systems, The Block reported.

Sources told the publication that he was one of a few employees who worked from home, and liked to get stuck into coding. "Gary always struck me as someone who was like, 'just tell me what to do and leave me alone,'" a source familiar with both Alameda's and FTX's operations told The Block.

Fraud charges and guilty plea

Unlike his cofounder, Wang has largely disappeared from view since he was fired from FTX after the company's implosion.

Beyond Bankman-Fried telling a Vox reporter in November that "Gary is scared," not much has been reported about the elusive cofounder.

On Wednesday, the US attorney for the Southern District of New York announced that both Wang and Ellison had pleaded guilty to fraud.

Wang had been charged with "a multiyear scheme to defraud equity investors in FTX" by the Securities and Exchange Commission.

The pair are said to be cooperating with the prosecutors, according to a statement from US attorney, Damian Williams.

Ilan Graff, Wang's attorney, told Insider: "Gary has accepted responsibility for his actions and takes seriously his obligations as a cooperating witness."

Sindhu Sundar contributed to this story.

Phil Rosen

Wed, December 21, 2022

Sam Bankman-Fried founded the now-bankrupt crypto exchange FTX.Tom Williams/Getty Images

Big players in distressed investing are eyeing FTX customers whose assets are stuck on the bankrupt crypto exchange, Bloomberg reports.

Names like Baupost Group and Oaktree Capital are among those that have expressed interest in buying their claims.

Talks over accounts holding over $100 million are heating up, per the report.

Big players in distressed investing are eyeing the claims of FTX customers whose assets are stuck on the bankrupt crypto exchange, sources told Bloomberg.

Top names like Baupost Group and Oaktree Capital Management are among those that have expressed interest, according to the report, potentially setting up risky bets that they will eventually get paid in bankruptcy proceedings.

- ADVERTISEMENT -

Meanwhile, other Wall Street players like Citigroup and Cowen are vying for a chance to play middleman here, the report added.

Valuations have hovered between 5 and 13 cents on the dollar, and customers must decide whether to get limited cash now or hold out for something better in the future, which isn't a sure thing.

Any investors face a great deal of uncertainty with FTX. The company's new management, led by John Ray III, has found over $1 billion in assets and $1.2 billion in cash versus liabilities of roughly $10 billion. Just how much of those funds will go to creditors and customers remains to be seen.

More and more investors are inquiring about accounts holding over $100 million, per the Bloomberg report. The largest 50 creditors have a face value of at least $20 million, and countless other customers lost access to assets on the exchange.

Since Sam Bankman-Fried stepped down as CEO and the exchange filed for bankruptcy in November, Ray has said that FTX had haphazard bookkeeping and suspect financial records, and that it's impossible to recoup all customer losses.

Several FTX customers who lost access to funds on the platform shared plans with Insider to pivot away from crypto and put cash into stocks in the future, and that they don't have much hope in the company making them whole.

Sam Bankman-Fried loved playing 'League of Legends' in meetings. Now the game's maker wants out of its $96 million FTX sponsorship deal.

Travis Clark

Thu, December 22, 2022

Riot Games wants out of a roughly $96 million agreement with bankrupt crypto firm FTX.

The company cited "reputational harm" amid FTX's collapse.

FTX's former CEO Sam Bankman-Fried was recently arrested on fraud-related charges.

"League of Legends" maker Riot Games wants out of a $96 million sponsorship deal with bankrupt cryptocurrency firm FTX.

Last week, the company cited "reputational harm" in a court filing, in which it outlined the terms of the deal.

In exchange for placement of the FTX logo on Riot Games' marketing materials, FTX was to pay the company roughly $96 million over the course of seven years, 2022 through 2028 — including $12.5 million this year, of which it still owes half.

But now Riot wants to terminate the agreement amid FTX's collapse and its cofounder and former CEO Sam Bankman-Fried's arrest earlier this month for numerous fraud-related charges. If the deal is terminated, it is unclear what FTX's remaining financial responsibilities will be.

"Prior to, and throughout this media firestorm, Riot's image and reputation to its customer base, remained inextricably linked to FTX through its former CEO, Mr. Bankman-Fried," the filing said. "Media outlets and Twitter commentators splashed images of Mr. Bankman-Fried playing 'League of Legends' — Riot Games' game — at the same time that FTX was crashing."

Riot Games and FTX did not immediately reply to Insider's request for comment.

Bankman-Fried's affinity for "League of Legends" is well known. In February 2021, he tweeted that he is "(in)famous" for playing the multiplayer online game "while on phone calls."

He was also once caught playing it during a pitch meeting with investors from venture-capital firm Sequoia Capital.

The filing noted that even the likes of billionaire Twitter owner Elon Musk and Rep. Alexandra Ocasio Cortez have both recently mocked Bankman-Fried's low score in the game — another example of his name and reputation being associated with it.

"The reputational harm inflicted upon Riot cannot be undone," the filing said. "It would be untenable for Riot to be forced to continue its association with a company whose reputation is forever tarnished in the eyes of the public."

Bankman-Fried was arrested in the Bahamas last week after US prosecutors filed charges against him, including wire fraud. On Wednesday night, he was extradited to the US, where he'll face the charges.

FTX Asks Judge for Help in Fight Over Robinhood Shares Worth About $450M

Nick Baker

Thu, December 22, 2022

FTX sought a U.S. bankruptcy court's help amid a battle over ownership of about $450 million worth of stock in Robinhood Markets (HOOD), according to a filing Thursday.

At issue are about 56 million shares of the brokerage owned by Emergent Fidelity Technologies Ltd., a corporate entity organized in Antigua and Barbuda and 90% controlled by former FTX CEO Sam Bankman-Fried, according to the filing.

Three parties, the filing says, have tried to get control of those shares: BlockFi (a lender that FTX had helped prop up earlier this year), Yonathan Ben Shimon (an FTX creditor appointed as a receiver in Antigua and granted permission to sell the shares under supervision of a court there) and Bankman-Fried himself (who has legal bills).

Read more: Sam Bankman-Fried Released on $250M Bail Secured by Parents

FTX's bankruptcy estate told ED&F Man Capital Markets, the brokerage where the shares are parked, to freeze the stock around the time the Chapter 11 case began on Nov. 11. FTX has determined that Emergent only "nominally" owns the shares and that they truly belong to FTX. "Emergent is a special-purpose holding company that appears to have no other business," the crypto exchange said in the filing.

The judge overseeing the bankruptcy case should force the shares to remain frozen while FTX tries to figure out how to repay all its creditors, FTX argued in the filing.

"The fact that multiple prepetition creditors of different Debtors and Mr. Bankman-Fried are all seeking to obtain possession of the Robinhood Shares demonstrates that the asset should be frozen until this Court can resolve the issues in a manner that is fair to all creditors of the Debtors," FTX said.

FTX says it has $1 billion in cash, as new management team tries to track down funds to pay back creditors

Carla Mozée

Wed, December 21, 2022

Then-FTX CEO Sam Bankman-Fried testified at a House Financial Services Committee in December 2021.Alex Wong/Getty Images

FTX has more than $1 billion in cash, the collapsed crypto exchange's new management said at a creditor hearing.

Management is working to retrieve funds from bank accounts to repay creditors and resolve the company's position.

The hearing was part of FTX's bankruptcy proceedings following its November implosion.

Bankrupt crypto exchange FTX has at least $1 billion in cash, new management told creditors at a hearing as they work to retrieve funds from bank accounts.

CoinDesk reported on Wednesday that new executives told creditors at a hearing that they have identified more than $1 billion in assets. The hearing was part of bankruptcy proceedings that have been taking place in recent weeks following the company's implosion in early November.

FTX has tracked down about $720 million in cash in US financial institutions authorized to hold funds by the Department of Justice. Nearly another $500 million is already being held in US institutions, the report said.

There is $6 million being kept for payroll and other operational purposes. Most of the remaining $423 million is mainly held at a single broker. FTX's new chief financial officer, Mary Cilia, declined to identify the broker at the hearing, the Coindesk report said.

"We are reaching out to all of those banks and changing the signatories on the accounts so that we can get access to the accounts and move the cash as much as we can to authorized depository institutions," Cilia said at the creditors' meeting. Japanese regulators are holding around $130 million of cash in Japan for redemption by local customers.

FTX in a November court filing said it owed its 50 biggest creditors nearly $3.1 billion.

Tuesday's hearing was part of FTX's Chapter 11 bankruptcy proceedings. FTX fell in November following a jump in withdrawals and allegations of misuse of FTX customer funds.

FTX's new CEO John Ray guided energy giant Enron and telecom company Nortel through their insolvencies. Bankman-Fried was expected to return to the US as early as Wednesday under extradition from the Bahamas.

Caroline Ellison, the former CEO

of Alameda, pleads guilty to charges

that carry up to 110 years in prison

following FTX collapse

Caroline Ellison, former Alameda Research CEO, pleaded guilty to charges that carry up to 110 years in prison.

Per her plea deal, she has pleaded guilty to seven charges, including wire and securities fraud.

She has also agreed to pay restitution of an amount to be determined by the courts.

Caroline Ellison, the former CEO of Alameda Research, pleaded guilty to charges that carry up to 110 years in prison after striking a plea deal with the Justice Department.

It's not likely that she will serve anywhere near the statutory maximum for the charges she pleaded guilty to because of the plea agreement she struck with prosecutors in the Southern District of New York, dated December 18.

Ellison faces seven charges that collectively carry a maximum prison sentence of 110 years. These include conspiracy to commit wire fraud, securities fraud, and commodities fraud. She also faces a charge of conspiracy to commit money laundering.

Ellison has agreed to waive any defenses to the charges. Per her deal with prosecutors, she also agreed to pay restitution, the amount of which the courts will determine.

As part of the deal, Ellison must cooperate fully with prosecutors, the FBI, and any other law-enforcement agencies. She must also provide documents, records, and evidence to prosecutors, as well as testify to a grand jury or at court trials when requested.

A lawyer for Ellison did not immediately respond to a request for comment.

Ellison was the FTX cofounder Sam Bankman-Fried's on-again, off-again girlfriend. She was the chief of Alameda Research, the trading firm Bankman-Fried launched. Also working with Bankman-Fried and Ellison at Alameda Research was Gary Wang, another FTX cofounder.

Wang, like Ellison, has pleaded guilty to fraud, according to a Wednesday announcement from the US attorney for the Southern District of New York.

In November, Reuters reported that Bankman-Fried secretly moved $10 billion in customer funds from FTX to Alameda Research. A large chunk of that money has gone missing, Reuters' sources said, pegging the amount between $1 billion and $2 billion.

Bankman-Fried told Reuters he "disagreed with the characterization" of the $10 billion transfer.

"We didn't secretly transfer," he told Reuters in text messages at the time. "We had confusing internal labeling and misread it."

On Wednesday night, Bankman-Fried was extradited from the Bahamas and landed back in the US.

FTX filed for Chapter 11 bankruptcy protection on November 11 after it imploded, decimating billions in customer funds overnight. Bankman-Fried resigned as CEO the same day.

Former Alameda Research CEO Caroline Ellison's plea agreement includes a deal for $250,000 bail and a surrender of the exec's travel documents

Morgan Chittum

Thu, December 22, 2022

The collapse of FTX exchange.NurPhoto / Getty Images

Former Alameda Research CEO Caroline Ellison's plea agreement includes $250,000 bail and an agreement to surrender travel documents.

Per the deal, Ellison will not be allowed to leave the continental United States and must forfeit proceeds of the crimes.

FTX cofounder Gary Wang also pleaded guilty to fraud charges in connection to the downfall of the crypto empire.

Former Alameda Research CEO Caroline Ellison could receive up to 110 years in prison for her role in the fallout of FTX, the once $32 billion crypto empire started by Sam Bankman-Fried.

Ellison, who oversaw FTX's sister quant trading firm and later pleaded guilty to seven charges including fraud, will not be allowed to leave the continental United States and must give up the proceeds from illicit activities, according to the plea agreement with the US Attorney's Office of the Southern District of New York.

The recently unsealed plea agreement says that Ellison must fully cooperate with prosecutors and law enforcement agencies, along with providing evidence and testifying to a grand jury or at a court trial, if asked.

The former exec could still receive criminal tax violations due to commodity and wire fraud charges, and the plea does not guarantee that other agencies won't prosecute Ellison in the future.

A court will need to agree to the plea deal, however, for it to go into effect. Ellison will be permitted bail, if she can pay a $250,000 personal recognizance bond.

A paragraph of the document, which is dated December 18, has been redacted.

FTX cofounder Gary Wang also plead guilty to fraud charges connected to FTX's downfall on Wednesday, according to US attorney Damian Williams.

The US Department of Justice, the Commodity Futures Trading Commission ,and the Securities and Exchange Commission have all announced charges against the two, accusing Ellison of manipulating the price of FTX's exchange token FTT, which Alameda used as collateral for investments.

All three execs "were active participants in a scheme to conceal material information from FTX investors, including through the efforts of Mr. Bankman-Fried and Ms. Ellison to artificially prop up the value of FTT, which served as collateral for undisclosed loans that Alameda took out from FTX pursuant to its undisclosed, and virtually unlimited, line of credit," SEC Deputy Enforcement Director Sanjay Wadhwa said in a statement on Wednesday.

Read the full seven-page plea agreement here.

Here are some of the most striking quotes.

Caroline Ellison faces up to 110 years in prison after pleading guilty to seven charges, including fraud.

Twitter and Tumblr accounts thought to be linked to Ellison contain musings about race science and gender roles.

Here are some of the most striking quotes from those accounts.

Following the implosion of cryptocurrency exchange FTX, the world is scrambling to learn more about Caroline Ellison.

Ellison was the CEO of Alameda Research, a trading firm that borrowed customer funds from FTX to cover its losses and make risky bets. She was fired when FTX and Alameda Research filed for bankruptcy.

On December 18, Ellison struck a plea deal with prosecutors in the Southern District of New York, pleading guilty to seven charges including wire and securities fraud. These charges carry a maximum sentence of 110 years in prison. According to Ellison's plea deal, she has agreed to provide prosecutors with evidence and "truthfully testify" about the FTX implosion during court trials.

Until recently, Ellison was a shadow behind the success of FTX and Sam Bankman-Fried, who was widely regarded as a crypto wunderkind.

Since FTX's demise, a Twitter account and two Tumblr blogs — that include personal and professional details that match those of Ellison's — have become the internet's greatest resources on the former CEO. They offer what could be a glimpse into the 28-year-old's personal beliefs, including her thoughts on cryptocurrency trading.

While Ellison's views are certainly not a direct reflection of her work, they map onto larger questions of diversity within the cryptocurrency industry. CoinDesk, a cryptocurrency publication, noted that "white men dominate crypto" while a 2022 study from the Morning Consult showed that 62% of all cryptocurrency owners identified as white and male.

Ellison did not respond to requests for comment. Here are some of the most revealing quotes found on these social media accounts.

December 22, 2022: This story has been updated to reflect the details of Ellison's plea deal.

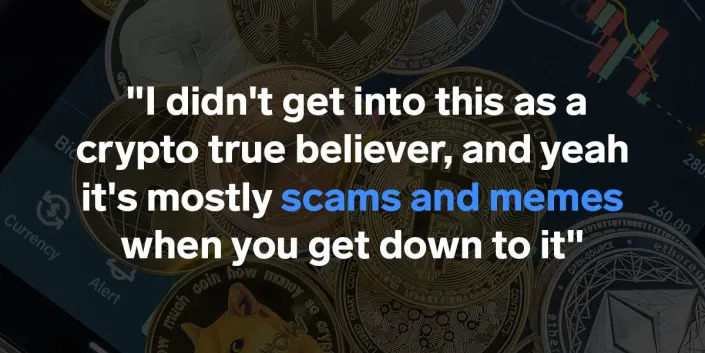

On believing in crypto

On one of Ellison's presumed Tumblr accounts, titled "worldoptimization," the author underscores the natural synergy between cryptocurrency and fraud.

"I didn't get into this as a crypto true believer, and yeah it's mostly scams and memes when you get down to it," the author wrote.

The author added, "but like, I have also come to see a real and pressing need for crypto."

For the author, the importance of crypto all comes down to the power of decentralization. "[D]ecentralized noncustodial money seems pretty foundational to civil liberties and the ability and if authoritarian governments are a serious threat to civilization, which seems not totally insane, it could end up being important," they wrote.

Source: worldoptimization

On using stimulants

Amid the high-octane work environment of FTX and Alameda Research, employees reportedly turned to stimulants like amphetamine, a drug for treating attention disorders.

"Nothing like regular amphetamine use to make you appreciate how dumb a lot of normal, non-medicated human experience is," Ellison tweeted in 2021.

Source: @carolinecapital

On gender disparities in math

Ellison exhibited a natural aptitude for math from an early age. She attended competitions like the Math Prize for Girls, which bills itself as "the largest math prize for girls in the world," and she went on to study mathematics and computer science at Stanford University.

That didn't necessarily make her a proponent for drawing more women into STEM.

In June 2020, the author of the "worldoptimization" Tumblr wrote, "Girls just aren't as good at math. I think my first exposure to feminism came in middle school. I was a math team kid, and one of the things that quickly becomes self-evident when you're a math team kid is that girls just aren't as good at math as boys."

Source: worldoptimization

On power, sex, and "cute boy things"

Ellison and Bankman-Fried's on-again, off-again polyamorous relationship with their coworkers caught the industry's attention following FTX's implosion. Anonymous sources told CoinDesk that the core 10 members of FTX and Alameda Research clan reportedly lived together in a house in the Bahamas and were all paired off in relationships with one another.

In a February 2020 post on "worldoptimization," Ellison may have likened the atmosphere to an "imperial Chinese harem."

"None of this non-hierarchical bullshit; everyone should have a ranking of their partners, people should know where they fall on the ranking, and there should be vicious power struggles for the higher ranks," the author wrote.

In an earlier post from 2019, the author outlined a few of the traits they find attractive in men including "controlling most major world governments" and "spatial reasoning abilities."

Source: worldoptimization

On her beliefs in race science

The Ellison-linked Tumblr contains thoughts about race science, or what the blog's author calls "HBD," or "human biodiversity." Proponents of human biodiversity, which some people associate with eugenics, believe that human beings can be divided into subgroups, or races, and that different human races have inherently different physical and mental capabilities. This idea has been largely discredited by scientists.

In a 2020 Tumblr post that opened with "cw: offensive, sorry," the author expressed their interest in human biodiversity because of their "strong impulse to put people into categories," using the Indian caste system as an example.

"There's a stereotype of racist people that they will like, assume any East Asian person speaks Chinese or something. I appreciate that HBD people are the exact opposite of that, and will like make fun of you for saying something about 'Indians' without specifying province and caste because come on, the genetic differences there are massive," the author wrote.

In January 2022, the author published another post tagged "#hbd cw" comparing "European" and "Asian" "kinship structures."

Source: worldoptimization

On her aversion to social justice

The "worldoptimization" Tumblr archive also contains 92 posts tagged "#not sj go away," where the author expresses views about social justice, including gender roles and race.

"Ugh Columbus Day came and went and I totally forgot I was planning to have a (meta ^ n)-contrarian take that actually Columbus was great," the author wrote in 2018.

In 2015, the author agreed with another Tumblr user who opined about the idea of social justice and how it has hampered free speech.

"Interestingly, though, social justice hasn't made me kinder to oppressed minorities," the quoted user had written. "It's just made me hide in places where sensitive people don't hang out. I breathe a sigh of relief every time someone makes a racist joke or mocks social justice, because it means I'm in a safe space, where no one is going to be deeply damaged just by me speaking my opinion."

"Yep same," worldoptimization replied.

Source: worldoptimization

On her final remarks

Ellison's last public posts are a couple of tweets she posted on November 6 in defense of the Alameda Research's balance sheet.

Source: @carolinecapital

Caroline Ellison is a math whiz, trader, and the shadow figure behind FTX's collapse — here's how a devout Harry Potter fan came to take part in crypto's biggest implosion

Lakshmi Varanasi,Huileng Tan

Thu, December 22, 2022

Nurphoto/Getty Images; @carolinecapital/Twitter; Jenny Chang-Rodriguez/Insider

Caroline Ellison was the CEO of Alameda Research, a trading firm launched by Sam Bankman-Fried.

She oversaw many of the risky bets Alameda took with FTX customers' crypto tokens.

Here is her background story.

Over the past few weeks, a mushroom of secrets about the inner workings of Sam Bankman-Fried's crypto exchange, FTX, have come to light.

From that, the once shadowy figure of Caroline Ellison has emerged as an important character behind FTX's seeming success and surprising downfall.

Ellison was the head of Alameda Research — the trading firm through which Bankman-Fried moved crypto tokens in tandem with running FTX. Amidst the revelation that FTX borrowed money from customer accounts to fund bets via Alameda, Ellison has become a subject of online speculation.

Ellison's virtual presence, however, is dwindling by the day. Her LinkedIn, online photos, and contact information have largely disappeared over the past couple of weeks. That's left journalists, investors, and voyeurs of all types scrambling to find information about her.

The curiosity has only heightened since CoinDesk reported via anonymous sources that she was in an on-and-off relationship with SBF.

Right now, the most reliable information about Ellison has been sourced from her Tumblr account, and the handful of media interviews she's given over the years. The bones of her virtual self suggest that Ellison is extraordinarily bright and highly educated as well as a math whiz and a big reader. She speculates often about gender roles and shifts in culture and society on Tumblr.

Here's what we know about Caroline Ellison.

December 22, 2022: This story has been updated to reflect the details of Ellison's plea deal.

Ellison grew up in the suburbs of Boston.

Skyline of Boston, Massachusetts.Getty Images.

Source: Forbes

Her father, Glenn Ellison, is the department head of economics at Massachusetts Institute of Technology. He once reported directly to Gary Gensler, the current chair of the Securities and Exchange Commission. Ellison's mother Sara Fisher Ellison, is a senior lecturer in economics at MIT. "We definitely got exposed to a lot of economics," Ellison once told Forbes in an interview.

William B. Plowman/Getty Images

Source: Cryptoslate and Forbes

When she was eight years old, Ellison reportedly wrote her father an economics paper analyzing stuffed animal prices at Toys 'R' Us.

Pixavril/Shutterstock

Source: Forbes

Ellison, who attended Newton North High School, had a special aptitude for mathematics. She would flex her skills in competitions like the Math Prize for Girls, which bills itself as "the largest math prize for girls in the world."

Pixabay via Google Images

Source: Gawker and Math Prize for Girls.

In 2012, Ellison enrolled at Stanford University, where she studied mathematics. Ruth Ackerman, a math professor who taught Ellison, described Ellison to Forbes as "bright, focused, very mathy."

People on the Stanford University campus in California.Ben Margot/AP

Source: Forbes

Like her future colleague, Bankman-Fried, Ellison began exploring effective altruism in college. It's a philosophical movement that uses calculations to understand how people can use their time, money, and resources to best help others. She eventually joined Stanford's Effective Altruism Club.

Orbon Alija/ Getty Images

Source: Forbes

After college, Ellison went to work for the trading firm Jane Street. There, she met Bankman-Fried, and the two supposedly bonded over their interest in effective altruism.

People walk by the New York Stock Exchange (NYSE) on June 14, 2022 in New York City. The Dow was up in morning trading following a drop on Monday of over 800 points, which sent the market into bear territory as fears of a possible recession loom.Spencer Platt/Getty Images

Source: Forbes

By 2018, Bankman-Fried, also known as SBF, had launched a crypto trading firm called Alameda Research, and persuaded Ellison to join him. "This was very much like, 'oh, yeah, we don't really know what we're doing,'" Ellison told Forbes of her initial impressions of Alameda.

Sam Bankman-Fried, founder of FTX and Alameda ResearchFTX

Source: Forbes

Aside from Ellison, the Alameda Research crew included SBF's close friends Nishad Singh, Gary Wang, and Sam Trabucco. They moved from Berkeley to Hong Kong in 2018 where they lived like college students and fiercely traded crypto. Ellison was the only female on the team. While the others played video games, she'd be watching the royal wedding of Prince Harry and Meghan Markle.

Meghan Markle and Prince Harry in their wedding carriage on May 19, 2018.Aaron Chown/WPA Pool/Getty Images

Source: Forbes

After SBF established FTX in 2019, Ellison began taking more responsibility at Alameda Research. She and her colleague, Sam Trabucco, were featured in Forbes' 30 Under 30 in 2022.

Screenshot of Caroline Ellison and Sam Trabucco on Forbes 30 Under 30.

Source: Forbes

Ellison maintained an active online persona. She tweeted under the handle @carolinecapital. She supposedly had two Tumblr accounts — worldoptimization and worldoptimization-lifeadvice — according to Gawker.

The Tumblr app went down.Shutterstock

Source: Gawker

Still, Ellison largely remained out of the limelight as FTX rose to fame. FTX employees told Forbes that Ellison was content staying behind the scenes.

Michael Blann/ Getty Images

Source: Forbes

In April, Trabucco stepped down as CEO. Since then, Ellison has been solely running Alameda.

Catherine McQueen/ Getty Images

Source: Forbes

Now, amid the fallout of FTX, online investigators ranging from the Twitter account, @Autismcapital, to media outlets like Gawker have rushed to unearth information on Ellison.

Boris Zhitkov/ Getty Images

Source: Gawker

CoinDesk, the crypto publication, reported through anonymous sourcing, that Ellison was among the 10-person crew of FTX and Alameda employees who all lived together in the Bahamas. CoinDesk noted that all 10 members were paired off in relationships with one another at some point. Ellison reportedly had an on-and-off relationship with SBF.

Leaf Cay, Bahamas

Source: Insider and CoinDesk.

On what is assumed to be her Tumblr account, Ellison likened the polyamory in the Bahamas house to an "imperial Chinese harem." She supposedly noted that there was an established hierarchy and everyone knew where they fell within it.

Dimitri Otis/ Getty Images

Source: Screenshot of the Ellison's supposed Tumblr provided by Twitter handle @OxHonky.

Ellison along with the other housemates reportedly shared a therapist named George Lerner.

Getty Images

Source: Gawker citing Sequoia Capital's profile of SBF, which was removed after the fallout.

Ellison is a reader and often posted book reviews on her Tumblr. The most recent titles she reviewed include The Golden Enclaves by Naomi Novik and Venomous Lumpsucker by Ned Beuman.

Raimund Koch/Getty Images

But her literary tastes range far and wide, from the Harry Potter series…

Amazon

Source: Ellison's worldoptimization Tumblr.

…to the Substack of Matthew Yglesias, a blogger who writes about economics and politics.

Matthew Yglesias, co-founding editor of Vox and author of "One Billion Americans."Moshe Zusman

Source: Ellison's worldoptimization Tumblr.

As of 2021, her favorite color was gray.

zhengshun tang/ Getty Images

Ellison's worldoptimization Tumblr.

She often talks about her relationship as being a "trad," which can be understood as one who adheres to conventional gender roles and traditions. Ellison contended on her Tumblr that over time, she's moved away from being a "trad" to becoming "a bit more agnostic on culture/society."

Busà Photography/ Getty Images

Ellison's worldoptimization Tumblr.

The late Supreme Court Justice Antonin Scalia reportedly lived in her former home.

AP

Source: Ellison's worldoptimization Tumblr.

Ellison's online presence — including her LinkedIn — is dwindling by the day. She last posted online on November 6 tweeting in defense of Alameda's balance sheet.

Screenshot of Ellison's twitter, @carolinecapital.

Source: Caroline Ellison's Twitter, @carolinecapital.

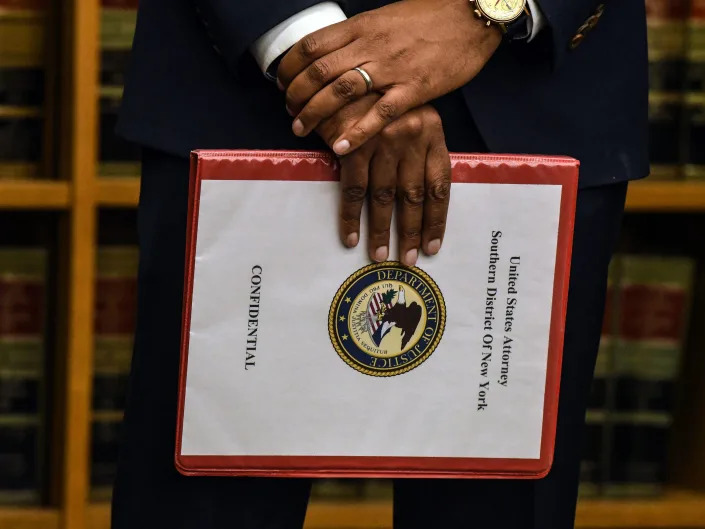

Ellison pleaded guilty to seven charges in the collapse of FTX, including fraud, according to her plea agreement with the Southern District of New York filed on December 18. She faces up to 110 years in jail, but has struck a plea deal with the Department of Justice and is cooperating with authorities.

Hands holding a file with cover titled "United States Attorney Southern District of New York."Stephanie Keith/Getty Images

Source: Insider