MINING.COM Staff Writer | August 13, 2021 |

Andina mine control room (Credit: Codelco)

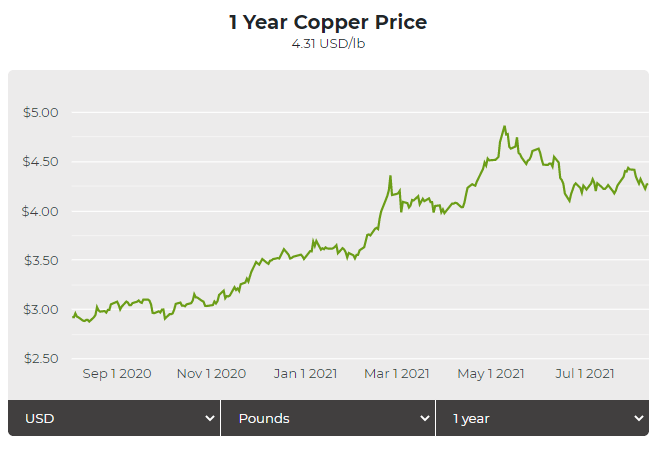

Copper prices advanced on Friday after workers at Codelco’s Andina copper mine in Chile went on strike, raising supply disruption risks.

Copper for delivery in September rose 1% from Thursday’s settlement price, touching $4.431 per pound ($9,748 per tonne) on the Comex market in New York

Click here for an interactive chart of copper prices

Copper prices have soared to record highs this year, handing unions in Chile additional leverage, ratcheting up tensions in labor negotiations and putting pressure on global supply of the red metal.

On Thursday, two unions at Andina walked off the job after rejecting the latest contract offer, while workers at JX Nippon Copper’s Caserones mine also went on a strike after labor contract talks collapsed.

Andina produced 184,000 tonnes of copper in 2020, while Caserones delivered 126,972 tonnes of copper in 2020.

On Thursday, workers at Chile’s Escondida mine, the world’s biggest copper deposit, approved a new contract, avoiding a labor strike.

120-year chart shows commodities

have never been this undervalued

Frik Els | August 11, 2021 |\

Image: Codelco via Flickr

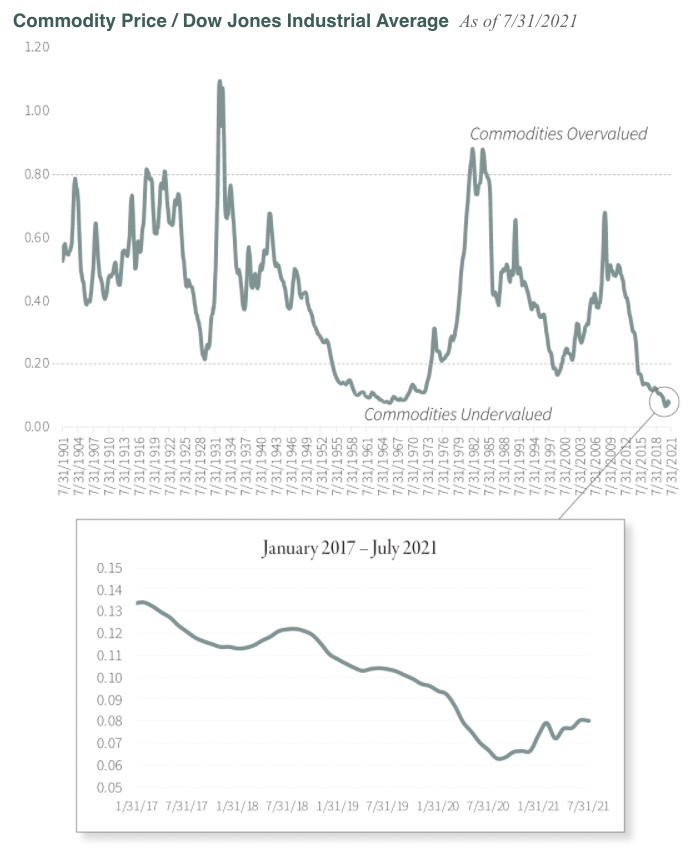

In its Q2 wrap-up, commodities investment house Goehring & Rozencwajg Associates (G&R) poses the question: Natural resources – Uninvestable assets or unprecedented opportunity?

To help answer the question, the Wall Street firm put together a 120-year chart comparing commodity prices to the Dow Jones Industrials going back to 1

Despite the uptick in metals and mineral prices over the past year, there is still a yawning gap and “real assets have never been as undervalued relative to financial assets,” according to the authors.

The chart shows other major bottoms occurred in 1929, 1969, and 1999 and, like those cycle nadirs, present an “excellent time to establish real asset positions,” according to G&R:

“Prior catalysts have all been monetary related. This time likely as well.”

In May, G&R made the case for a $30,000 copper price as supply comes under pressure from depletion at the world’s major mines. G&R’s latest research is headlined: The IEA Ushers in the Coming Oil Crisis.

No comments:

Post a Comment