LME Is ‘Open for Business’ Amid Calls to Sanction Russian Metal

, Bloomberg News

(Bloomberg) -- The London Metal Exchange has no plans to ban Russian metal from its platforms on the grounds that governments are responsible for setting any sanctions, according to a senior exchange official.

The LME is “open for business,” Adrian Farnham, chief executive officer of the LME’s clearing house, who has been tapped to head the exchange on an interim basis, told the CRU World Copper Conference in Santiago. “Our view is that it’s up to governments to set sanctions. We don’t think it’s our role to go ahead.”

Still, the bourse is listening to some in the industry who support sanctions amid an ongoing debate, he said.

Commodities from wheat to oil to nickel and aluminum have been caught up in market turmoil in the wake of Russia’s attack on Ukraine. Aluminum and nickel haven’t been targeted by sanctions, but if the LME were to take action, such a ban could have a seismic impact in markets for those metals.

The exchange’s copper committee, which only plays an advisory role at the LME, recommended banning new supplies of Russian metal from the bourse, according to people familiar with the matter, Bloomberg News reported in mid-March.

The exchange said at the time it doesn’t plan to take any action that goes beyond the scope of the Russian sanctions.

Nickel Tumult

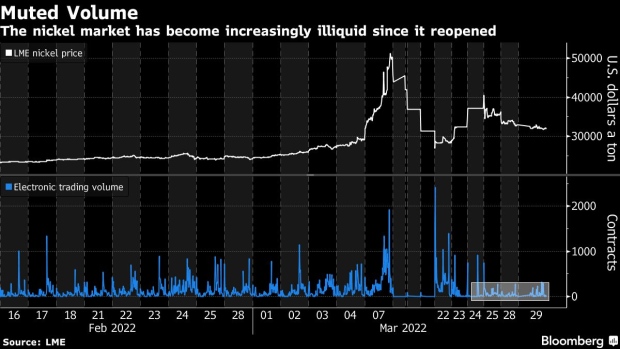

The LME is working to shore up confidence in the bourse amid tumult in nickel. The exchange halted nickel trading and canceled nearly $4 billion in transactions earlier this month after prices spiked by 250% in two days, as it sought to protect its brokers from huge margin calls owed by Tsingshan Holding Group and other short position holders.

After a haphazard effort to restart trading, nickel has spent much of the past fortnight locked at the upper or lower limit of a new daily price cap designed to rein in the unprecedented volatility.

Nickel trading on the LME is “back functioning again” in the wake of the historic short squeeze, Farnham said, acknowledging that it’s taking time for people to regain confidence.

LME remains open to further measures after introducing price bands and over-the-counter reporting, he added.

No comments:

Post a Comment