Trump’s National Insecurity Strategy – OpEd

January 4, 2026

MISES

By Vincent Cook

Trump’s latest National Security Strategy (NSS) document has predictably sent foreign policy pundits of all stripes into a tizzy, with globalists (both of the unilateralist-neoconservative variety and of the multilateralist “rules-based international order” variety) howling once again about Trump not being one of them, while “NatCons” celebrate the NSS’s assault on censorial Eurowokeness and the NSS’s dire warnings about a “stark prospect of civilizational erasure” in Europe.

In spite of the Euro-bashing orientation of the NSS, America’s militarist/imperialist lobby can take heart in the NSS’s endorsement of the Monroe Doctrine coupled to a “Trump Corollary” that sounds very much like the Roosevelt Corrollary and the Lodge Corrollary, as well as affirming a hodge-podge of other globalist doctrines (though not explicitly naming them) like the Carter Doctrine of keeping unfriendly powers out of the Persian Gulf (i.e., waging endless wars in the Middle East) and the Truman Doctrine of containing the spread of Communism, at least in Asia with respect to the Chinese and North Korean regimes. In terms of the overall spending commitment, the bottom line remains the “Hague Commitment” of increasing Pentagon spending to 5 percent of GDP.

Of course, massive increases in the demand for military goods and services will have to be matched by corresponding increases on the supply side if the Hague spending increases are to strengthen the Pentagon’s and its allies’ ability to enforce the witch’s brew of imperialistic doctrines with which the Pentagon has been tasked. This raises the thorny economic problem of how to increase the physical availability of cutting-edge weapons, munitions, and manpower at reasonable prices. A spending increase by itself doesn’t guarantee an increase in military might if an anemic, underperforming productive sector can’t respond well to the spending; instead, one merely drives up prices as higher spending confronts inelastic supply curves.

This supply problem is not a mere hypothetical concern—the Russo-Ukrainian War clearly demonstrates that modern missile and drone technologies have negated the kind of mechanized, mobile, combined-arms tactics that characterized the Second World War. The days of rapid blitzkrieg attacks and paralyzing “shock and awe” strikes are over. Instead, ground combat in Ukraine has largely degenerated into the brutal static trench warfare that characterized the First World War a little over a hundred years ago. What has been retained from the Second World War playbook unfortunately is the wanton destruction of civilians far from the front lines using long-range missiles and drones.

In this kind of war, combat can drag on for years and years with little to show for all the dreadful carnage and destruction as long as each side is able and willing to keep feeding warm bodies and vast quantities of basic munitions like artillery shells into the meatgrinder. However, the economic capacity of America and its NATO and East Asian allies to wage such old-fashioned prolonged wars of attrition successfully is highly doubtful these days. A temporary halt in munitions and missile deliveries to Ukraine last July out of fears of stockpile depletions flashed an ominous danger signal that Western economies are in no shape to undertake a major mobilization required for a conventional meatgrinder war.

The NSS does take notice of the munitions aspect of the supply problem. The section of the NSS that deals with economic security embraces the following goals:Balanced trade

Securing access to critical supply chains and minerals

Reindustrialization

Reviving our defense industrial base

Preserving and growing America’s financial sector dominance

One critical problem with these goals is that they are mutually incompatible with each other. Reducing trade deficits to zero to achieve “balanced trade” also means reducing net imports of savings from foreigners to zero. When foreigners earn more dollars from sales of their goods to Americans than they spend on purchases of goods made in America, they lend their surplus dollars to Americans. Cutting off vendor-financed imports means fewer inputs and less financing available for reindustrialization and for reviving the defense industrial base.

Balancing of trade is also incompatible with maximizing access to critical supply chains and minerals overseas. If, for example, America has a critical need for cobalt that is only available in the Democratic Republic of the Congo (DRC), why must the US government petulantly insist on the DRC balancing its sales of cobalt to America with purchases of American-made goods? Creating artificial restrictions on what the Congolese can do with their dollar earnings only discourages them from selling cobalt to Americans in the first place.

Intensifying the international dominance of America’s financial sector—that is, artificially propping up foreign demand for US Treasury securities, making foreigners pay a portion of America’s inflation tax, and facilitating discretionary confiscations of the assets of hostile powers—does benefit certain predatory American institutions (both governmental and privileged private sector actors) at the expense of foreigners, but it also thwarts the goals of reindustrialization and revival of the defense industrial base. American industries need more thrift (i.e., restraint of present consumption so that more labor and resources can be devoted to making more capital goods), not more Federal Reserve funny money and more boom/bust cycles spawned by fractional reserve credit. American financial predators gain at the expense of productive Americans too.

Apart from the raging contradictions among the NSS’s economic goals, another critical problem is the NSS’s eerie silence concerning the manpower issue, a problem the Russians and Ukrainians know all too well. If the Pentagon must resort to a meatgrinder strategy to wage more Ukrainian-style wars in East Asia, the Middle East, and Latin America (and maybe in Europe too, if NATO behaves as Trump wishes), it is going to need a lot more meat. With falling birthrates, steeper immigration barriers, and now even mass deportations, the prospects of the Pentagon finding enough young Americans to populate future national cemeteries look rather dim. Moreover, increasing the Pentagon’s manpower requirements would make it more difficult to find the additional workers needed for reindustrializing and for reviving the defense industrial base.

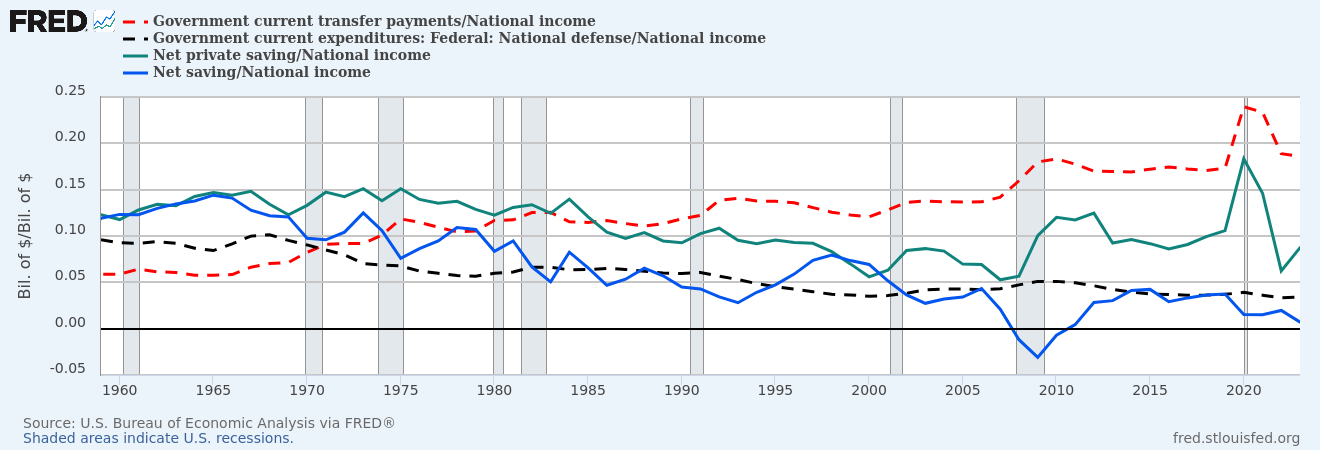

The most critical problem of all is that the NSS doesn’t reverse the growth of welfare statism, which has been deindustrializing America and skewing federal spending priorities away from the Pentagon over the past sixty years. Figure one offers the long-run view of savings and government spending:

Figure 1: National Income Shares—Transfer Payments, Defense, Net Private Saving, and Net Saving

Source: FRED®

The two dashed lines track different categories of government spending as a fraction of National Income; the red line represents transfer payments for benefits like Social Security and Medicare, while the black line represents spending on the Pentagon. Since the late 1960s, the Pentagon has declined from about 10 percent of National Income to well under 5 percent today. Transfer payments, on the other hand, have soared from a little over 5 percent in the mid-1960s to nearly 20 percent today. The Department of Defense over the period has encountered a pair of peer competitors who pose a greater existential threat to it than even the Chinese People’s Liberation Army and the Russian Red Army do: the Department of Health and Human Services and the Social Security Administration.

The two solid lines track net domestic savings as a fraction of National Income. The green line represents net private savings; quantifying thrift by private individuals and businesses as a fraction of National Income. The blue line—representing net savings overall—shows how much of the share of National Income devoted to private savings remains for productive investments after government deficits have been subtracted from the green line.

As transfer spending soared and Americans came to rely increasingly on government promises of future economic security, they became less and less inclined to save, driving the green line down to about half of its 1960s/early-1970s values. Meanwhile, government budgets that were formerly balanced even at the height of the Vietnam War and the “Great Society” have sunk into chronic massive deficits, pushing the blue line further and further below the green line. The result is that the blue line is now at zero, meaning that in aggregate Americans are not setting aside any of their income to grow America’s stock of capital goods. Reindustrialization and revival of defense industries without massive borrowing from foreigners (and the massive trade deficits that accompany them) has become impossible; America can just barely maintain its depleted industries at current levels.

Without massive cuts to Social Security and Medicare, there will be neither reindustrialization nor significant increases in the Pentagon’s conventional military capabilities. The aggressive combination of “doctrines” in the NSS that seek to strategically encircle China and Russia are probably not viable over the long run in any event, but welfare state-induced capital consumption absolutely exposes the NSS’s vain pretense of America gearing up for conventional meatgrinder wars as sheer nonsense. There is no credible strategy for security to be found in this NSS.

MISES

The Mises Institute, founded in 1982, teaches the scholarship of Austrian economics, freedom, and peace. The liberal intellectual tradition of Ludwig von Mises (1881-1973) and Murray N. Rothbard (1926-1995) guides us. Accordingly, the Mises Institute seeks a profound and radical shift in the intellectual climate: away from statism and toward a private property order. The Mises Institute encourages critical historical research, and stands against political correctness.