U.S. Plots 12 Offshore Wind Lease Auctions by 2028 and Revises Rules

The Biden administration is moving forward aggressively to expand the U.S. offshore wind energy industry including mapping out a five-year plan for up to a dozen new leases and streamlining and modernizing the rules for development. All of this comes as the industry however continues to struggle to get projects from concept to reality with New York suffering the latest setback in moving forward with approved projects.

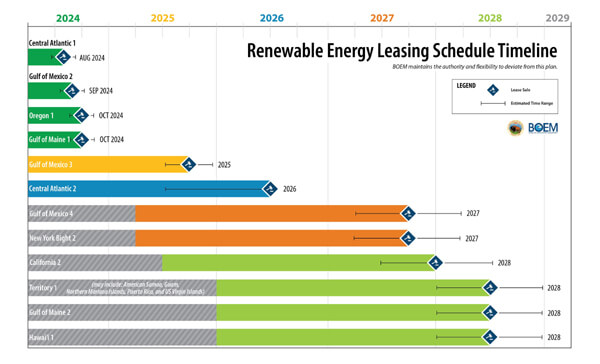

Secretary of the Interior Deb Haaland announced the new five-year offshore wind leasing schedule which anticipates auctions in the Atlantic, Gulf of Mexico, Pacific, and the waters offshore of the U.S. territories in the next five years. The leasing schedule includes four potential offshore lease sales in 2024 (Central Atlantic, Gulf of Maine, Gulf of Mexico, and Oregon). It will be followed by one each in 2025 (Gulf of Mexico) and 2026 (Central Atlantic), two in 2027 (Gulf of Mexico and New York Bight), and four in 2028 (California, a U.S. Territory, Gulf of Maine, and Hawaii).

The new schedule is a follow-on to a 2021 timeline that called for seven lease sales by 2025. The previous plan included a commitment to deploy 30 gigawatts of offshore wind by 2030 and a target goal of permitting at least 25 gigawatts of onshore renewable energy by 2025. Currently, the U.S. has just over 240 MW installed offshore, which is up from 42 MW last year.

Today, they reported that the Department has approved the nation's first eight commercial-scale offshore wind projects, held four offshore wind lease auctions (Including the New York Bight and the first-ever sales offshore the Pacific and Gulf Coasts), and advanced the process to establish additional Wind Energy Areas in Oregon, the Gulf of Maine and the Central Atlantic. Thus far, the Department has approved more than 10 gigawatts of clean energy from offshore wind projects, enough to power nearly four million homes.

While they highlight progress, the industry has also faced significant challenges from the changing economics, interest rates, supply chain delays, and a lack of installation vessels. Ørsted last year canceled development plans for large projects planned off New Jersey and last week New York announced it closed its third-round solicitation without making any awards. They cited economic challenges due to “material modifications,” brought about by GE Verona’s decision not to proceed with a larger wind turbine which would have been the basis for the three selected projects.

New York announced yesterday that it had issued a request for information ahead of a planned next round in the summer of 2024. They are also working to complete power agreements with two projects selected in a round at the beginning of 2024. At the same time, Connecticut, Massachusetts, and Rhode Island are reviewing proposals from their coordinated solicitation while New Jersey plans a new round this year to get its projects back on track.

To aid in the approval process, the Bureau of Ocean Energy Management (BOEM) and the Bureau of Safety and Environmental Enforcement (BSEE) today finalized updated regulations for renewable energy development on the U.S. Outer Continental Shelf. Haaland says the final rule increases certainty and reduces the costs associated with the deployment of offshore wind projects by modernizing regulations, streamlining overly complex processes and removing unnecessary ones, clarifying ambiguous regulatory provisions, and enhancing compliance requirements.

Among the key provisions of the new rules, they are citing that it eliminates unnecessary requirements for the deployment of meteorological buoys and increases survey flexibility. It also clarifies safety management system regulations and oversight of critical safety systems and equipment. BOEM’s renewable energy auction regulations are being reformed and it tailors financial assurance requirements and instruments to address concerns raised by the industry. The Department expects that the final rules will result in cost savings of roughly $1.9 billion for the offshore wind industry over the next 20 years.

No comments:

Post a Comment