Mantle beneath Earth’s Continents Experienced Large-Scale Heating Two Billion Years Ago

Sep 24, 2021

New research from the University of Adelaide sheds light on why cold eclogites — high-pressure, metamorphic rocks that consist primarily of garnet and omphacite — mysteriously disappeared from geological records during the early stages of the Earth’s development.

The supercontinent Nuna about 1.59 billion years ago. Image credit: Alexandre DeZotti.

“Cold eclogites mysteriously disappeared from the Earth’s rock record between 1.8 and 1.2 billion years ago before reappearing after this time,” said Dr. Derrick Hasterok, a researcher in the Department of Earth Sciences at the University of Adelaide.

“They are important because they are sensitive to the temperatures in the upper mantle and provide evidence of rocks rapidly transported deep below Earth’s surface along geological faults lines that occur where tectonic plates collide.”

“The prevailing belief is that cold eclogites are preserved only when supercontinents merged,” he said.

“But there is ample evidence for a nearly continuous geological record of cold eclogites over the past 700 million years during which time two supercontinents formed and broke-up.”

Associated with this change in eclogites is a change in the concentration of many trace elements in igneous rocks found elsewhere in the crust, which provide additional evidence of heating beneath continents.

These trace elements are found in critical minerals, which are considered vital for the economic well-being of the world’s major and emerging economies.

“We found evidence from the trace element chemistry of granites that suggests a large-scale heating of the continents around 2 billion years ago that corresponds with the assembly of Nuna (also known as Columbia, Paleopangaea, and Hudsonland), a supercontinent which completed its formation 1.6 billion years ago,” said Dr. Renee Tamblyn, also from the Department of Earth Sciences at the University of Adelaide.

“The Earth has generally been cooling since its formation but Nuna had an insulating effect on the mantle, rather like a thick blanket, which caused temperatures to rise beneath the continents and prevent the preservation of eclogites and change the chemistry of granites.”

“The changes in chemistry resulting from this unusual warming event during Earth’s geologic past could help to locate certain critical minerals by looking for rocks formed before or after this heating event — depending on which element is of being looked for.”

The findings were published in the journal Geology.

_____

R. Tamblyn et al. Mantle heating at ca. 2 Ga by continental insulation: Evidence from granites and eclogites. Geology, published online September 21, 2021; doi: 10.1130/G49288.1

Geological cold case may reveal critical minerals

Researchers on the hunt for why cold eclogites mysteriously disappeared from geological records during the early stages of the Earth's development may have found the answer, and with it clues that could help locate critical minerals today.

"Cold eclogites mysteriously disappeared from the Earth's rock record between 1.8 and 1.2 billion years ago before reappearing after this time," said Dr. Derrick Hasterok, Lecturer, Department of Earth Sciences, University of Adelaide.

"Cold eclogites are important because they are sensitive to the temperatures in the upper mantle and provide evidence of rocks rapidly transported deep below Earth's surface along geological faults lines that occur where tectonic plates collide.

"The prevailing belief is that cold eclogites are preserved only when supercontinents merged. But there is ample evidence for a nearly continuous geological record of cold eclogites over the past 700 million years during which time two supercontinents formed and broke-up."

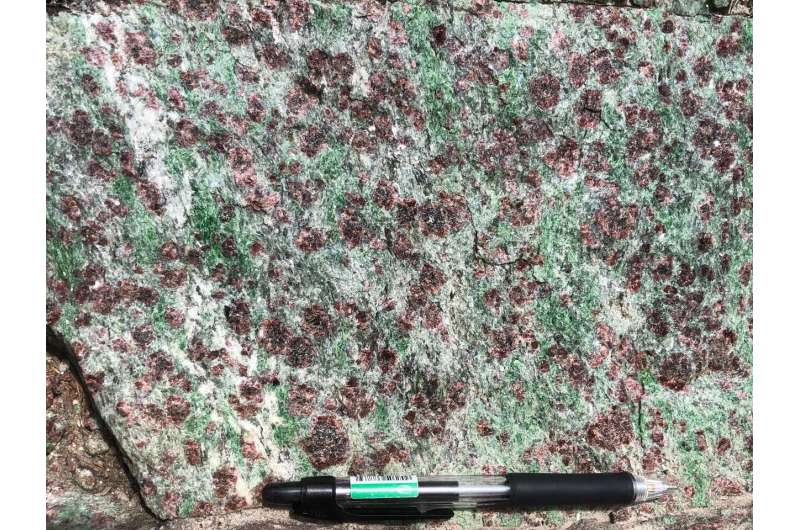

Eclogites are high-pressure, metamorphic rocks that consist primarily of garnet and omphacite (a sodium-rich variety of pyroxene).

Associated with this change in eclogites is a change in the concentration of many trace elements in igneous rocks found elsewhere in the crust, which provide additional evidence of heating beneath continents. These trace elements are found in critical minerals. Critical minerals are considered vital for the economic well-being of the world's major and emerging economies.

Lead author Dr. Renee Tamblyn worked with Dr. Hasterok and fellow researchers Professor Martin Hand and Ph.D. student Matthew Gard from the University of Adelaide on the study which was published in the journal Geology.

"We found evidence from the trace element chemistry of granites that suggests a large-scale heating of the continents around 2 billion years ago that corresponds with the assembly of Nuna, a supercontinent which completed its formation 1.6 billion years ago," said Dr. Tamblyn.

"The Earth has generally been cooling since its formation but Nuna had an insulating effect on the mantle, rather like a thick blanket, which caused temperatures to rise beneath the continents and prevent the preservation of eclogites and change the chemistry of granites.

"The changes in chemistry resulting from this unusual warming event during Earth's geologic past could help to locate certain critical minerals by looking for rocks formed before or after this heating event—depending on which element is of being looked for."

Much of Western Australia is older than 2 billion years while South Australia and the eastern states are generally younger.

"The rocks in the Northern Territory and NW Queensland are a little older than the 1.8 billion year mark so may be a place where we can continue our investigations into this mysterious geological case," said Dr. Hasterok.

.jpg?ext=.jpg) Testing of the high-temperature superconducting magnet (Image: Tokamak Energy)

Testing of the high-temperature superconducting magnet (Image: Tokamak Energy).jpg?ext=.jpg) Aziz Dag (right), Westinghouse Regional Vice President Nordics, VVER & UAE, and Demianiuk signing the MoC at Westinghouse Electric Sweden representative office in Kiev, Ukraine (Image: Westinghouse)

Aziz Dag (right), Westinghouse Regional Vice President Nordics, VVER & UAE, and Demianiuk signing the MoC at Westinghouse Electric Sweden representative office in Kiev, Ukraine (Image: Westinghouse).jpg?ext=.jpg) The IAEA General Conference is being held from 20-24 September (Image: D Calma/IAEA)

The IAEA General Conference is being held from 20-24 September (Image: D Calma/IAEA).jpg?ext=.jpg) Temelin provides heat to a nearby town, and a connection is being made to another (Image: ČEZ)

Temelin provides heat to a nearby town, and a connection is being made to another (Image: ČEZ)

_1.jpg?ext=.jpg)

.jpg?ext=.jpg) The heads of Getka, NuScale and Unimot yesterday (Image: Unimot)

The heads of Getka, NuScale and Unimot yesterday (Image: Unimot).jpg?ext=.jpg) GEH's vision for BWRX-300 (Image: GEH)

GEH's vision for BWRX-300 (Image: GEH).jpg.aspx)