Why the heck is there still an automotive chip shortage?

As with most things in this convoluted industry, it's complicated. But the situation should start to improve later this year.

Craig Cole

Aside from the raw, human toll, COVID-19 has dramatically changed how we live, from travel and education to the way people work. This pandemic has also had an outsized -- and unfortunate -- impact on the automotive industry, snarling global supply chains and limiting vehicle production. But perhaps nothing has hamstrung car companies more than the ongoing semiconductor shortage, which is still a major issue two years after coronavirus went global.

For several important reasons, "The chip shortage is still very much a problem," said Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions.

Automakers large and small are still being affected by an acute lack of semiconductors, which are absolutely necessary, even in the most basic cars and trucks. Everything from advanced driver-assistance features to infotainment systems to heated steering wheels are powered by some sort of computer chip, and that's only going to accelerate in future.

Toyota continues to face shortages that will affect manufacturing. "Our teams are working diligently to minimize the impact on production … in North America we are projecting a reduction of approximately 25,000 to 30,000 vehicles in February," the automaker told Roadshow. The good news is, Toyota does not anticipate these shortfalls will impact employment.

GM has similar challenges. Late last year, the company confirmed it wasn't able to offer certain features on a range of models due to a lack of chips, though things are getting better. "Fortunately, at the moment we do not have any North American assembly plants that are on downtime due to the global shortage of semiconductors," a spokesperson for the Detroit-based automaker told Roadshow. Second shifts have just resumed at its assembly plants in Fairfax, Kansas, home of the Chevy Malibu and Cadillac XT4, and Ramos Arizpe, Mexico, where the Chevy Blazer and Equinox SUVs are built.

Ford missed out on an estimated 1.25 million sales last year. Volkswagen fell short of planned production by 1.15 million, GM and Toyota missed out on 1.1 million and Stellantis came up short by about 1 million units.

Global ramifications

Overall vehicle production was dramatically reduced in 2021 because of the chip shortage. According to Jeff Schuster, president of the Americas operation and global vehicle forecasting at LMC Automotive,"Ford was hit the hardest and they were hit early." This is because it had several super-high-profile launches, including a redesigned F-150. According to Schuster, the Blue Oval missed out on an estimated 1.25 million units last year.

But Ford wasn't the only automaker to stumble. Volkswagen fell short of planned production by around 1.15 million vehicles, GM and Toyota were both out about 1.1 million and Stellantis came up short by around 1 million units. But not all companies were affected equally. "As a group, I would say the Japanese and Korean OEMs were a little more insulated," noted Schuster. They're closer to China, where many chips are made. This is why Chinese manufacturers felt less impact than their global competition.

According to a study released by the US Department of Commerce, the median inventory of computer chips held by consumers -- like automakers and medical device manufacturers -- fell from 40 days in 2019 to less than 5 in 2021. The implications of this are dire. "If a COVID outbreak, a natural disaster or political instability disrupts a foreign semiconductor facility for even just a few weeks, it has the potential to shut down a manufacturing facility in the US, putting American workers and their families at risk," the report noted, a danger that isn't lost on car companies.

How could this happen?

The auto sector employs some of the brightest and most prescient people of any industry. They're used to planning things out years in advance and sweating every detail to meet safety and fuel economy standards as well as customer needs. This is what makes the industry's collective semiconductor misstep such a surprise. Schuster said he doesn't think anyone thought this would mushroom into the problem it became, though car companies should have been aware of the potential risks.

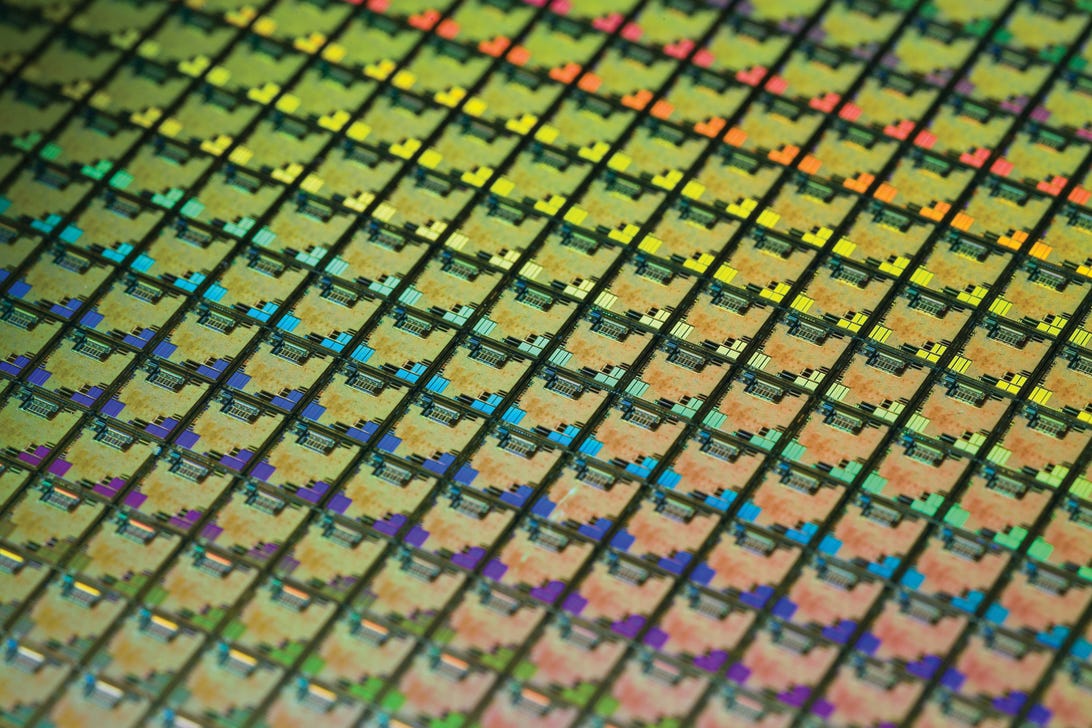

"Chips go into virtually everything we buy anymore," Fiorani said. At the beginning of the pandemic, automakers cut their semiconductor orders, anticipating a big downturn in sales. "OEMs stepped out of line and the manufacturers that make chips reallocated that factory space to much more profitable, much more in-demand chips for iPhones and PlayStations and other things," he added. Now that auto sales are red-hot again, chipmakers can't meet demand because their capacity has been spoken for. Unfortunately, it's not as simple as turning the lights back on and ramping production up again.

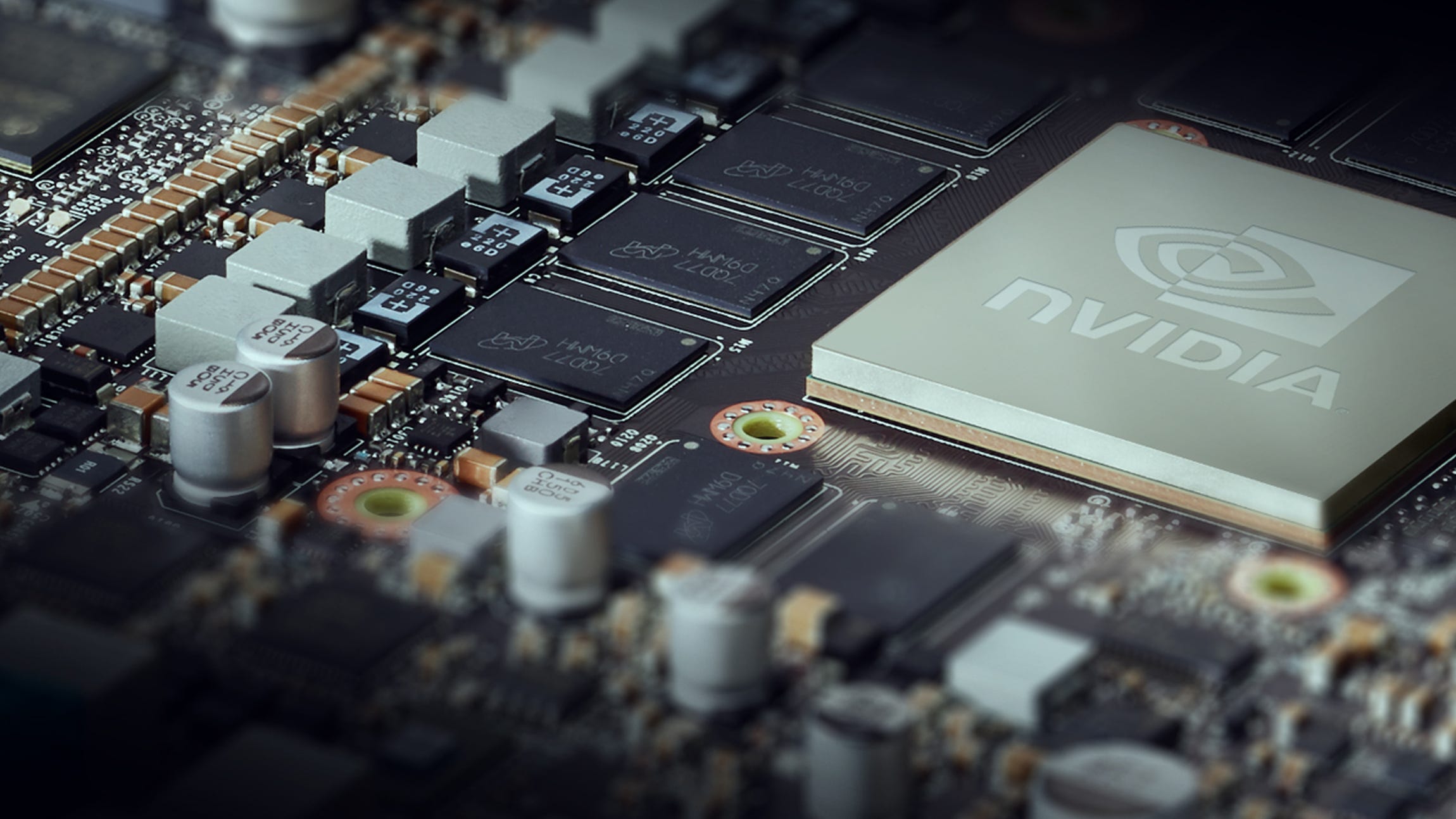

Profitability is another issue Fiorani pointed out. The automotive industry requires older chips, ones that make semiconductor manufacturers less money. It takes only a fraction of the processing power to run a few parking sensors than it does an iPhone 13 Pro. Additionally, for safety, car companies use proven designs, reliable chips that function for decades in all temperatures, humidity levels and other conditions. Whether it's Nvidia, Texas Instruments, TSMC or any other manufacturer, chipmakers have been incentivized to produce more advanced semiconductors at the expense of their automotive customers.

LMC Automotive projects it will likely take all of 2022 and maybe a portion of 2023 for things to start getting back to normal.

Solutions to a microchip-sized problem

Still, there are a couple options to ensure a reliable supply of automotive-grade chips in the coming years. Foreign companies can increase capacity, or we could make more of them here in the US. Schuster said both strategies are likely key to solving this issue because global chip demand is only going to increase, and not just from the automotive sector. Gaming, smartphones and the burgeoning internet of things are going to consume more and more semiconductors in the coming years.

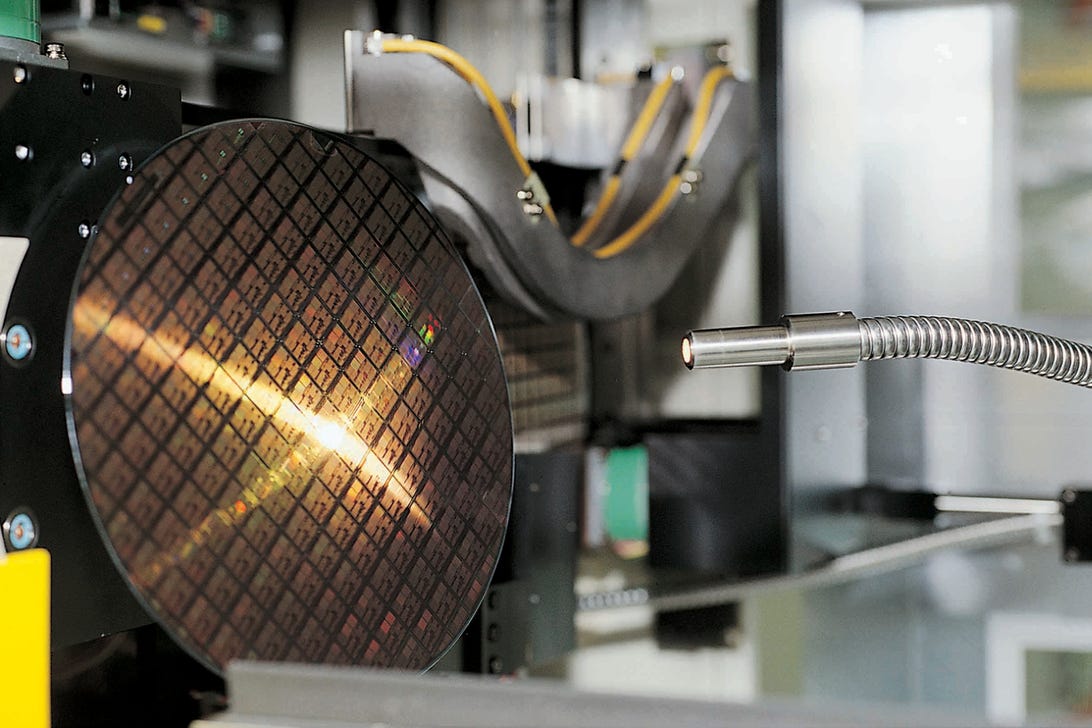

Making chips domestically is important, but it is not a silver-bullet solution. Fiorani explained, "The biggest problem is, one of these plants can't just pop up overnight." He said it takes months, if not years, to construct a new facility, which has to be located in a place with certain resources. Converting an existing building into a chip factory is not really an option because they're so specialized. And then there's the cost. "The number I've been told is $10 billion," and that's just to get started, he said. This is a hugely capital-intensive business, another hurdle.

Powerful but beautiful.

One additional option, though, is forming some sort of automotive industry chip consortium. Fiorani said this might be the best way to prevent future supply bottlenecks, though he admitted getting cutthroat car companies to work together on something this big is likely a major challenge.

The prognosis: Cautious optimism

If there's any good news in all this, vehicle demand remains strong and companies are able to sell whatever cars and trucks they can build. Schuster said the chip shortage should ease this year, though LMC Automotive projects it will likely take all of 2022 and maybe a portion of '23 for things to start getting back to normal, whatever normal is in a COVID-19 world. Likewise, Fiorani said he estimates everything will start coming together in the second half of the year, when -- fingers crossed -- vehicle production could return to preshortage levels.

"There is some investment in this field and government and industry are stepping up to increase the output of automotive-grade chips," Fiorani said. "We're just hoping it's enough to offset the losses." Obviously, plenty is still up in the air right now, but hopefully the worst of the auto industry's semiconductor shortage is in the rearview mirror.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/HKGSS4GATVACBLHTBMFE3BKP5E.JPG)