Reuters | April 18, 2024 |

Chile President Gabriel Boric. Credit: Ministerio de las Culturas | Flickr

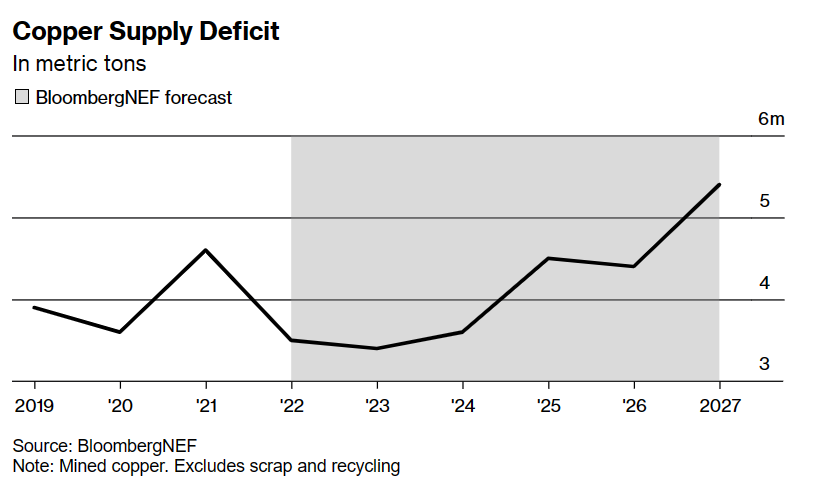

Chilean President Gabriel Boric told a major copper industry conference on Wednesday he expects production at state-run miner Codelco to grow slowly this year and reach 1.7 million metric tons by 2030, and that he sees copper prices rising.

“The Codelco production will rebound,” he said, offering a vote of confidence for the country’s top copper producer whose output last year hit a quarter-century low, at 1.325 million metric tons.

Boric’s comments came in a surprise appearance at a gathering of top global copper executives and analysts at CESCO Week, which alongside the CRU World Copper Conference, makes up the biggest annual gathering of sector professionals.

At a time when global companies have raised concern about long approval times for new mines and expansions, he said Chile, the world’s biggest copper producer, is dedicated to speeding up the permitting process for mining projects.

He also stressed the need for greater economic distribution of mining industry profits to local communities.

As well, Boric said one of Chile’s strong suits was ensuring long-term security for investors.

“Long-term mining projects work when there is greater certainty, when there are clear rules for all,” he said. “Investments are also based on the perception of trust. And that is something intangible.”

When Boric said he believed this attitude should underscore Chilean policy no matter who is president, the room of nearly 2,000 attendees burst into applause.

He said Canada-based Teck Resources’ CEO Jonathan Price had remarked in a recent meeting that the company might not have invested in copper mine Quebrada Blanca if it had known it would have taken 10 years to get off the ground, but he was proud of the project.

The mine’s expansion last year was among the biggest mining investments in Chile in a decade.

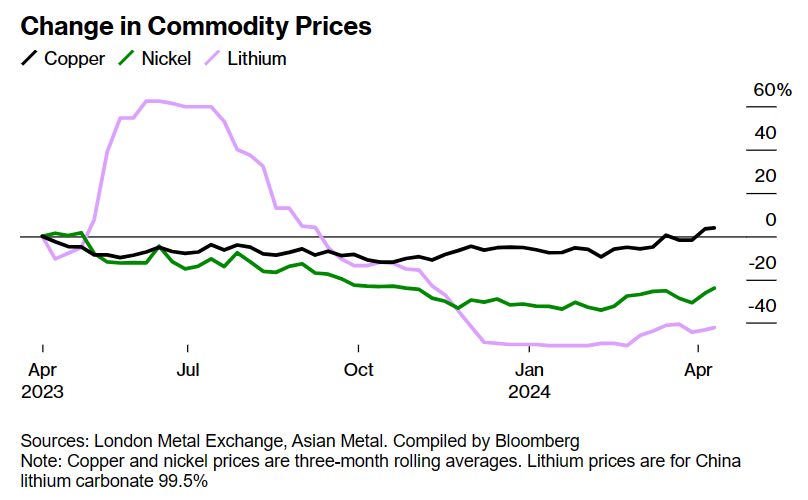

Boric also talked about the government’s efforts to boost lithium production, praising the benefits of public-private partnerships at a time when Codelco is tasked with spearheading such partnerships in Chile’s lithium industry.

A process meant to encourage private investment in lithium kicked off just this week, he said, adding that he expected output of the ultralight metal to double in a decade.

(By Daina Beth Solomon, Alexander Villegas and Ernest Scheyder; Editing by Sonali Paul)

Reuters | April 16, 2024 |

Spence copper mine located in the Atacama Desert, in northern Chile. (Image courtesy of BHP).

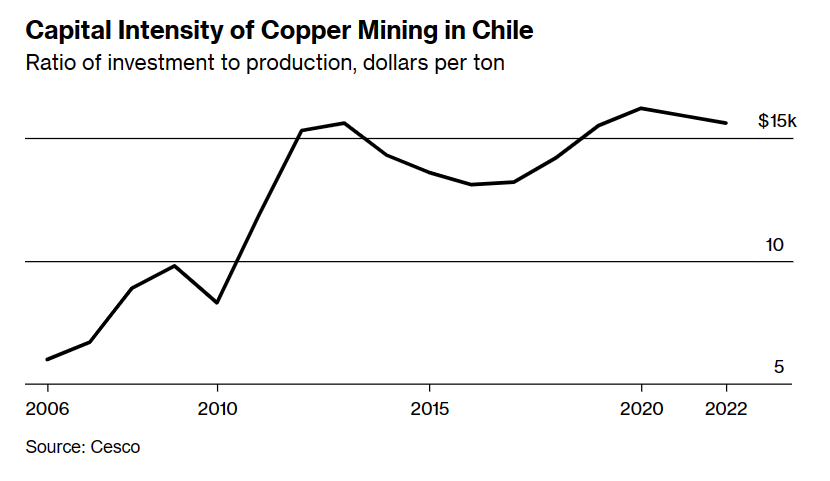

Chile’s government needs to quickly approve a proposal to streamline permitting for the mining industry to unlock and promote investment in the world’s top copper-producing country, a top executives said on Tuesday.

“In Chile it is urgent to improve the permit system to allow companies to approve large investment projects in a timely manner,” BHP President Americas Brandon Craig said on a panel at the World Copper Conference being held in Santiago.

“This not only applies to new projects, but also to permits needed to optimize current operations,” he added. BHP is a top copper producer and its flagship Escondida mine in Chile is the world’s largest copper mine.

Rio Tinto, which has a 30% stake in Escondida and partnered with state-run Codelco for copper exploration, agreed that more streamlining is needed to boost investment.

“I would like to invest more in Chile, but I need help,” said Bold Baatar, head of Rio Tinto’s copper business. “The more we can streamline the permitting process (in Chile) … I think that would be helpful.”

Mining companies and industry groups have complained about the extensive permitting process in Chile. In January, the government presented legal reforms to streamline permitting for investments, which can currently reach up to 500 requests from various authorities.

The reforms still must be approved by Congress, where the government has faced strong opposition. The government was able to pass a mining tax reform last year, but a major industry request during the debate was to streamline permitting and reduce start-up times for multi-million dollar copper projects, which is Chile’s largest export.

“I hope these reforms are approved quickly so that the industry can unlock large mining investments,” Craig said.

(By Fabian Cambero and Alexander Villegas; Editing by Andrea Ricci and Richard Chang)