Hydrogen’s Chicken-and-Egg Problem Persists as Buyers Hesitate

- Hydrogen’s global narrative is shifting from broad national strategies to sector-specific use cases.

- Market challenges persist, especially in MENA and the U.S., as high production costs, lack of long-term demand certainty, and policy uncertainty stall progress.

- To avoid stranded assets and foster market growth, MENA countries must create robust domestic hydrogen demand.

The conversation about low-carbon hydrogen continued last week at the annual World Utilities Congress, hosted by the multinational energy and water company TAQA in Abu Dhabi.

While the hoped-for future trade between Europe and the Middle East and North Africa (MENA) remained in focus, a shift in emphasis appeared. While national goals look increasingly dubious, progress is occurring in specific industry sectors guided by international agreements. Meanwhile, MENA countries confront the imperative to develop domestic markets for their clean hydrogen.

Looking for good news

Industry observers strained to find good news during a discussion called ‘Low carbon and green hydrogen: navigating challenges to open opportunities.’

High cost, lack of demand and regulatory uncertainty were named as the main factors holding projects back.

Even the world’s premier project – NEOM Green Hydrogen in Saudi Arabia – is in danger of delays. TotalEnergies will buy 70,000 tons per year in a long-term contract, about one-third of planned production, but there are no other buyers yet according to a report by Bloomberg News last week.

In Europe, with EU mandates and pipelines for hydrogen under development, there is ongoing criticism of the regulatory regime being shaped by the EU, which many participants believe is too onerous. Europe’s incentive schemes and contract for difference programs are producing just a small part of the green fuels required to meet EU goals.

And the outlook for hydrogen in the US remains precarious, where incentives may be revoked to offset tax cuts.

Chicken and egg

There’s a basic ‘chicken and egg’ problem afflicting the nascent industry, in which there’s no market without demand, and no demand without a market.

“We’re trying to create a market out of essentially nothing, we’re at very early stages,” said Frederik Beelitz, Head of Advisory for Central Europe, Aurora Energy Research.

“Bridging the gap between the levelized cost of hydrogen and the willingness to pay is currently the big challenge, mainly on the demand side,” he said.

“Potential offtakers for green or low-carbon hydrogen are just not willing to pay the relatively high cost that it now incurs.”

Producers want long-term off-take agreements, but off-takers such as industrial companies and utilities want shorter agreements in anticipation of the cost of hydrogen falling as production ramps up and technology improves.

"No one can commit to a 10-year price, no one can carry that risk,” said Jan Haizmann, CEO, Zero Emissions Traders Alliance.

“But we’ve seen how quickly renewables scaled and hydrogen might follow the same path if the conditions are right."

In Europe, the chicken and egg problem is being met with push and pull policies. On the supply side, pull factors taking the levelized cost of hydrogen down include support mechanisms for capital cost and financing. On the demand side, push factors act to raise the capacity or willingness or buyers to pay. Auction devices such as Germany’s H2Global, now going into its second auction round, provide critical price information while subsidizing the difference between suppliers’ long-term prices and buyers’ preference for short-term contracts. However, it’s unclear whether these programs will build meaningful scale.

Sector specific

At last week’s conference and other recent events, there’s been less use of the term ‘hydrogen industry’ and more emphasis on industry sectors. Hydrogen and its derivatives are now seen as high value fuels for very specific applications.

In Europe, the Renewable Energy Directive (RED III) sets clear targets for the maritime and aviation sectors, in the form of the percentage of ‘renewable fuels of non-biological origin’ (RFNBO) that fuels must contain.

This should create demand for derivatives and synthetic or e-fuels produced with hydrogen. Such fuels include ammonia and e-methanol in the maritime sector and e-kerosene in the aviation sector.

In aviation, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) has entered Phase 1. Airlines can purchase carbon credits in the voluntary market, which must meet the high CORSIA standards, or they can purchase sustainable aviation fuel. The amount of emissions covered will expand greatly when Phase 2 starts in 2027 with the inclusion of Brazil, India, Russia and China in the scheme.

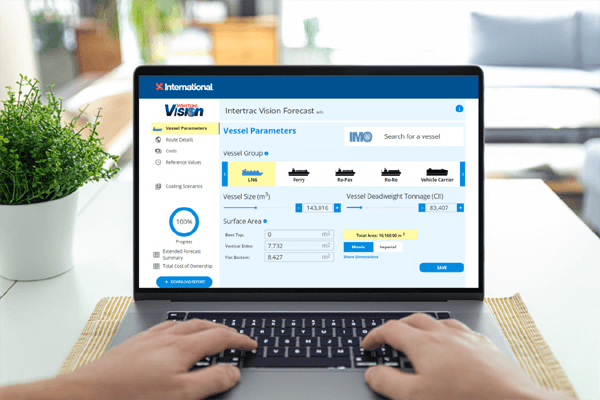

In global shipping, the International Maritime Organization (IMO) has issued draft rules mandating greenhouse gas emissions reductions for ships (5,000 gross tonnage or greater) and imposing penalties for non-compliance.

These rules will effectively impose the first ever global carbon price for international shipping and create demand for green and low-carbon hydrogen derivatives and biofuels. They should compel shipowners and the fuel producers and bunkering companies supplying them to substitute renewable and low-carbon fuels, including expensive-to-produce e-methanol, in place of fossil-derived fuels.

Demand for low-carbon hydrogen should also arise in the power sector, with more electrification of transport and industry and increasing demand for electricity produced from renewable energy systems.

As the price of renewable power continues to decline, it will make hydrogen more competitive because much of its cost is based on electricity prices. Where seasonal power demand variations occur, it can play a critical role in seasonal storage.

In fact, hydrogen production and storage could help utilities to hedge against low power prices in Europe, where renewable energy has exposed them to very low and even negative prices.

Carrots and sticks for domestic markets

For MENA countries, the prospects for large-scale green hydrogen exports look increasingly unlikely in the near future. Yet countries such as Saudi Arabia and the UAE have already invested a lot and risk stranded assets. The question is critical for Saudi Arabia, where the biggest electrolyser production in the world will launch at NEOM next year, and this hydrogen will need to find 100% offtake for 600 tonnes per day produced.

“To have it all go out on ships is very ambitious,” said Jan Haizmann. “They will have to think about what to do with the remainder, as export opportunities may not be realized.”

The countries are already large consumers of hydrogen in their refining and chemicals industries. They have green hydrogen targets in place and plan to develop domestic demand for green and blue (with carbon capture) hydrogen.

"Countries in the region need to build their own internal markets with clear rules and binding targets that drive demand," said Haizmann. And he emphasized that they will likely need incentives to create demand.

They will need ‘carrots and sticks’, including binding targets that compel companies to procure certain volumes of low carbon fuels for their operations or face penalties, because a purely voluntary system that mostly relies on export scenarios is unlikely to work.

As an example, he pointed to the incentives that, over time, supported the rise of renewable energy systems in many regions.

“With every new technology, there is a need to incentivize it to get to high volumes, and when high volumes are achieved, then prices come down,” he said.

“The production opportunities for hydrogen in MENA are fantastic, almost unrivalled, because of the sunshine here,” he said. “But it doesn’t remove the need to do something to realize the opportunities.”

By Alan Mammoser for Oilprice.com

Why the Hydrogen Dream Remains Unfulfilled

- President Bush’s 2003 vision for a hydrogen economy has not been realized due to significant challenges including a lack of refueling infrastructure and the high cost of clean hydrogen production.

- Battery-electric vehicles have become the dominant technology in the zero-emission vehicle market, surpassing hydrogen fuel cells due to advancements in battery technology and greater industry investment.

- While hydrogen still holds promise for industrial applications such as heavy trucking and steelmaking, its use in personal vehicles is hindered by energy inefficiency and inconsistent policy support.

In his 2003 State of the Union address, President George W. Bush offered a bold vision of a cleaner energy future. Standing before Congress and the nation, he announced a $1.2 billion initiative to develop hydrogen-powered vehicles, proclaiming that “the first car driven by a child born today could be powered by hydrogen and pollution-free.”

The appeal was clear: a shift away from imported oil and a meaningful reduction in vehicle emissions. After all, the combustion product of hydrogen is just water.

That child would be turning 22 this year. But the hydrogen car that was supposed to carry them into a cleaner future is still not in their driveway. In fact, outside of a few test markets, it’s not in anyone’s driveway.

So, what happened?

The Promise—and the Problem

Bush’s speech wasn’t just political theater. At the time, hydrogen fuel cells were seen as a potential long-term alternative to gasoline-powered internal combustion engines. Automakers like Toyota and Honda were investing heavily in hydrogen vehicle prototypes. And with oil prices rising, the idea of tapping into the universe’s most abundant element for clean energy made good sense—at least on paper.

But two decades later, the hydrogen economy has failed to materialize in any meaningful way for the average consumer. The reasons are complex, but five key factors stand out.

1. The Infrastructure That Never Came

Hydrogen is a gas with low volumetric energy density. It must be compressed to high pressure or liquefied and then transported from its production facility to its final destination. Those steps are energy intensive. Cars then require an entirely separate refueling infrastructure from gasoline or electric vehicles.

That’s not a small hurdle—it’s a multi-billion-dollar roadblock. Unlike electric vehicles, which can charge at home or increasingly in public parking lots, hydrogen vehicles depend on specialized high-pressure refueling stations that are costly to build and maintain.

Today, the U.S. has fewer than 60 public hydrogen stations, and nearly all of them are in California. Without nationwide infrastructure, widespread consumer adoption remains elusive. And without consumers, infrastructure investment remains commercially unjustifiable. It’s a chicken-and-egg problem with no clear resolution in sight.

2. The Cost of Clean Hydrogen

Most of today’s hydrogen—about 95% globally—is produced from natural gas in a process that emits significant carbon dioxide. This has been dubbed “gray hydrogen” and is cheap but dirty when it comes to carbon emissions. “Green hydrogen,” made via electrolysis of water powered by renewable energy, avoids emissions but costs two to three times more to produce.

Government subsidies are available that provide incentives for green hydrogen production, but President Trump’s “One Big Beautiful Bill Act” would terminate the 45V tax credit for hydrogen starting in 2026, potentially derailing nascent green hydrogen projects and significantly setting back progress.

Electrolyzer technology is improving, and costs are slowly declining. But green hydrogen still struggles to compete with both gasoline and electricity from the grid. Until production costs drop substantially—or carbon pricing levels the playing field—hydrogen for transportation will remain economically disadvantaged.

3. The Rise of Battery Electric Vehicles

In 2003, hydrogen fuel cells and battery-electric vehicles (BEVs) were competing for the future of zero-emission transportation. Hydrogen had the early momentum—Toyota’s first fuel-cell vehicle hit U.S. roads in 2002. But then came Tesla, followed by a wide variety of electric vehicle offerings.

Over the past 15 years, improvements in lithium-ion battery density, charging infrastructure, and manufacturing scale have made BEVs the dominant clean car technology. The industry bet on batteries, and it paid off. Today, global automakers are planning to invest $1.2 trillion in electric vehicles and batteries through 2030, with virtually no comparable commitment to hydrogen-powered cars.

4. Policy Whiplash

Inconsistent energy policies across different presidential administrations are a challenge for every energy option. While the Bush administration gave hydrogen an initial boost, policy support fizzled under subsequent administrations. President Obama emphasized battery-electric vehicles and solar, while President Trump focused on fossil fuels. Only recently—under the Inflation Reduction Act and the bipartisan infrastructure law—has hydrogen regained some federal momentum.

But even now, the lion’s share of support goes toward hydrogen’s industrial applications—steel, ammonia, long-haul trucking—not personal vehicles. Without sustained, targeted subsidies and coordination, hydrogen cars may remain a niche solution in a battery-first market.

5. The Efficiency Dilemma

One of hydrogen’s biggest drawbacks is its energy inefficiency. To power a hydrogen vehicle, you must first generate electricity, use that electricity to split water into hydrogen, compress and transport the hydrogen, then convert it back into power for the vehicle. Each step incurs energy losses.

In contrast, battery-electric vehicles store electricity directly, with far less waste. The end result? A BEV can use renewable energy three times more efficiently than a hydrogen-powered car. That math doesn’t favor hydrogen—at least not for passenger vehicles.

Where Hydrogen Still Holds Promise

Despite these challenges, hydrogen is one of the most important industrial chemicals globally. In fact, it’s gaining traction in sectors where batteries struggle—like heavy trucking, shipping, and aviation. Hydrogen is also essential if we are to decarbonize certain industrial processes, such as steelmaking and fertilizer production.

The International Energy Agency projects that clean hydrogen could play a significant role in a net-zero emissions future. But that role is more likely to involve powering cargo ships and industrial furnaces than personal transportation.

A Vision Ahead of Its Time?

To his credit, George W. Bush’s vision for a hydrogen economy was based on a desire to innovate, reduce emissions, and secure America’s energy future. But the execution proved far more difficult than the ambition.

In 2025, hydrogen still holds promise—but it’s not the silver bullet that many once hoped. The path forward will require technological breakthroughs, regulatory clarity, and realistic expectations about where hydrogen truly adds value. Which, honestly, all of which was said in 2003.

Bush was right to dream big. But as the past two decades have shown, turning that dream into reality involved a lot more hurdles than many proponents initially envisioned.

By Robert Rapier for Oilprice.com

Trump’s ‘Beautiful’ Bill Casts a Cloud Over Hydrogen’s Future

- Trump’s new House-passed bill aims to repeal key clean energy tax credits, including the 45V hydrogen subsidy and the 48 Investment Tax Credit, jeopardizing major U.S. hydrogen and ammonia projects.

- Companies like Air Products, CF Industries, and Plug Power warn that losing 45V credits could make low-carbon hydrogen economically unviable.

- While hydrogen loses ground, carbon capture survives intact, with 45Q tax credits preserved, for now.

A week ago, the U.S. House of Representatives passed Trump’s “Big, Beautiful Bill” designed to deploy large tax cuts, extra spending on defense and immigration enforcement by primarily leveraging deep cuts to the Inflation Reduction Act (IRA) of 2022.

With the contentious bill now headed for the Senate, some energy experts are warning of dire consequences for some renewable energy industries if it becomes law. To wit, the sweeping policy bill seeks to phase out billions in tax credits for the budding green hydrogen and EV battery industries. Created under the Inflation Reduction Act during the Biden administration, the Section 45V tax credit has been a major boon for low-carbon hydrogen and ammonia projects across the country.

This could be profound: a total of 46 hydrogen and ammonia-related projects were qualified to receive 45V tax benefits in Louisiana alone, including massive builds from Air Products & Chemicals (NYSE:APD), Clean Hydrogen Works and Bia Energy.

Over the past couple of years, Louisiana has emerged as the country’s leading hydrogen hub, focused on industry growth and sustainability. The state is home to some of the largest hydrogen projects in the country, including Clean Hydrogen Works' $7.5 billion ammonia and blue hydrogen project slated to create 1,472 jobs; Air Products' $4.5 billion blue hydrogen plant; Bia Energy Operating Company's $550 million blue hydrogen project and Monarch Energy's $426 million green hydrogen project.

Losing 45V tax credits may seriously erode the economic viability of these companies: according to company filings, Air Products received $19.7 million in federal tax credits in 2024, with the company’s federal tax credit claims jumping nearly 40% between 2020 and 2024. That’s perhaps not a coincidence when you consider that the 45V program kicked off in 2021 after former President Joe Biden passed the IRA.

With over 10 million tons of gross annual output, Illinois-based CF Industries (NYSE:CF) is one of the largest ammonia producers in the world, with Louisiana accounting for half of the company’s output. CF has already secured renewable energy certificates that qualify its pilot electrolyzer project for 45V tax credits when operational. When asked about the impact of the termination of 45V credits, Ryan Stiles, who manages the company’s ammonia production, said that some customers are likely to be less tolerant of paying more for low-carbon ammonia without the 45V subsidies.

The hydrogen sector heavyweight, Plug Power (NASDAQ:PLUG), only began operations in Louisiana a month ago; however, the company has previously flagged the importance of the 45V credit, stating that any limitation “could be materially adverse to the Company and its near-term hydrogen generation projects.”

Yet another provision in Trump’s big bill would spell doom for Section 48 Investment Tax Credit for certain clean energy technologies, ending eligibility for the credits in 2032--three years earlier than the IRA intended.

On a brighter note, the bill still provides tax credits for carbon capture and sequestration under Section 45Q.

“We expect our investment into the Donaldsonville CCS project will increase our free cash flow in the range of $100 million per year due to the United States’ 45Q tax credit for permanently sequestering CO2,” CF Industries said in its annual report.

CF Industries is not the only energy company that will be counting its lucky stars for Trump’s big bill leaving CCS credits intact. Big Oil has invested considerable capital into carbon capture projects, including Exxon Mobil’s (NYSE:XOM) latest CCS project targeting power-hungry U.S. data centers. The Oil & Gas giant has unveiled a groundbreaking plan wherein the company will provide low-carbon power to the U.S. data centers powering the AI boom. Exxon’s proposal outlines a first-of-its-kind facility that will use natural gas to produce electricity while capturing more than 90% of the CO2 emissions. The captured emissions will then be stored deep underground. ExxonMobil’s current CCS technology supports industries involved in steel, hydrogen and ammonia production, with the company having secured agreements to store up to 6.7 million tons of CO2 annually for these sectors.

Meanwhile, last month, Shell (NYSE:SHEL), Equinor (NYSE:EQNR), and TotalEnergies (NYSE:TTE) expanded their Northern Lights CCS project with $714 million in total investments. The decision comes after a deal with Swedish energy company, Stockholm Exergi, which has pledged to send up to 900,000 tonnes of CO? each year over a 5-year span. With the additional investment, Northern Lights is now capable of storing at least 5 million tonnes of CO? per year, more than triple the original target of 1.5 million tonnes.

By Alex Kimani for Oilprice.com

- Trump’s new House-passed bill aims to repeal key clean energy tax credits, including the 45V hydrogen subsidy and the 48 Investment Tax Credit, jeopardizing major U.S. hydrogen and ammonia projects.

- Companies like Air Products, CF Industries, and Plug Power warn that losing 45V credits could make low-carbon hydrogen economically unviable.

- While hydrogen loses ground, carbon capture survives intact, with 45Q tax credits preserved, for now.

A week ago, the U.S. House of Representatives passed Trump’s “Big, Beautiful Bill” designed to deploy large tax cuts, extra spending on defense and immigration enforcement by primarily leveraging deep cuts to the Inflation Reduction Act (IRA) of 2022.

With the contentious bill now headed for the Senate, some energy experts are warning of dire consequences for some renewable energy industries if it becomes law. To wit, the sweeping policy bill seeks to phase out billions in tax credits for the budding green hydrogen and EV battery industries. Created under the Inflation Reduction Act during the Biden administration, the Section 45V tax credit has been a major boon for low-carbon hydrogen and ammonia projects across the country.

This could be profound: a total of 46 hydrogen and ammonia-related projects were qualified to receive 45V tax benefits in Louisiana alone, including massive builds from Air Products & Chemicals (NYSE:APD), Clean Hydrogen Works and Bia Energy.

Over the past couple of years, Louisiana has emerged as the country’s leading hydrogen hub, focused on industry growth and sustainability. The state is home to some of the largest hydrogen projects in the country, including Clean Hydrogen Works' $7.5 billion ammonia and blue hydrogen project slated to create 1,472 jobs; Air Products' $4.5 billion blue hydrogen plant; Bia Energy Operating Company's $550 million blue hydrogen project and Monarch Energy's $426 million green hydrogen project.

Losing 45V tax credits may seriously erode the economic viability of these companies: according to company filings, Air Products received $19.7 million in federal tax credits in 2024, with the company’s federal tax credit claims jumping nearly 40% between 2020 and 2024. That’s perhaps not a coincidence when you consider that the 45V program kicked off in 2021 after former President Joe Biden passed the IRA.

With over 10 million tons of gross annual output, Illinois-based CF Industries (NYSE:CF) is one of the largest ammonia producers in the world, with Louisiana accounting for half of the company’s output. CF has already secured renewable energy certificates that qualify its pilot electrolyzer project for 45V tax credits when operational. When asked about the impact of the termination of 45V credits, Ryan Stiles, who manages the company’s ammonia production, said that some customers are likely to be less tolerant of paying more for low-carbon ammonia without the 45V subsidies.

The hydrogen sector heavyweight, Plug Power (NASDAQ:PLUG), only began operations in Louisiana a month ago; however, the company has previously flagged the importance of the 45V credit, stating that any limitation “could be materially adverse to the Company and its near-term hydrogen generation projects.”

Yet another provision in Trump’s big bill would spell doom for Section 48 Investment Tax Credit for certain clean energy technologies, ending eligibility for the credits in 2032--three years earlier than the IRA intended.

On a brighter note, the bill still provides tax credits for carbon capture and sequestration under Section 45Q.

“We expect our investment into the Donaldsonville CCS project will increase our free cash flow in the range of $100 million per year due to the United States’ 45Q tax credit for permanently sequestering CO2,” CF Industries said in its annual report.

CF Industries is not the only energy company that will be counting its lucky stars for Trump’s big bill leaving CCS credits intact. Big Oil has invested considerable capital into carbon capture projects, including Exxon Mobil’s (NYSE:XOM) latest CCS project targeting power-hungry U.S. data centers. The Oil & Gas giant has unveiled a groundbreaking plan wherein the company will provide low-carbon power to the U.S. data centers powering the AI boom. Exxon’s proposal outlines a first-of-its-kind facility that will use natural gas to produce electricity while capturing more than 90% of the CO2 emissions. The captured emissions will then be stored deep underground. ExxonMobil’s current CCS technology supports industries involved in steel, hydrogen and ammonia production, with the company having secured agreements to store up to 6.7 million tons of CO2 annually for these sectors.

Meanwhile, last month, Shell (NYSE:SHEL), Equinor (NYSE:EQNR), and TotalEnergies (NYSE:TTE) expanded their Northern Lights CCS project with $714 million in total investments. The decision comes after a deal with Swedish energy company, Stockholm Exergi, which has pledged to send up to 900,000 tonnes of CO? each year over a 5-year span. With the additional investment, Northern Lights is now capable of storing at least 5 million tonnes of CO? per year, more than triple the original target of 1.5 million tonnes.

By Alex Kimani for Oilprice.com

Fouling control systems have never been more important when it comes to helping shipowners reduce carbon emissions and improve vessel efficiency to comply with ever-evolving regulations.

Fouling control systems have never been more important when it comes to helping shipowners reduce carbon emissions and improve vessel efficiency to comply with ever-evolving regulations.