SCI-FI-TEK

China Is Desperate to Dominate Nuclear Fusion

- China has invested up to $13 billion in fusion energy since 2023, aiming for commercial power by 2030.

- U.S. lawmakers and scientists warn that Chinese dominance in fusion could reshape global geopolitics.

- Experts call for a $10 billion federal funding boost and stronger public-private partnerships to keep America competitive.

China has spent up to $13 billion developing fusion energy since 2023 and could commercially replicate star power to generate electricity by 2030, becoming the first nation to master what’s commonly dubbed “the holy grail of energy solutions.”

Doing so would give the Chinese Communist Party (CCP) “the potential to reshape global geopolitics” and “dominate a new energy era,” Massachusetts Institute of Technology physicists warn.

This cannot happen, said Rep. Randy Weber (R-Texas), who chairs the House Science, Space, and Technology Committee’s Energy Subcommittee.

“Fusion energy technologies must be developed and deployed by nations that uphold democratic values, transparency, and international cooperation—not by authoritarian regimes that might exploit energy dominance as a weapon,” he said in opening remarks of a Sept. 18 hearing on the nation’s fusion programs.

“The U.S. must prioritize fusion energy development to outpace the CCP’s aggressive timelines,” Weber added, or China will dominate “the most consequential breakthrough of the century.”

Four fusion experts told the subcommittee during the two-hour hearing that the CCP doesn’t have to win what they see as an existential race, calling on the Trump administration to boost funding to match China’s investment, coordinate research and development with allies, and establish fusion demonstration programs using the same “playbook” that spearheaded breakthroughs in other technologies.

Unlike fission, nuclear fusion replicates the reaction produced by firing atoms, which is the power emitted by stars, and has the potential to provide limitless, clean energy. It is often referred to as “the holy grail of energy solutions.”

Fusion has been researched by academic institutions and government laboratories since the 1950s, with significant breakthroughs in 2022—including Lawrence Livermore National Laboratory’s National Ignition Facility completing a nuclear fusion reaction that produced more energy than used to power the experiment—spurring rapid, exponential advancements since.

“This is our ‘Kitty Hawk’ moment, ushering in a new era of virtually unlimited fusion power,” Commonwealth Fusion Systems Co-Founder/CEO Bob Mumgaard said, calling for a $10 billion one-time “kick” in Department of Energy (DOE) funding.

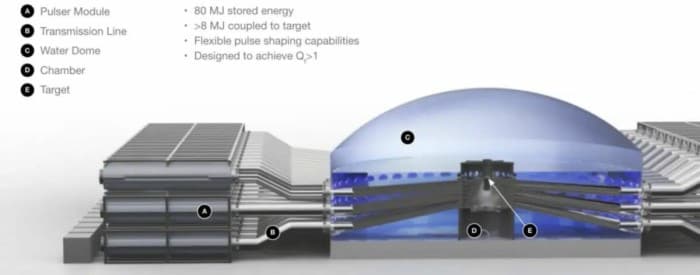

A rendering of Pacific Fusion’s Demonstration System, which the company maintains will achieve “net facility gain”—or more energy produced than consumed in a reaction—by 2030. Pacific Fusion illustration provided for congressional testimony on Sept. 18, 2025

‘Decisive Moment Is Upon Us’

Mumgaard, whose company aims to build a small fusion power plant with an ARC tokamak design by the early 2030s, said the nation’s fusion industry has grown from 23 companies that raised $1.78 billion in private capital in 2021 to 53 companies that raised $10.6 billion in 2024.

But now these burgeoning enterprises need to test experimental fusion reactors in a limited-risk environment, which is where DOE and federal funding could make the difference, he said.

Mumgaard said in his testimony that a fusion demonstration program similar to DOE’s advanced fission reactor program would “accelerate deployment of at least three different fusion power plant approaches, with construction starting by the end of 2028 and entering operation by the early 2030s.”

He called for “milestone-based, cost-shared funding that awards only those who show substantial progress toward the goal” with “selection of participants based not just on scientific merit, but also by requiring a clear path to commercial and business success.”

“I agree this $10 billion injection would go a long way to setting us on the course,” Oak Ridge National Laboratory Fusion Energy Division Director Troy Carter concurred.

“The decisive moment is upon us,” he testified. “With deliberate action now—by supporting new facilities, public-private partnerships, and sustained innovation—we can ensure the U.S. leads in bringing fusion energy from scientific promise to commercial reality.”

“The U.S. fusion industry is on the cusp of commercialization,” Pacific Fusion founder and President Will Regan said in his testimony. “America wrote the playbook on investing in fundamental scientific breakthroughs and then scaling their industrial application through the private sector. Fusion is no different, and today we’re at the last mile of solving key scientific challenges to enabling commercial deployment.”

Rep. Zoe Lofgren (D-Calif.) said, while “very much opposed overall” to the fiscal year 2026 (FY26) budget crafted by President Donald Trump, “I would like to say when it comes to his specific request for fusion, it’s moving in the right direction, and I am glad for that.”

DOE’s FY26 budget request provides $7.1 billion for the Office of Science, which includes fusion research and explicitly directs Congress to allocate in a way that “maintains U.S. competitiveness in priority areas such as fusion.”

“I’m hoping we’ll continue to work on a bipartisan basis to get to where we need to go,” Lofgren said. “Like Wayne Gretzky said, ‘You need to skate to where the hockey puck is going to be.’”

“In a world increasingly concerned with how to address rapidly growing energy needs, as well as geopolitical tensions arising from access to energy and energy resources, fusion energy gives us hope,” University of Wisconsin assistant professor Stephanie Diem testified. “We have achieved remarkable scientific advances; now we need robust support to build a thriving fusion energy ecosystem.”

By Zerohedge