Mapping resilient supply solutions for graphite, a critical mineral powering energy storage: Rice experts’ take

Rice University

video:

Rice researchers weigh in on graphite’s rise to critical mineral status, mapping out trajectories toward more resilient, clean and efficient supply practices and systems.

view moreCredit: Video by Jorge Vidal/Rice University

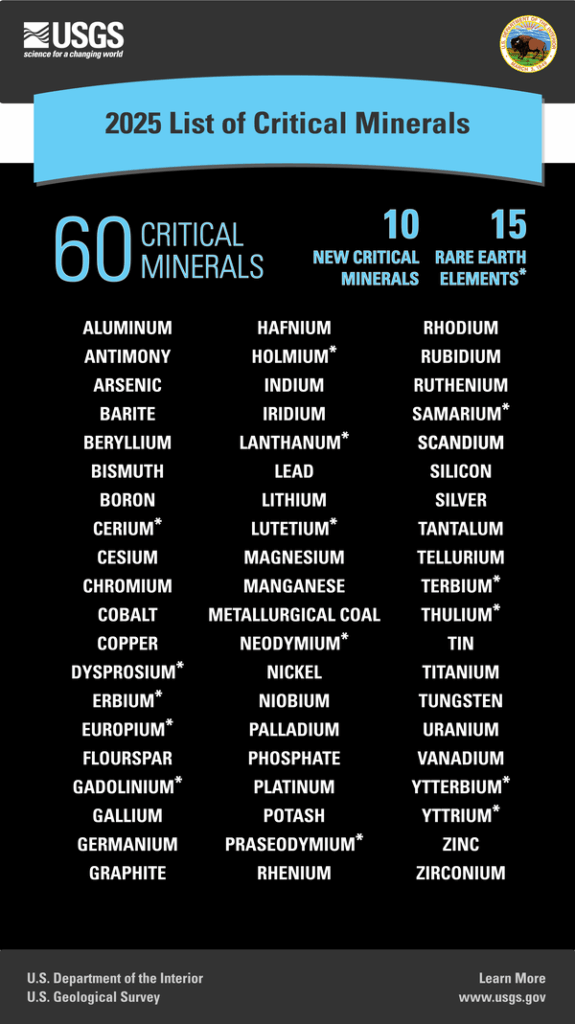

HOUSTON – (Nov. 7, 2025) – Graphite, the primary anode material in lithium-ion batteries, has become central to energy storage technologies and a growing focus of supply chain concerns. Even as graphite demand is rising faster than lithium demand, global production remains highly concentrated and carbon-intensive.

A perspective article by Rice University researchers traces graphite’s transformation from an industrial commodity to a critical mineral, outlining emerging solutions that could make graphite production cleaner and more resilient, including manufacturing synthetic graphite from renewable sources such as biomass and captured carbon dioxide.

Featured experts:

Pulickel Ajayan, Rice’s Benjamin M. and Mary Greenwood Anderson Professor of Engineering and professor of materials science and nanoengineering, and Sohini Bhattacharyya, research scientist in the Ajayan research group, can address follow-up questions on graphite’s role in the energy economy, including:

- How lower-carbon graphite production can strengthen supply security.

- Environmental and supply chain challenges in graphite production.

- Advances in “green” synthetic graphite and recycling of spent battery anodes.

- How industry and policy can help secure sustainable U.S. supply.

For media inquiries or to request interviews, contact Silvia Cernea Clark, media relations specialist, at sc220@rice.edu.

-30-

This news release can be found online at news.rice.edu.

Follow Rice News and Media Relations via Twitter @RiceUNews.

Review paper:

Graphite: The New Critical Mineral | Nature Reviews Materials | DOI: 10.1038/s41578-025-00848-5

Authors: Sohini Bhattacharyya, Soumyabrata Roy, Xiaodong Lin, Nicolo Campagnol, Alexandru Vlad and Pulickel M. Ajayan

https://doi.org/10.1038/s41578-025-00848-5

Video is available at:

https://youtu.be/uMcMcgvC0nM?si=X6Ywo-OXHMlbrccw

https://rice.box.com/s/nefxuneiztvaagw4nkqkr1zelioes3pl

(Video by Jorge Vidal/Rice University)

About Rice:

Located on a 300-acre forested campus in Houston, Texas, Rice University is consistently ranked among the nation’s top 20 universities by U.S. News & World Report. Rice has highly respected schools of architecture, business, continuing studies, engineering and computing, humanities, music, natural sciences and social sciences and is home to the Baker Institute for Public Policy. Internationally, the university maintains the Rice Global Paris Center, a hub for innovative collaboration, research and inspired teaching located in the heart of Paris. With 4,776 undergraduates and 4,104 graduate students, Rice’s undergraduate student-to-faculty ratio is just under 6-to-1. Its residential college system builds close-knit communities and lifelong friendships, just one reason why Rice is ranked No. 1 for lots of race/class interaction and No. 7 for best-run colleges by the Princeton Review. Rice is also rated as a best value among private universities by the Wall Street Journal and is included on Forbes’ exclusive list of “New Ivies.”

Journal

Nature Reviews Materials

Article Title

Graphite: The New Critical Mineral