JPMorgan warns of ‘more volatility’ facing energy transition

The outlook for the global energy transition is likely to be more volatile than investors may have expected, according to JPMorgan Chase & Co.

“We’ve had a bit of a reset,” James Janoskey, the London-based global co-head of JPMorgan’s natural resources group, said in an interview. The clean-energy transition is “still going to happen, but it will be more elongated than we thought previously, with more volatility and with some sub-sectors going faster than others.”

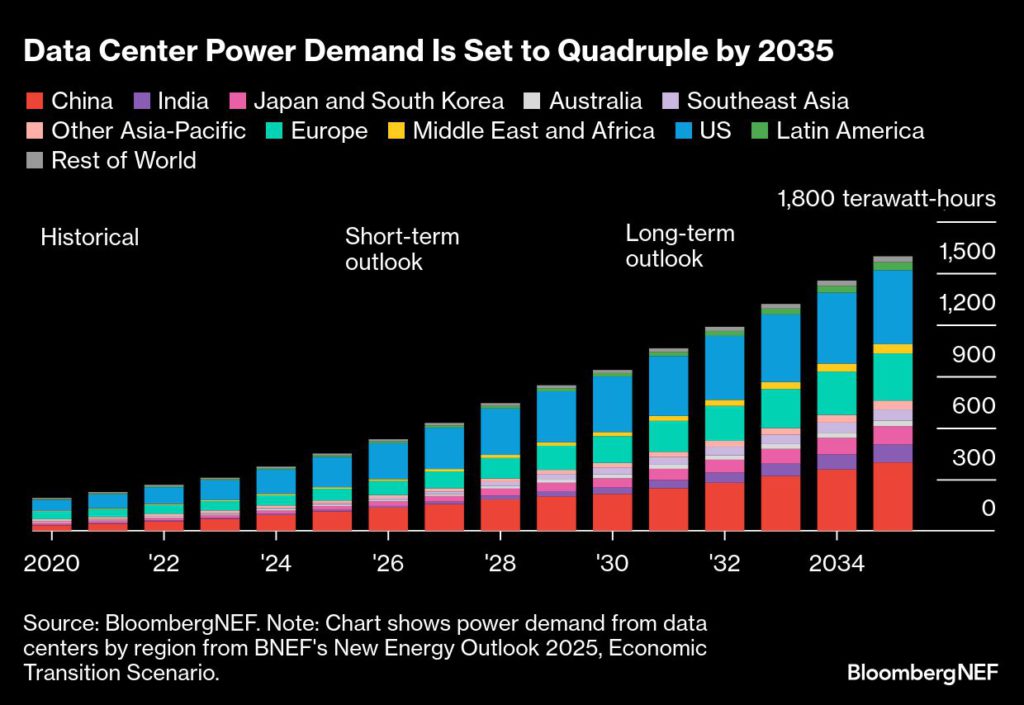

He says JPMorgan isn’t planning to back away from financing companies tied to the energy transition, noting that the bank is convening a summit in March intended to help clean-tech firms raise equity growth capital. At the same time, the geopolitical, business and economic context means that fossil fuels continue to attract capital, in large part due to the rise of artificial intelligence and the data centers needed to power it.

There’s still growth in the amount of capital being allocated to the low-carbon economy, said Janoskey, whose role within JPMorgan’s investment banking unit covers global energy, power, renewables and mining. “But the predicted trend line that showed traditional fossil fuels going down and then leveling off — and low carbon sources going up and to the right — has not materialized.”

It’s clear that “oil and gas will remain a meaningful part of the energy mix for the foreseeable future,” he said. “So we are not really talking about a transition or replacement at this point, it’s more of an addition to meet growing demand.”

The outlook for a transition away from high-carbon technologies and toward cleaner, greener alternatives has been complicated by a cocktail of political backlash in the US, competitiveness concerns in Europe and the rise of AI globally. Clean energy is drawing record investment, green stocks are outperforming, and renewables are generally the cheapest form of power. At the same time, the Trump administration has pitted itself against sectors such as wind and solar, as it works to turbocharge the production of oil, gas and even coal.

There’s still transition dealmaking to be done, albeit with a somewhat different focus than might once have been expected, Janoskey said. “Today the conversation is not just about energy transition, but also energy security, energy dominance and affordability,” he said.

JPMorgan is looking at financing opportunities in the nuclear power industry, including for small modular reactors, Janoskey said. The bank is also interested in doing deals to help finance power grid modernization and battery storage, he said.

No bank is bigger than JPMorgan when it comes to financing energy deals overall, according to BloombergNEF. For every dollar JPMorgan provided to the fossil-fuel industry — either via direct loans or debt and equity underwriting — it allocated 69 cents to green projects, according to a September BNEF report that looks at transactions through the end of 2024.

BNEF says “fragmentation” has beset global efforts to deliver a low carbon future. Still, while “climate mitigation is no longer the shared priority it once was” and despite “some awkward mood music,” the energy transition “keeps on trucking,” it concluded in a Jan. 6 report.

For the world to have a chance of limiting global warming to the critical threshold of 1.5C, capital allocations to green projects need to be four times the amount those spent on fossil fuels, BNEF has calculated.

Janoskey says JPMorgan continues “to look to actively finance the lower carbon part of that business and try to scale that up.” But the bank has “put in less capital to that area than we may have hoped as some clients pulled back or delayed projects in recent times,” he said.

(By Alastair Marsh)