Trump launches $12B minerals vault to cut China reliance

US President Donald Trump is preparing to launch a strategic stockpile of critical minerals backed by $12 billion, aiming to protect manufacturers from supply disruptions as the US accelerates efforts to reduce dependence on Chinese metals.

The White House confirmed on Monday the start of “Project Vault,” which would combine $1.67 billion in private capital with a $10 billion loan from the US Export-Import Bank to buy and store minerals for automakers, technology companies and other industrial users.

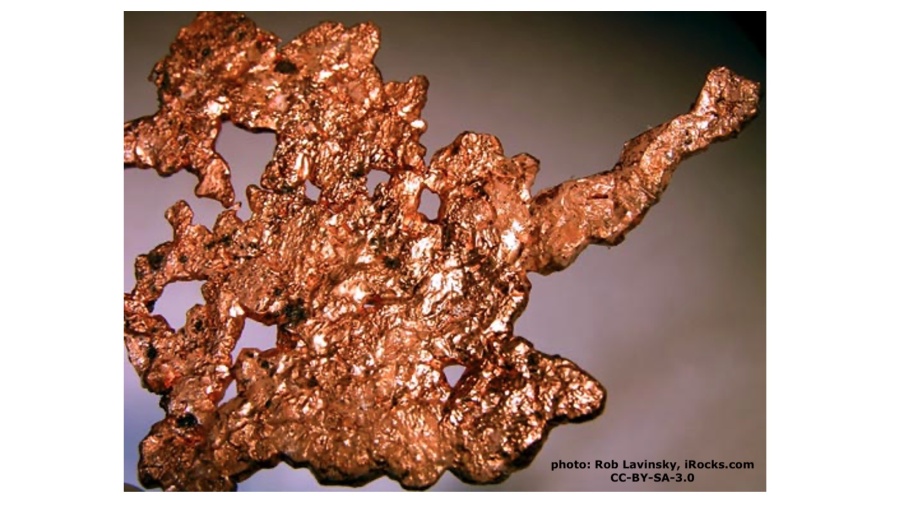

The model mirrors the country’s emergency oil reserve but focuses instead on materials such as gallium and cobalt used in products ranging from smartphones to jet engines.

The project spans the automotive, aerospace and energy sectors and underscores Trump’s broader push to rewire US supply chains away from China, the world’s dominant producer and processor of critical minerals.

More than a dozen companies have reportedly signed on, including General Motors Co., Stellantis NV, Boeing Co., Corning Inc., GE Vernova Inc. and Alphabet Inc.’s Google. Commodities traders Hartree Partners LP, Traxys North America LLC and Mercuria Energy Group Ltd. will handle purchases to fill the stockpile.

“Project Vault is a clear signal that US critical‑mineral policy has moved to deployment,” US Critical Materials chairman, Harvey Kaye, told MINING.COM. “It says unequivocally that secure supplies of rare earths and heavy minerals like gallium are now treated as strategic infrastructure for our economy and defense industrial base, to establish US sovereignty.”

Kaye noted that for companies like US Critical Materials, it confirms that high-grade domestic supply is no longer optional.

Beyond defence

Trump is scheduled to meet Monday with GM chief executive officer Mary Barra and mining entrepreneur Robert Friedland, representing both consumers and producers of critical minerals.

While the US already maintains a national stockpile for defence purposes, it lacks a comparable reserve for civilian industry. That gap has taken on urgency as the Pentagon ramps up its own accelerated stockpiling campaign, targeting up to $1 billion in mineral acquisitions in the near term.

The drive is supported by Trump’s One Big Beautiful Bill Act, which allocates $7.5 billion for critical minerals, including $2 billion to expand the national stockpile by 2027, $5 billion for supply-chain investments and $500 million for a Pentagon credit program to encourage private projects.

The administration has also taken the unusual step of investing directly in domestic mining companies to boost US rare earths production and processing.

Last month, a bipartisan group of US lawmakers introduced a bill to create a $2.5 billion stockpile of critical minerals, a move aimed at stabilizing market prices and encouraging domestic mining and refining.

Senior administration officials told Bloomberg News Project Vault was oversubscribed, citing investor confidence in the credit quality of participating manufacturers, their long-term purchase commitments and the backing of the US export-credit agency. Under the plan, companies can draw down their allotted materials as long as they replenish them, with full access permitted during major supply disruptions.

Manufacturers that commit to buying set quantities at fixed prices will also agree to repurchase the same amounts at the same cost in the future, a structure the administration says will help stabilize prices and dampen market volatility.

Bloomberg News was the first to report the creation of the critical minerals strategic reserve.

‘Project Vault’ wins some metals industry support as stocks gain

The US government’s planned $12 billion initiative to stockpile critical minerals is winning support from parts of the metal markets, while raising doubts elsewhere about how effective the initiative will be.

Critical minerals span everything from aluminum to zinc, but it’s smaller, niche markets such as rare earths where federal buying is more likely to move prices and impact trade flows. Developers with ties to the Trump administration reacted more strongly than larger, established miners. MP Materials Corp. jumped as much as 7% on Monday, while Almonty Industries Inc. rose 9.7% before paring gains.

Aclara Resources Inc., which recently secured US funding for a mine in Latin America, said government stockpiling could help get more projects off the ground. An analyst at William Blair & Co. called the plan “a major tail wind” for rare earths.

“Industrial clients are reluctant to provide take-or-pay contracts given the early-stage nature of many initiatives,” said Aclara chief executive officer Ramon Barua. By stepping in as a buyer, the government can help finance alternative supply chains and “bridge that gap,” he said.

The Trump administration’s venture — dubbed Project Vault — would combine $1.67 billion of private capital with a $10 billion loan from the US Export-Import Bank to procure and store minerals for automakers, technology companies and other manufacturers. Ex-Im’s board is scheduled to vote later Monday to authorize the record-setting 15-year loan, more than double the bank’s previous largest deal.

MP Materials, in which the Pentagon agreed to make a $400 million equity investment in July, was up 3.6% at 2:08 p.m. in New York while tungsten miner Almonty had pared gains to 0.2%. USA Rare Earth Inc. rose as much as 16% before retreating, while United States Antimony Corp. was up 10%.

The efforts are part of the government’s push to shore up supply chains critical to autos, aerospace and energy. While details remain limited, the scale alone sets Project Vault apart from earlier proposals and signals a return to a more interventionist federal role in physical commodity markets.

The initiative shows the administration’s “major focus on rare earth” and it’s “determination to take control back from China,” wrote William Blair’s Neal Dingmann, who expects further government funding for rare earth providers and customers.

The approach builds on US inventory accumulation that’s already underway. Exchange warehouses and trade data show rising stockpiles of copper, platinum and palladium over the past year, blurring the line between commercial inventories and state-backed strategy as government-supported investments proliferate across metals markets.

US officials “want to make sure they’re reducing their external vulnerabilities in terms of metal supply chains,” said Helen Amos, commodities analyst at BMO Capital Markets. “They’re investing directly in equity, they’re building up stockpiles and looking at strategic partnerships with trading companies,” Amos said. “They’re coming at it from all possible angles.”

For Almonty CEO Lewis Black, $12 billion is a fairly modest sum when spread across dozens of critical metals and compared with Cold War–era stockpiling. Rules require government purchases to be non-disruptive, further constraining the program’s effectiveness, he said.

In tight markets such as tungsten, the US will still have to compete for global supplies with China, Black said.

“Where are they going to get the material from? There’s nothing out there,” he said. “China is extraordinarily aggressive in buying non-Chinese concentrate and scrap, and the financial regulations that apply to us don’t apply to them.”

Even so, the scale of Project Vault far exceeds the $2.5 billion Strategic Resilience Reserve proposed by lawmakers under the Secure Minerals Act. That gap points to a growing bipartisan consensus that metals deserve the same strategic treatment as oil, as geopolitical risks increase and China’s grip of several critical minerals tightens.

Rather than addressing any immediate shortages though, Project Vault appears designed to enhance resilience and shape market dynamics, according to BMO’s Amos. Stockpiling would give policymakers a tool to smooth domestic prices — buying during downturns and releasing inventory when prices surge — echoing the logic of Cold War–era reserves.

While niche metals may see outsize effects, large and liquid markets such as copper are less likely to move. BMO estimates there is already about $13 billion worth of metal sitting in US warehouses.

Strategically, Project Vault reinforces a broader shift in US industrial policy, adding another lever to reduce reliance on adversarial supply chains, particularly those tied to China. It signals a US government increasingly willing to operate across every layer of the metals ecosystem — from mine to market — in pursuit of security goals.

(By James Attwood)