As stated earlier last month, Europe’s reliance on China for the minerals and materials underpinning the clean energy transition is no accident; it was a policy choice. And just as it chose dependency, Europe can choose resilience. The contours of that choice are now sharp and urgent: this is not about isolationism, but about strategic autonomy, industrial renaissance, and practical competitiveness.

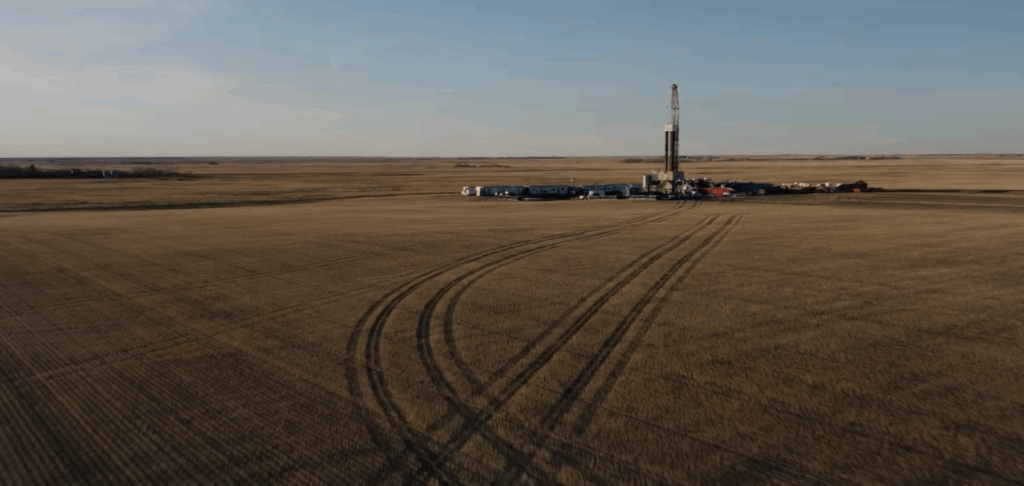

Europe’s vulnerability lies not in geology but in policy and capacity. Europe is not barren of lithium, nickel, graphite, rare earths, or manganese. These minerals are present from the Iberian Peninsula to Scandinavia. What Europe lacked, until recently, was the projects to turn them into secure supply chains on its own shores. Enough talk. The next phase must be action.

Concrete Groundwork: Mining and Processing Capacity

European policymakers have begun to pivot from rhetoric to reality. Under the Critical Raw Materials Act (CRMA), the EU has defined clear targets: by 2030 ensure at least 10% of critical raw materials extraction occurs within Europe, 40% processing capacity is domestic, and 25% of demand is met through recycling.

Real projects are now part of that roadmap:

- Graphite Mining in Greenland: The Greenland government recently granted a 30-year mining permit for the Amitsoq graphite project, designated a strategic project under the EU framework. This deposit is one of the highest-grade graphite sources on Earth, critical for lithium-ion battery anodes. Backed by the European Raw Materials Alliance, the project illustrates a new model of responsible extraction tied directly to European battery supply chains.

- Lithium Production in Germany: In Germany, a massive funding package, roughly $3.9 billion, has been secured for a lithium hydroxide plant aimed at powering electric vehicle batteries. Stretching beyond mere extraction, it combines upstream raw materials with downstream refining and renewable energy production, a blueprint for integrated European supply chains.

These projects show ambition, but scale matters. Europe must attract far greater capital deployment to match the huge global demand for clean technology metals.

Institutional Engines: Policy and Finance

Europe is far from passive. The EU has rolled out several important structural initiatives that highlight the focus given to this topic:

- The Critical Raw Materials Act itself institutionalizes industrial strategy around raw materials for the first time, providing regulatory certainty and supply chain safeguards.

- Through the ReSourceEU programme and a related €3 billion plan, Brussels aims to de-risk essential supply chains, seed public-private partnerships, and build joint stockpiles. Initiatives ranging from magnet recycling to collective procurement strategies are emerging as tools to blunt external pressures.

- The European Raw Materials Alliance (ERMA) mobilizes industry, finance and governments to diversify suppliers, build capacity, and foster innovation across the value chain. European member states are now collaborating on coordinated exploration programmes and permitting reforms to unlock domestic geology.

If Europe is serious about resilience, these mechanisms must be scaled up and integrated with national strategies.

Processing and Circularity: The Overlooked Strength

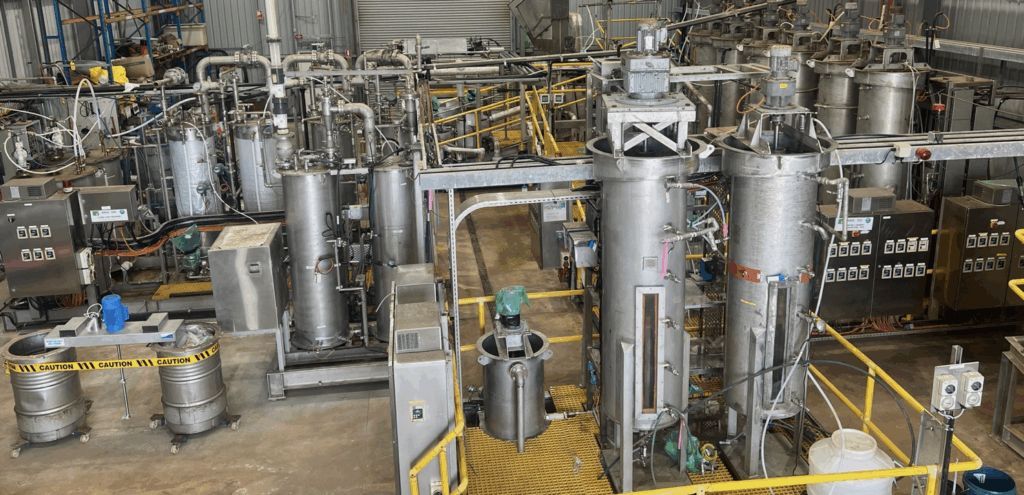

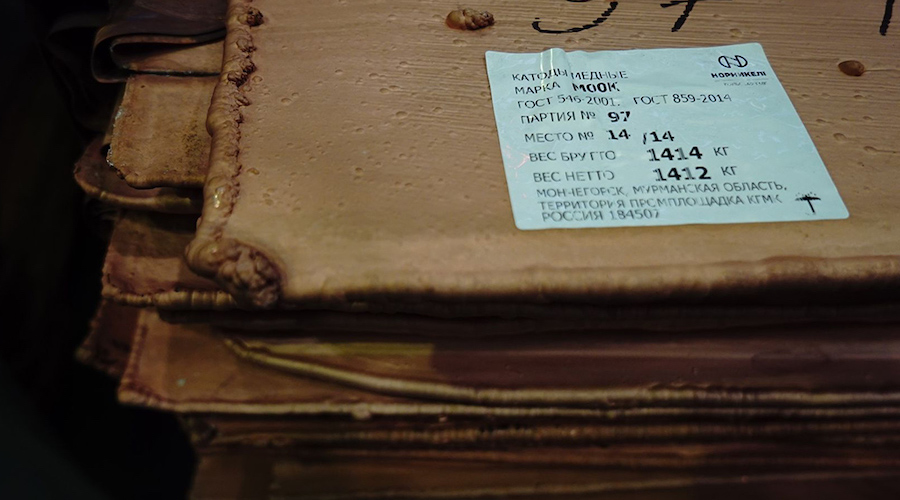

Extraction is only half the battle. The true chokepoint historically has been processing and refinement, where China today commands an estimated 80-plus percent of global capacity.

Europe’s answer is multifaceted:

- Domestic refining facilities are being prioritised through strategic projects under the CRMA. Dozens of designated initiatives, spanning rare earth separation to battery precursor production, are intended to reduce chokehold dependencies.

- Recycling must become industrialised. Europe is now pushing hard on advanced magnet recycling for wind turbines and EVs, including potential export restrictions on scrap magnets so they recirculate inside the EU industrial ecosystem. This is literally turning waste into strategic material.

- Innovation networks like SCRREEN are accelerating cross-cutting technology research in mining, processing, recycling and substitution, blending industry, policy, and science to create competitive European processes.

These efforts, from cradle to cradle, must be amplified if Europe wants autonomous supply chains that are also environmentally and socially credible.

Lessons From Competitors

One reason the U.S. has advanced faster recently is its willingness to industrialize with money. Subsidies, tax credits, and government anchor offtake agreements have catalysed projects that otherwise would stall. Europe must match strategic ambition with equally bold financing, not just rules.

Permitting bottlenecks and political pushback remain genuine barriers. European regulators must balance environmental standards with streamlined, predictable approval processes, rather than defaulting to prohibitive delays.

The Road Ahead: Strategic Autonomy, Not Autarky

Europe’s path to resilience is not to sever ties with global suppliers, including China, but to diversify, internalise capacity, and hedge against shocks. Strategic autonomy does not mean self-sufficiency at all costs; it means having options, leverage, and redundancy.

The next decade will define whether Europe remains dependent or becomes a producer, processor, and recycler on its own terms. The minerals are there. The industrial base remains world-class. What remains is the political will to translate promise into production. Europe must show that strategic choices can, indeed, rewrite supply chains just as geopolitics once wrote them.

By Leon Stille for Oilprice.com