Staff Writer | March 15, 2022

Ambri Inc’s high-temperature battery technology. (Image by Ambri).

A new report by IDTechEx estimates that by 2025, over 10% of the stationary energy storage market will be accounted for by non-lithium battery chemistries, up from <5% in 2021.

According to the market analyst, though electric vehicles are the largest market for battery technology and will remain so, the importance of the stationary market will grow and once energy density can be de-prioritized as it can be for stationary storage systems, the choice of battery chemistries and systems will become less restrictive.

“In particular, more long-duration storage is expected to be needed to enable higher penetration levels of variable renewable power sources. Here, lower cost and longer-lasting technologies are needed,” the dossier reads. “Li-ion batteries will likely struggle to profitably exploit electricity price variations over storage periods of 6-8 hours, let alone the days or weeks’ worth of storage that may eventually be needed.”

In IDTechEx’s view, improvements to alternative stationary battery technologies will also help to make them more attractive.

Such improvements are already being carried out by a number of companies that, based on data collected by the UK-based firm, have demonstrated prototypes and rolled out battery systems for early customers.

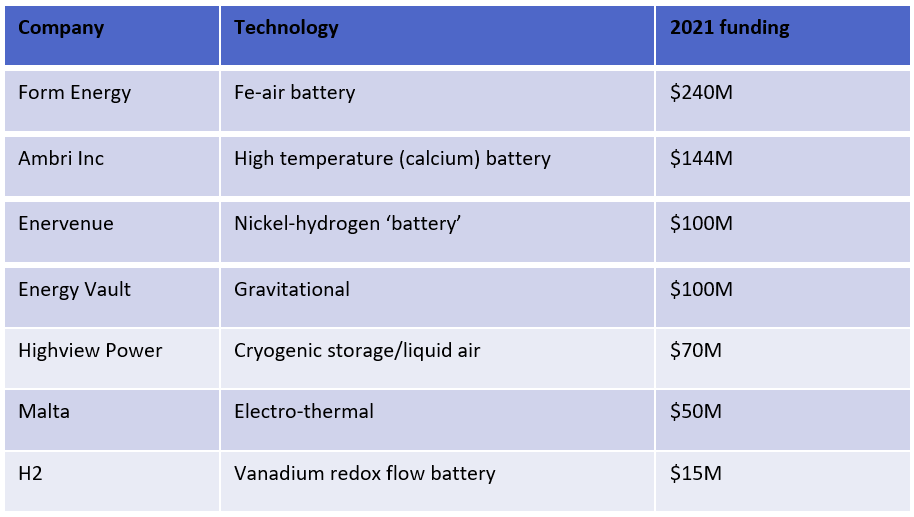

“Various battery chemistries based on zinc, iron, and other low-cost materials are also being developed and commercialized. Interest in these alternatives can be highlighted by some of the funding raised in 2021 from companies developing these long-duration technologies, including the $200 million for Form Energy’s iron-air, $144 million for Ambri Inc’s high-temperature battery, and $100 million for Enervenue’s nickel-hydrogen hybrid battery,” the report reads.

“Companies developing non-electrochemical storage technologies such as Highview Power and Energy Vault have also raised considerable funding in 2021.”

(Source: IDTechEx).

IDTechEx’s review predicts that several factors playing against the lithium-ion industry could open opportunities for battery chemistries, and energy storage technologies, that utilize lower cost, more widely available materials and that can also offer additional safety and environmental benefits.

The analyst’s data show that the second half of the 2020s could see lithium, cobalt, and nickel supply disruptions and bottlenecks, while the sector will also have to deal with the ongoing questioning of the safety and environmental credentials of materials throughout the Li-ion supply chain.

“Li-ion will continue to dominate the energy storage space in the short term. For battery electric vehicles, this will continue to be the case even in the long-term as there are few realistic alternatives beyond related chemistries based on silicon and lithium-metal anodes or solid-electrolytes,” the report reads.

But for stationary storage, IDTechEx predicts alternatives to Li-ion are set to play an increasingly important role due to their potential for improving cost and safety, easing material supply burdens, and the often less demanding requirements on energy density in the stationary sector.

IDTechEx’s review predicts that several factors playing against the lithium-ion industry could open opportunities for battery chemistries, and energy storage technologies, that utilize lower cost, more widely available materials and that can also offer additional safety and environmental benefits.

The analyst’s data show that the second half of the 2020s could see lithium, cobalt, and nickel supply disruptions and bottlenecks, while the sector will also have to deal with the ongoing questioning of the safety and environmental credentials of materials throughout the Li-ion supply chain.

“Li-ion will continue to dominate the energy storage space in the short term. For battery electric vehicles, this will continue to be the case even in the long-term as there are few realistic alternatives beyond related chemistries based on silicon and lithium-metal anodes or solid-electrolytes,” the report reads.

But for stationary storage, IDTechEx predicts alternatives to Li-ion are set to play an increasingly important role due to their potential for improving cost and safety, easing material supply burdens, and the often less demanding requirements on energy density in the stationary sector.

No comments:

Post a Comment