CHARTS: Mining stocks gain on tech but remain an afterthought for investors

Frik Els | January 13, 2023 |

Scoop up some mining stocks. Stock image

MINING.COM tracks the world’s top 50 biggest mining companies by market value, and at the end of 2022 the ranking had a combined value of $1.39 trillion.

It’s just a shade below the companies’ combined market cap at the end of 2021. That compares to a 9% drop in the Dow Jones Industrial Average and a nearly 20% decline in the S&P500 over the course of the year.

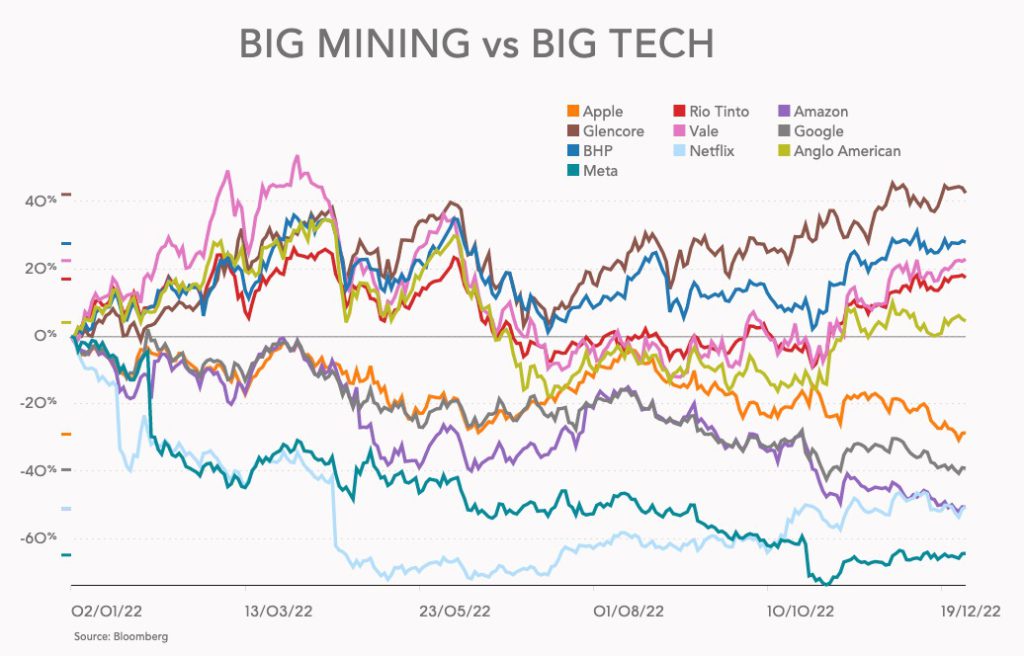

The year started with a big bang and measured from individual stocks’ 52-week highs – almost all hit in March/April – the top 50 has shrunk by more than $1 trillion. It’s a precipitous decline, but compared to other sectors, notably big tech, much of those losses were recouped by the end of the year.

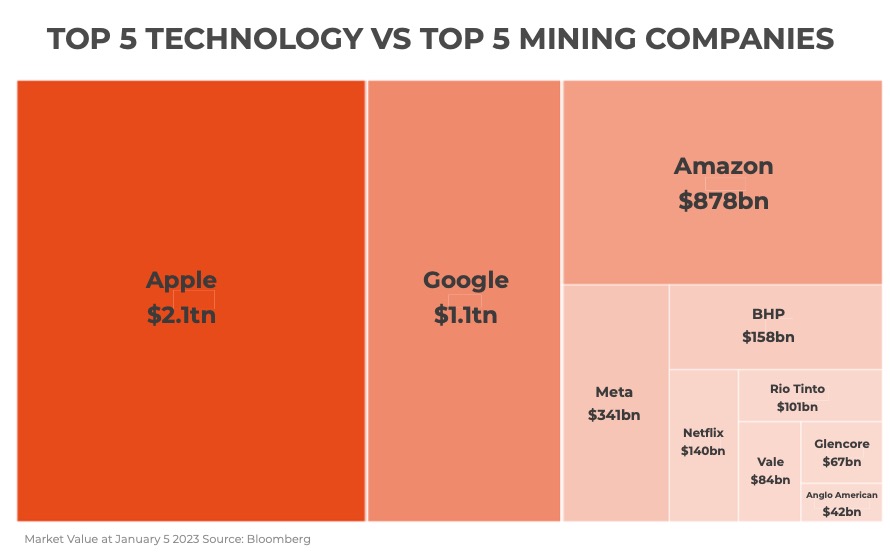

The top 5 most valuable tech firms were worth a collective $4.55 trillion at the start of 2023, down an astonishing $2.9 trillion over the past year. That compares to the combined value of $454 billion for mining’s top tier.

But it’s hard to ignore the fact that at Apple’s market capitalisation alone – even after shedding nearly $750 billion in 2022 — you can buy the world’s 50 most valuable mining companies, the next 50, and have enough left over to snap up three years of global copper mine production and buy 2022’s seaborne iron ore — all of it.

While critical minerals and metals (aren’t they all?) are now a geopolitical talking point and developed economies have finally woken up to the fact that they’ve largely been cut out of global hard commodity supply chains, it is clear from the relative valuations of virtual vs real assets that a massive disconnect still exists.

All the way back in 2019, Bernstein’s Paul Gait wrote a paper following the New York money managers’ conference on decarbonisation and the vast volumes of metals and minerals and massive investment in new projects needed to achieve the world’s climate goals.

Gait had this to say about the affordability of meeting those targets and the relative valuation of the big tech stocks and the mining industry:

“It is, however, important to remember that when we highlight the impact of decarbonisation on copper prices there is absolutely no sense in which this can be taken to imply that we ‘cannot afford’ to deliver a “green economy” (and the resulting transformation of industrial and economic processes).

“The market capitalisation of such entities as Facebook or Netflix imply that there is more than enough money, more than enough capital to deliver whatever economic transformation is required. The fact that our revealed preference (amusing cat videos) is at variance with our stated preference (a sustainable economic future for our children) should not be erroneously taken to infer that there is some financial constraint on the ends we choose to pursue.”

No comments:

Post a Comment