Shell looks to sell off its stake in controversial Cambo oilfield

Jillian Ambrose Energy correspondent

Fri, 5 May 2023

Photograph: Andy Buchanan/AFP/Getty Images

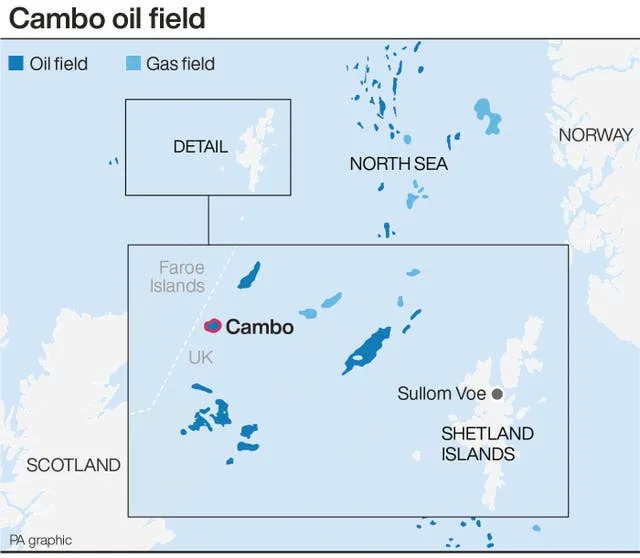

Shell is hoping to find a buyer for its stake in a controversial oilfield off the Shetland islands that became a key focus for the UK’s anti-fossil fuel campaigners.

The oil company still holds a 30% stake in the Cambo oilfield more than a year after it cast the project’s future in doubt by pulling the plug on its investment, blaming a weak economic case and the risk of delay.

The plans to develop Cambo, which is the second-largest undeveloped oil and gas discovery in the North Sea, ignited fierce protest from climate campaigners and the threat of a legal challenge if ministers allowed new drilling to go ahead.

Simon Roddy, who leads Shell’s upstream business in the UK, said it had reviewed the project and struck a deal with Cambo’s majority owner, Ithaca Energy, to sell off its stake.

“We wish Ithaca Energy well in the future development of the field, which will be important to maintain the UK’s energy security and to sustaining domestic production of the fuels that people and businesses need,” Roddy said.

Shell wants to sell off the full 30% stake to a new buyer, with the option of selling on a smaller stake and the balance of its working interest sold to Ithaca Energy. If Shell finds a buyer who wants more than 30%, then Ithaca could add a further 19.99% of its own interest to create a working interest of almost 50%.

Alan Bruce, the Ithaca CEO, said the Shell agreement was a meaningful step towards developing the Cambo field, which could be “a key asset in helping maintain the UK’s future energy security”.

Shell announced in late 2021 it would pull out of any future investment in Cambo in what many climate campaigners had believed would deal a “deathblow” to the project.

The oilfield’s prospects were revived last year when Ithaca Energy became the majority owner after paying about $1.5bn (£1.2bn) to buy private-equity backed Siccar Point Energy, the operator of the field.

The company will now need to persuade the government to give Cambo the green light despite a growing backlash against fossil fuel developments. It is also pushing the government to reform its North Sea windfall tax, which had created “fiscal instability” that threatens its ability to invest, Bruce said.

Cambo could produce about 170m barrels of oil equivalent during its 25-year operational life at half the carbon intensity of the average barrel of North Sea oil, according to Ithaca. It has also promised there would be no gas flaring at Cambo, and that its rigs would be powered by electricity, rather than gas or diesel.

Jillian Ambrose Energy correspondent

Fri, 5 May 2023

Photograph: Andy Buchanan/AFP/Getty Images

Shell is hoping to find a buyer for its stake in a controversial oilfield off the Shetland islands that became a key focus for the UK’s anti-fossil fuel campaigners.

The oil company still holds a 30% stake in the Cambo oilfield more than a year after it cast the project’s future in doubt by pulling the plug on its investment, blaming a weak economic case and the risk of delay.

The plans to develop Cambo, which is the second-largest undeveloped oil and gas discovery in the North Sea, ignited fierce protest from climate campaigners and the threat of a legal challenge if ministers allowed new drilling to go ahead.

Related: Does the UK really need to drill for more North Sea oil and gas?

Simon Roddy, who leads Shell’s upstream business in the UK, said it had reviewed the project and struck a deal with Cambo’s majority owner, Ithaca Energy, to sell off its stake.

“We wish Ithaca Energy well in the future development of the field, which will be important to maintain the UK’s energy security and to sustaining domestic production of the fuels that people and businesses need,” Roddy said.

Shell wants to sell off the full 30% stake to a new buyer, with the option of selling on a smaller stake and the balance of its working interest sold to Ithaca Energy. If Shell finds a buyer who wants more than 30%, then Ithaca could add a further 19.99% of its own interest to create a working interest of almost 50%.

Alan Bruce, the Ithaca CEO, said the Shell agreement was a meaningful step towards developing the Cambo field, which could be “a key asset in helping maintain the UK’s future energy security”.

Shell announced in late 2021 it would pull out of any future investment in Cambo in what many climate campaigners had believed would deal a “deathblow” to the project.

The oilfield’s prospects were revived last year when Ithaca Energy became the majority owner after paying about $1.5bn (£1.2bn) to buy private-equity backed Siccar Point Energy, the operator of the field.

The company will now need to persuade the government to give Cambo the green light despite a growing backlash against fossil fuel developments. It is also pushing the government to reform its North Sea windfall tax, which had created “fiscal instability” that threatens its ability to invest, Bruce said.

Cambo could produce about 170m barrels of oil equivalent during its 25-year operational life at half the carbon intensity of the average barrel of North Sea oil, according to Ithaca. It has also promised there would be no gas flaring at Cambo, and that its rigs would be powered by electricity, rather than gas or diesel.

August Graham, PA Business Reporter

Fri, 5 May 2023

Shell is looking to sell its stake in the controversial Cambo oil field, its partner Ithaca Energy has said.

The oil major is looking for a buyer for its 30% holding in the project, which is the second-largest undeveloped oil and gas discovery in the UK’s North Sea.

Cambo has been the focal point of many protests, and Shell has been rumoured for months to be looking for someone to take over its part.

(PA Graphics)

In 2021 Shell scrapped its development plans for the project, putting its future into doubt. In August last year Reuters reported that it had hired bankers to sell the stake.

The remaining 70% of the oil field is owned by Ithaca Energy.

Ithaca said that the two companies had agreed on several possible outcomes. Shell might sell all of its stake, but if it only manages to find a buyer for a portion of the stake, it can offload its remaining share to Ithaca.

If a buyer wants to purchase more than Shell’s 30% stake then Ithaca will sell up to 19.99% of its holding in the project, it said.

“Following an internal review, we have decided to sell our 30% working interest in Cambo and have agreed a process with Ithaca Energy for the sale of Shell’s stake in the field this year,” said Shell’s senior vice president of UK Upstream, Simon Roddy.

“We wish Ithaca Energy well in the future development of the field, which will be important to maintain the UK’s energy security and to sustaining domestic production of the fuels that people and businesses need.”

Ithaca chief executive Alan Bruce said: “Our agreement with Shell represents a meaningful step towards the development of Cambo, the second-largest undeveloped field in the UK continental shelf and a key asset in helping maintain the UK’s future energy security.”

He added: “Ithaca Energy remains committed to investing in the UK North Sea, however, the impact of the amended Energy Profit Levy and the fiscal instability it has created continues to constrain our ability to invest.

“We are actively engaging, in a constructive manner, with the UK Government in pursuit of the fiscal stability required to make critical investment decisions that will support the UK’s long-term energy security.”

No comments:

Post a Comment