Support may be eroding for Trudeau’s high immigration targets

Buildings under construction in Montreal on May 31, 2023.

By Randy Thanthong-Knight

August 8, 2023

Most Canadians view Prime Minister Justin Trudeau’s plan to raise immigration targets as adversely affecting the cost of housing, signaling a shift in public attitudes in the typically newcomer-friendly country.

Polling by Nanos Research Group for Bloomberg News shows about two out of three respondents believe increasing the annual target for permanent residents to half a million by 2025 will have a negative impact on the cost of housing. Only one in five believe it will have a positive impact.

The survey suggests Canadians’ opinions are changing at a time when Trudeau’s government is being criticized for exacerbating housing shortages by boosting the number of immigrants. Concerns about inflation and the rising cost of housing have been increasing over the last year, said Nik Nanos, chief data scientist and founder of Nanos Research Group.

“Although Canadians traditionally support immigration, increasing the number of new Canadians while there is stress on the housing market has dampened enthusiasm,” he said.

Five months ago, another poll showed 52% of participants said the government’s immigration push would have a positive impact on the economy. These views were likely connected to jobs and the unemployment rate, Nanos said.

“The research puts a spotlight on the housing pain point and the collision of increasing the number of new Canadians when housing is seen as being increasingly unaffordable.”

Immigration Increase Seen Worsening Housing Costs

Two in three Canadians say the surge has an adverse affect on housing

Sources: Nanos Research Group, Bloomberg

Question: The Government of Canada is planning to increase the annual target of immigrants as permanent residents from 465,000 in 2023 to 500,000 by 2025. Do you think this increase will have a positive, somewhat positive, somewhat negative, negative or no impact on the cost of housing?

While advanced economies globally are confronting similar challenges from decreasing birth rates and aging workforces, wider support among Canadians for immigration had for years given Trudeau leeway to steadily boost permanent resident targets to stave off long-term economic decline.

Under the current plan, the government aims to welcome 465,000 permanent residents in 2023, up from a record 431,000 last year. By 2025, the annual target will reach 500,000, with foreign students, temporary workers and refugees making up another group that’s expected to be even larger.

A worsening imbalance between housing supply and demand, combined with rising cost of living and higher interest rates, has already priced out many Canadian residents, including younger generations and recent immigrants. It has also prompted calls from economists for the government to revise its immigration policy.

But the government is so far sticking with its current plan. Last week in an interview with Bloomberg News, Immigration Minister Marc Miller said he would either keep or raise the annual targets because of the diminishing number of working-age people relative to the number of retirees and the risk it poses to public service funding.

The latest Nanos survey of 1,081 people was conducted by phone and online between July 30 and Aug. 3. It’s considered accurate within 3 percentage points, 19 times out of 20.

New condo prices in Toronto drop for the first time in a decade: Urbanation

, BNN Bloomberg

The price of a new condominium in the Greater Toronto Area (GTA) has fallen for the first time in a decade, according to a report from Ubranation Inc.

The average price of a new condo in the region fell 2.2 per cent year-over-year to $1,411 per square foot, the figures revealed. This marks the first annual price drop in 10 years for new condos, the report said.

There were also fewer buyers interested in purchasing a new condo, it revealed.

New condo sales in the GTA fell 35 per cent on an annual basis to 4,610 units sold, and reached a decade low of 28 per cent below the average second-quarter figures, the report detailed.

On a quarterly basis, new condo sales did jump 118 per cent, however, the data revealed sales for the first half of this year were down 59 per cent compared to the first half of 2022.

As for bringing more housing supply online, developers launched 27 presale projects in the second quarter of 2023 with a total of 7,349 units, however this marked a 27 per cent decline from the same period last year, the report revealed. While there were fewer presale units constructed in Q2 of 2023, the figures were in line with the 10-year average of 7,276 units, the data showed.

The softness is being attributed to buyers being hesitant to enter the market following of the Bank of Canada’s latest round of rate increases.

Buyers showed the most interest in the GTA, where lower priced projects in the 905 region reached a record high portion of sales at 60 per cent, while new condo sales in the city of Toronto hit a record low of 14 per cent, the report said.

“As the population expands at a record pace, the GTA’s 12-month running total for new condo sales has dropped to its lowest level since 2009,” Shuan Hildebrand, president of Urbanation, said in a press release.

Demand for lower priced projects is being reflected in the average sold price of new launches, which fell to a seven-quarter low at $1,236 per-square-foot, according to the data. That figure is down eight per cent annually and 13 per cent lower than the average of $1,426 per-square-foot of projects launched in the first quarter of last year.

Despite the price drop, condo sales remain under pressure, the report said.

"This will soon begin to impact construction and eventually cause serious supply shortages in a few years, the extent of which will depend on how long the current slowdown in presale activity persists,” he said.Canada sticks with immigration target despite housing crunch

, Bloomberg News

Prime Minister Justin Trudeau’s government won’t lower its immigration targets despite growing criticism that drastic population growth worsens existing housing shortages.

In one of his first interviews a week into his new cabinet role, Immigration Minister Marc Miller said the government will have to either keep — or raise — its annual targets for permanent residents of about half a million. That’s because of the diminishing number of working-age people relative to the number of retirees and the risk it poses to public service funding, he said.

“I don’t see a world in which we lower it, the need is too great,” said Miller, who’s expected to announce new targets on Nov. 1. “Whether we revise them upwards or not is something that I have to look at. But certainly I don’t think we’re in any position of wanting to lower them by any stretch of the imagination.”

Globally, advanced economies are confronting similar challenges from decreasing birth rates and aging workforces, and many are competing for skilled workers. But while immigration for some countries is a divisive issue that can polarize voters and even topple a government, Canada has comfortably relied on public support to open its doors more widely for working-age newcomers.

Miller’s comments suggest the government is still counting on that backing to grow its population rapidly to stave off long-term economic decline. Trudeau’s government has consistently raised its target for permanent residents. Last year, foreign students, temporary workers and refugees made up another group that’s even larger, bringing total arrivals to a record one million.

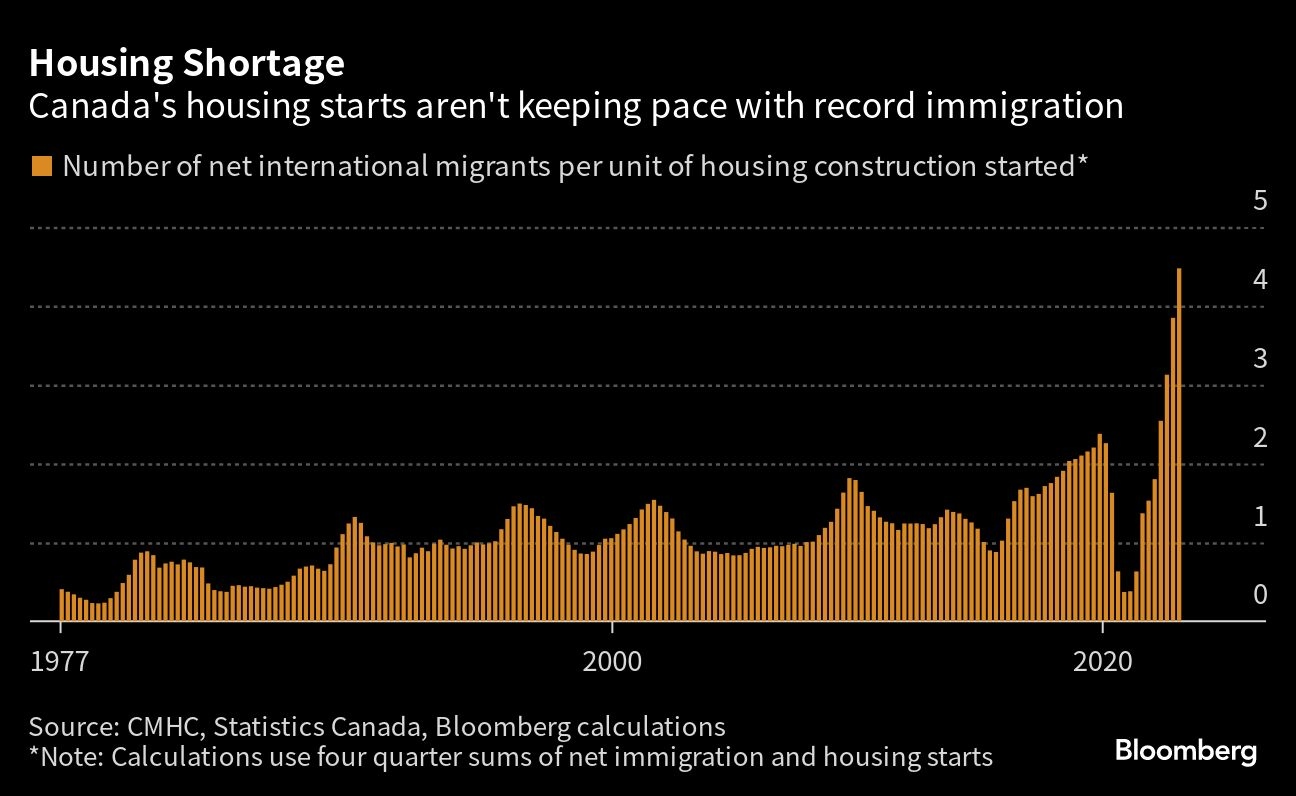

In the short term, however, that massive growth has strained major urban centers and exacerbated housing shortages. In the 12 months to March, 4 to 5 international migrants arrived in Canada for every newly started unit of housing construction. That’s the highest ratio of new Canadians to new homes on record in data going back to 1977.

Many Canadians now criticize the government for not only doing too little to boost supply, but also making it worse by adding too much demand from immigration. But Miller pushed back against that view.

“We have to get away from this notion that immigrants are the major cause of housing pressures and the increase in home prices,” he said. “We tend not to think in longer historical arcs or in generational terms, but if people want dental care, health care and affordable housing that they expect, the best way to do that is to get that skilled labor in this country.”

On Wednesday, National Bank Financial’s Chief Economist Stefane Marion called on the government to revise its immigration policy until housing construction catches up with demand. Marion said the government’s decision to open the “immigration floodgates” led to a “record imbalance” between housing supply and demand, and homebuilders can’t keep up with the influx.

A recent survey by Ottawa-based Abacus Data showed 61 per cent of respondents believed Canada’s immigration target is too high, and 63 per cent of them said the number of immigrants coming to the country was having a negative impact on housing.

“What’s driving this is really rational concerns, not xenophobia,” said David Coletto, Abacus Data’s chief executive officer. “From many people’s perspective, the growth that Canada experienced hasn’t been matched with an increase in infrastructure. It’s putting a strain on public opinion toward immigration more broadly. We’d be foolish to assume that Canada’s immune to the same forces that have affected other countries.”

In another survey published in July, 39 per cent of respondents said they would be more likely to vote for a political party that promised to reduce immigration numbers. That compared with 24 per cent who said they’d be less likely to do so and 30 per cent who said it’d have no impact. This suggests there may be an appetite for campaigning on reducing immigration, according to Coletto.

Last week in an extensive cabinet shuffle, Trudeau shored up his economic bench and laid some groundwork for future elections as his government faces attacks over the rising cost of living. Sean Fraser was moved from immigration to housing and infrastructure. Miller — who as Crown-Indigenous relations minister quieted some the loudest criticisms of Trudeau on reconciliation — took the reins at immigration.

“Politicians look in electoral cycles. But in my role, we have to look in generational cycles,” Miller said. “Canada needs to address that in a smart way, and that means attracting a younger segment of the population to make sure that people can retire with same expectations and benefits that their parents had. That’s the stark reality of it.”

- With assistance from Erik Hertzberg.

Soaring housing costs could spell 'disastrous'

political consequences for Trudeau

, Bloomberg New

Trudeau has played defense on the issue this summer, appointing a new housing minister last week and shifting some of the blame to other levels of government on Monday. But with his party already sinking in recent polls, housing has become a serious vulnerability for Trudeau.

“Failure to be seen as doing enough on housing could be politically disastrous for the Liberals,” said David Coletto, chief executive officer of polling firm Abacus Data.

The issue is particularly important for Canadians under 40 years old — a critically important demographic that Trudeau’s party couldn’t have won the last two elections without, Coletto said. His firm’s most recent poll put Pierre Poilievre’s Conservatives 10 points ahead of the Liberals.

The benchmark price for a Canadian home has more than doubled over the past decade, reaching $760,600 (US$572,470) in June. Trudeau’s government, which took power in 2015, has also steadily raised its annual immigration targets, with more than one million people arriving last year, straining an already tight housing supply.

Poilievre has hammered Trudeau on the issue, focusing on the anger of younger generations. Canada’s housing affordability is among the worst in the world, he told reporters Tuesday outside the Parliament building in Ottawa.

“Rent has doubled,” he said. “Mortgage payments, doubled. Needed down payments, doubled. All after eight years of Justin Trudeau.”

To be sure, skyrocketing housing costs have many causes beyond Trudeau’s control. Provinces and cities — responsible for land-use planning, zoning and permitting — bear some of the blame, as do real estate investors, foreign buyers, years of rock-bottom interest rates and other factors.

Still, Canada’s ambitious immigration targets have outpaced home building, aggravating the imbalance between demand and supply. In the 12 months to March, 4 to 5 international migrants arrived in Canada for every newly started unit of housing construction. That’s the highest ratio of new Canadians to new homes on record in data going back to 1977.

Poilievre, however, repeatedly sidestepped reporters’ questions on Tuesday about whether he would reduce immigration targets.

Former Liberal lawmaker Adam Vaughan, who helped craft Trudeau’s $82 billion national housing strategy released in 2017, argued the country is better off today than it would have been without his party’s policies. If it had done nothing, federal spending for social housing this year would have been just $1 billion, he said.

However, more needs to be done, and time would be better spent focusing on solutions across levels of government than laying blame, he said. Trudeau’s comment on Monday that housing isn’t a primary federal responsibility was “problematic,” Vaughan said.

“It is a responsibility of the federal government, if not literally then it is politically, and I would argue that it is morally,” said Vaughan, who now works at public relations firm Navigator.

The federal government has a range of tools it could use to address the housing shortage without swelling its debt, said Mike Moffatt, senior policy and innovation director at the Smart Prosperity Institute.

Those measures include targeting immigration policy toward construction workers, electricians and others who could boost housing supply and slowing down international student visa approvals until provinces require universities to build more housing for them.

If the government is going to act, “they better do so quickly because time’s not on their side, and there’s a chance that one of the opposition parties could really start to own this issue,” Moffatt said.

Marci Surkes, who formerly worked as Trudeau’s policy director, said she suspects the government is working on a housing plan as a central plank of its fall budget update.

“This should be ground that the Liberal Party should be occupying and owning,” said Surkes, who now works as an adviser to the Compass Rose Group. “They should have been making progress that was feeling more tangible at this point. And yet the circumstances being what they are economically, whatever progress has been made to date certainly doesn’t feel like enough.”

New Democratic Party Leader Jagmeet Singh, whose party has agreed to prop up the Liberal minority government in Parliament, said on Tuesday that Trudeau’s “finger-pointing” isn’t going to solve the housing issue, even though all orders of government hold some responsibility.

“We can’t ignore significant levers that the federal government has,” he said. “The levers are so significant that I would say the federal government has incredible powers to actually solve this problem if they choose to do so.”

New housing minister says closing door on newcomers is no solution to housing crunch

, The Canadian Press

Canada's new housing and infrastructure minister says closing the door to newcomers is not the solution to the country's housing woes, and has instead endorsed building more homes to accommodate higher immigration flows.

Sean Fraser, who previously served as immigration minister, was sworn in Wednesday morning as part of a Liberal government cabinet shuffle aimed at showcasing a fresh team ahead of the next federal election.

He comes into the role at a time when strong population growth through immigration is adding pressure to housing demand at a time when the country is struggling with an affordability crisis.

"The answer is, at least in part, to continue to build more stock," Fraser told reporters after being sworn in.

"But I would urge caution to anyone who believes the answer to our housing challenges is to close the door on newcomers."

Instead, the minister said immigration would be part of the solution to the housing challenge.

"When I talked to developers, in my capacity as a minister of immigration before today, one of the chief obstacles to completing the projects that they want to get done is having access to the labour force to build the houses that they need," he said.

Prime Minister Justin Trudeau's decision to hand over the federal housing file to the Nova Scotia MP has been praised by experts who say that the Liberals need a strong communicator in charge as Canadians deal with an affordability crunch.

As part of the shakeup, the housing file has been merged with infrastructure and communities. Fraser said the goal is to look at housing and infrastructure projects together, rather than in isolation.

"If we encourage cities and communities to build more housing where infrastructure already exists or where it's planned to be, we're going to be able to leverage more progress for every public dollar that's invested," he said.

Ahmed Hussen, who became housing minister in 2021, has faced criticism for his handling of the file as the housing crisis worsened across the country.

Hussen is staying in cabinet as minister of international development.

"The selection of Sean, I think, is a recognition that the job requires fundamentally an energy and urgency and a passion in order to be able to effectively compete with the message that (Conservative Leader) Pierre Poilievre has put forward," said Tyler Meredith, a former head of economic strategy and planning for Trudeau’s government.

Meredith said the choice to shift Fraser from immigration to housing also signals the federal government knows the two files are linked.

"If they lose the argument on housing, they will lose the argument on immigration, and they will then lose what is frankly, some of the some of the most effective pieces of their economic strategy," Meredith said.

Canada's population grew by more than one million people in 2022, a pace that experts say is adding pressure to housing demand. That, in turn, pushes up prices even further.

A recent analysis by BMO found that for every one per cent of population growth, housing prices typically increase by three per cent.

The Liberals have been taking a lot of heat from Poilievre for the state of the housing market. He's blamed Trudeau's government for the crisis, as well as municipal "gatekeepers" for standing in the way of new developments.

Poilievre has focused on the need to build more housing and has not weighed in on whether Canada needs to change the number of people it lets into the country.

The Conservative leader has also been particularly focused on speaking to young people struggling with affordability, commonly referring to the "35-year-olds still living in their parents' basements" in the House of Commons.

Fraser, 39, acknowledged during the news conference that housing affordability is a major challenge facing younger Canadians in particular.

"It's a real challenge for people my age and younger who are trying to get into the market, but it's also a challenge for low-income families," Fraser said.

"There's no simple solutions, but if we continue to advance measures that help build more stock, that help make sure it's easier for people to get into the market and make sure we're offering protections for low-income families, particularly in vulnerable renting situations, we're going to be able to make a meaningful difference."

The housing crisis that once was associated with Vancouver and Toronto is now affecting all corners of the country, and experts say a shortage of homes is at its root.

The Canada Mortgage Housing Corporation has warned the country needs to build 3.5 million additional homes — on top of the current pace of building — to restore affordability by 2030.

Carolyn Whitzman, a housing policy expert and adjunct professor at the University of Ottawa, said the decision to combine housing and infrastructure is a good move.

"Housing is infrastructure. It's essential, as essential as water and sewers and hospitals and schools, for the functioning of a society," she said.

Whitzman also called Fraser a "fairly effective communicator" and noted his experience as immigration minister may also help inform his role in the housing file.

Canadian population growth to drive home prices higher and faster: Report

, BNN Bloomberg

The expected rise in Canada’s population is likely to make the country’s limited housing supply worse – and ultimately lead to even higher home prices, a report by Zoocasa forecasted.

The influx of immigration to Canada, alongside internal population growth and a shortage of housing, will drive shelter costs up, the report released on Wednesday said.

“The more people who live in Canada, the more homes are needed, which will exacerbate the already limited supply of homes," it stated.

The data showed that 2022 was a record-breaking year for the country’s housing market and immigration numbers.

“The government welcomed the largest number of immigrants in a single year (2022), according to Immigration, Refugees and Citizenship Canada, and at the same time, the national average home price soared to a monthly high of $804,900 – a 31 per cent increase from 2021,” it said.

So far, 2023 has not shown a similar trend.

One possible reason for this could be the aggressive interest rate hikes the Bank of Canada has pursued, the report said. The average home price dropped in 2023 by 5.5 per cent from the year prior, despite immigration reaching a new record of 3.9 per cent growth, it detailed.

The decline is likely to only be temporary, it said.

The report pointed to home price declines throughout the 2008-2009 financial crisis as a point of reference.

“The largest drop in the national average home price in the past 18 years was in 2009, when the price went from $320,500 in January 2008 to $296,300 in January 2009 – a 7.6 per cent decline due to the Great Recession which began in Canada in 2008. It only took a year for prices to recover and from 2010 until 2018 prices continuously climbed,” the data showed.

While overall population growth aids economic activity, the problem of where to house more people still remains.

“Population growth helps to stimulate the economy by filling labour shortages, but a side-effect of this growth is that home prices will likely be driven up higher,” the report said.

The report identified major metropolitan areas throughout Canada, such as Toronto or Vancouver, as key regions where home prices will be pushed upward due to the growth.

“Home price growth and population growth have simultaneously trended upwards and this is likely to continue at an even faster rate in the future,” it forecasted.

, BNN Bloomberg

The expected rise in Canada’s population is likely to make the country’s limited housing supply worse – and ultimately lead to even higher home prices, a report by Zoocasa forecasted.

The influx of immigration to Canada, alongside internal population growth and a shortage of housing, will drive shelter costs up, the report released on Wednesday said.

“The more people who live in Canada, the more homes are needed, which will exacerbate the already limited supply of homes," it stated.

The data showed that 2022 was a record-breaking year for the country’s housing market and immigration numbers.

“The government welcomed the largest number of immigrants in a single year (2022), according to Immigration, Refugees and Citizenship Canada, and at the same time, the national average home price soared to a monthly high of $804,900 – a 31 per cent increase from 2021,” it said.

So far, 2023 has not shown a similar trend.

One possible reason for this could be the aggressive interest rate hikes the Bank of Canada has pursued, the report said. The average home price dropped in 2023 by 5.5 per cent from the year prior, despite immigration reaching a new record of 3.9 per cent growth, it detailed.

The decline is likely to only be temporary, it said.

The report pointed to home price declines throughout the 2008-2009 financial crisis as a point of reference.

“The largest drop in the national average home price in the past 18 years was in 2009, when the price went from $320,500 in January 2008 to $296,300 in January 2009 – a 7.6 per cent decline due to the Great Recession which began in Canada in 2008. It only took a year for prices to recover and from 2010 until 2018 prices continuously climbed,” the data showed.

While overall population growth aids economic activity, the problem of where to house more people still remains.

“Population growth helps to stimulate the economy by filling labour shortages, but a side-effect of this growth is that home prices will likely be driven up higher,” the report said.

The report identified major metropolitan areas throughout Canada, such as Toronto or Vancouver, as key regions where home prices will be pushed upward due to the growth.

“Home price growth and population growth have simultaneously trended upwards and this is likely to continue at an even faster rate in the future,” it forecasted.

Justin Trudeau is shifting some of the blame

for eye-popping housing costs in Canada

, Bloomberg News

Canadian Prime Minister Justin Trudeau heaped some of the blame for skyrocketing housing costs on high interest rates and inaction by other levels of government, signaling a more defensive tone on an issue where his main political rival has hit him hard.

Trudeau touted a federal investment in a housing project in Hamilton, Ontario, on Monday, telling reporters that his government is focused on making housing affordable and bolstering the supply of homes for lower and middle-income Canadians.

But he repeatedly pointed to provinces and municipalities — which control land-use planning, zoning and permitting — as crucial in solving the issue. He also said the previous Conservative government — in which now-leader Pierre Poilievre was a cabinet minister — failed to address the issue for 10 years.

“I’ll be blunt: Housing isn’t a primary federal responsibility,” Trudeau said. “It’s not something that we have direct carriage of, but it is something that we can and must help with.”

The rhetoric is a shift for Trudeau, whose government jumped into the housing arena when it was first elected in 2015. He has since rolled out an $82 billion (US$62 billion) national housing strategy and made sweeping promises, including doubling the pace of housing starts over the next decade.

\But his efforts haven’t made a meaningful dent in housing costs, with the benchmark house price reaching $749,100 (US$567,930) in June, up 2 per cent from a month earlier. At the same time, he has set record-high immigration targets, welcoming more than a million people last year and straining already crunched housing supply.

The remarks show the government “is giving up on solving the housing crisis it created,” said John Pasalis, president of Toronto-based real estate brokerage company Realosophy Realty.

“Our federal government is supercharging the demand for housing by rapidly increasing Canada’s population growth rate without any regard for where people will live and is now blaming the provinces and cities for not doing the impossible – tripling the number of homes they build each year,” Pasalis said.

Poilievre has seized upon anger about the cost of housing, especially among young Canadians, and recent polls have put his Conservatives as much as 10 points ahead of Trudeau’s Liberals. An election could be held any time in the next two years.

Trudeau recently shuffled his cabinet to more strongly emphasize economic issues, especially housing. He selected Sean Fraser as housing and infrastructure minister to deliver the message that it understands Canadians’ struggles on housing and is doing everything it can to help.

Trudeau also said on Monday that he hopes inflation continues to fall so that interest rates will also decline, which would ease mortgage costs for Canadians.

Asked about workers demanding higher wages amid high inflation, most recently in the strike at British Columbia ports, Trudeau said he wants to avoid a wage-price spiral.

“We want to keep inflation down so we can have interest rates start coming down again to help people be able to afford their own homes,” he said.

The Bank of Canada raised rates for a second straight meeting on July 12 to 5 per cent, the highest level in 22 years. Headline inflation has come down to 2.8 per cent in Canada, but mortgage interest costs are up 30 per cent from last June. Without mortgage costs, inflation would have been at 2 per cent.

Trudeau said during the 2021 campaign that he doesn’t “think about monetary policy,” underscoring his deference to Bank of Canada Governor Tiff Macklem and his policymakers. While the prime minister’s comments on Monday didn’t criticize the central bank, they did mark a shift in that he publicly expressed a desire to see lower rates.

Fraser also seems to be pointing to interest rates as a source of the affordability challenge in Canada. In an interview with the Canadian Broadcasting Corp., he said inflation – primarily caused by global factors – has triggered higher rates that have pushed some families with variable-rate mortgages to the limit.

, Bloomberg News

Canadian Prime Minister Justin Trudeau heaped some of the blame for skyrocketing housing costs on high interest rates and inaction by other levels of government, signaling a more defensive tone on an issue where his main political rival has hit him hard.

Trudeau touted a federal investment in a housing project in Hamilton, Ontario, on Monday, telling reporters that his government is focused on making housing affordable and bolstering the supply of homes for lower and middle-income Canadians.

But he repeatedly pointed to provinces and municipalities — which control land-use planning, zoning and permitting — as crucial in solving the issue. He also said the previous Conservative government — in which now-leader Pierre Poilievre was a cabinet minister — failed to address the issue for 10 years.

“I’ll be blunt: Housing isn’t a primary federal responsibility,” Trudeau said. “It’s not something that we have direct carriage of, but it is something that we can and must help with.”

The rhetoric is a shift for Trudeau, whose government jumped into the housing arena when it was first elected in 2015. He has since rolled out an $82 billion (US$62 billion) national housing strategy and made sweeping promises, including doubling the pace of housing starts over the next decade.

But his efforts haven’t made a meaningful dent in housing costs, with the benchmark house price reaching $749,100 (US$567,930) in June, up 2 per cent from a month earlier. At the same time, he has set record-high immigration targets, welcoming more than a million people last year and straining already crunched housing supply.

The remarks show the government “is giving up on solving the housing crisis it created,” said John Pasalis, president of Toronto-based real estate brokerage company Realosophy Realty.

“Our federal government is supercharging the demand for housing by rapidly increasing Canada’s population growth rate without any regard for where people will live and is now blaming the provinces and cities for not doing the impossible – tripling the number of homes they build each year,” Pasalis said.

Poilievre has seized upon anger about the cost of housing, especially among young Canadians, and recent polls have put his Conservatives as much as 10 points ahead of Trudeau’s Liberals. An election could be held any time in the next two years.

Trudeau recently shuffled his cabinet to more strongly emphasize economic issues, especially housing. He selected Sean Fraser as housing and infrastructure minister to deliver the message that it understands Canadians’ struggles on housing and is doing everything it can to help.

Trudeau also said on Monday that he hopes inflation continues to fall so that interest rates will also decline, which would ease mortgage costs for Canadians.

Asked about workers demanding higher wages amid high inflation, most recently in the strike at British Columbia ports, Trudeau said he wants to avoid a wage-price spiral.

“We want to keep inflation down so we can have interest rates start coming down again to help people be able to afford their own homes,” he said.

The Bank of Canada raised rates for a second straight meeting on July 12 to 5 per cent, the highest level in 22 years. Headline inflation has come down to 2.8 per cent in Canada, but mortgage interest costs are up 30 per cent from last June. Without mortgage costs, inflation would have been at 2 per cent.

Trudeau said during the 2021 campaign that he doesn’t “think about monetary policy,” underscoring his deference to Bank of Canada Governor Tiff Macklem and his policymakers. While the prime minister’s comments on Monday didn’t criticize the central bank, they did mark a shift in that he publicly expressed a desire to see lower rates.

Fraser also seems to be pointing to interest rates as a source of the affordability challenge in Canada. In an interview with the Canadian Broadcasting Corp., he said inflation – primarily caused by global factors – has triggered higher rates that have pushed some families with variable-rate mortgages to the limit.

'Skyrocketing population growth' drove economic expansion across Canada: Report

, BNN Bloomberg

Last time population growth was this strong was before Maple Leafs last won Stanley cup (1967)

Desjardins 7:40

A new report from Desjardins economists says population gains have supported growth in each Canadian province this year – while warning that a downturn still could occur in 2024.

Desjardins released its report on provincial outlooks on Tuesday, which revised growth expectations higher in both Ontario and British Columbia after rebounds in each respective market. The economists behind the report noted that oil-producing regions are expected to perform better relative to non-oil-producing provinces, including B.C. and Ontario, throughout the year and into 2024.

Marc Desormeaux, a principal economist at Desjardins and one of the authors of the report, said in an interview with BNN Bloomberg Tuesday that there are three main takeaways from the findings.

“The first is that in this environment of a slowing Canadian economy, we think that the commodity-producing provinces will fare the best in terms of economic growth,” he said. “The second thing is that we've revised our projections significantly higher for Ontario and B.C., in large part because of the strength of the housing market to begin 2023.”

Thirdly, Desormeaux said “very, very strong” population growth is “supporting economic growth across Canada.”

The report also stated that amid labour shortages, “skyrocketing population growth has supported the economic expansion in all provinces so far this year.” Despite that countrywide expansion, the authors noted that all regions should feel the impact of higher interest rates over the next few months.

“In our view, while these developments help the 2023 growth arithmetic, they delay the downturn rather than preclude it,” the report said.

“Monetary policy works with a lag, and all regions should increasingly feel the dampening impacts of sharply higher interest rates in the coming months.”

Retail sales in Ontario and B.C. have fallen behind other regions, the report’s authors said, adding that the largest real estate markets in both provinces have “retreated in June” following another interest rate hike from the Bank of Canada.

“As we approach 2024, housing‑exposed provinces should see the more significant slowdowns we’ve long been expecting,” the report said.

By contrast, Alberta and Saskatchewan “remain less vulnerable” and stand to benefit from commodity prices and increased production, the report said.

The report also noted that net international immigration trends should continue, assuming federal policy continues to focus on attracting newcomers and that immigration has benefited provincial growth across the country in 2023.

“Persistently strong population growth will play a role in stimulating demand for goods and services,” the report said.

Immigration figures will also impact growth on a provincial basis, the report said, as Ontario and B.C. are experiencing record numbers of new non-permanent residents. However, this trend could change if admissions for temporary foreign workers decline due to an economic slowdown.

, BNN Bloomberg

Last time population growth was this strong was before Maple Leafs last won Stanley cup (1967)

Desjardins 7:40

A new report from Desjardins economists says population gains have supported growth in each Canadian province this year – while warning that a downturn still could occur in 2024.

Desjardins released its report on provincial outlooks on Tuesday, which revised growth expectations higher in both Ontario and British Columbia after rebounds in each respective market. The economists behind the report noted that oil-producing regions are expected to perform better relative to non-oil-producing provinces, including B.C. and Ontario, throughout the year and into 2024.

Marc Desormeaux, a principal economist at Desjardins and one of the authors of the report, said in an interview with BNN Bloomberg Tuesday that there are three main takeaways from the findings.

“The first is that in this environment of a slowing Canadian economy, we think that the commodity-producing provinces will fare the best in terms of economic growth,” he said. “The second thing is that we've revised our projections significantly higher for Ontario and B.C., in large part because of the strength of the housing market to begin 2023.”

Thirdly, Desormeaux said “very, very strong” population growth is “supporting economic growth across Canada.”

The report also stated that amid labour shortages, “skyrocketing population growth has supported the economic expansion in all provinces so far this year.” Despite that countrywide expansion, the authors noted that all regions should feel the impact of higher interest rates over the next few months.

“In our view, while these developments help the 2023 growth arithmetic, they delay the downturn rather than preclude it,” the report said.

“Monetary policy works with a lag, and all regions should increasingly feel the dampening impacts of sharply higher interest rates in the coming months.”

Retail sales in Ontario and B.C. have fallen behind other regions, the report’s authors said, adding that the largest real estate markets in both provinces have “retreated in June” following another interest rate hike from the Bank of Canada.

“As we approach 2024, housing‑exposed provinces should see the more significant slowdowns we’ve long been expecting,” the report said.

By contrast, Alberta and Saskatchewan “remain less vulnerable” and stand to benefit from commodity prices and increased production, the report said.

The report also noted that net international immigration trends should continue, assuming federal policy continues to focus on attracting newcomers and that immigration has benefited provincial growth across the country in 2023.

“Persistently strong population growth will play a role in stimulating demand for goods and services,” the report said.

Immigration figures will also impact growth on a provincial basis, the report said, as Ontario and B.C. are experiencing record numbers of new non-permanent residents. However, this trend could change if admissions for temporary foreign workers decline due to an economic slowdown.

No comments:

Post a Comment