China Plastics Makers Risk Closures as Tariffs Hit Feedstock Imports

- Data from the U.S. Energy Information Administration shows that China takes in about half of U.S. exports of ethane.

- IndraStra: The United States has been virtually the only supplier of ethane to Chinese petrochemical makers since 2018.

- With tariffs looming large over this trade, Chinese ethane consumers may have to close shop.

Plastics manufacturers in China are facing some tough times ahead due to their dependence on imports of U.S. feedstock. These imports are already running at record highs. This year, they were expected to surge by 20%, but then Trump started his tariff offensive. And there are no suppliers of this feedstock that compare in terms of production size with the United States.

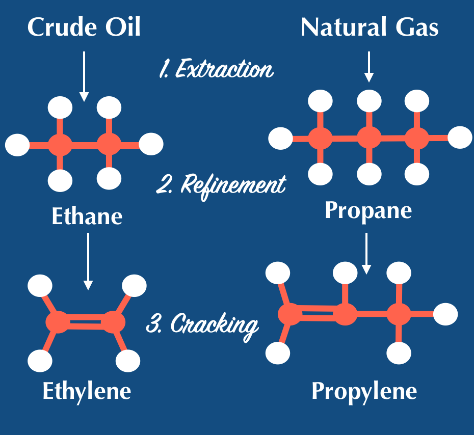

Ethane is a component of natural gas. Its production in the U.S. took off with the shale gas boom and is still booming thanks to the relentless growth in petrochemical demand on a global scale. This turned the U.S. into a major exporter to the biggest plastics maker in the world: China. Now, the flow of ethane to Chinese plastics manufacturers is set to shrink significantly as Washington and Beijing trade tariffs instead of commodities.

“The situation is dire for China’s ethane crackers as they have no alternative to US supply,” Manish Sejwal, Rystad Energy analyst, told Bloomberg this week. “Unless they are granted tariff exemptions, they may have to stop production or close shop.”

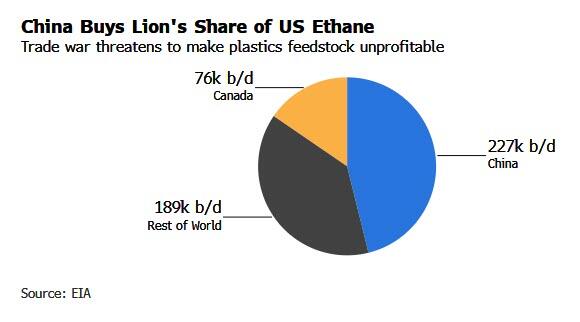

Data from the U.S. Energy Information Administration shows that China takes in about half of U.S. exports of ethane, or 248,000 barrels daily. The rest of the world, per that data, takes in 277,000 barrels daily. For U.S. gas producers, this is not a huge volume of exports—especially compared with the export of another natural gas constituent: propane. Those exports from the U.S. run at some 1.87 million barrels daily. And those ethane exports to China were set to soar.

Reuters reported back in February that Chinese plastics makers’ already substantial reliance on U.S. ethane supply, which is cheaper than alternatives thanks to the shale boom, was about to grow. The reason: slimming profits that those companies were looking to boost by cutting costs. Several Chinese petrochemical makers were investing in ethane cracker expansion, storage buildout, and the construction of ethane carriers for the increased import flows. Now, based on the latest reports, these plans are all in jeopardy, with all that investment risking ending up wasted.

Analysts forecast in February that China’s imports of ethane were set to rise by between 9% and as much as 34% this year, which would drive an overall increase in U.S. ethane exports, according to the EIA. The agency saw total U.S. ethane exports this year hitting 520,000 bpd, or 8% higher than the 2024 average daily, for a total annual 11.2 million tons. That 11.2 million tons of exports is no small potatoes for gas producers in the shale patch, especially with domestic gas prices where they are.

The United States has been virtually the only supplier of ethane to Chinese petrochemical makers since 2018, strategic analysis provider IndraStra noted in a recent report on the ethane and propane situation between the United States and China. The propane and ethane trade between the two is worth a not insignificant $18 billion annually. In fact, IndraStra says, the size of the U.S.-China liquid petroleum gas trade ranks second only to their agricultural trade.

So, with tariffs looming large over this trade, Chinese ethane consumers may have to close shop—but U.S. producers will be hit as well because there are precious few alternative destinations for this amount of gas. “The U.S. needs to be able to send its propane to China. For a large portion of it, the propane has nowhere else to go except China,” Kristen Holmqvist, analytics managing director at RBN Energy, said, as quoted by IndraStra. In other words, the situation with ethane is, while not equally bad, perhaps, certainly fraught with unpleasant potential developments for both buyers and sellers of the petrochemical feedstock if the tariffs remain in place.

By Irina Slav for Oilprice.com

Trade War Threatens to Shut Down Chinese Plastics Factories

By ZeroHedge - Apr 22, 2025

- Chinese plastics factories heavily reliant on US ethane imports are at risk of widespread shutdowns due to tariffs implemented during the US-China trade war.

- The lack of alternative ethane suppliers and existing long-term contracts make it difficult for Chinese factories to find alternative solutions, leading to financial losses.

- Economic indicators suggest a potential slowdown in China's GDP growth, further exacerbating the challenges faced by the plastics industry and the overall economy.

Previously we explained that the US-China trade war has been unique in that the US was hit fast and hard, mostly through capital markets and financial linkages, which travel instantaneously with acute consequences (the recent dump of US treasuries by China and subsequent purchases of the yuan and perhaps gold took effect in milliseconds, and prompted a cottage industry of narratives how the US dollar is losing its reserve currency status). At the same time, the impact to the Chinese economy takes a while to propagate, as supply chains take weeks if not months to normalize to a new status quo; the period is even longer when the frontrunning of tariffs meant China would overproduce in the days leading up to the outbreak of the trade war, and keep economic output artificially inflated, as demonstrated by the paradoxically strong Q1 GDP numbers out of Beijing. Yet once the slowdown hits, as it inevitably will, the consequences for China - which unlike the US has no social safety net - will be far more dire. It also means that the trade war with China will apex only once Beijing suffers max pain, at which point Xi will be far more amenable to talks with Trump. The only question is when will said max pain moment hit.

We don't know yet, although we are keeping a close eye on alternative Chinese economic indicators (one can't trust official Chinese data in normal times, and one certainly can't trust any local "data" at a time when gepolitical leverage is measured in growth basis points, even if they are completely fabricated) for the tipping point.

Until then, however, there are growing signs that the first wave of pain has already landed, and as Bloomberg reports, Chinese plastics factories that depend on a gas they mainly import from the US are contending with the prospect of widespread shutdowns as the world’s two largest economies bunker down for a prolonged trade war.

The world’s dominant plastics manufacturer gets almost all its ethane, a petrochemical feedstock that is also a component of natural gas, from the US. But eye-watering tariffs on American goods mean plants that cannot process substitute raw materials will bleed money; their only alternative is to mothball production for the near (or not so near) future.

"The situation is dire for China’s ethane crackers as they have no alternative to US supply,” said Manish Sejwal, an analyst at Rystad Energy AS, using an industry term for such facilities. "Unless they are granted tariff exemptions, they may have to stop production or close shop."

Needless to say, that would be catastrophic for China's plastics industy.

Most so-called crackers in China use naphtha as a feedstock, with processors that solely use ethane as raw material for petrochemicals making up is less than 10% of the total at about 4 million tons, according to Rystad. China is by far the biggest buyer of American supply, according to the US Energy Department.

But with 125% tariffs in place, factories would have lost $184 for every ton of US ethane they processed in the week ending April 11, according to Rystad data. That compares with more than $100 they would have made in profits if there were no tariffs.

According to Bloomberg, the extra costs are another blow for China’s plastics sector, which is already dealing with a glut as the growth in production capacity exceeds demand. The tussle is also threatening other feedstocks, including natural gas liquids and propane, and has led to sharp drops in US prices, hardly the inflationary shock so many have predicted.

Across China, domestic ethane production won’t be able to plug the gap, with the nation producing around 120,000 tons in 2024, according to industry consultancy JLC International.

Furthermore, the ethane market “is marked by long-term contracts, with little to no opportunity to resell cargoes on the spot market,” Rystad said April 10, making it tough for the Chinese to obtain alternative supplies from non-US sources.

While China has so far avoid widespread closures of production across sectors, it appears likely that the plastics industry in general, and the ethane and propane supply chains in particular, will be among those hit first and hardest. So for those seeking to time the moment of max pain, and greatest malleability of Beijing, keep an eye on Chinese plastic prices and/or labor strikes in the region.

The lower the former goes, the higher the latter will move, and the faster the trade war will come to an end. And come to an end it will, because as even Goldman forecast in its latest China forecast (available to pro subs here), the country's GDP is about to fall off a cliff: the bank now expects China's Q2 GDP growth to crater to just 0.8% QoQ from 4.9% in Q1. And that's just the start, if China is unable to unleash a stimulus similar in size to what it did during covid.

By Zerohedge.com

No comments:

Post a Comment