Extreme Heat Exposes Fragile U.S. Energy Grid

- Extreme heat in the US highlights the urgent need for clean, reliable baseload power, with nuclear energy presented as the optimal solution due to its scalability and carbon-free nature.

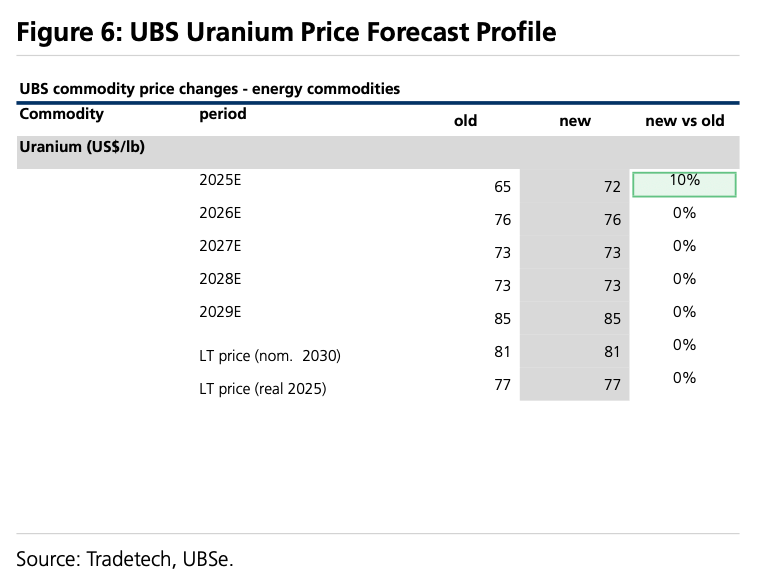

- UBS analysts have upgraded their near-term uranium price forecasts by approximately 10% to $72/lb for 2025, citing improved policy sentiment, bipartisan support, and tighter global supply.

- The article reinforces a long-term bullish stance on nuclear energy, noting potential US nuclear capacity growth to 400 GW by 2050 and highlighting specific stock views like Paladin Energy and Boss Energy.

For the third consecutive day, extreme heat across the eastern half of the U.S. has triggered power grid alerts and emergency warnings, highlighting the fragility of current energy infrastructure. Extremely tight power grids reinforce a core part of our energy thesis: the urgent need for clean, reliable baseload power, and there is no better option than nuclear.

The current environment strengthens our conviction as long-term 'atomic bulls', a stance we've maintained since our original call in December 2020 (read here). Nuclear energy remains the only scalable, carbon-free solution capable of delivering 24/7 generation for powering up America in the 2030s (more here).

On Wednesday, a team of UBS analysts, led by Dim Ariyasinghe, upgraded their near-term uranium price forecast by ~10% (to $72/lb for 2025) due to improved policy sentiment, bipartisan support, and tighter supply from global disruptions.

The analysts recently hosted a call with the Atlantic Council, noting that U.S. nuclear capacity could grow from approximately 100 GW to 400 GW by 2050—surpassing the Biden administration's current targets. News earlier this week of New York's plan to develop a 1GW plant provided additional tailwinds for the industry.

"We upgrade our near-term U prices ~10% on an improved US policy backdrop, which has buoyed broader market sentiment," Ariyasinghe penned in a note to clients.

UBS maintains a long-term price forecast of $77/lb (real 2025) and $81/lb nominal from 2030.

Uranium spot prices...

Ariyasinghe's stock views within the industry:

- Paladin Energy (PDN): Maintains a BUY rating with price target lifted 3% to A$9.40/share. Restart at the Langer Heinrich mine is ahead of schedule; FY26 production revised slightly down to 4.5Mlb due to blending lower-grade ore, but this is offset by higher prices and improved costs.

- Boss Energy (BOE): Downgraded to SELL despite production success at Honeymoon mine and a 6% price target increase to A$3.50/share. UBS views the stock as overvalued after an 81% YTD rally and cites risks in long-term growth clarity, wellfield geology, and expansion capex.

Separately, long-time readers will recognize familiar ZeroHedge favorites like Cameco (CCJ) and Oklo, both of which continue to log fresh record highs week after week. We've consistently laid out the investment framework over the years—and most recently provided additional, comprehensive guides (read here & here) on how to profit as an 'atomic bull' in this unfolding nuclear era.

By Zerohedge.com

Data Centers Surge, but U.S. Grid Chokes on Hardware Bottlenecks

Demand for critical electrical equipment supply is soaring as U.S. utilities plan billions of dollars of investments in transmission and distribution to meet rising power consumption after two decades of zero growth.

U.S. power utilities have announced billions of dollars in capital plans for the next few years and are getting a lot of requests from commercial users, most notably Big Tech, for new power capacity in many areas next to planned data centers.

Annual investment in transmission and distribution infrastructure by U.S. investor-owned utilities has nearly doubled over the past decade, Wood Mackenzie said in a new report.

But supply chain bottlenecks could delay project timelines and hurt company profitability, according to the energy consultancy.

Supply Chain Constraint

Soaring demand for electrical materials and equipment, such as transformers and switchgear, is pressuring the sector, which has already become notorious for the long lead times on project execution.

The challenges are likely to stay – and even escalate – as investments in manufacturing, clean energy, and data centers are boosting demand for key electrical equipment components. On the other hand, U.S. tariffs and most of all—the uncertainty about any part of said tariffs—is making procurement of electrical equipment more difficult, Wood Mackenzie says.

The tariffs imposed by the Trump Administration are by no means the biggest challenge for power equipment and component supply. But they add direct costs to materials imported into the United States, as well as indirect impacts on the supply of critical materials such as electrical steel and copper.

Rising investment in U.S. manufacturing facilities, the growth in clean energy capacity despite the Trump Administration’s cuts to tax credits, the surge in electricity demand due to AI data centers, ageing equipment, and the need for grid resilience amid extreme weather events, are all pushing demand for key transmission and distribution (T&D) equipment higher. This includes equipment for electrical distribution and backup power, including transformers, switchboards, panelboards, and voltage assembly products.

Investment in T&D by investor-owned utilities has surged in the past decade—from just over $50 billion in 2016 to more than $100 billion in 2025, according to estimates by Wood Mackenzie.

And as electricity demand rises, utility companies have lengthening lists of grid maintenance, hardening, and development projects, many of which require key electrical equipment, the energy consultancy says.

In just one example, WoodMac expects demand for three-phase, pad-mounted transformers in the United States to surge by 145% from now until 2034.

Supply is not enough to meet demand for electrical components, and an expected lag in capacity expansion is set to send electrical equipment prices even higher than they are now.

“These equipment prices are also at risk of being impacted by new US trading policies as the materials and component parts are frequently imported from China, Mexico and Canada,” Wood Mackenzie analysts say.

Power Demand Growth

The U.S. Energy Information Administration (EIA) raised this month its electricity demand projections for the near term. In the Short-Term Energy Outlook (STEO) for June, the EIA increased its forecast for retail electricity sales to better reflect projected demand growth, especially in the Electricity Reliability Council of Texas (ERCOT) and PJM independent system operators.

The upward revisions are most notable in the commercial sector, where data centers are an expanding source of demand. The EIA expects U.S. commercial electricity sector consumption to grow by 3% in 2025 and by 5% in 2026. In the previous STEO, the administration expected commercial electricity demand would grow by an annual average of 2% through 2026.

Onshoring of manufacturing activity and AI-related data centers are driving an increase in U.S. electricity consumption, Goldman Sachs said in a report earlier this year.

U.S. electrical power demand is expected to rise by 2.4% each year through 2030, with AI-related demand accounting for about two-thirds of the incremental power demand in the country, the investment bank said.

More than $700 billion of grid investment is expected in the country through 2030, as the U.S. infrastructure needs to be updated to accommodate the unprecedented growth of electricity demand, according to Goldman Sachs.

The world’s biggest economy will need all energy sources to ensure power demand is met. Natural gas is the biggest near-term winner of AI advancements, but renewables will also play a key role in powering the data centers of next-generation computing, analysts say.

“The US is reaching a power demand inflection point due to the rise of energy-intensive artificial intelligence (AI), the need for more AI-ready data center capacity, and the reshoring of manufacturing,” Goldman Sachs noted in its February report.

Procuring key electrical equipment will be crucial to the completion of many transmission and distribution projects by 2030.

“Looking ahead, challenges in sourcing electrical equipment are likely to escalate due to clean energy investments, manufacturing investments, data centre builds, aging equipment, equipment and material tariffs, weather events and the push to electrification,” Wood Mackenzie said.

By Tsvetana Paraskova for Oilprice.com

No comments:

Post a Comment