As rescue ends in tragedy, Codelco asks experts what went wrong

After six deaths at its biggest mine, Chile’s state-owned copper giant Codelco will now examine what caused Chile’s deadliest mining accident in decades — and how it can prevent another tragedy.

A frantic weekend rescue mission recovered the bodies of all five workers still missing since Thursday, when seismic activity caused a tunnel collapse at one of the world’s biggest underground copper mines.

The Chilean company is convening a panel of international experts to audit the El Teniente mine and establish what exactly happened, and the incident is likely to spark scrutiny over copper supply at a time of growing global demand for the wiring metal.

“We have opened an investigation to determine if there were failures,” chairman Maximo Pacheco told reporters Sunday. “If any responsibility lies with our supervisors or executives, we will apply maximum measures.”

But it was a weekend of mourning for Codelco and the country’s mining industry, which accounts for a quarter of the world’s mined copper.

A 100-person rescue team — including some who helped free 33 workers trapped in another Chilean mine 15 years ago — battled around the clock to reach the trapped workers. Unlike that successful San Jose rescue in 2010, all those missing at El Teniente were found dead.

Codelco has halted all mining at the site after the collapse, triggered by seismic activity at a new section of the complex called Andesita. It’s a major setback for the miner’s effort to recover from a yearslong output slump, and will add to delays in rolling out investments to overhaul aging operations.

El Teniente is crucial for Codelco’s aim to return to pre-pandemic production of about 1.7 million tons a year, from about 1.4 million tons now. The mine accounts for about a quarter of the company’s output.

International audit

The timing of any restart will depend on the outcome of the investigation, and what measures may be needed to reinforce the structure or adjust mining methods. Mines in Chile are generally designed to withstand much stronger seismic activity than the 4.2-magnitude event that caused the collapse.

Asked about reports that workers at El Teniente had flagged safety concerns prior to this tragedy, Pacheco said no official complaints had been received either anonymously or otherwise. Still, he vowed to get to the bottom of the accident and take the appropriate measures.

“We’re going to commission an international audit to determine what we did wrong,” Pacheco said on Sunday. Codelco delayed reporting quarterly results Friday as it dealt with the accident.

To be sure, Andesita is a relatively small part of Codelco’s multi-billion-dollar project pipeline in Chile as it plays catchup after decades of underinvestment. But it’s a key component — along with the Diamante and Andes Norte projects — in keeping El Teniente churning out copper in the years ahead as other sections of the 120-year mine deplete.

Safety issues

While Codelco has made its mines much safer in recent years as part of an industry-wide safety push, sporadic accidents continue to affect both new projects and existing operations.

Last year, its Radomiro Tomic open pit was the scene of a fatal accident that led to extended production disruptions, while a worker at its Ventanas division died in an accident while repairing a warehouse roof. In 2023, an electrical technician at El Teniente died.

In 1994, a firedamp gas explosion at the now closed Schwager coal mine claimed the lives of 21 miners. The deadliest accident in Chilean mining was a 1945 fire at El Teniente that generated a lethal cloud of smoke and carbon monoxide in the tunnels, killing 355 workers.

(By James Attwood)

Codelco must send reports to restart underground mining after El Teniente collapse

Chilean state-run miner Codelco must produce four reports on the collapse at its El Teniente copper mine that killed six people after an earthquake last week, according to a government document seen by Reuters on Monday, before it can restart its underground operations there.

Codelco is the world’s largest copper producer.

The firm said in a filing on Monday that it was committed to restoring operations as soon as safety conditions permitted, but that the effects of the stoppage could not yet be estimated.

A document from the government’s mining service SERNAGEOMIN showed that in order to lift the suspension, Codelco would have to hand in four reports of the collapse at El Teniente.

The reports must include an analysis of the cause of the collapse, a recovery plan and an evaluation of its fortification systems, the document said.

(By Daina Beth Solomon and Fabian Cambero; Editing by Sarah Morland and Kylie Madry)

Copper price rises with US tariffs, Codelco mine stoppage in focus

Copper edged higher as traders continued to digest US President Donald Trump’s decision to spare the most traded form of the metal from his 50% tariff, while a deadly mine accident in Chile raised supply concerns.

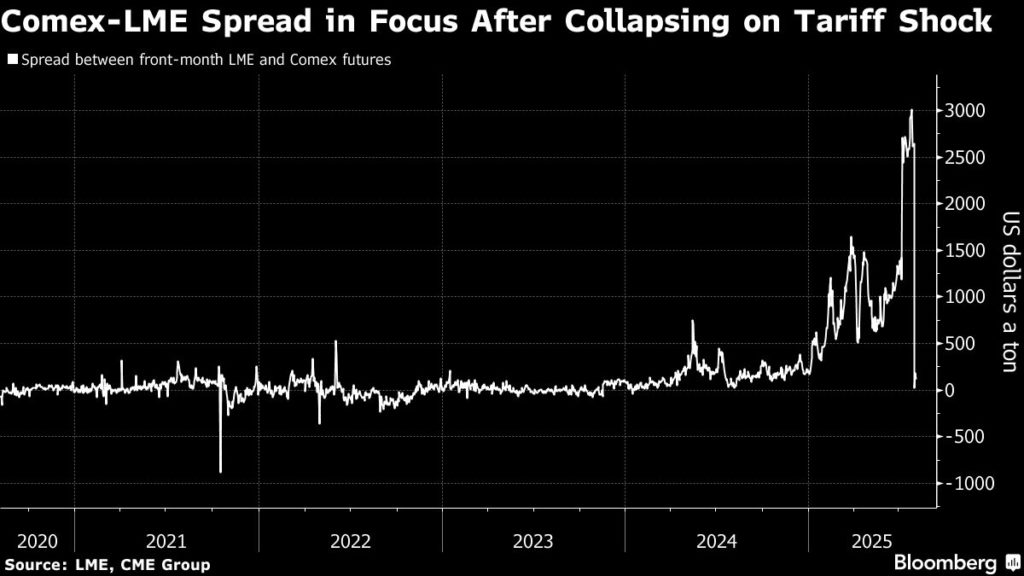

Copper rose as much as 1.1% on the London Metal Exchange, with trading conditions starting to settle after the White House’s shock move last week to exclude refined metal from the newly imposed import levy. The decision sent US prices plunging by a record 22% on Thursday, pushing them back to parity with the LME’s global benchmark.

A key question now is what will happen to the huge volume of copper that’s been shipped to the US in anticipation of tariffs, with the spreads between prices in London, New York and Shanghai likely to determine whether the metal flows back out quickly or remains in US ports. On Monday, US copper futures on CME Group’s Comex were trading about 1.5% — or $130 a ton — above those on the LME, undercutting the immediate rationale for exports.

“In the past, metal flowed between the CME and LME whenever the spread between those two prices moved outside a $100-200/t band,” Bank of America analysts led by Irina Shaorshadze said in an emailed note. “As the trade flows normalize, the LME-CME spread should revert to the historical mean-reverting relationship.”

Copper traders are also on alert for supply disruptions, after six people were killed in a tunnel collapse triggered by an earth tremor last week at El Teniente, which accounts for over a quarter of Chilean mining giant Codelco’s output. Underground operations are halted and — with the company launching an investigation into the causes — it’s unclear how long the stoppage will last or whether it will trigger changes to Codelco’s output goals.

El Teniente, one of the world’s biggest underground mines, produced 356,000 tons of copper last year. That volume is equivalent to more than a month of Chinese imports of refined copper.

The stoppage at El Teniente comes as the world’s copper smelters face intense competition to secure mine supply. Treatment fees — typically the main earner for smelters — remain at deeply negative levels on a spot basis, and plants in the Philippines and Japan have cut output or closed. Even in China, where output has remained robust, there is some speculation that production is reaching a limit.

Investors are also monitoring other unexpected mine disruptions, including at the massive Kamoa-Kakula complex run by Ivanhoe Mines Ltd. in the Democratic Republic of Congo. Still, Ivanhoe executives on Friday delivered an upbeat assessment on prospects for returning that mine to previous output guidance.

LME copper prices were 0.8% higher at $9,707.50 a ton as of 12:18 p.m. local time.

Other metals opened Monday flat to higher, gaining support from a weaker dollar. Iron ore futures in Singapore rose 1.5% to $101.50 a ton, recovering from their biggest weekly decline since April. Aluminum and zinc also rose.

Mitsubishi Materials may scale back copper smelting due to worsening margins

Japan’s Mitsubishi Materials is considering scaling back copper concentrate processing at its Onahama Smelter & Refinery as falling treatment and processing charges (TC/RCs) weigh on earnings, it said on Monday.

In June, peer JX Advanced Metals said that it was also considering copper production cuts due to a significant deterioration in ore purchase terms.

Mitsubishi Materials said the worsening TC/RCs from miners were expected to further erode smelting margins.

“To maintain and improve profitability, we need to raise the ratio of recycled raw materials and accelerate the shift to feedstock less vulnerable to TC/RC fluctuations,” the company said in a statement.

It is now considering the possibility of a partial shutdown of production facilities and a reduction in copper concentrate processing at Onahama, after planned maintenance from October to November this year, Mitsubishi Materials said.

Last month, Japan Mining Industry Association Chair Tetsuya Tanaka warned that domestic copper smelters faced tough mid-year negotiations with global miners over TC/RCs, saying they could not accept the extremely low terms agreed by Chinese smelters.

Some Chinese smelters agreed TC/RCs of $0 per metric ton and 0 cents per pound with Chilean miner Antofagasta during mid-year talks. These rates are seen as an industry benchmark and far below the 2025 annual charges of $21.25 a ton and 2.125 cents per pound.

Tanaka, who is also Mitsubishi Materials president, said at the time that shrinking smelting margins were putting non-Chinese smelters under severe pressure.

(By Yuka Obayashi; Editing by Emelia Sithole-Matarise)

No comments:

Post a Comment