Top 15 US Billionaires Gained Nearly $1 Trillion in Wealth in Trump’s First Year

The US has 935 billionaires, roughly a dozen of whom have jobs within the Trump administration.

By Sharon Zhang ,

The US has 935 billionaires, roughly a dozen of whom have jobs within the Trump administration.

By Sharon Zhang ,

January 7, 2026

U.S. President Donald Trump speaks during a news conference with Elon Musk (L) in the Oval Office of the White House in Washington, D.C., on May 30, 2025.ALLISON ROBBERT / AFP via Getty Images

Anew analysis finds that the richest 15 billionaires in the U.S. saw their wealth skyrocket by nearly $1 trillion in the first year of President Donald Trump’s second term, which also contained one of the single largest cuts to welfare benefits in U.S. history.

The Institute for Policy Studies (IPS) report, citing data from Forbes, has found that U.S. billionaires’ assets surged by a whopping 21 percent in 2025.

The 935 billionaires in the U.S. now control $8.1 trillion in wealth, the analysis found — nearly double the amount of wealth held by the bottom 50 percent of Americans, which comprises over 170 million people. Roughly a dozen of these billionaires work in the Trump administration.

The very richest billionaires saw the biggest gains. The top 15 richest people in the U.S. gained 33 percent in wealth last year, with their wealth skyrocketing from $2.4 trillion to $3.2 trillion — a gain of roughly $800 billion, IPS found.

A significant portion of this gain was driven by the wealth accumulation of one person: Elon Musk, the richest man on earth. In 2025, Musk’s wealth rose from $421 billion to $726 billion, a gain of $305 billion.

With this amount of money, Musk could singlehandedly pay for Republicans’ newly enacted cuts to Medicare for the next decade, estimated to cost $536 billion. He could fund health benefits for tens of millions of Americans and still be left with nearly $200 billion to spare.

IPS points out that Musk’s net worth has increased by 2,800 percent since 2020, when he was valued at just under $25 billion.

Other billionaires and billionaire families saw gains of tens of billions of dollars last year, including Google cofounder Larry Page, Oracle cofounder Larry Ellison, and the Walton family.

“The affordability crisis is hitting ordinary Americans particularly hard as we head into the new year, but not everyone is feeling the pain: billionaires are raking in staggering profits off the backs of ordinary workers,” said Chuck Collins, who directs IPS’s Program on Inequality and the Common Good.

Regular Americans are indeed struggling. At the end of 2025, polls were already finding that an affordability crisis was spreading across the U.S., with roughly 30 percent of Americans saying they skipped medical care in the past year due to cost, according to surveys by Politico and GQR for The Century Foundation.

This is slated to become far worse as Republicans’ cuts to Medicaid and Affordable Care Act (ACA) subsidies kick in this year. Last week, on New Year’s Day, Affordable Care Act subsidies for tens of millions of Americans expired overnight, causing premiums to double on average as a result of cuts to the Republican budget bill. Meanwhile, the Congressional Budget Office has estimated that 16 million people will lose their health care benefits altogether due to the Medicaid and ACA cuts.

These cuts were enacted to pay for a massive tax cut for billionaires and the rest of the top richest Americans. The CBO estimated that the richest Americans would see a gain of $12,000 each year as a result of the bill, while the poorest 10 percent would see their wealth decrease by $1,600 yearly on average.

“It’s not just that U.S. billionaires are entering 2026 with record-breaking increases in extreme wealth: it’s that they are also paying far less in taxes compared to the huge amount of wealth they amass. Average taxpayers like you and I pay income tax at triple the rate of the wealthiest Americans,” said Omar Ocampo, inequality researcher for IPS, in a statement. “Not only are a small number of Americans holding more wealth than the rest of America, but they’re also not paying their fair share in taxes.”

Anew analysis finds that the richest 15 billionaires in the U.S. saw their wealth skyrocket by nearly $1 trillion in the first year of President Donald Trump’s second term, which also contained one of the single largest cuts to welfare benefits in U.S. history.

The Institute for Policy Studies (IPS) report, citing data from Forbes, has found that U.S. billionaires’ assets surged by a whopping 21 percent in 2025.

The 935 billionaires in the U.S. now control $8.1 trillion in wealth, the analysis found — nearly double the amount of wealth held by the bottom 50 percent of Americans, which comprises over 170 million people. Roughly a dozen of these billionaires work in the Trump administration.

The very richest billionaires saw the biggest gains. The top 15 richest people in the U.S. gained 33 percent in wealth last year, with their wealth skyrocketing from $2.4 trillion to $3.2 trillion — a gain of roughly $800 billion, IPS found.

A significant portion of this gain was driven by the wealth accumulation of one person: Elon Musk, the richest man on earth. In 2025, Musk’s wealth rose from $421 billion to $726 billion, a gain of $305 billion.

With this amount of money, Musk could singlehandedly pay for Republicans’ newly enacted cuts to Medicare for the next decade, estimated to cost $536 billion. He could fund health benefits for tens of millions of Americans and still be left with nearly $200 billion to spare.

IPS points out that Musk’s net worth has increased by 2,800 percent since 2020, when he was valued at just under $25 billion.

Other billionaires and billionaire families saw gains of tens of billions of dollars last year, including Google cofounder Larry Page, Oracle cofounder Larry Ellison, and the Walton family.

“The affordability crisis is hitting ordinary Americans particularly hard as we head into the new year, but not everyone is feeling the pain: billionaires are raking in staggering profits off the backs of ordinary workers,” said Chuck Collins, who directs IPS’s Program on Inequality and the Common Good.

Regular Americans are indeed struggling. At the end of 2025, polls were already finding that an affordability crisis was spreading across the U.S., with roughly 30 percent of Americans saying they skipped medical care in the past year due to cost, according to surveys by Politico and GQR for The Century Foundation.

This is slated to become far worse as Republicans’ cuts to Medicaid and Affordable Care Act (ACA) subsidies kick in this year. Last week, on New Year’s Day, Affordable Care Act subsidies for tens of millions of Americans expired overnight, causing premiums to double on average as a result of cuts to the Republican budget bill. Meanwhile, the Congressional Budget Office has estimated that 16 million people will lose their health care benefits altogether due to the Medicaid and ACA cuts.

These cuts were enacted to pay for a massive tax cut for billionaires and the rest of the top richest Americans. The CBO estimated that the richest Americans would see a gain of $12,000 each year as a result of the bill, while the poorest 10 percent would see their wealth decrease by $1,600 yearly on average.

“It’s not just that U.S. billionaires are entering 2026 with record-breaking increases in extreme wealth: it’s that they are also paying far less in taxes compared to the huge amount of wealth they amass. Average taxpayers like you and I pay income tax at triple the rate of the wealthiest Americans,” said Omar Ocampo, inequality researcher for IPS, in a statement. “Not only are a small number of Americans holding more wealth than the rest of America, but they’re also not paying their fair share in taxes.”

If the proposed tax is enacted, Huang would face a roughly $8 billion tax bill—a tiny fraction of his $165 billion net worth.

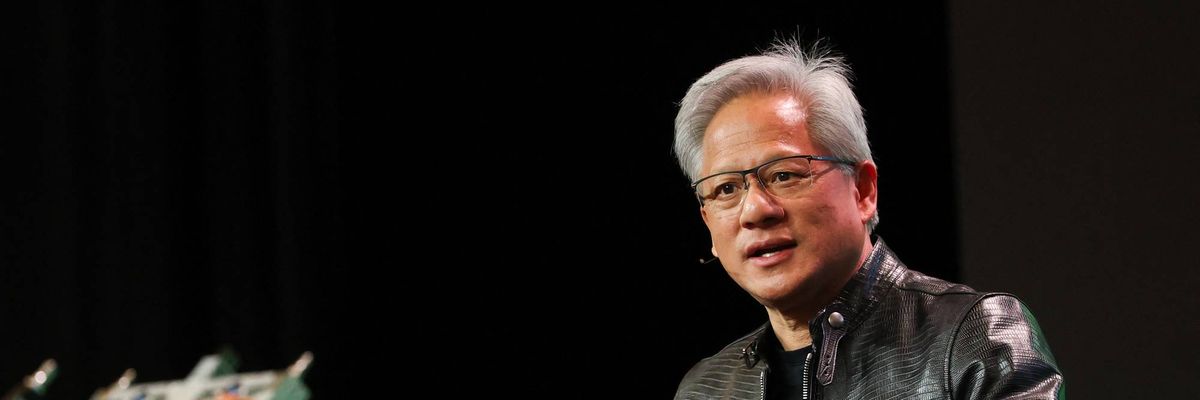

Nvidia founder and CEO Jensen Huang speaks during an event in Las Vegas, Nevada, on January 6, 2026.

(Photo by Patrick T. Fallon / AFP via Getty Images)

Jake Johnson

Jan 07, 2026

COMMON DREAMS

Jensen Huang, CEO of the tech behemoth Nvidia and the eighth-richest man in the world, said Tuesday that he is “perfectly fine” with a grassroots push in California to impose a one-time wealth tax on the state’s billionaire residents.

In an interview with Bloomberg, Huang said that “we chose to live in Silicon Valley, and whatever taxes, I guess, they would like to apply, so be it”—a nonchalant response that diverges from the hysteria expressed by other members of his class in response to the proposed ballot initiative.

“It never crossed my mind once,” Huang said of the tax proposal.

If the proposed 5% levy on billionaire wealth makes it onto the November ballot and California voters approve it, Huang would face an estimated $8 billion tax bill—a tiny slice of his $165 billion net worth. Those subject to the tax would have the option of paying the full amount owed all at once or over a period of five years.

“'Who cares’ is absolutely the appropriate reaction,” said Matt Bruenig, founder of the People’s Policy Project, a left-wing think tank. “It means nothing to him. David Sacks types look like the biggest babies in the world.”

Bruenig was referring to the White House cryptocurrency czar who left California for Texas at the end of 2025 in an apparent effort to avoid the possible billionaire tax, which would apply to anyone living in California as of January 1, 2026.

“As a response to socialism, Miami will replace NYC as the finance capital and Austin will replace SF as the tech capital,” Sacks declared in a social media post last week.

“Frontline caregivers are glad to hear that, much like the overwhelming majority of billionaires, Mr. Huang will not be uprooting his life or business to make an ideological point over a 1% per year fix to a problem that Congress created.”

The proposed one-time tax on California’s roughly 200 billionaires would raise an estimated $100 billion in revenue, funds that would be set aside for the state’s healthcare system, food assistance, and education.

Organizers are pursuing the tax in direct response to unprecedented Medicaid cuts enacted by US President Donald Trump and the Republican-controlled Congress over the summer.

Suzanne Jimenez, chief of staff of Service Employees International Union-United Healthcare Workers West and the lead sponsor of the ballot initiative, welcomed Huang’s response to the proposed tax in a statement late Tuesday.

“We agree with Jensen Huang that California has a tremendous talent pool of workers uniquely qualified to continue moving many industries forward, including within the tech sector and beyond,” said Jimenez. “This initiative will ensure the $100 billion healthcare funding crisis created by [the Trump-GOP legislation] in July is fixed, so that all of those workers can access emergency rooms and vital healthcare in California.”

“Frontline caregivers are glad to hear that, much like the overwhelming majority of billionaires, Mr. Huang will not be uprooting his life or business to make an ideological point over a 1% per year fix to a problem that Congress created last July—and that California will unite to solve this November,” Jimenez added.

No comments:

Post a Comment