Cecilia Jamasmie | March 24, 2023 |

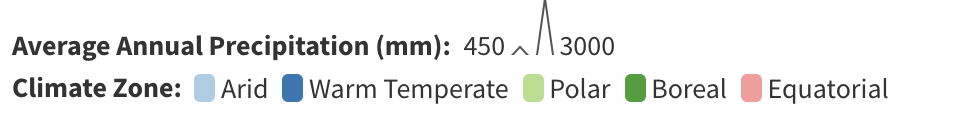

Most lithium is produced in South America, Australia and China.

Bolivia’s government is calling on its lithium-producing neighbours to forge ahead with the idea of setting a Latin America-wide policy on the exploitation of the coveted battery metal.

The idea, part of a broader initiative involving Argentina, Bolivia, Brazil and Chile to form an OPEC-like cartel, seeks to collectively boost the bargaining power of these countries, President Luis Arce said in a speech in La Paz.

“We must be united in the market, in a sovereign manner, with prices that benefit our economies, and one of the ways, already proposed by (Mexico’s) President Andres Manuel Lopez Obrador, is to think of a kind of lithium OPEC,” Arce said, local paper La Razon reported.

Bolivia holds the world’s largest lithium resources at 21 million tonnes, according to the US Geological Survey. The area of sprawling salt flats known as the “lithium triangle”, which includes northern Chile and Argentina, has about 65% of the globe’s known resources of the white metal.

If Peruvian, Mexican and Brazilian potential reserves were added, the region would hold nearly 70% of the world’s lithium reserves. This would translate into a restructuring of the world economic scenario around the energy transition and a provide a new, sound source of income for Latin American economies, according to the Latin American Strategy Centre for Geopolitics (CELAG).

Bolivia, which has almost no industrial production or commercially viable reserves, inked in January a deal with a consortium that includes Chinese battery giant CAT to jointly extract lithium from its Uyuni and Oruro salt flats.

The partnership would give the group of companies, which also includes mining giant CMOC, rights to develop two lithium plants.

Arce, who wants to industrialize Bolivia’s lithium before the end of his term in 2025, expressed concern about foreign meddling in the lithium business, particularly from the United States.

“We don’t want our lithium to be in the Southern Command’s crosshairs, nor do we want it to be a reason for destabilizing democratically elected governments or foreign harassment,” he said.

Chile, Argentina and Bolivia have been talking about creating a lithium cartel since July last year. They now seek to integrate other Latin American nations with an incipient lithium industry, including Brazil and Mexico.

Analysts, including Geopolitical Monitor’s Arman Sidhu, believe that bringing the idea to fruition is likely to spark opposition from environmentalists and indigenous groups that contributed to left-wing victories in Chile, Argentina, and Brazil.

He also warned of additional obstacles, including China’s monopolist position in the industry, investors’ fears and the long-term political viability of such an idea.

Latin America’s Bid To Challenge China’s Dominance In The Lithium Market

- Bolivia is spearheading a plan to establish a Latin America-wide policy on lithium exploitation and create an OPEC-like cartel with Argentina, Brazil, and Chile.

- The region contains the world's largest lithium reserves and could hold almost 70% of the global reserves if potential reserves in Brazil, Mexico, and Peru were included, providing a new source of income for Latin American economies.

- The plan is likely to face opposition from environmental and indigenous groups, while China's dominant position in the industry and investors' fears pose additional obstacles.

The government of Bolivia has called on its neighbors, Argentina, Brazil and Chile, to work on setting a Latin America-wide policy on the exploitation of lithium. The idea is part of a broader initiative to form an OPEC-like cartel to collectively boost these countries' bargaining power.

President Luis Are spoke in La Paz, saying, "We must be united in the market, in a sovereign manner, with prices that benefit our economies, and one of the ways, already proposed by (Mexico's) President Andres Manuel Lopez Obrador, is to think of a kind of lithium OPEC."

Bolivia has the world's largest lithium resources at 21 million tonnes, according to the US Geological Survey. The "lithium triangle" area of northern Chile and Argentina, which includes sprawling salt flats, has about 65% of the globe's known resources of the metal.

The region could hold nearly 70% of the world's lithium reserves if Peruvian, Mexican and Brazilian potential reserves were added, providing a new source of income for Latin American economies and a restructuring of the world economic scenario around the energy transition, according to the Latin American Strategy Centre for Geopolitics (CELAG).

Bolivia inked a deal with a consortium that includes Chinese battery giant CAT to jointly extract lithium from its Uyuni and Oruro salt flats in January. The partnership would give the group of companies, including mining giant CMOC, rights to developing two lithium plants.

President Are wants to industrialize Bolivia's lithium before the end of his term in 2025 but remains cautious of the potential geopolitical implications that it may bring.

President Are explained, "We don't want our lithium to be in the Southern Command's crosshairs, nor do we want it to be a reason for destabilizing democratically elected governments or foreign harassment."

Chile, Argentina and Bolivia have been discussing creating a lithium cartel since July last year. They aim to integrate other Latin American nations with a nascent lithium industry, including Brazil and Mexico.

Analysts, including Geopolitical Monitor's Arman Sidhu, believe the plan will likely face opposition from environmental and indigenous groups that contributed to left-wing victories in Chile, Argentina, and Brazil. He also warned of additional obstacles, including China's potential unwillingness to have its dominance in the industry undermined.

Opponents argue that lithium mining, which can involve vast amounts of water, can cause significant environmental damage, particularly to local communities.

There have also been concerns about the rights of indigenous people in the region who may be affected by mining the metal.

Supporters argue that developing a lithium industry in Latin America could boost the region's economies, particularly as demand for electric vehicles and renewable energy grows.

In recent years, China has been the dominant player in the lithium market, controlling a significant proportion of the world's supply of the metal.

China's position has led to concerns about the security of supply, particularly as demand for lithium is likely to increase due to the ongoing renewable energy and electric vehicle boom.

Developing a lithium cartel in Latin America could help counterbalance China's position in the market and provide greater security of supply for the rest of the world.

The idea of a lithium cartel is still in its early stages, and it remains to be seen whether it will come to fruition.

It could represent a significant shift in the global lithium market and provide a new source of income for Latin American economies.

Whether this will be achieved without significant opposition remains to be seen, but the potential benefits of a lithium cartel may be too substantial to ignore.

By Michael Kern for Oilprice.com

Reuters | March 22, 2023 |

South Carolina. Credit: Adobe Stock

Albemarle Corp said on Wednesday it had chosen Chester County, South Carolina, as the location for a $1.3 billion lithium processing plant it hopes will cement its status as a cornerstone of the rapidly growing US electric vehicle industry.

The facility, which was first announced last year without a specific location, will double the company’s lithium processing capacity and thus its ability to supply key customers – including Tesla Inc – who are hungry for more North American supplies of the battery metal.

Already the world’s largest lithium producer with major facilities in Chile, China and Australia, Albemarle has moved aggressively to expand in the United States, which it sees as its next major area of growth thanks to tax credits and other incentives offered by the US Inflation Reduction Act.

The South Carolina plant will be able to process 50,000 tonnes of lithium each year from rock Albemarle plans to mine in North Carolina as well as from recycled batteries. That’s roughly enough of the white metal to make 2.4 EVs annually.

“This facility will help increase the production of US-based lithium resources to fuel the clean energy revolution while bringing us closer to our customers as the supply chain is built out in North America,” Albemarle chief executive Kent Masters said in a statement.

Construction of the 800-acre project is expected to begin late next year, though the company did not provide a timeline for when the site will open. The plant should employ 300 workers with an average annual pay of $93,000.

The company received a lithium processing grant last year from the White House. Despite the recent softening in lithium prices, Albemarle has said it expects demand to continue to rise.

Shares of the Charlotte, North Carolina-based company fell 1.6% to $219.33 in afternoon trading.

(By Sourasis Bose, Arunima Kumar and Ernest Scheyder; Editing by Anil D’Silva, Vinay Dwivedi and Diane Craft)

Bloomberg News | March 22, 2023

Salting the lithium fields (Stock image by jobi_pro.)

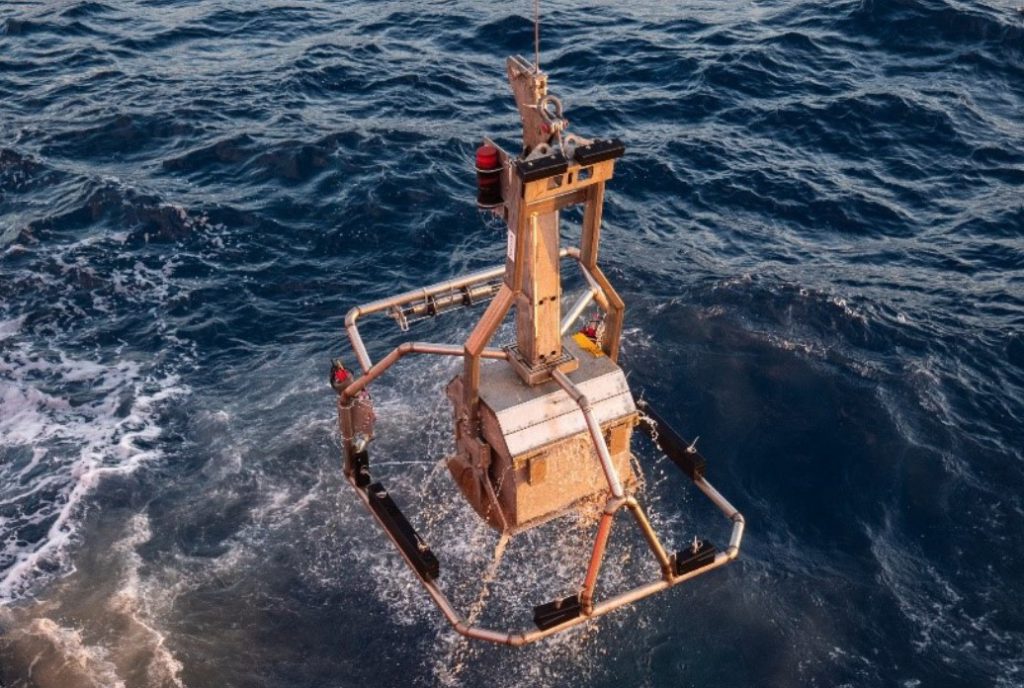

Chile’s government plans to require all new lithium projects to tap a production technique that’s barely used commercially anywhere in a bid to reduce water losses.

The requirement — mentioned by Mining Minister Marcela Hernando in a presentation Wednesday — may constrain future production in a country with the world’s biggest reserves of the key ingredient in electric-vehicle batteries at a time of growing demand.

Chile, the world’s No. 2 lithium supplier, has been losing market share, with output restricted to just two companies — SQM and Albemarle Corp. — from a single salt-flat in the Atacama desert. The two firms currently pump up vast amounts of brine, storing it in giant evaporation ponds for a year or more before processing it and shipping it off to Chinese and Korean battery makers.

As simple as it is profitable, the process uses far less fresh water, chemicals and energy than hard-rock mining. But it means billions of liters of salty water is vaporized in one of the most arid places on Earth, which some say is a threat to wildlife.

As the Chilean government prepares to unveil a policy to develop new deposits, it will require projects to use a more selective or direct process that would mean far less evaporation — and probably less output and profit. Both SQM and Albemarle are investigating such techniques, which are relatively untested commercially.

“For us, any future development has to done with direct extraction,” Minister Hernando said.

With direct lithium extraction, or DLE, brine can be reinjected back into salt flats, reducing the environmental impact and accelerating production. But it has to be adapted to the particular conditions of each salt flat.

The administration of Chile’s left-leaning President Gabriel Boric is creating a bigger role for the state in lithium. Its new policy will include the creation of a state lithium company, with which private firms would partner to develop projects in unexplored brine deposits.

Last year, contracts awarded to private companies under the previous government were rescinded amid growing resource nationalism and a push to introduce less polluting production techniques.

(By James Attwood)