ALL CAPITALI$M IS STATE CAPITALI$M

South Korea Expands Support for Shipbuilders as Challenges Grow

The South Korean government announced a series of new initiatives planned to further support the domestic shipbuilding industry. Government officials cite the strong orderbook built over the past two years as the industry rebounded and leadership in what they term “high-value” ships while also recognizing the growing competition and need to develop new technologies.

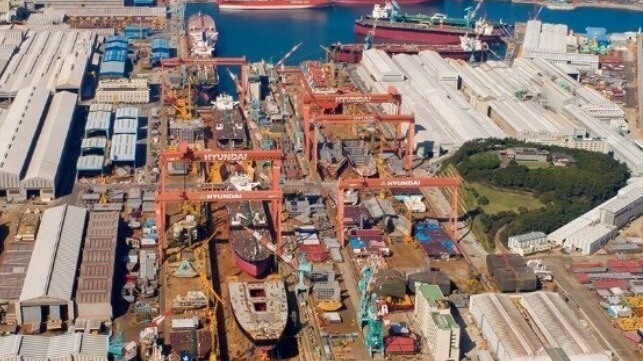

Minister of Trade, Industry, and Energy, Lee Chang-yang outlined the plans to support the industry with further investments during a tour of the HD Hyundai Heavy Industries shipyard in Ulsan on Wednesday, May 10. Supported by the Ministry of Justice and the Financial Services Commission, he said the government would be expanding its investments to support the development of new technologies while also increasing the foreign worker programs and providing new financial support programs all designed to expand South Korea’s position in the industry.

Previously the government had launched programs to support research and development of advanced technologies including ammonia, hydrogen, and electric propulsion. They have also outlined programs to support training and recruitment to meet the long-term employment needs and address the current shortage of skilled workers.

The announcement of the new programs comes as the shipbuilding industry is under pressure as global orders have slowed since late 2022. Clarkson Research in its latest monthly update highlighted that April saw the lowest monthly level in three years, with just 80 ships (1.85 million compensated gross tons) ordered, a 62 percent decline over a year earlier and a 44 percent decline versus the previous month. South Korea’s shipyards received orders for only 13 ships, 20 percent of the market, while China grew its market share to 70 percent.

Minister Lee however highlighted that South Korean shipbuilders currently have orders for nearly 40 million tons or 35 percent of the order backlog. He pointed to the $9.4 billion in orders booked in the first three months of the year and a 12-year high of 38.68 million CGT in March, enough to “generate income for the next three years.” Korea won 70 percent of the high-value and green shipping orders in March, including 17 of the 19 LNG carriers ordered worldwide. The Minister expects the industry will generate $21.5 billion in exports this year alone.

"The world has a close eye on our shipbuilders' technology and manufacturing capability, and the business environment is changing favorable to us, with ship prices rising and more demand for environment-friendly vessels," Lee said during his presentation. "The government will spare no effort to support the industry's rebound and for market leadership in the future.”

To address the labor shortage, the government said that approximately 5,500 foreign workers had entered South Korea so far this year. They have already reached a third of the industry’s goal of 14,000 foreign workers this year with the government promising more efforts to simplify visa and labor regulations.

Other programs include investments of approximately $135 million for R&D of new technologies. The government looks to expand efforts in autonomous shipping and eco-friendly designs to continue the leadership in high-value shipbuilding. The Financial Services Commission is also expanding finance programs designed to extend more support to medium-sized shipbuilders. More state-run and commercial lenders will be involved to ensure more access to financing for the large and medium-sized shipbuilders as well as increase the guarantee rate for shipbuilders to protect from contacts terminated due to a builder’s default.

The ministers said the industry is coming back from years of an industry-wide recession but it will be critical to maintain South Korea’s competitive price, quality, and technological advantages.

Korea Commissions LNG Bunker Vessel with Domestic Containment System

South Korea christened its new domestically designed and built liquified natural gas bunker vessel this week. The ship marks a milestone as it incorporates the country’s newly developed second-generation LNG containment system. The goal was to develop a domestic technology that will be competitive on the international market and provide a marketing advantage for Korean shipbuilders.

Christened the Blue Whale, the vessel has the capacity to provide 7,500 cubic meters of LNG fuel directly to vessels, which represents an advancement as it replaces up to 250 trucks required to deliver the same amount of LNG. The vessel was built in a project led by Korea LNG Bunkering which is a subsidiary of KOGAS, which in turn was selected by the Ministry of Trade, Industry and Energy in 2020. The government provided a subsidy of $11.7 million to support the development and construction of the bunker vessel with the new tank design and technology

The completion of the ship marks a 20-year effort by Korea to develop a domestic LNG containment system. Officials noted that while their shipyards continue to be a leader in the construction of LNG carriers, they and their competitors continue to license containment technology at a cost of up to $7.5 million per vessel. The goal of the project was to end Korean dependence on technologies from French giant GTT, the world’s leading company in the design and construction of LNG tanks and containment systems.

“We will be able to secure advanced, high-value homegrown cargo technology, as the Blue Whale will verify the KC-2 system for commercialization,” said Korea’s Ministry of Trade, Industry and Energy.

The new system is the second attempt by the South Koreans in a project that began in 2004 when Korea Gas Corporation in partnership with Daewoo Shipbuilding and Marine Engineering, Hyundai Heavy Industries, and Samsung Heavy Industries, began to jointly develop LNG tanks with support from the government.

The first product, the KC-1 LNG tank technology, took 10 years to develop and was adapted for use on four domestic ships, but structural defects caused gas leakages, and installation of the tank on carriers was halted. Based on lessons learned with the KC-1 membrane technology, the Korean government launched a second project in 2017 to upgrade the system to come up with the advanced KC-2 tank design.

The Blue Whale will be operated by Hyundai LNG Shipping after winning a bidding contest in January for the right to run the vessel. It will be employed for bunkering and will undergo a rigorous series of tests and demonstrations. Korea expects to commercialize the KC-2 technology to provide a new competitive advantage in the sector.

Korean shipyards continue to be the leader in shipbuilding for gas carriers although China has begun to compete for new orders. The Blue Whale was built by Hyundai Heavy Industries at the Ulsan Shipyard at a cost of $41.7 million. Hyundai Heavy Industries highlights that it has built a total of 100 LNG ships to date and that it currently has orders for 58 of the 155 LNG carriers to be built worldwide.

HMM Enters Bidding to Acquire Hyundai LNG Shipping

HMM has reportedly decided to enter the bidding to acquire its former LNG shipping operation that was spun off a decade ago during the company’s liquidity crisis. The Korea Herald is reporting on Friday that HMM notified IMM Holdings, owners of the gas carrier, of its intent to enter the bidding and to begin a due diligence process.

South Korea’s largest LNG carrier, Hyundai LNG Shipping was put up for sale by the investment company that has owned it since 2014. IMM reported its plans to sell the company it had acquired for a reported $375 million a decade ago opening the bidding process in March. Since then, an initial list of 20 potential buyers has reportedly been narrowed to four, with all of them being foreign companies. Media report said the potential buyers are located in the United States, the UK, Denmark, and Greece, with bidding expected to be completed later this month.

HMM reportedly had sought to buy the gas carrier at the end of 2022 but could not agree on a price and gain the support of its two large shareholders. IMM then placed the company up for sale, but recently there have been objections because of the critical role the company plays in the import of LNG to Korea. The shipping industry recently objected to the government over the possible foreign sale of Hyundai LNG Shipping. Reports said that the government is also considering the ramifications of a foreign sale and looking to possibly block it on the grounds of national security.

HMM is also currently beginning a process to be privatized by its owners Korea Development Bank and the Korea Ocean Business Corporation, both government institutions that had become the largest shareholders during a financial rescue of the company then known as Hyundai Merchant Marine. The banks recently named a group of advisors to structure the sale process for HMM. It is expected that they might launch bidding later this year for the carrier.

The company which is today primarily a container carrier had previously reported its strategy was to grow its operations including in bulk shipping. In July 2022, HMM detailed a five-year strategy calling for $11.4 billion in investments that would double its container capacity. They also said investments would be made to increase the bulk fleet, which includes 10 VLCC crude oil tankers as well as one Suezmax, two chemical tankers, and one LNG carrier. HMM also has a fleet of dry bulkers for iron ore and coal transport.

Hyundai LNG Shipping reports it launched Korea’s first LNG carrier in 1994. After the IMM acquisition in 2014, they won a transportation contract with KOGAS and more recently began expanding the fleet including with LPG carriers. Earlier this year they took delivery on three VLGCs built by Hyundai Samho Heavy Industries with two more due for delivery later this year. The total fleet will consist of 16 LNG carriers and six LPG carriers. They also recently launched Korea’s first LNG bunker vessel.

The Korea JoongAng Daily is reporting that the bidding process for Hyundai LNG Shipping will now be delayed to permit HMM to enter a proposal. IMM had previously said it had not received a reasonable financial offer from a Korean company but that it is not opposed to selling the company to Korean investors at a fair price.