Photo by JC Gellidon on Unsplash

LONG READ

December 30, 2024

ALTERNET

Reporting Highlights

Company Doctors: Insurance company doctors make crucial recommendations on mental health treatment.

Court Rulings: Judges have repeatedly criticized some insurance companies, and their doctors, for denying this coverage.

Business as Usual: Companies continue using the same psychiatrists in spite of the harsh rulings.

These highlights were written by the reporters and editors who worked on this story.

In a New Orleans courtroom one afternoon this April, three federal appeals court judges questioned a lawyer for the country’s largest health insurance company.

They wanted to know why United Healthcare had denied coverage for a 15-year-old girl named Emily Dwyer, whose anorexia had taken such a toll on her body that she had arrived at a residential treatment facility wearing her 8-year-old sister’s jeans.

The company’s lawyer explained that United’s denial came after three separate psychiatrists working on behalf of the insurer concluded that Dwyer was no longer engaging in concerning behaviors — not over-exercising and not struggling as much at meals. As a result, United’s doctors agreed that, after five months, she didn’t need the additional treatment at the facility that her own doctors said was essential.

The judges on the 5th U.S. Circuit Court of Appeals didn’t appear to buy it. Judge Andrew Oldham said he didn’t understand how the insurance company’s lawyer could stand by a defense that “seems to be not true.”

“The record is teeming, teeming with concerning behaviors,” a frustrated Oldham said.

Oldham, according to a recording of the hearing, ticked off a list. Dwyer, he said, compulsively checked her body. She altered her gait so that her thighs didn’t touch as she walked. And during a three-day weekend meant to see how she would do away from the facility, she lost a couple of the hard-earned pounds she had gained while in treatment.

“How in the world can you say, ‘Oh, well, that’s not a problem’?” Oldham, who had been named to the appeals court by President Donald Trump, asked at the hearing. United’s approach, the judge said, essentially boiled down to “We’ll just gamble with her life.”

Many Americans have faced the denial of mental health treatment by their insurance companies — at times despite vivid evidence of the risk such decisions pose. In most cases, patients don’t appeal. But in a tiny percentage, patients and their families decide to fight the denials in federal court, setting up a David-versus-Goliath battle where insurers frequently have the upper hand.

The cases, ProPublica found, expose in blunt terms how insurance companies can put their clients’ health in jeopardy, in ways that some judges have ruled “arbitrary and capricious.” To do so, court records reveal, the insurers have turned to a coterie of psychiatrists and have continued relying on them even after one or more of their decisions have been criticized or overturned in court.

In their rulings, judges have found that insurers, in part through their psychiatrists, have acted in ways that are “puzzling,” “disingenuous” and even “dishonest.” The companies have engaged in “selective readings” of the medical evidence, “shut their eyes” to medical opinions that opposed their conclusions and made “baseless arguments” in court. Doctors reviewing the same cases have even repeated nearly identical language in denial letters, casting “significant doubt” on whether they’re independent.

Some doctors made critical errors, contradicted by the very records they claimed they reviewed, according to thousands of pages of court documents, interviews and insurance records. Ruling after ruling reveals how they failed to meaningfully engage with patients’ families or medical providers or to adequately explain their decisions.

And when insurers have faced pushback over why they’re denying treatment, they have sometimes abandoned one rationale and shifted to other grounds to deny coverage.

In dozens of court cases, ProPublica found, judges ruled that insurance companies had violated a federal law meant to protect people who get health insurance through their jobs. The companies in several cases also broke a provision in the law designed to end discrimination between coverage of mental health and medical claims. As a federal judge wrote of one company last year, the insurer was “applying separate and unequal treatment limitations” to mental health patients.

The U.S. Department of Labor, which regulates health insurance plans for about 136 million Americans, is responsible for making sure that insurance companies are loyal to the patients, not just to the company’s bottom line.

Grant Vaught, a spokesperson for the federal agency, said it has opened “some investigations into the conduct of the individual doctors and psychiatrists employed by insurers,” but declined to specify an exact number. One case resulted in the removal of a doctor and the review organization they worked for. Vaught did not elaborate on whether physicians in any other cases faced professional repercussions. Agency officials said they don’t have the budget or staff to adequately police insurers. Despite repeatedrequests to Congress for more funding and stronger enforcement tools, the agency has not received much of what it asked for.

ProPublica reached out to six insurance companies that court records show have continued to rely on doctors who, judges found, wrongly recommended denying mental health coverage. The doctors aren’t named as parties in the lawsuits, but their decisions are included in complaints, exhibits and judgments. None of the insurers responded to questions about whether they take those repeated cases into account — by, say, refraining from using those doctors — or whether there’s a need for reform.

Optum — the United unit responsible for mental health — and the other insurance companies said they employ licensed physicians to conduct reviews. An Optum spokesperson said the company requires its doctors to undergo testing each year to make sure they are issuing appropriate coverage decisions, and the company conducts regular audits of doctors’ decisions.

“Our priority is ensuring the people we serve receive safe and effective care for their individual needs,” the spokesperson said.

These denials, which frequently come when patients are in the thick of treatment, can have grave consequences. Patients have relapsed into alcohol or drug use, become violent or died after prematurely leaving mental health facilities.

To keep Emily in treatment, the Dwyers would have to burn through their savings and refinance the mortgage on their home in Austin, Texas. They also wrote to the insurance company, hoping to persuade it to continue paying, but United wouldn’t budge.

Her parents came to suspect that the company had broken the law. But if they wanted to prove it, they’d have to go to court.

A “Striking Lack of Care”

Taking on United wasn’t going to be easy.

Dwyer’s first denial had come in June 2015, after her treatment team couldn’t convince a United staff psychiatrist that she was critically ill. At the time, Dwyer’s body image was distorted and she constantly shook her legs to burn calories. Her red blood count, hemoglobin levels and blood pressure were all low.

Dwyer still suffered from many of the same symptoms when, about one month later, United tapped another company doctor for an additional review, as insurers often do. By then, her family had already reluctantly agreed to move her down from residential treatment to partial hospitalization, but had to pay about $350 a day for costs the insurance company would not cover.

Then, the insurer denied even partial hospitalization.

The Dwyers didn’t give up, and the facility filed an appeal. For that review, United turned to Prest & Associates, a firm that health insurers hire to review cases like Dwyer’s. The firm referred the case to psychiatrist Dr. Barbara Center.

Dwyer’s psychologist, her primary care provider and the Austin doctor who diagnosed her eating disorder got on the phone with Center and described the disastrous weekend away from the facility, according to court records. During that weekend, while Dwyer was shopping with her mom, she broke down in tears when she saw her reflection in a dressing room mirror. Her doctors pleaded with United to continue covering her treatment.

But Center recommended that United uphold the denial.

Center specialized in child and adolescent psychiatry after graduating from medical school. She joined Prest & Associates as a reviewer in 2000 and within five years was promoted to chief medical officer of the company, according to her resume. She is licensed as a doctor in at least 20 states. In some cases, her reviews took place early on in the process and were a jumping-off point for other doctors; in others, she served as the final word. In a 2016 sworn deposition, Center said that she earned a base salary, plus additional pay contingent on productivity, or the time it takes her to review a case.

In the 15 years before the Dwyers’ April hearing in the federal appeals court, Center’s recommendations were referenced in at least 12 lawsuits around the country that alleged insurers had wrongly denied insurance coverage to patients who needed intensive mental health care. Four of those lawsuits ended in rulings in favor of the insurer, in which judges found that Center’s denial “was not deficient,” as alleged; the insurers’ “decisions were reasonable and appropriate”; and the plan “correctly denied benefits.”

Out of the other eight cases ProPublica identified, four ended in confidential settlements with no admission of wrongdoing by the insurers, one in a partial judgment in favor of the insurer and a partial settlement, and three in judgments finding the insurance company had improperly denied coverage, one of which was appealed and then settled.

The most critical of those rulings came in 2014, the year before Center reviewed Dwyer’s appeal. Center was assigned to assess the case of a 43-year-old woman with an eating disorder, severe depression and suicidal thoughts. A United doctor had already recommended denying a request for the woman to remain at a California hospital.

Center wrote that the woman was not suicidal when, her medical records showed, she was actively planning to either overdose or starve herself to death. Center also incorrectly listed her weight, a key detail given her anorexia. And she undercounted the number of laxatives the woman was taking, saying she took 75 to 100 a day when the treatment notes repeatedly said 130.

The case made it all the way up to the 9th U.S. Circuit Court of Appeals, where, in a unanimous opinion, the judges wrote that “Center’s ‘independent’ evaluation and coverage decision were based on obvious factual errors.” The court wrote that a third doctor quoted nearly verbatim from Center’s erroneous report. The judges concluded there was a “striking lack of care” by all three psychiatrists.

The Labor Department filed a friend-of-the-court brief in the case, one of only 15 it filed that year related to the federal employee benefits law, that said Center’s case summary “contained errors on practically every aspect” of the woman’s condition and treatment.

Timothy Hauser, then an associate solicitor at the Labor Department, was one of the attorneys who signed the brief. In an interview with ProPublica, he called the facts of the 9th Circuit case “quite disturbing.” He said the agency has tried to address the issue of doctors whose denials repeatedly appear in lawsuits by filing amicus briefs and updating regulations. The agency spokesperson said the department cannot comment on specific investigations into doctors, including Center.

But with just a few hundred investigators and nearly 4 million benefit plans, Hauser said the agency is “necessarily selective in opening investigations” that could lead to fines or penalties. The department also has no legal authority over insurers’ hiring or personnel decisions. Insurers, he stressed, have a responsibility when it comes to the doctors they hire.

Lisa Kantor, the lawyer who represented the hospital in the 9th Circuit case, said that after reading the appeals court’s ruling, she assumed insurance companies would stop working with Center.

“I really thought after that decision, which was quite a while ago, I’d never see her name again,” Kantor said. But less than a year later, a new client sent her a denial letter citing Center’s review.

Over the next decade, United and other insurance companies across the country hired Center even as her recommendations to deny continued tobesingled outin court cases.

When Center sat for the sworn deposition in 2016, she acknowledged that she had not reviewed the patient’s full medical records when deciding to deny coverage. Center said she generally reviews only the information sent to her by the insurance company that hires her; in this case, she said the insurer had not sent her the patient’s complete records.

Determining a doctor’s denial rate is difficult because it’s not publicly tracked. ProPublica obtained data from a company representing more than 100 facilities in their appeals with insurance companies. While the data is not necessarily representative of the thousands of other mental health facilities across the country, it provides a small window into Center’s work. According to an analysis of this data, Center’s rate for recommending denials over the last three years was about 90%, compared with an overall rate of about 55%.

Center declined to comment. But in a statement, a Prest & Associates spokesperson said that Center is committed to providing the highest standards of service. The spokesperson added that the firm “reviews complex, nuanced behavioral health cases” at the request of insurance providers using “standardized guidelines identified by the insurance provider.” The reviewers consider medical records, case notes and, when requested by the insurers, interviews with patient providers, but a patient’s full records are not typically made available to them.

The firm, the spokesperson said, provides advisory opinions on whether treatment is medically necessary but does not usually decide whether to terminate coverage. In the vast majority of cases, that’s done by the insurer.

“Prest and its licensed healthcare professionals have not been sued in relation to their medical necessity review work,” the spokesperson said. “No Prest reviewer — including Dr. Center — has been sued for wrongfully denying coverage, as Prest is not responsible for benefit determinations.” And as a contractor, the spokesperson said, the company isn’t “privy to information related to litigation involving cases reviewed by Prest.”

The spokesperson for United’s mental health arm, Optum, did not respond to specific questions about Dwyer’s lawsuit or Center.

Not Considered the Practice of Medicine

Having the weight of an MD behind a decision can be powerful, but lawyers and judges who’ve handled these sorts of cases say it can be misleading. Although doctors ultimately determine whether to cut off insurance coverage for a particular treatment, those decisions are generally not considered the practice of medicine and therefore cannot be challenged in a malpractice lawsuit. The doctors advising insurance companies can’t be individually sued on medical grounds, even if something goes wrong after the denial. As a result, their names are cited in lawsuits filed against the insurers, but they are not defendants in suits brought by people denied insurance.

Four lawyers who spoke to ProPublica said seeing the same insurance company doctors come up in case after case signaled that they may be improperly denying coverage, though the lawyers stressed that the doctors work within a system designed by the insurers. They said each case must be examined individually to assess whether, or to what degree, a psychiatrist erred.

“There are certain lists of doctors that are repeat players. We see them over and over,” said Brian King, a Utah attorney who sues insurers for wrongfully denying mental health claims. “When we see those reviewers, it makes us more skeptical about whether a full and fair review has been provided.”

King said many of his cases end in settlements — with confidentiality clauses that prevent the parties from disclosing the terms — in large part because families want to avoid the uncertainty of going to court and a process that often lasts several years. Residential treatment can cost families well into six figures; based on his experience, King said families who settle can expect to recover at least half of what they paid.

For lawyers as well as families, identifying doctors and their denial histories is challenging given a lack of public information. That leaves lawsuits as one of the few windows into their work records.

“That information is probably the best we have, but it’s patently inadequate,” said D. Brian Hufford, a New York lawyer who focuses on health insurance class-action suits.

In addition, multiple doctors typically weigh in on the same case during its different stages. Some denial letters don’t even list the doctors’ names.

To identify some doctors whose denials are repeatedly cited, ProPublica examined insurance letters and interviewed dozens of lawyers, mental health providers and reviewers. A national company that conducts appeals on behalf of mental health facilities also shared internal data tracking appeal calls with insurers. ProPublica then ran the doctors’ names through legal databases and reviewed each lawsuit.

One of those doctors was Cigna’s Dr. Mohsin Qayyum, whose coverage recommendations have been cited in at least 17 lawsuits that allege wrongful denial of coverage by the insurer. Eleven of the 17 ended in settlements, in which Cigna denied allegations of wrongdoing. Judges ruled in Cigna’s favor in four cases, though two of those were appealed and then settled. One case was partially ruled in favor of Cigna and partially settled. And one ended in a judgment against Cigna.

In one of the two cases where judges ruled in Cigna’s favor without a settlement, a judge wrote that the reviewing physicians — including Qayyum — “acted reasonably and in good faith.” In the other, the judge wrote that while the record paints a picture of the patient as “troubled and in need of mental health treatment,” the court could not say that Cigna’s decision not to cover treatment was unreasonable “given the deferential standard this Court must apply.”

In the case where a judge ruled against Cigna, Qayyum had upheld the denial of coverage for a teenage boy with depression, substance use disorder and high anxiety. The judge wrote that the company’s denials failed to engage with the information and assessments that the patient’s providers had submitted. She also found that the denial letter misstated the level of care the patient was actually seeking. As a result, the company acted “arbitrarily and capriciously,” a key legal threshold in these cases.

In an email, Qayyum wrote that he is not a named party in any of the 17 lawsuits and stressed that settlements do not mean he or Cigna improperly denied a requested service. He said his approval rates are “in line” with his peers’, though he would not say what those rates are. “As a board-certified psychiatrist for 26 years, I am proud of the work I do every day, as both a clinician in my private practice, and a medical director at Cigna,” Qayyum wrote.

A Cigna spokesperson said its doctors “are committed to improving the health of patients.” If a denial is ultimately overturned, the spokesperson said that the company’s clinical leaders “use it as a learning opportunity” and meet with the doctor to review cases. The spokesperson said the company provides mentorship and coaching opportunities, requires its doctors to attend case studies and expects them to “perform a thorough and independent review of the services being requested.”

The spokesperson added that the company is concerned that ProPublica’s reporting on lawsuits, “some dating back nearly a decade … is designed to paint a deeply biased picture of medical directors in our industry.” The spokesperson also said the company’s “approach to behavioral health access and treatment has evolved substantially as the landscape and the clinical evidence has evolved.”

Insurers have tried to defend against lawsuits by pointing out that multiple doctors all reached the decision to deny coverage. But judges have criticized doctors for rubber-stamping denials and for “multiple levels of deficient arbitrary and capricious determinations.” Just last year, a judge wrote that “three deficient denials considered together does not amount to substantial evidence to save any one of them.”

In interviews with ProPublica, federal judges criticized a system that fails to address problems that arise in court case after court case. They faulted the Employee Retirement Income Security Act, which governs many insurance claims in court, for not allowing for punitive damages, the sort that can rise into the millions of dollars and deter companies from bad conduct.

To one federal judge, who like others spoke about cases on condition of anonymity, doctors and the insurance companies they work for essentially get off scot-free. “They might have to pay 10 claims,” the judge said, “but if they can avoid paying a thousand claims, then why would they change anything?”

In the summer of 2023, United’s decision-making led one federal judge in Utah to quote Alice from the famed “Through the Looking-Glass.” The insurer had reversed course on why it was denying coverage for a 13-year-old boy with autism. United first said that the facility where the boy was being treated wasn’t a licensed residential treatment center. It was. Then the company said the facility primarily offered educational services. It didn’t.

United’s argument, Judge Bruce Jenkins wrote, called to mind Alice asking “whether you can make words mean so many different things.”

He went on to write that it sometimes appears the insurer’s only duty is to “preserve the plan’s financial assets rather than offering aid to the plan’s human assets (its members and beneficiaries).”

An Uphill Battle

For years, Emily Dwyer hid her eating disorder from her family. She found ways to flush food down the toilet or convince her parents that she was going for a walk when she was actually retrieving sneakers she had stashed in the neighbor’s hedges and exhausting herself on hourlong runs.

At 5’2”, she was not to be underestimated. The oldest of four girls, she excelled at almost everything. Straight A’s in her liberal arts and science magnet school. A lively friend group. Medals in cross-country. Experts have found that many anorexia patients are high achievers who set nearly impossible standards for themselves. That was the case for Dwyer, who said her extreme drive included succeeding at her eating disorder.

By January 2015, her parents pulled her out of school. They could finally see through the lies she was telling them about having already eaten at school or needing to stay through dinner to work on a project. If she ate at all, it would take her hours to get through a meal. When her family was sleeping, she would wake up at 3 a.m. to secretly exercise in her bedroom.

They took her to Dr. Ed Tyson, who specializes in eating disorders and who diagnosed Dwyer with anorexia. He told her parents she was in danger and desperately needed residential treatment. He made it clear that the treatment would be successful only if she completed it.

In February, when the Dwyers made the trip from Austin to an eating disorder treatment center near the mountains of Utah, Emily weighed 75 pounds. Records show her body mass index, which compares someone’s weight relative to their height, was dangerously low at 13.9. She was lethargic and hollow-eyed.

As her father, Kelly, drove from the airport to the facility, he caught sight of his daughter in the rearview mirror with her head in her mother Allison’s lap. He knew that she wouldn’t survive without the treatment.

The team at the facility placed Dwyer on a 4,000-calorie-a-day diet and 24-hour monitoring. In addition to the anorexia, her doctors diagnosed her with anxiety, depression and severe malnutrition. She refused to engage with her therapists.

“I was not willing to think deeply or be reflective of anything,” Dwyer said in a recent interview. “I was very angry.”

When United issued its denial after five months, saying she was ready for intensive outpatient treatment, her parents knew she wasn’t. They consulted Tyson, who emphasized that releasing their daughter prematurely would increase the likelihood of her needing residential treatment again and could put her health at grave risk.

“Emily was still struggling, so it would be difficult to get all the food that she would need,” Tyson said in an interview with ProPublica. “Pretty soon the other physical parameters would start to go south. The red blood cells, the white blood cells. The heart muscle gets smaller. The muscle itself becomes weaker, so when it pumps, it can’t pump as hard.”

For Kelly Dwyer, a lawyer who counsels clients on mergers and acquisitions, facing the prospect of releasing her too early was too much to bear. He couldn’t imagine putting Emily back in a facility if she relapsed. The first time, when she clung to him in those final moments, it was the hardest thing he’d ever had to do.

“I never, ever wanted to do it again,” he said.

Without so much as a whisper to their daughter, they filled out the paperwork to refinance their mortgage.

In 2017, nearly two years after the initial denial, the Dwyers sued United for wrongfully denying coverage. In 2019, a federal district judge held a trial that lasted about 90 minutes, but it took him nearly four years to issue a decision. He ruled in favor of United. The Dwyers appealed.

“Talk about delayed justice,” said the Dwyers’ lawyer, Elizabeth Green, who previously worked at Kantor’s firm, which took the case on contingency, meaning without any guarantees that it would get paid. Most lawyers in these kinds of cases take them on a contingency basis.

The federal appeals court — just one level below the U.S. Supreme Court — didn’t take nearly so long to issue a ruling. In September, about five months after hearing the case, the three-judge panel of the 5th U.S. Circuit Court of Appeals reversed that decision and ruled unanimously in favor of the Dwyers. The judges, led by Oldham, dissected the denial letters issued by the three doctors and found they were “not supported by the underlying medical evidence.” In fact, the judges wrote, they were “contradicted by the record.”

When United denied Emily Dwyer’s coverage, the judges wrote, “she was still very ill.”

Judges have repeatedly warned insurance companies that they cannot ignore the opinions of the doctors who are actually treating the patients. What’s more, they must explain how they engaged with them. As in many cases examined by ProPublica, the psychiatrists reviewing Dwyer’s treatment used boilerplate language in their denial letters and failed to provide or offer a sufficient explanation.

“We therefore join a growing number of decisions rejecting similar denial letters issued by United across the country,” Oldham and his fellow judges wrote.

The Dwyers recognize the privilege that allowed them to pay for their daughter’s continued treatment without knowing if or when they’d get their money back. They also understood how to navigate the legal system. Their goal, in addition to getting reimbursed, was to make it harder for insurance companies to kick children out of treatment when they need it.

For their daughter, the extra seven weeks made all the difference. That time, Emily said in an interview, forced her to confront her eating disorder and get comfortable in her new body. She had gained more than half of what she weighed when she arrived in Utah, but she made a point of avoiding knowing her weight. She developed deep connections with the other girls in the program and witnessed them battle the same compulsions.

Toward the end of her time there, she even mentored new patients and earned a key to the bathroom, one of the final steps before going home.

No insurance company doctor, Dwyer said, could understand her situation in a quick call to her doctors — even if she had reached her target weight.

“You can’t just make this decision, wipe your hands and leave work for the day,” she said. “Your actions have real consequences.”

When the Dwyers learned from ProPublica that Center had rejected their appeal about a year after a judge had issued the blistering opinion against her in a different case, her denial stung even more. It was maddening to hear that she has been involved in multiple lawsuits that have been settled or where a judge found the insurer wrongfully denied coverage.

“There is no accountability,” Allison Dwyer said.

A New Beginning

Of all the girls Emily Dwyer met while in treatment, most relapsed or needed to be readmitted to a residential facility.

“The treatment definitely saved my life,” said Dwyer, who is now 24. “I have no doubt that if I left in July, I would have relapsed.”

Afraid that her high school would buzz about the anorexic girl who was so sick she had to spend months at a facility out of state, she transferred schools. Her first year back was filled with doctor and therapy appointments. She had sprouted 2 inches during and after treatment, which meant she was still significantly shorter than the rest of the family, but at least she was growing again. She was so determined to prove that she was better that she once hid 23 batteries in her pockets during a weigh-in.

When she moved away for college, she still struggled. But in her junior year, Kyle, a boy she met at freshman orientation, became more than a friend. He thought she was the most beautiful person in the world, on the inside and out, and for the first time since she got sick, she began to see herself in that way.

This summer, they married on a clear September day in a redwood grove in California, her brown hair swept up in a loose braid that fell onto her shoulders.

Three weeks after her wedding, she started her second year at Stanford Law School. She has traded in her running shoes for a yoga mat and is working to perfect her stew recipe. Most mornings, she and Kyle eat breakfast together before he heads out to teach English to fifth graders, and she pulls out her bike for the 10-minute ride to campus.

Agnel Philip contributed data analysis.

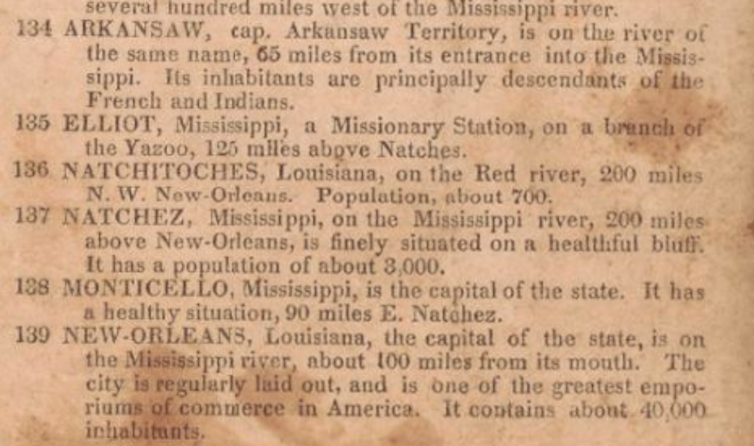

.jpg)