Centrica Extends Life of Two UK Nuclear Plants to 2028

Centrica has confirmed that Heysham 1 and Hartlepool nuclear power stations will remain in operation until March 2028, extending their previously expected closure dates by one year.

The extension, approved following graphite core inspections in 2025, secures continued output of homegrown, low-carbon electricity capable of powering more than four million UK homes annually. Centrica, which holds a 20% stake in the stations alongside operator EDF, said the additional year of generation would contribute around 3TWh of electricity to its portfolio between 2026 and 2030.

This move comes amid mounting pressure on the UK to bolster energy security and reduce reliance on fossil fuels. Since December 2024, lifetime extensions across the UK’s nuclear fleet are expected to add about 60TWh of supply, with Centrica’s share totaling 12TWh.

Centrica has been deepening its involvement in nuclear power, most recently committing £1.3 billion to acquire a 15% equity stake in Sizewell C, the 3.2GW plant under construction in Suffolk. Once operational, Sizewell C is expected to deliver reliable zero-carbon baseload electricity for at least six decades.

Chris O’Shea, Centrica’s Chief Executive, said the extensions demonstrate the importance of nuclear in a diversified UK energy mix: “The UK needs more reliable, affordable, zero-carbon electricity, so the extension of Heysham 1 and Hartlepool is great news. We believe in having a diversified energy system, with nuclear power playing a key role in ensuring stability and sustainability for decades to come.”

The announcement highlights how existing nuclear assets are being leveraged to support the country’s decarbonisation strategy while bridging the gap until new capacity comes online. Heysham 2 and Torness are still expected to close in 2030, but further reviews will depend on ongoing inspections and regulatory assessments.

Further life extension of two UK nuclear power stations

_63014.jpg)

In December 2024, EDF Energy extended the lifetimes of all four of its generating advanced gas-cooled reactor (AGR) plants. It said Heysham 1 and Hartlepool - which were due to move into defuelling in March 2026 based on a review in 2023 - would continue operating until March 2027. Meanwhile, Heysham 2 and Torness - which were due to move into defuelling in March 2028 based on a review in 2021 - will operate until March 2030.

The company has now announced that, following a series of positive graphite inspections at both plants over the past nine months, it has decided Heysham 1 and Hartlepool will continue operating until March 2028.

"Extending the life of these stations makes sense," said Mark Hartley, Managing Director of EDF's Nuclear Operations business. "It secures employment for longer for more than 1,000 people who work at those sites, and it supports the UK's ambitions to have a clean, secure electricity supply. A further year of operation for these two stations has the potential to power more than four million homes and reduce the need for imported gas."

EDF Energy noted that Heysham 2 and Torness were not in scope for this review after a two-year extension and remain scheduled to generate until March 2030.

"EDF's ambition is to continue making zero-carbon electricity at its four generating AGR stations for as long as it is safe and commercially viable to do so and will keep station lifetimes under review," it said.

Centrica, which has a 20% share in the Heysham and Hartlepool plants, noted: "The total life extensions announced since December 2024 are projected to add approximately 12 TWh to the company's electricity generation volumes between 2026 and 2030, with 3 TWh attributable to the extensions announced today."

"The UK needs more reliable, affordable, zero-carbon electricity, so the extension of Heysham 1 and Hartlepool is great news," said Centrica Group CEO Chris O'Shea. "We believe in having a diversified energy system, with nuclear power playing a key role in ensuring stability and sustainability for decades to come."

Tom Greatrex, Chief Executive of the Nuclear Industry Association, commented: "These lifetime extensions are hugely welcome - they'll cut bills, cut emissions and protect jobs in communities that rely on them. It's the single biggest step forward for energy security this year, and a vital boost for our stretched power grid. And the real opportunity ahead is even greater: by building new nuclear alongside these extensions, we can secure a clean, reliable and resilient power system for the long term."

US uranium company unveils conversion facility plans

_74650.jpg)

Texas-headquartered UEC said the new company will be called United States Uranium Refining & Conversion Corp. (UR&C). The initiative responds to federal policy under recent Executive Orders from the White House calling for a fourfold increase of US nuclear generating capacity by 2050 and reducing reliance on overseas suppliers. Onshoring the nuclear fuel cycle is seen as a priority for national security.

"Positioning UEC as the only vertically integrated US company with uranium mining, processing, refining and conversion capabilities is both a significant commercial opportunity and a strategic necessity for the United States," UEC President and CEO Amir Adnani said. UEC's end-to-end capabilities would provide a secure, geopolitically reliable source of uranium hexafluoride - the feedstock needed for uranium enrichment to produce nuclear fuel - for "undersupplied domestic and allied markets," he added.

"We are structuring UR&C as a subsidiary to advance this initiative in a fiscally optimal manner, including tactical partnerships and direct investments. This allows UEC to maintain a strong balance sheet and continue to prioritise its core uranium mining and processing business, while separately advancing UR&C to enhance UEC shareholder value," Adnani said.

UEC Chairman and former US Secretary of Energy Spencer Abraham said the USA has "for far too long" relied on foreign sources to supply and process the critical materials essential for national and economic security. "We are seeking to address this problem by advancing a vertically integrated supply chain for natural UF6, providing essential feedstock for commercial enrichment to power the world's largest nuclear reactor fleet and supplying the unobligated US-origin uranium required to fuel America's nuclear navy. The proposed facility directly aligns with US policy and would contribute to unlocking American enrichment growth."

UEC has three hub and spoke in-situ recovery uranium platforms in South Texas and Wyoming with a combined licensed production capacity of 12.1 million pounds U3O8 (4654 tU) per year. UR&C will position UEC as the only American company with a nuclear fuel supply chain capability from uranium production to refining, conversion, and delivery of natural UF6, the company said. High conversion prices in both the spot and long-term markets are "indicative of a highly undersupplied market and a major bottleneck in the US nuclear fuel supply chain, and market conditions, plus current federal government support, have created a "prime opportunity" for a US company to develop a new uranium refining and conversion plant, it added.

The proposed facility - which UEC says will be the largest conversion facility in the USA and "amongst the most modern in the Western world" - is envisaged as having a designed capacity to produce some 10,000 tU per year as UF6, representing a "substantial share" of the USA's 18,000 tU per year demand.

The proposed facility is the result of work initiated with Fluor Corporation in July 2024 and supported by a recently completed AACE Class 5 conceptual study. UEC said it has initiated discussions on potential siting options, "evaluating factors such as logistics, workforce availability, public acceptance, local incentives, and synergies with other fuel cycle facilities."

"The project will move forward contingent on several factors, including completion and assessment of additional engineering and economic studies, securing strategic government commitments, utility contracts, regulatory approvals, and favorable market conditions," the company said. "UEC has begun initial discussions with the United States government, state-level energy authorities, utilities, and financial entities, and will report further updates as these engagements advance."

Conversion is a chemical process to refine U3O8 to uranium dioxide, which can then be converted into uranium hexafluoride gas. Honeywell's Metropolis Works plant, built in the 1950s in southern Illinois, is currently the only uranium conversion facility in the USA. It was temporarily shut down from 2017 to 2023 due to poor market conditions, but was restarted in July 2023.

Yellowcake production begins at Kayelekera

Production of the first dried and drummed U3O8 is the final step in the commissioning of the process plant at Lotus Resources Inc's 85%-owned project in Malawi.

_54848.jpg)

Kayelekera first produced uranium in 2009, but when Australian-based Lotus Resources acquired the project from Paladin Energy in 2020 it had been under care-and-maintenance since 2014. Last year, the company announced plans for an accelerated restart of the project, and earlier this month Malawi's President Lazarus McCarthy Chakwera took part in a ceremony to officially inaugurate the mine as it moved into the final commissioning stages.

Samples from Kayelekera will soon be sent to each of the three western uranium converters for qualification ahead of the first shipment of uranium from the site. In the meantime, the company will continue to focus on ramping up production and building inventory in anticipation of making its first uranium shipment later this year, Lotus Managing Director Greg Bittar said.

The company is now "positioned to join the ranks of global uranium producers" at a crucial time for the global uranium market, Bittar noted. "Achieving this milestone on budget and within the timeline of Q3 CY25 targeted at the beginning of Kayelekera's accelerated restart is a testament to the quality and dedication of Lotus' team, contractors and all stakeholders," he said.

Lotus plans to ramp up to a steady-state production level of 200,000 pounds U3O8 (77 tU) per month in the first quarter of 2026. The company currently has four binding sale arrangements for a minimum of 3.5 million pounds, and up to 3.8 million pounds U3O8 of Kayelekera's output starting from 2026, including with three leading North American power utilities, the company said.

Go-ahead for preliminary works at Polish plant site

_49559.jpeg)

The permit, issued by Beata Rutkiewicz, covers: surveying works; development of the construction site, including the construction of temporary technical and other facilities; removal of trees; construction of a temporary fence; and levelling the terrain.

Polskie Elektrownie Jądrowe (PEJ) said the works - which will cover an area of about 330 hectares - will begin in the coming months.

Preparatory works will begin with the staking out of the area, where site facilities will be prepared, the company said. In parallel, checking the area for possible archaeological sites and unexploded ordnance will continue, "so that the work will be carried out in a safe manner for personnel and bystanders". Then, in late October/early November, tree and shrub removal will begin. According to the plan, tree clearing will be completed by spring 2026.

PEJ noted that, over the past year and a half, it has conducted an extensive environmental and survey campaign that precedes the start of preparatory works. The site of the future power plant was surveyed once again to determine the conditions before the start of works and to effectively relocate protected plant and animal species. These activities, it said, fulfilled the obligation under the environmental decision issued by the General Director for Environmental Protection.

"The beginning of preparatory works is an important landmark in our project, which is why obtaining this permit is so important to us," said Marek Woszczyk, President of the Management Board of PEJ. "In accordance with the established schedule, we are consistently moving towards starting the key stage of the investment project, which is the construction of the power plant. Timely delivery of such a complex project would not have been possible without efficient and professional cooperation with government administration, in this case with the Head of the Pomorskie Voivodship and representatives of the Pomorskie Voivodship Office."

In November 2022, the Polish government selected Westinghouse AP1000 reactor technology for construction at the Lubiatowo-Kopalino site in the Choczewo municipality in Pomerania in northern Poland. In September 2023, Westinghouse, PEJ - a special-purpose vehicle 100% owned by Poland's State Treasury - signed an 18-month Engineering Services Contract under which Westinghouse and Bechtel will finalise a site-specific design for a plant featuring three AP1000 reactors. The aim is for Poland's first AP1000 reactor to enter commercial operation in 2033. The total investment costs of the project are estimated to be about PLN192 billion (USD49 billion).

SASKATCHEWAN

McArthur River delays impact Cameco production

Cameco's 2025 production figures will be impacted by development delays at McArthur River, although strong production at Cigar Lake will help make up for this, the company has said. Meanwhile, together with Orano Canada, it has signed a new agreement with an Indigenous-owned airline to ensure transport to its operations in northern Saskatchewan.

Development delays and the expected timing of ground freezing as the mine transitioned into two new mining areas were among a list of potential risks to the McArthur River mine production schedule that were identified by the company back in January. These delays have meant that some production from operations at the site in Saskatchewan is being deferred, although this is partially being offset by strong performance at the Cigar Lake mine, Cameco said in its latest update on its 2025 production plans.

"The impact of these risks was dependent on the magnitude of the delay, the McArthur River mine’s ability to substitute feed for the Key Lake mill with production from alternative mining areas, and our ability to offset reduced production from McArthur River/Key Lake with additional production from the Cigar Lake mine," the company said in an update released on 28 August. "We have determined that we are unable to fully mitigate the expected impact of the delayed development and slower than anticipated ground freezing in the first half of 2025."

2025 production from the McArthur River/Key Lake operation is now anticipated to be between 14 million and 15 million pounds U3O8 (5385-5770 tU) on a 100% basis (9.8-10.5 million pounds for Cameco's share) in 2025. This is down from the previous forecast, of 18 million pounds U3O8 (100% basis; 12.6 million for Cameco's share).

"At the Cigar Lake mine, we continue to expect to produce 18 million pounds U3O8 (100% basis; 9.8 million pounds our share) this year, however performance to date at Cigar Lake has been strong, creating an opportunity to potentially offset up to 1 million pounds (100% basis) of the shortfall at the McArthur River/Key Lake operation," the company said.

The McArthur River mine is owned 69.805% by Cameco and 30.195% by Orano. The Key Lake mill is owned 83.333% by Cameco and 16.667% by Orano. Cigar Lake is owned 54.547% by Cameco, 40.453% by Orano Canada Inc. (Orano) and 5% by TEPCO Resources Inc.

Rise Air contract

In a separate announcement, Cameco and Orano Canada Inc announced the signature of a 15-year agreement with Indigenous-owned airline Rise Air, to provide workforce transportation services for northern Saskatchewan operations. The agreement is worth around CAD500 million (USD364 million).

This is the latest agreement between the companies in a relationship dating back to 1993, although previous agreements with Rise Air have typically spanned three years or less.

Rise Air CEO Derek Nice said the 15-year agreement will be transformative for Saskatchewan’s largest regional airline, which plays a vital role in connecting northern communities and supporting regional economic development. "It means we can plan for the future with confidence - investing in modern equipment, upgrading our facilities, and expanding hiring and training. Most importantly, it allows us to focus on building long-term careers for residents of northern Saskatchewan."

"Air transportation is critical to our operations in northern Saskatchewan," Cameco President and CEO Tim Gitzel said. "Without the ability to fly workers to our remote sites, we cannot operate. This contract ensures continued access to our sites through an exciting new fleet of aircraft."

Rise Air is owned by Athabasca Basin Development and Prince Albert Development Corp, and is one of Canada’s largest indigenous-owned air carriers operating 24 aircraft. The ownership collectively impacts 12 First Nations and four municipalities.

EIA programme proposed for Norwegian plant

_45872_49591.jpg)

Nuclear project developer Norsk Kjernekraft submitted a proposal to Norway's Ministry of Energy in November 2023 for an assessment of the construction of the small modular reactor (SMR) plant. According to the preliminary plan, the plant will be located in a common industrial area - the Taftøy industrial park - in the border area between Aure and Heim. The plant is planned to consist of several SMRs, which together will produce around 12.5 TWh of electricity annually, if the plant is realised in its entirety.

In April this year, the Ministry of Energy, the Ministry of Health and Care Services, the Ministry of Justice and Public Security, and the Ministry of Climate and Environment requested the Norwegian Water Resources and Energy Directorate (NVE), the Norwegian Radiation and Nuclear Safety Authority (DSA), and the Norwegian Directorate for Civil Protection (DSB) prepare an Environmental Impact Assessment (EIA) programme for the proposed plant.

"An assessment programme is a review of which topics a developer must investigate before applying for licences, permits and approvals in line with current regulations," DSA noted. "The goal is to ensure that environmental and social considerations are taken into account."

"The three directorates have submitted a proposal for which topics should be investigated in order to assess a nuclear power plant in Aure and Heim," Kjetil Lund, Director of Water Resources and Energy at NVE said. "Now it is up to the ministries to consider how the further work should be organised."

DSA Director Per Strand added: "Nuclear power plants must be operated safely, securely and responsibly to ensure that people and the environment are protected from the negative consequences of radiation, and it is important that the assessment programme is clear about the consequences a nuclear power plant will have on the environment and society. The regulations impose strict requirements on nuclear power plants."

DSA noted that although the assessment programme is designed specifically for a nuclear power plant at Taftøy industrial park, "most of the proposed assessment topics and requirements will still be relevant for any other nuclear power plants".

"The directorates believe that the development of nuclear power production in Norway should start with an overall, state-wide approach, rather than a local initiative for a specific facility with a given location," Strand said. "This is also in line with international recommendations from the International Atomic Energy Agency."

Austrheim proposal

The proposal for an assessment programme is the first formal step in Norway towards establishing a nuclear power plant. The submission of a proposal by Norsk Kjernekraft in November 2023 for the Aure and Heim SMR plant was the first of many such proposals that have since been submitted for SMR plants in various locations across the country.

Today, Norsk Kjernekraft and Austrheim Municipality announced that the joint venture Fensfjorden Kjernekraft AS has submitted a notification with a proposal for an assessment programme to the Ministry of Energy. The notification marks the start of the formal regulatory process to assess the construction of a nuclear power plant in Austrheim Municipality, Vestland County.

In June 2024, the Norwegian government appointed a committee to conduct a broad review and assessment of various aspects of a possible future establishment of nuclear power in the country. It must deliver its report by 1 April 2026.

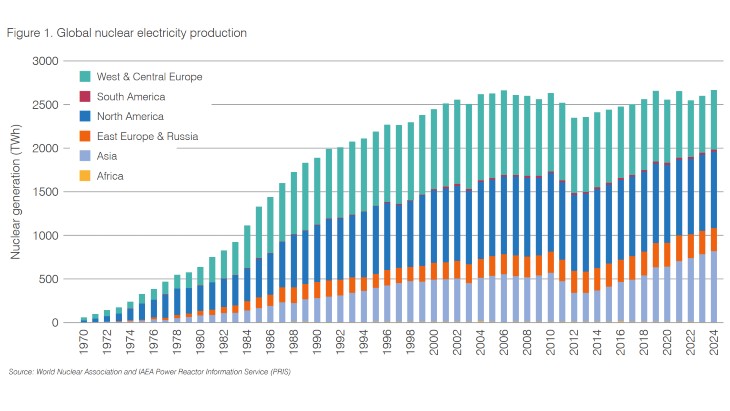

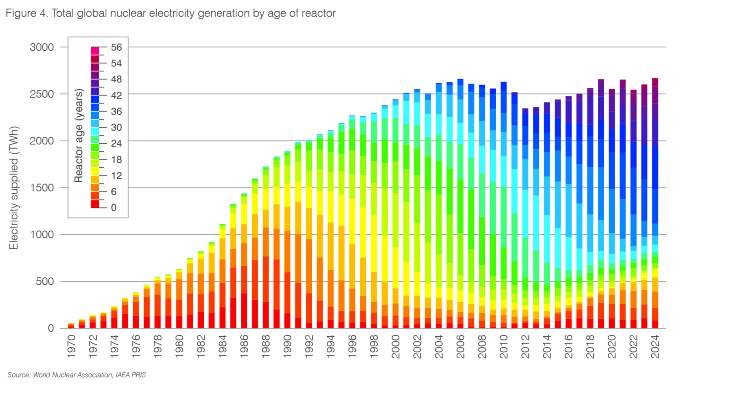

Record-breaking year for nuclear electricity generation

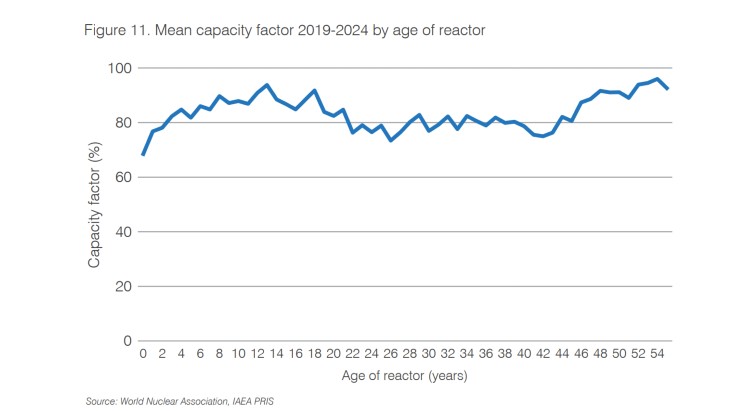

The latest edition of the yearly report, produced by World Nuclear Association, also recorded that the average capacity factor increased to 83% - the capacity factor is how much electricity is produced as a percentage of what could be produced if a power plant was operating at full power non-stop for the entire year.

One of the findings of World Nuclear Performance Report 2025 was that there is no decline in performance of reactors as they age, with more than 60% of reactors achieving a capacity factor of more than 80%.

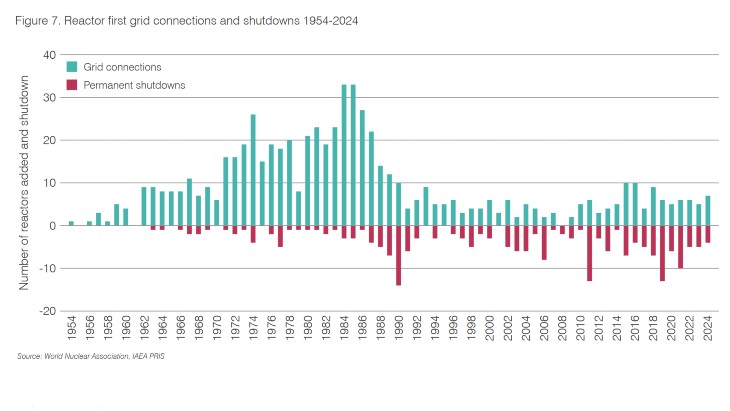

The report says that the increase in global nuclear generation over the past decade is primarily down to Asia, which accounts for 56 of the 68 reactors commissioned. And of the 70 reactors currently under construction, 59 are located in the region.

Director General of World Nuclear Association Sama Bilbao y León said: "The new record electricity generation from nuclear energy in 2024 is a testament to the industry. To meet our global energy and climate goals, it is a record that needs to be bettered again and again, every year, by increasingly larger amounts.

"The challenge ahead is immense, but so is the opportunity. With the backing of bold global industry leaders, forward-thinking governments, and an increasingly engaged public, the path to tripling nuclear capacity is not only achievable, it is necessary. This is our chance to build a cleaner, more secure energy future for everyone everywhere, powered by reliable, low-carbon nuclear energy."

During 2024 seven reactors were connected to the grid - Zhangzhou 1 in China, Vogtle 4 in the USA, Shidaowan Guohe One in China, Kakrapar 4 in India, Flamanville 3 in France, Fangchenggang 4 in China and Barakah 4 in the UAE.

Construction began on nine more during 2024 - Chashma 5 in Pakistan, El Dabaa 4 in Egypt, Leningrad II-3 in Russia, and in China, Lianjiang 2, Ningde 5, Shidaowan 1, Xudabao 2 and Zhangzhou units 3 and 4.

Four reactors were permanently shut down in 2024. These were Kursk 2 in Russia, an RBMK light water graphite reactor, Pickering 1 and 4 PHWRs in Canada, which had operated for 53 and 51 years respectively, and Maanshan 2, a 41-year-old pressurised water reactor that was closed as part of the Taiwanese government phase-out policy.

Report author, Jonathan Cobb, senior programme lead, climate, at World Nuclear Association, told the World Nuclear News podcast that he expects to see the new record broken again in the next years.

"As the reactors currently under construction are grid-connected over the next five to six years, we should see global nuclear capacity and total nuclear generation continuing to rise. There may be some closures of older plants, but our analysis has shown that for the current reactor fleet, including those reactors that have operated for at least 50 years, there is no decline in reactor performance related to age ... indeed, in the US, we are seeing some reactors that recently shut being reopened," he said.

Listen to the full World Nuclear News podcast interview with Jonathan Cobb