The National Transportation Safety Board (NTSB) has reported the probable cause of the container ship strike that took down the Francis Scott Key Bridge: a loose wire buried inside a switchboard. The agency has now released its complete report, detailing the findings of its forensic team - and the challenging, monthlong effort to find one loose wire on a 10,000-TEU boxship.

In the early hours of March 26, 2024, as the container ship Dali got under way outbound from the port of Baltimore, a high voltage breaker for a transformer tripped and shut down the ship's auxiliary power. This cut out the vessel's propulsion and steering, leaving Dali helpless and adrift. Efforts to restart were unsuccessful. Without a tug to assist, Dali drifted into a pier supporting the Francis Scott Key Bridge and destroyed it, collapsing the structure and killing six people.

After the accident, the National Transportation Safety Board began an intensive effort to determine the cause of the blackout, and it summoned Dali's shipbuilder - HD Hyundai Heavy Industries - to send experts to assist. The ship was still in the channel, trapped in the wreckage of the bridge, but was accessible by boat for investigators to come aboard.

On April 1, representatives from HHI, the shipowner, the crew and the NTSB gathered at the Dali's switchboard to see if they could recreate the circumstances of the electrical fault. The high voltage breaker would not close, so HHI dispatched a circuit breaker specialist to the scene for another attempt.

On the next try, on April 10, the breaker closed successfully. The transformer was left energized and the breaker left closed to see if it would trip again in the manner of the casualty voyage. Two days later, without warning, the breaker tripped and caused a blackout - just like it had on the morning of the accident. On April 29, as testing continued, it tripped for a third time.

At this point, HHI opted to remove and dig into the breaker. They found that an undervoltage release circuit (a safety control signal) was de-energized, a condition that would disconnect the high voltage breaker and cause the fault. Only at this point - after disassembling the electrical panel and dispatching three separate teams of experts from the OEM - did the investigators discover a loose wire in a single terminal block, one of hundreds in the panel.

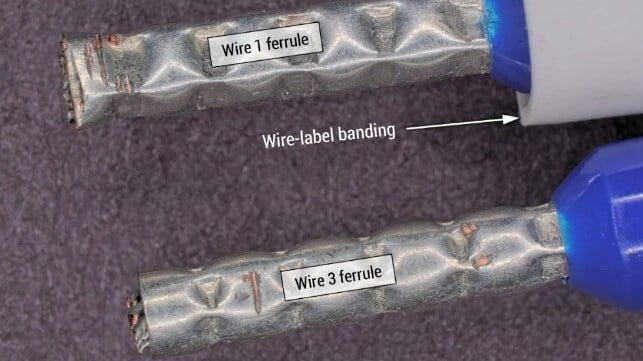

The panel was built with standard spring-grip terminal blocks for each wire connection. To make a connection, the spring is pushed back with a tool, a bare ferrule on the tip of the wire is inserted down into the terminal block, and the spring is released, forcing the ferrule against a contact.

Aboard the Dali, each individual wire had a cylindrical label with the wire number on it. The label on this particular wire had been clamped too far down towards the tip, NTSB found, preventing it from being fully inserted. On lab inspection, the agency's technicians discovered evidence of scraping and arcing on the metal terminal and on the wire tip - a sign of a loose connection - and crushing at the very end of the ferrule, where the spring clamp had made a tenuous contact.

"Any shipboard movements or vibrations could have moved the wire, resulting in an interruption in the connection and causing electrical arcing," NTSB concluded. "Any interruption in the Wire 1’s connection would have caused the HR1 breaker to open, resulting in a [low voltage] blackout."

According to NTSB, "HHI also stated that they did not have any specific materials, instructions, or training for their electrical installation technicians related to the installation of HV switchboards."

HHI, the shipowner and the shipmanager are currently engaged in litigation over the cause of the casualty. Owner Grace Ocean and shipmanager Synergy - which face massive liability claims for the destruction of the bridge - have filed a lawsuit claiming that HHI "defectively designed the switchboard in such a manner that wiring connections were not secure, could not be verified as secure, and could lose connection during normal operation." HHI disputes this allegation and is contesting the claim in court.

In a statement, HHI said that the loose wire inside the panel should have been caught by technical inspectors post-delivery, and alleged that the resulting fault was a product of "inspection failures" during the ship's service life. The shipbuilder's maintenance guidance at the time of delivery included a recommendation to check terminal connections every three years, and HHI asserted that this was not properly performed.

"After the ship was delivered and continuing after subsequent re-sales, it was incumbent on the ship’s owner and operator to engage in regular and appropriate inspection and maintenance to ensure that the systems and components on the ship remained in seaworthy condition," HHI said in a statement. "Routine inspection over the past decade should have identified a wire that came loose over time."

NTSB has recommended that the shipbuilder should "incorporate proper wire-label banding installation methods into [its] electrical department’s standard operating procedures" to ensure that wires can be fully inserted in terminal connections. It has also advised the vessel operator to incorporate "the use of infrared thermal imaging for routine monitoring of electrical components" in order to detect poor terminal connections during a vessel's service life.

Configuration errors

The loose wire tripped the breaker, but several additional configuration choices caused the situation to spiral.

First, the breakers for the vessel's two transformers were set to manual mode, and so the shutdown of transformer 1 did not automatically prompt a switchover to transformer 2. If they had been in automatic mode, the initial blackout would have been shortened from 58 seconds to 10 seconds, giving the crew more time to react, NTSB said.

Second, the engine control system was set up to shut off the main engine if cooling water pressure dropped. When the cooling water pump shut off, this automatic safety system shut down the main engine to avoid damage, per class rules at the time of the vessel's construction. Though this met original class requirements, it "endangered the vessel because it prevented the main engine from being available following the initial underway blackout, thus reducing the vessel’s maneuverability," NTSB concluded. The agency called for more research on redundant / backup power systems to ensure that the ship maintains emergency maneuvering capabilities.

Third, the crew had been using a flushing pump to supply fuel oil pressure to the auxiliary engines. The pump was not designed for this purpose, and was not set up to restart automatically when emergency generator power came back online. The pump was located two decks below the engine control room, too far away to access and restart manually in an emergency. Fuel pressure for the auxiliaries dropped, they shut down, and the vessel went into a second blackout - just as it approached the bridge pier. This pump configuration was not approved by class, according to NTSB.

"Using the flushing pump as a fuel supply pump sacrificed both redundancy and automation of the fuel supply system and violated established classification rules," said shipbuilder HHI in a statement, agreeing with NTSB's assessment. "Had the shipowner and operator used the ship’s transformer in automatic mode and the fuel supply system as designed and manufactured, power would have been restored within seconds, and the second blackout, which led to the tragedy, would not have happened."

Fourth, NTSB noted serious issues with the software of the vessel's Voyage Data Recorder, or "black box." The manufacturer's proprietary playback software limited access to just 36 hours of bridge audio data. To get more, NTSB extracted its memory and took it to the VDR OEM's headquarters, where the data was pulled out in a painstaking process over the course of a day and a half, then reassembled from thousands of one-minute snippets.

"The functional limitations of the software posed barriers to the NTSB’s efficient extraction and analysis of VDR data from the accident in the time-critical early stages of the investigation," the agency said. "While IMO regulations require that a VDR continuously records audio for at least 30 days, the . . . software made exporting the full 30-day audio dataset with commercially available software unfeasible."

Lastly, NTSB noted that the Francis Scott Key Bridge was not equipped to survive a vessel strike of a modern ship like Dali. The bridge had been hit before in 1980, but the ships of that earlier era were small, and the bridge's light fendering had been enough for protection. The replacement bridge will have to be built to a more robust standard for surviving contact with a Post-Panamax boxship, and NTSB has notified all owners of similarly vulnerable bridges to implement long-known safety standards for allision protection.