At least six killed as protests against Iran's worsening economy spread beyond cities

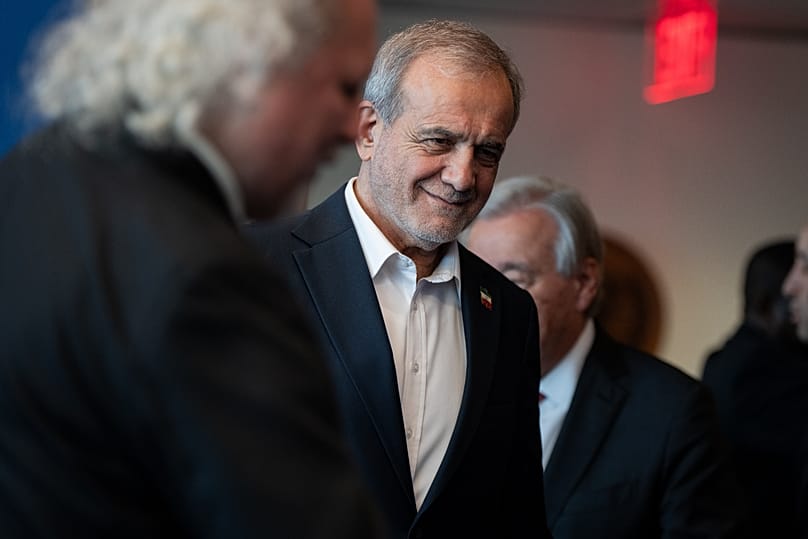

Iran's President Masoud Pezeshkian says there is not much he can do as the currency has rapidly depreciated, with $1 now trading at around 1.4 million rials.

At least six people have been killed in widening protests against Iran's worsening economy, authorities said on Thursday, as demonstrations spread outside major cities into rural provinces.

The protests have become the biggest in Iran since 2022, when the death of 22-year-old Mahsa Amini in police custody triggered nationwide demonstrations.

However, the demonstrations have yet to be countrywide and have not been as intense as those surrounding the death of Amini, who was detained over allegedly wearing her hijab incorrectly.

The most-intense violence appeared to strike Azna, a city in Iran's Lorestan province, some 300 kilometers southwest of Tehran.

There, online videos purported to show objects in the street ablaze and gunfire echoing as people shouted: "Shameless! Shameless!"

The semi-official Fars news agency reported three people had been killed. State-run media did not fully acknowledge the violence there or elsewhere.

It wasn't clear why there wasn't more reporting over the unrest, but journalists had faced arrest over their reporting in 2022.

The US-based Abdorrahman Boroumand Center for Human Rights in Iran said two people had been killed in Lordegan, identifying the dead as demonstrators.

It also shared a still image of what appeared to be an Iranian police officer, wearing body armour and wielding a shotgun.

Iran's government-run media did not immediately report on the violence in Lordegan.

In 2019, the area around Lordegan saw widespread protests, and demonstrators reportedly damaged government buildings after a report said people there had been infected with HIV by contaminated needles used at a local clinic.

Protests due to economic pressures

A separate demonstration on Wednesday night reportedly led to the death of a 21-year-old volunteer in the Revolutionary Guard (IRGC) Basij force.

The state-run IRNA news agency reported on the IRGC member’s death but did not elaborate.

An Iranian news agency called the Student News Network, which is believed to be close to the Basij force, directly blamed demonstrators for the death, citing comments from Saeed Pourali, a deputy governor in Iran's Lorestan province.

Another 13 Basij members and police officers suffered injuries, he added.

"The protests that have occurred are due to economic pressures, inflation and currency fluctuations, and are an expression of livelihood concerns," Pourali said.

"The voices of citizens must be heard carefully and tactfully, but people must not allow their demands to be strained by profit-seeking individuals."

Record currency fall

Iran's civilian government under reformist President Masoud Pezeshkian has been trying to signal it wants to negotiate with protesters.

However, Pezeshkian has acknowledged that there is not much he can do as Iran's rial currency has rapidly depreciated, with $1 now trading at around 1.4 million rials.

Meanwhile, state television separately reported on the arrests of seven people, including five it described as monarchists and two others it said had linked to European-based groups.

State TV also said another operation saw security forces confiscate 100 smuggled pistols, without elaborating.

Iran's theocracy had declared Wednesday a public holiday across much of the country, citing cold weather, likely as a bid to get people out of the capital for a long weekend.

The protests, taking root in economic issues, have heard some demonstrators chant slogans against Iran's leadership as well.

Bazaar Strikes Spread To More Cities On

Day 4: Regime Opens Fire On Protesters In

Fasa – OpEd

By Mahmoud Hakamian

On Wednesday, December 31, 2025, the nationwide uprising of Iranian market merchants and youth entered its fourth consecutive day, intensifying in scope and ferocity. What began as an economic protest against the collapse of the national currency has rapidly transformed into a full-scale political confrontation with the clerical regime. Reports from across the country indicate that strikes have spread from the capital, Tehran, to major provincial hubs and smaller cities, defying a heavy security crackdown.

The situation escalated significantly in Fasa, Fars Province, where security forces opened fire on protesters who had stormed the governorate building. The regime’s attempt to quell the unrest with brute force, coupled with hollow promises of “dialogue,” appears to have only fueled the public’s resolve, as the traditional economic backbone of society joins the call for regime change.

Escalation and clashes: The battle for Fasa

On Wednesday, the city of Fasa became a flashpoint for the uprising. According to reports from the scene, the protests turned into a direct confrontation with suppression forces. Defiant youth and outraged citizens gathered in front of the governorate building, chanting slogans against the government. The situation deteriorated when protesters managed to break down the doors of the governorate and enter the building.

In a desperate bid to regain control, Islamic Revolutionary Guard Corps (IRGC) units and security forces opened fire on the unarmed crowds. Video footage and reports indicate that agents fired directly at protesters. Despite the use of live ammunition, the people of Fasa continued to resist, forcing some armed security units to retreat in certain areas. To instill fear, the regime deployed military helicopters to patrol the skies over the city.

While the state-run Mehr News Agency, quoting an “informed source,” denied any deaths and claimed the situation was “managed,” they admitted that protesters had breached the entrance of the governorate. However, local reports suggest casualties.

Nationwide strikes: The bazaar stands still

While street clashes erupted in Fasa, the economic heart of Iran remained in a state of paralysis. In Tehran, the Grand Bazaar saw a heavy deployment of security forces, particularly in the Hammam-Chal district and near the Parsian Passage. Reports indicate that the regime has flooded the market with agents to the point where even two people standing together are dispersed. Security forces fired tear gas in the Delgosha Passage to break the resolve of the merchants, but the strike held firm.

Merchants in Tehran are paying a heavy price for their defiance. Shopkeepers in prime locations, who face monthly rents between 1.5 billion and 2.5 billion rials, are incurring daily losses of 100 to 150 million rials by keeping their shutters down. Yet, as one report noted, “This is real protest; when the entire market is in a state of strike and resistance.”

The strikes were not limited to the capital.Kermanshah: A total strike was observed across the Gold Market, Modarres Passage, Valiasr Passage, and the Islamic Bazaar. The regime deployed a line of suppression forces stretching approximately 8 kilometers from Ferdowsi Square to the Garage area. Reports confirmed the brutal beating of a shopkeeper near the Arg Passage, proving that the regime’s talk of “dialogue” is merely a cover for violence.

Isfahan: Strikes hit the mobile phone market on Bozorgmehr Street and areas around Naqsh-e Jahan Square. A brave woman was filmed shouting “Death to the Oppressor” in the city center.

Shiraz: The Vakilabad bazaar and markets on Kazemi Street were largely closed.

Other Cities: Complete or partial strikes were reported in Tabriz (where merchants were threatened with arrest), Ramhormoz, Asadabad (Hamadan), Shirvan (where teachers joined the protests), Dorud, Yasuj, Arak, Dehloran, Kuhdasht, Ganaveh, and Dargahan (Qeshm).

Regime’s panic: Militarization and hollow threats

The rapid spread of the uprising has triggered panic within the regime’s leadership. In a significant move on Wednesday, Supreme Leader Ali Khamenei appointed IRGC Brigadier General Ahmad Vahidi as the Deputy Commander of the IRGC. Vahidi is a notorious figure, the first commander of the terrorist Quds Force, and is wanted internationally for his role in the AMIA bombing in Argentina. His appointment signals the regime’s intent to crush the protests with military force.

Financial software

Simultaneously, the regime is attempting to prevent university students from joining the uprising. Beheshti and Allameh Tabataba’i universities in Tehran announced that all classes would be held online until the end of the term, citing “cold weather” and “energy shortages.” Student organizations have dismissed these reasons as excuses to empty campuses and prevent gatherings.

On the judicial front, Prosecutor General Mohammad Movahedi-Azad warned protesters that any action deemed as “security disruption” would be met with “decisive action.” Furthermore, the Basij organization announced “neighborhood-centered” drills scheduled to run from January 3 to April 2026, a clear attempt to militarize residential areas and intimidate the public.

Economic collapse fueling political fire

The current uprising is rooted in a catastrophic economic collapse. By late 2025, the value of the US dollar reached approximately 1,450,000 rials, and the official annual inflation rate surpassed 42 percent. Food prices have soared by 72 percent, destroying the purchasing power of the people and the viability of businesses. The elimination of subsidies and the introduction of a triple-tiered fuel pricing system have further enraged the public.

However, the slogans chanted in the streets prove that the grievances have moved far beyond economics. In Izeh, the mother of executed protester Mojahed Korkor joined the crowds chanting “Death to Khamenei.” In Kermanshah, youth chanted “No Gaza, No Lebanon, My Life for Iran” and “Death to the oppressor, be it the Shah or the Leader.”

The Bazaar has now decisively turned against the regime. This shift represents a profound fracture in the regime’s traditional support base. As the government spokesperson speaks of “dialogue,” the people in the streets of Iran’s cities have a different answer: “Fire answers fire.”

Mahmoud Hakamian

Mahmoud Hakamian writes for The People’s Mojahedin Organization of Iran (PMOI), also known as Mujahedin-e-Khalgh (MEK)

Protests Push Iran Into a New Phase of Turmoil

- The sharp plunge of the Iranian rial and worsening inflation have sparked multi-day protests, market closures, and renewed anti-government chants across major cities.

- Analysts say Iran’s economic crisis is being exacerbated by international isolation and sanctions, limiting the government’s ability to stabilize the economy.

- Rising domestic unrest coincides with heightened external pressure, as U.S. President Donald Trump signals support for potential Israeli strikes tied to Iran’s missile and nuclear programs.

Iran's leadership is facing mounting pressure from abroad and emerging dissent from within as street protests over its reeling economy and the threat of a new round of military strikes hang over the country.

Demonstrations were reported in several cities, with markets and shops shuttered and students holding rallies at universities, on December 30.

This follows two days of demonstrations that saw security forces launch volleys of tear gas to disperse crowds. People were chanting anti-government slogans to protest a sharp weakening of the currency.

Third Day Of Closures

Videos posted on social media showed a third day of closures and demonstrations.

One video, verified by RFE/RL, showed protesters pushing back security forces in Tehran. Projectiles were thrown at the police, who appeared to fire tear gas at the crowd.

"We're in a new phase of turmoil in the country, which is the phase of the dollarization of the Iranian economy...which led to protests," Tehran-based political analyst Hamid Asefi told RFE/RL's Radio Farda.

"The situation in the bazaars and in the economy does not have a [bright outlook]. We can't say that in 4, 5 months everything will be back to normal," he added.

As Iran reeled from the street protests put down with tear gas and batons, a new threat was looming from across the Atlantic as US President Donald Trump hosted Israeli Prime Minister Benjamin Netanyahu at his Mar-a-Lago residence in Florida.

Asked whether he would support new Israeli military strikes on Iran if it continued with its missile program or nuclear program, Trump was unequivocal.

"If they will continue with the missiles -- yes; the [continuation of its] nuclear [program] -- fast. One will be 'yes, absolutely,' the other one, 'we'll do it immediately.'"

Moments earlier, Trump also noted the domestic challenges facing the Iranian authorities.

"They’ve got a lot of problems in Iran. They have tremendous inflation. Their economy is bust…and I know that people aren’t so happy. But don’t forget, every time they have a riot or somebody forms a group, little or big, they start shooting people,“ he said.

Iranian Rial Plunges Sharply

The Iranian rial is trading at around 1.4 million to the dollar, compared to around 800,000 a year ago, on unofficial markets. Official exchange rates are better but unavailable to many Iranian individuals and businesses.

Many stores have closed as traders shuttered their businesses in protest and joined the demonstrations.

"It's the bread and butter issues: Merchants don't know if they sell their goods today, will they be able to buy more goods and sell them? And if they're supposed to sell them at a huge loss, they come to the streets and make themselves heard," analyst Asefi said.

US-based Iranian political analyst Ali Afshari agreed, underlining the role of Iran's international isolation under US and UN sanctions in pummeling the economy.

"The government cannot resolve this issue fundamentally, it needs a change in foreign policy, which is very difficult due to the stances by the Trump administration," he told RFE/RL.

"It makes it hard to reach an agreement and as long as the sanctions are in place, Iran is isolated. In such a situation, it is very difficult to fix the economy," he added.

The poor state of the economy may not be the only factor driving the renewed protests in Iran.

Crowds were also chanting "death to the dictator," a slogan often heard during the mass nationwide Women, Life, Freedom protests that rocked the country in 2022.

Against this backdrop, the prospect of further strikes by Israel appears to have increased following Netanyahu's visit to Florida.

"They know the consequences. The consequences will be very powerful, maybe more powerful than the last time," Trump said, referring to the 12-day war in June, when Israel and the United States launched a bombing campaign targeting Iranian nuclear and military sites.

"To some extent Netanyahu has shifted the focus, spotlighting the missile threat as the next frontier of confrontation and as justification for potential military action," Sanam Vakil, head of the Africa and Middle East program at the London-based Chatham House think tank, told RFE/RL.

"This does not make military strikes more likely on their own, but it broadens the list of possible triggers and rationales for future action.... Heavy blows to military infrastructure could rally nationalist sentiment around the regime, even as they exacerbate economic and political pressures," she added.

Officials in Tehran have responded to the twin challenges with threats and appeals.

Ali Shamkhani, a senior adviser to Supreme Leader Ayatollah Ali Khamenei, responded to the comments by saying any attack on Iran would prompt "an immediate harsh response."

"Under Iran's defense doctrine, responses are set before threats materialize," Shamkhani wrote on X on December 29, adding that Iran's missile capability? and defense are not "containable or permission-based."

Iranian President Masud Pezeshkian said "the response of the Islamic Republic of Iran to any oppressive aggression will be harsh and regrettable."

Earlier, he said he had asked the Interior Ministry to listen to protesters' "legitimate demands through dialogue with their representatives" -- a different approach than that adopted by security forces in Tehran in recent days.

By RFE/RL

Iranian president urges government to listen to protesting shopkeepers' demands

Iran's President Masoud Pezeshkian said on Tuesday he had asked the interior ministry to "listen to the legitimate demands" of protesters after several days of demonstrations by shopkeepers in Tehran. Student protests also broke out on Tuesday as Iran's embattled currency hit new lows on the unofficial market, state media reported.

Issued on: 30/12/2025

By: FRANCE 24

04:10

Iran's president urged his government to listen to the "legitimate demands" of protesters, state media reported Tuesday, after several days of demonstrations by shopkeepers in Tehran over economic hardships.

Shopkeepers in the capital had shut their stores for the second day in a row on Monday, after Iran's embattled currency hit new lows on the unofficial market.

They were joined on Tuesday by students protesters joining demonstrations in universities in the capital Tehran and the central city of Isfahan, decrying declining living standards, local media reported.

"Demonstrations took place in Tehran at the universities of Beheshti, Khajeh Nasir, Sharif, Amir Kabir, Science and Culture, and Science and Technology, as well as the Isfahan University of Technology," reported Ilna, a news agency affiliated with the labour movement.

The US dollar was trading at around 1.42 million rials on Sunday – compared to 820,000 rials a year ago – and the euro nearing 1.7 million rials, according to price monitoring websites.

"I have asked the Interior Minister to listen to the legitimate demands of the protesters by engaging in dialogue with their representatives so that the government can do everything in its power to resolve the problems and act responsibly," President Masoud Pezeshkian said, according to the state-run IRNA news agency.

Protesters "are demanding immediate government intervention to rein in exchange-rate fluctuations and set out a clear economic strategy", the pro-labour news agency ILNA reported Monday.

Price fluctuations are paralysing the sales of some imported goods, with both sellers and buyers preferring to postpone transactions until the outlook becomes clearer, AFP correspondents noted.

"Continuing to do business under these conditions has become impossible," ILNA quoted protesters as saying.

The conservative-aligned Fars news agency released images showing a crowd of demonstrators occupying a major thoroughfare in central Tehran, known for its many shops.

Another photograph appeared to show tear gas being used to disperse protesters.

"Minor physical clashes were reported ... between some protesters and the security forces," Fars said, warning that such gatherings could lead to instability.

Battered economy

Iranian Chief Justice Gholamhossein Mohseni Ejei called for "the swift punishment of those responsible for currency fluctuations", the justice ministry's Mizan agency reported Monday.

The government has also announced the replacement of the central bank governor.

"By decision of the president, Abdolnasser Hemmati will be appointed governor of the Central Bank," presidency communications official Mehdi Tabatabaei posted on X.

Hemmati is a former economy and finance minister who was dismissed by parliament in March because of the sharp depreciation of the rial.

Pezeshkian delivered on Sunday the budget for the next Persian year to parliament, vowing to fight inflation and the high cost of living.

In December, inflation stood at 52 percent year-on-year, according to official statistics. But this figure still falls far short of many price increases, especially for basic necessities.

The country's economy, already battered by decades of Western sanctions, was further strained after the United Nations in late September reinstated international sanctions linked to the country's nuclear programme that were lifted 10 years ago.

Western powers and Israel accuse Iran of seeking to acquire nuclear weapons, a charge Tehran denies.

(FRANCE 24 with AFP)

Iranian government acknowledges protests, vows to fix economy, currency crisis

Iran’s government spokeswoman said she recognised nationwide protests over living costs, in a bid to cool tensions which have been running high in recent hours due to the collapse in the country's currency and rampant inflation.

As part of indirect efforts to calm the situation, authorities ordered a one-day shutdown of Tehran and other provinces, and the president moved to soften a contentious 2026 budget.

In unusually explicit remarks, government spokeswoman Fatemeh Mohajerani said the administration “sees and recognises” both protests and economic hardship, framing the demonstrations as livelihood-driven rather than political.

Iran's President Masoud Pezeshkian also signalled readiness to amend fiscal plans for the upcoming year to contain inflation and shore up social support, marking a change in tactic for the Islamic Republic, which has historically cracked down on street protests with deadly consequences.

The change in tone aims to de-escalate tensions after protests by traders and shopkeepers over the collapsing rial spread across central Tehran on December 28, 29, coinciding with leadership turmoil at the Central Bank and mounting pressure over the draft 1405 (March 2026–March 2027) budget.

Speaking at a televised news conference in Tehran on December 30, Mohajerani said the Interior Ministry had been instructed to establish “dialogue mechanisms” with protesters and stressed the government viewed peaceful assembly as a right.

She added, “A 20-point programme [to change economic direction] covers four axes: improving livelihoods, controlling inflation, managing the market, and improving economic growth.”

Even “sharp voices”, she said, would be heard with patience, a tacit acknowledgement of the anger visible on the streets. “If people are speaking out, it means the pressure on them is heavy.”

She noted inflation remained “high” and said the government did not defend the status quo. While the state spends “billions of dollars” on subsidies, she admitted much of the support fails to reach households effectively.

Tehran is now seeking parliamentary approval to shift subsidies from the start of supply chains to the consumer end, with a mix of food baskets and credits to be finalised this week. No figures were disclosed.

On inflation control, Mohajerani blamed chronic budget deficits and banking imbalances, pledging tighter spending discipline to year-end and more orderly allocations next year.

She also said curbing excessive bank borrowing from the Central Bank was a priority, signalling resistance to further bond issuance that could rattle capital markets.

Earlier in the day, authorities announced a wide shutdown of Tehran and other provinces on Wednesday, December 31, citing extreme cold and energy management.

All government offices, schools, universities, banks and commercial centres will close, except for emergency services, with university exams proceeding.

Officials urged residents to cut consumption to avoid power cuts and gas shortages.

Similar remote-working or virtual measures were rolled out in several other provinces as temperatures plunged below freezing, a move that some Iranians privately linked to security concerns following protests, though officials framed it strictly as an energy decision.

The political system also moved to close ranks. In a letter sent earlier on December 30, Pezeshkian told parliament speaker Mohammad Bagher Ghalibaf he agreed to five “livelihood and economic” amendments to the 1405 budget, including higher pay for public employees and pensioners, adjustments to income-tax thresholds favouring lower earners.

.jpg)