World Nuclear News

US enrichment companies end 2025 on high note

_29069.jpg)

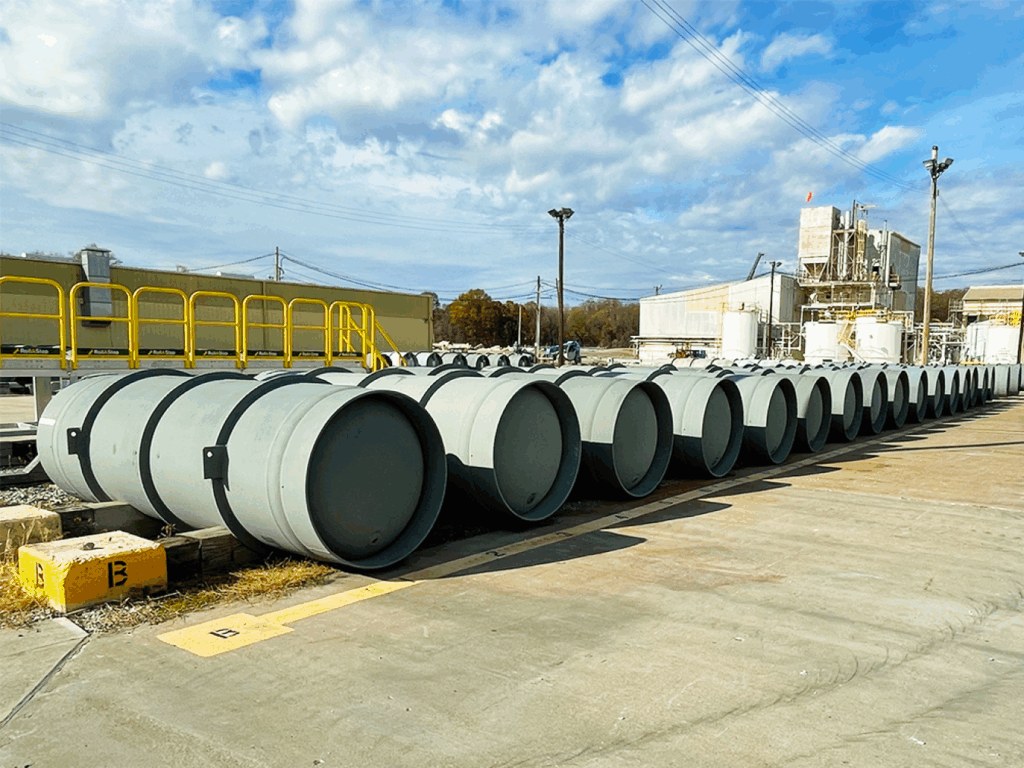

Centrus announced on 19 December that it had started manufacturing centrifuges at its centrifuge manufacturing factory in Oak Ridge, Tennessee - relying on a domestic manufacturing supply chain - to support commercial low-enriched uranium (LEU) enrichment activities at its facility at Piketon, Ohio. The first new production capacity is expected to come online in 2029.

This is part of a multi-billion-dollar uranium enrichment capacity expansion which is underpinned by funding from the Department of Energy via task orders for the production of LEU and high-assay low-enriched uranium (HALEU), private capital, commercial contracts and third-party investments.

Centrus Energy CEO and President Amir Vexler described the official start of "industrial-scale centrifuge manufacturing build for commercial LEU enrichment" as an "historic step" for the company. "We make this announcement after carefully evaluating the business's internal and external progress as well as its future prospects and many competitive advantages. These include the significant progress in building our supply chain; the advancement across the many available avenues to acquire low-cost of capital to support our build, including imminent DOE funding announcements; and, evaluating the progress in our internal manufacturing capabilities," he said.

The USA's last domestically owned commercial uranium enrichment capacity, the Paducah gaseous diffusion plant in Kentucky, closed in 2013, leaving the Urenco USA (UUSA) plant at Eunice in New Mexico as the only commercial enrichment capacity in the USA - a plant using a European centrifuge design manufactured in the Netherlands. This has left the USA dependent on overseas enterprises. But with demand for nuclear power expected to grow in the coming years - and a complete ban on US imports of Russian enriched uranium from 2028 - "new domestic, US-owned uranium enrichment capacity is urgently needed and in high demand", the company said. A fully domestic source of enriched uranium is also needed to fulfil national security missions - and Centrus says its AC100M centrifuge is the only deployment-ready US-origin enrichment technology that can currently meet that need.

The expansion programme is expected to support thousands of direct and indirect jobs in Ohio, Tennessee, and across the country.

Economic benefits

Meanwhile, a new report by Oxford Economics has found that the operations of Urenco USA contributed more than USD360 million to the US economy in 2024-2025 and supported more than 1,700 jobs in total at the UUSA plant and elsewhere in the USA. The company also purchased some USD68.6 million worth of goods and services from US suppliers.

The report, using 2024 data, was commissioned by Urenco USA to quantify its impact at the local, state, and national level as it looks to make further investments in the site in future years, including adding new capacity and constructing new facilities, the company said.

"From fuelling reliable electricity production across the country to inspiring the next generation in our local schools, Urenco USA and our employees make substantial contributions at a local, regional, and national level, as evidenced by the results seen in the Oxford Economics report," Managing Director John Kirkpatrick said.

The study was released in the same month that Urenco USA completed its first production run of low-enriched uranium plus, or LEU+ - material enriched to 8.5% in the fissile uranium-235 isotope - and also started up a new cascade of centrifuges that are part of a programme to install 700,000 separative work units (SWU) of capacity by 2027 at the New Mexico plant.

US awards $2.7 billion worth of orders to boost uranium enrichment

The US Energy Department announced on Monday it was awarding orders totaling $2.7 billion to three companies to boost domestic uranium enrichment over the next 10 years in a broader effort to reduce US dependence on Russian supply.

American Centrifuge Operating, General Matter and Orano Federal Services secured the orders, the department said in a statement.

The contracts would require the companies to meet specific milestones to provide enrichment services for low-enriched uranium and high-assay low-enriched uranium, or HALEU, for existing nuclear power plants and new, smaller modular reactors.

“Today’s awards show that this Administration is committed to restoring a secure domestic nuclear fuel supply chain capable of producing the nuclear fuels needed to power the reactors of today and the advanced reactors of tomorrow,” Secretary of Energy Chris Wright said.

Russia is currently the only country that makes HALEU – uranium enriched to between 5% and 20%, which is said to make new high-tech reactors more efficient – in commercial volumes. Funds to make the fuel domestically in the United States were included in a law to ban uranium shipments from Russia fully by 2028.

The DOE awarded American Centrifuge Operating, a subsidiary of Centrus Energy, and General Matter, backed by tech billionaire Peter Thiel, with $900 million each to develop domestic HALEU enrichment capacity. It awarded Orano Federal Services with $900 million to expand domestic low-enrichment uranium production.

The Energy Department separately awarded an additional $28 million to Global Laser Enrichment, part-owned by Canadian uranium company Cameco, to further its work to build next-generation uranium enrichment technology for the nuclear fuel cycle.

Global Laser Enrichment had sought a $900 million award.

HALEU’s critics say it is a weapons risk if it gets into the wrong hands and recommend limiting enrichment to between 10% and 12% for safety. Uranium fuel used in today’s reactors is enriched to about 5%.

(By Valerie Volcovici and Costas Pitas; Editing by Susan Heavey and Nia Williams)

Denison ready to start construction at Canadian uranium project

Denison Mines Corporation says it is ready to make a final investment decision and begin construction of the Phoenix In-Situ Recovery uranium mine, with first production expected by mid-2028.

_77863.jpg)

Regulatory, engineering, and construction planning progress over the past year has positioned Phoenix in a "construction-ready state", the company said, and has confirmed an expected 2-year construction timeline. Provided final regulatory approvals to commence construction are received in the first quarter of 2026, "targeted first production remains on track for mid-2028".

The company has also issued an updated estimate of post-final investment decision (FID) initial capital costs for the project, of CAD600 million (USD437 million). The updated capital expenditure figure is a 20% increase relative to the previous estimate in the 2023 Phoenix feasibility study, when adjusted for inflation, but the project is now in a construction-ready state and no further adjustments to the figure are expected prior to commencement of construction, the company said.

Denison President and CEO David Cates said the company "stands ready" to make the FID and begin construction of the mine following the recent conclusion of a Canadian Nuclear Safety Commission public hearing and receipt of an initial approval to commence construction activities from the Province of Saskatchewan.

"Owing to years of work de-risking and advancing Phoenix, the project is now ready to become the first new large-scale uranium mine built in Canada since Cigar Lake, with first production expected by mid-2028," he said, adding that the timeline positions Phoenix to benefit from an anticipated acceleration in uranium demand based on increasingly widespread global adoption of nuclear energy, as well helping reinvigorate Canada's natural resources sector.

"Based on our strong balance sheet, and the advanced state of project engineering, construction planning, and procurement activities, we are confident that we will be able to make a positive final investment decision following receipt of final regulatory approvals. While our estimate of initial capital costs has increased modestly from the 2023 Phoenix feasibility study, it is important to note that the project is now ready for construction, continues to have only a two-year construction schedule, and that the updated costs are the basis for our project Control Budget - meaning that there are no further revisions expected prior to the commencement of construction," Cates said.

Phoenix is part of the Wheeler River project, described by Denison as the largest undeveloped uranium project in the infrastructure-rich eastern portion of the Athabasca Basin region, in northern Saskatchewan. The project is host to the high-grade Phoenix and Gryphon uranium deposits, discovered by Denison in 2008 and 2014, respectively, and is a joint venture between Denison (90%) and JCU (Canada) Exploration Company Limited (10%). Denison is the operator.

In-situ recovery (ISR) - also referred to as in-situ leach - is a method of recovering uranium minerals from ore in the ground by dissolving them in situ, using a mining solution injected into the orebody. The solution is then pumped to the surface, where the minerals are recovered from the uranium-bearing solution. More than half of the world's uranium production is now produced by such methods. The technique - which requires a geologically suitable orebody - has not so far been used in Canadian uranium operations, although in addition to the Phoenix deposit Denison has been investigating the potential for using ISR at other Canadian projects including the Heldeth Túé uranium deposit at Waterbury Lake and the Midwest Main project.

China begins construction of two new nuclear power units

_30199.jpg)

The construction of Phase I (units 1 and 2) of the Bailong plant was among approvals for 11 new reactors granted by China's State Council in August 2024. State Power Investment Corporation (SPIC) plans to build two CAP1000 pressurised water reactors - the Chinese version of the Westinghouse AP1000 - as the first phase of the plant. An investment of about CNY40 billion (USD5.6 billion) is planned for the two units, which are expected to take 56 months to construct. Excavation of about 66,000 cubic metres of earth to form the foundation pit - which will eventually be 12.2 metres deep and cover an area of about 3000 square metres - began in late December 2024.

SPIC subsidiary Shanghai Nuclear Engineering Research & Design Institute (SNERDI) - joint general contractor for the project - announced it poured the first concrete on 22 December for the basemat of the nuclear island at Bailong unit 1. The company said a total of a 6,662 cubic metres of concrete was poured in a process lasting just over 64 hours.

.jpg)

(Image: SNERDI)

Located on Jiangshan Peninsula in Fangchenggang City, Guangxi Province, the Bailong plant is planned to have six units, with a total installed capacity of 8.62 GWe and a total investment of approximately CNY120 billion. The first phase of the project adopts the CAP1000 design, with each unit having a capacity of 1.25 million kilowatts. Four CAP1400 reactors are also proposed to be built at the site - located about 24 kilometres from the border with Vietnam and about 30 kilometres southwest of China General Nuclear's Fangchenggang nuclear power plant - in later phases.

After the first phase of the project is completed and put into operation, it is expected to generate about 20 billion kilowatt-hours of electricity per year, which is equivalent to reducing standard coal consumption by about 6 million tonnes and carbon dioxide emissions by about 16 million tonnes per year. "It will play a positive role in optimising Guangxi's energy structure and promoting energy conservation and emission reduction, and provide stable and reliable clean energy support for Guangxi to accelerate the construction of a national comprehensive energy security zone and serve the high-quality development of ethnic minority areas," SPIC said.

SNERDI also poured the first concrete for the nuclear island basemat of Lufeng unit 2 on 22 December.

.jpg)

(Image: SNERDI)

The proposed construction of four 1250 MWe CAP1000 reactors (units 1-4) at the Lufeng site was approved by China's National Development and Reform Commission in September 2014. However, the construction of units 1 and 2 did not receive State Council approval until August 2024. Approval for units 3 and 4 is still pending. First concrete for unit 1 was poured in February last year.

Contractor China Nuclear Construction Corporation 22 (CNI22) said about 6,635 cubic metres of concrete was expected to be poured in a process lasting about 68 hours to form the foundation of unit 2's nuclear island, measuring about 89 metres long and 49 metres at its widest point.

.jpg)

(Image: SNERDI)

The Lufeng plant - located in Jieshi Town, Lufeng City, Guangdong Province - is planned to eventually have six 1,000-megawatt pressurised water reactor units.

In April 2022 the State Council approved construction of two HPR1000 (Hualong One) units at Lufeng as units 5 and 6. First concrete was poured for unit 5 on 8 September 2022 and that for unit 6 on 26 August 2023.

"Upon completion, [the plant] will further optimise the regional energy structure, alleviate power supply pressure, and provide a continuous and stable supply of clean energy for the economic development of the Greater Bay Area," CNI22 said.

Chinese reactor enters commercial operation

_72306.jpg)

On 1 January, the 1126 MWe (net) domestically-designed pressurised water reactor completed a series of commissioning tests, including a test run lasting 168 hours, the China National Nuclear Corporation (CNNC) subsidiary said. "This marks the full completion and commissioning of the first phase of the Zhangzhou nuclear power project, making an important contribution to optimising the national energy structure and achieving the 'dual carbon' goal."

China's Ministry of Ecology and Environment issued construction licences for Zhangzhou units 1 and 2 on 9 October 2019 to CNNC-Guodian Zhangzhou Energy Company, the owner of the Zhangzhou nuclear power project, which was created by CNNC (51%) and China Guodian Corporation (49%) in 2011. Construction of unit 1 began one week after the issuance of the construction licence, with that of unit 2 starting in September 2020. Zhangzhou 1 entered commercial operation on 1 January last year.

The loading of nuclear fuel into Zhangzhou 2 began on 11 October 2025 and the reactor achieved its first criticality on 3 November. It was connected to the grid on 22 November.

.jpg)

The Zhangzhou site (Image: CNNC)

Once fully completed, the six-unit Zhangzhou plant is expected to provide over 60 billion kilowatt-hours of clean energy annually, estimated to meet 75% of the total electricity consumption of Xiamen and Zhangzhou cities in southern Fujian.

China Nuclear Power Corporation said that following the start of commercial operation of Zhangzhou 2, the number of operating nuclear power units controlled by the company has increase to 27, with the installed capacity increasing from 25,000 MWe to 26,212 MWe.

Gantry crane delivered for Atucha 2's dry storage project

The crane was developed by IMPSA, based on a technical specification from Nucleoelectrica.

Installation and commissioning of the equipment is scheduled to take place over a four-month period this year.

According to Nucleoelectrica, the dry storage facility is now 38% complete and is "essential ... to ensure the future operation of Atucha 2 and to guarantee the responsible management of nuclear fuel". It said that the capacity of the current storage pools at the site is scheduled to be reached in December 2027.

The company says that the high-strength concrete base has been completed and "construction is progressing on system components, including containers, shielded lids, and supporting steel structures".

It said the new facility is designed with passive ventilation, which will ensure temperatures remain within safe ranges without the need for electrical power or human intervention. The gantry crane has been designed to ensure the ability to safely handle and place the storage containers for used nuclear fuel during dry storage operations.

A dry fuel storage facility for the Atucha 1 nuclear power plant was opened in 2022 to store fuel assemblies used in the pressurised heavy water reactor.

Situated about 100 kilometres northwest of Buenos Aires, Atucha 1 has been generating electricity since 1974. The fuel bundles used by unit 1 of the plant had previously been stored within the reactor building, but a decision was made to increase the storage space available as part of a project to increase its service life.

Atucha 2 is a 693 MWe pressurised heavy water reactor and was ordered in 1979. It was a Siemens design, a larger version of the first unit at Atucha, and construction started in 1981 by a joint venture of Argentina's National Atomic Energy Commission and Germany's Siemens-Kraftwerk Union. However, work proceeded slowly due to lack of funds and was suspended in 1994 with the plant 81% complete.

In 1994, Nucleoeléctrica Argentina was set up to take over the nuclear power plants from CNEA and oversee construction of Atucha 2. In 2003, plans for completing Atucha 2 were presented to the government. The government announced a strategic plan in August 2006 for the country's nuclear power sector, including completion of Atucha 2. The unit was effectively completed in September 2011. First criticality was achieved early in June 2014, and grid connection was later that month, with full power in February 2015.

Fourth shell of BREST-OD-300 peripheral cavity installed

Ivan Babich, from the Experimental and Demonstration Energy Complex at the Siberian Chemical Combine, said: "At the moment, the pressure vessel of the BREST-OD-300 reactor block is approximately 70% assembled."

He said that during 2026 the lead coolant circulation circuit will be formed, the vessel concrete will be completed, and all major internal devices will be installed. "Completion of the reactor vessel assembly is scheduled for the end of 2026," he added.

The next stage will see the reactor's peripheral cavities connected to the central cladding, which was installed in September, forming a closed circuit for the lead coolant circulation. This circuit will eventually house steam generators, main circulation pumps, coolant purification system equipment, and other internal reactor equipment. The central cladding is designed to accommodate the core basket and fuel assemblies, Rosatom said.

The BREST-OD-300 reactor has an integral layout - its vessel is not an all-metal structure, instead it is a metal-concrete structure with the space between the cavities gradually filled with concrete during construction. Because of its large size, it can only be delivered in parts, with assembly only possible at the construction site.

The background

The BREST-OD-300 fast reactor is part of Rosatom's Proryv, or Breakthrough, project to enable a closed nuclear fuel cycle. The 300 MWe unit will be the main facility of the Pilot Demonstration Energy Complex at the Siberian Chemical Combine site. The complex will demonstrate an on-site closed nuclear fuel cycle with a facility for the fabrication/re-fabrication of mixed uranium-plutonium nitride nuclear fuel, as well as a used fuel reprocessing facility.

Recent progress updates included the news in October that the last roofing truss had been moved into place on the turbine hall and the metal shell for the central cavity- which weighs 143 tonnes and is more than 14 metres tall with a diameter of 8 metres - had been installed in place. The four perpheral cavity shells were all installed during December.

Initial operation of the demonstration unit will be focused on performance and after 10 years or so it will be commercially oriented. The plan has been that if it is successful as a 300 MWe (700 MWt) unit, a 1200 MWe (2800 MWt) version will follow - the BR-1200.

First Kursk II unit connected to the grid

The power unit's capacity will be gradually increased in steps, with safety tests and checks, to 35-40%. This will be followed by a lengthy period of increasing it to 100%.

The VVER-TOI pressurised water reactor has a capacity of 1,250 MW - higher than previous generations of VVER reactors. Rosatom says the service life of the main equipment has doubled, and it features a mix of passive and active safety systems and includes a core meltdown localiser.

The construction of the Kursk II power plant will more than replace the capacity of the four RBMK-1000 units at the Kursk plant as they come to the end of their lives.

Rosatom Director General Alexei Likhachev said: "The Kursk nuclear scientists deserve congratulations and thanks for such a wonderful New Year's gift, and the entire country for acquiring a new source of clean energy. Much work remains ahead for the Kursk residents. But the following can already be confirmed - the Kursk unit is the first embodiment of the latest VVER-TOI nuclear power unit design. This design not only incorporates the latest advances in nuclear energy. It is also the most powerful power unit in Rosatom's fleet: 1,250 MW, which is 50 MW more than the previous record-holders, the power units of Leningrad NPP-2."

Andrey Petrov, First Deputy Director General for Nuclear Energy at Rosatom and President of JSC ASE said: "Today's power start-up is the result of the hard work of tens of thousands of people - from those who poured the first concrete in 2018 to the engineers involved in the commissioning operations. Despite external threats, every specialist successfully completed their work, recognising their responsibility to the team and to the country. The new power unit will increase nuclear power generation by more than 50% to meet the needs of the Kursk Region and ensure the stable operation of the Central Asian Unified Energy System, guaranteeing its energy stability and confident progress."

Alexander Shutikov, CEO of Rosenergoatom, said: "The power unit's commissioning is proceeding according to plan. Comprehensive testing of the unit is currently under way, ensuring the required power level is reached. The equipment and systems must operate efficiently, reliably, and safely, as required by the process regulations. After all the process operations, we will confirm with Rostekhnadzor (Russia's nuclear regulator) that the unit's characteristics and physical parameters comply with modern nuclear energy standards and requirements."

Background

Kursk II is a new nuclear power plant in western Russia, about 60 kilometres (37.5 miles) from the Ukraine border, that will feature four VVER-TOI reactors, the latest version of Russia's large light-water designs. They have upgraded pressure vessels and a higher power rating of 3300 MWt that enables them to generate 1300 MWe gross. Construction of the first unit began in 2018, its polar crane was installed in October 2021 and the reactor vessel was put in place in June 2022. Concreting of the outer dome of the first unit was completed in August 2023. The second unit is also under construction and the target is for all four units to be in operation by 2034.

The new units will replace the four units at the existing, nearby Kursk nuclear power plant, which are scheduled to shut by 2031. The first unit was shut down after 45 years of operation in December 2021 and the second unit followed in January 2024. The original design life for the four RBMK-1000 reactors at the plant was for 30 years but had been extended by 15 years following life extension programmes.

Duke Energy submits early site permit application for nuclear project

_49562.jpg)

An early site permit - or ESP - is an optional process to confirm a site's suitability for new nuclear generation: possession of such a permit reduces the risk of delays during licensing and construction. The early site permit is technology neutral - a technology can be selected later in the development process - but Duke said its application includes six potential reactor technologies, including four small modular reactor (SMR) designs and two non-light-water designs. Large light-water reactors are not included in the permit application.

"We're taking a strategic approach to new nuclear development that allows us to advance licensing activities while reducing risks and allowing technologies to mature," said Duke Energy's Chief Nuclear Officer Kelvin Henderson.

An early site permit will provide "future optionality" for Duke's customers and the communities it serves, the company said, adding that - if additional evaluation confirms small modular reactor technology at the Belews Creek site offers the best value for customers - it plans to add 600 megawatts of advanced nuclear to the system by 2037, with the first reactor coming on line in 2036. An early site permit is valid for 10 to 20 years, and can be renewed for an additional 10 to 20 years, but would not allow the construction of a plant to begin - that would require a construction permit, or a combined construction and operation licence.

Submission of the application to the US Nuclear Regulatory Commission (NRC) marks the culmination of two years of work, Duke Energy said.

The NRC notified Duke in a letter dated 18 December that it had completed a pre-application readiness assessment of the draft site safety analysis report, environmental report and other supporting documents for the application.

In October, Duke Energy filed a resource plan with utility regulators proposing the evaluation of large light-water reactor technology, as well as small SMRs, to help meet growing electricity demand across North Carolina and South Carolina. The plan identifies the William States Lee III Nuclear Station site in Cherokee County, South Carolina, and the Shearon Harris Nuclear Plant site in Wake County, North Carolina, as those best suited for new large reactors.

The existing Belews Creek Steam Station is a two-unit plant on the shores of Belew Lake, in Stokes County, with a total capacity of 2200 MWe. It was built as a coal-fired plant, entering commercial operation in 1974, but is now co-fired on coal and natural gas (co-firing means the units can use either coal or natural gas, or a combination of these fuels). The current units are scheduled to retire in the late 2030s. Repurposing the site offers a cost-saving opportunity for customers, and enables Duke Energy to reinvest in the local community, the company has said.