Dave Levinthal

Sun, November 6, 2022

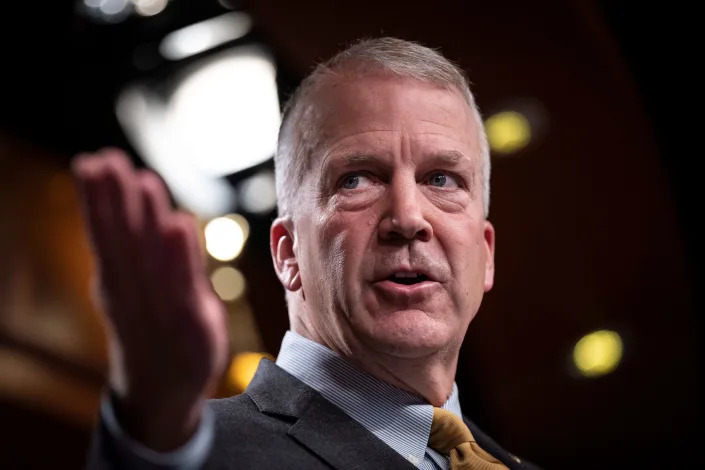

Republican Sen. Dan Sullivan,

Sen. Dan Sullivan, a Republican from Alaska, was weeks late disclosing two stock sales.

Sullivan's office told Insider that an investment manager was tardy informing the senator that the stock had been sold.

Since 2021, 75 members of Congress have violated the Stop Trading on Congressional Knowledge Act's disclosure provisions.

Republican Sen. Dan Sullivan of Alaska violated a conflicts-of-interest and transparency law by failing to disclose two stock sales until weeks past a federal deadline.

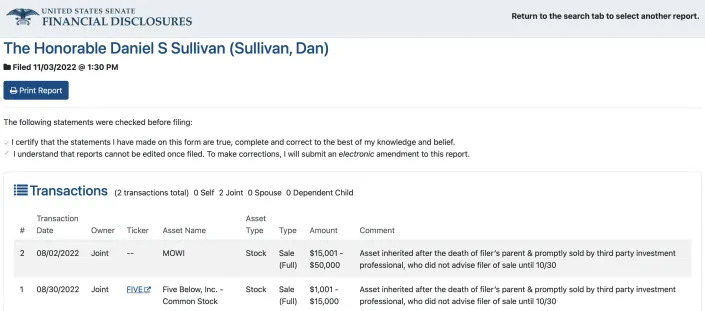

Sullivan affirmed in a financial disclosure filed with the US Senate that he inherited and sold $15,000 to $50,000 worth of stock in Mowi, a seafood company, on August 2, and $1,001 to $15,000 worth of stock in Five Below Inc., a discount store chain, on August 30.

But the senator did not publicly report the sales until November 3, well past a 45-day stock trade disclosure specified in the Stop Trading on Congressional Knowledge Act of 2012.

Congress created this law to curb insider trading among lawmakers and provide the American public with more information about public officials' personal financial dealings — and dozens of lawmakers have since violated it.

A personal financial disclosure filed on November 3, 2022, by Sen. Dan Sullivan, a Republican who represents Alaska.US Senate

In a statement to Insider, Sullivan spokesman Mike Reynard said that Sullivan wasn't aware of the sale of his stock until after a federal disclosure deadline had already passed.

"The two assets were inherited after the death of the Senator's parent and were promptly sold by the third party investment manager, who did not advise the senator until October 30," Reynard said.

Sullivan's mother, Sandy Sullivan, died in 2019, and his father, Tom Sullivan, died in 2020.

"As soon as the senator was made aware of the sale, the necessary steps were immediately taken" to file disclosure paperwork with the US Senate Select Committee on Ethics, "which has acknowledged receipt," Reynard said.

Reynard did not reply to a question about who the third-party investment manager is or why the investment manager didn't inform the senator of the stock sales until after a federal deadline for publicly disclosing the sales.

A potential stock trade ban in Congress

Since 2021, Insider and other media organizations have identified 75 members of Congress — a cross-section of Republicans and Democrats, leaders, and back-benchers — who've violated the STOCK Act's disclosure provisions by failing to properly report their various financial trades or holdings.

Two of those members — Democratic Reps. Bill Keating of Massachusetts and Lloyd Doggett of Texas — violated the STOCK Act within the past week.

Insider's ongoing "Conflicted Congress" project, along with reporting from The New York Times, Wall Street Journal, and Sludge, have also found numerous examples of financial conflicts of interests among federal lawmakers, judges, and executive branch officials.

Calls for reform have come from numerous quarters inside and outside of Congress. And in September, after months of deliberations, dickering, and delay, Democratic House leaders — backed by Speaker Nancy Pelosi — unveiled a bill that would ban members of Congress, as well as many other top government officials, from trading individual stocks. It would also strengthen the generally weak penalties for violating the STOCK Act.

But some Democrats and Republicans alike, as well as government reform groups, immediately lambasted it, either arguing that the bill is too broad or too riddled with loopholes, such as allowing lawmakers to create blind investment trusts that they don't consider truly blind.

House leadership ultimately punted on voting until after the midterm elections, meaning it'll be mid-November before debate on the stock-ban bill resumes in earnest.

Sullivan's office did not respond to Insider's question about whether the senator supports or opposes the House leadership bill.

Read the original article on Business Insider

No comments:

Post a Comment