CRIMINAL CRYPTO CAPITALI$M

FTT Token at Center of New US Charges in FTX CaseLyllah Ledesma

Thu, December 22, 2022

The U.S. Securities and Exchange Commission (SEC) has called FTX’s FTT exchange token a security. FTT was sold as an investment contract and is a "security," the SEC said in a complaint filed late Wednesday, in a move that is sure to have a wide-ranging impact on the industry. "If demand for trading on the FTX platform increased, demand for the FTT token could increase, such that any price increase in FTT would benefit holders of FTT equally and in direct proportion to their FTT holdings," the SEC wrote in its complaint.

Former Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang have pleaded guilty to criminal fraud charges tied to FTX's collapse. The SEC and Commodity Futures Trading Commission also announced charges against the two, saying Ellison manipulated the price of FTT. The duo are cooperating with investigators. The U.S. Attorney for the Southern District of New York did not specify what they were being charged with.

Twitter has integrated cryptocurrency prices into search results using a plug-in from charting platform TradingView. The integration allows users to type crypto or stock tickers into the search bar to generate the current value and a price chart. The result also includes a link to trading app Robinhood. The social media giant has had several ties to the crypto industry over the past few years, adding a tipping feature in September 2021 while the company was under the management of Jack Dorsey. Since then, Twitter has been taken over by Elon Musk.

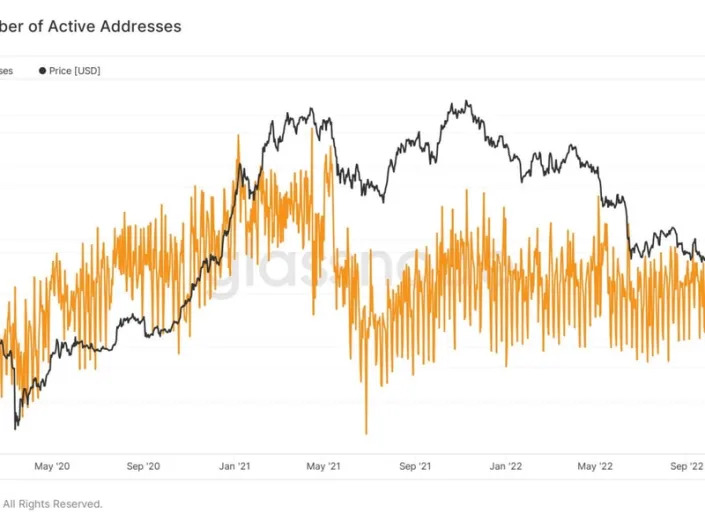

Chart of the Day

(Glassnode)

The chart shows the number of daily active bitcoin addresses since January 2020. The metric filters out addresses with unsuccessful transactions.

The average number of daily active addresses (DAA) this year has been 921,445 – a 16% drop from the 2021 average of 1.1 million.

"Aside from the decline in trading volumes, the fall in DAA could also correspond to reduced mining operations as miners' activity corresponds to BTC's most significant on-chain movements," the Dec. 12 issue of Bitfinex's Alpha report said.

The greater the active user participation on the blockchain, the higher the demand for and the price of the cryptocurrency.

SEC Calls FTT Exchange Token a Security

Sam Reynolds

Wed, December 21, 2022 at 9:25 PM MST·2 min read

FTX's exchange token FTT was sold as an investment contract and thus is a "security," the U.S. Securities and Exchange Commission said in a complaint filed late Wednesday, in a move that is sure to have a wide-ranging impact on the industry.

"If demand for trading on the FTX platform increased, demand for the FTT token could increase, such that any price increase in FTT would benefit holders of FTT equally and in direct proportion to their FTT holdings," the SEC wrote in its complaint. "The large allocation of tokens to FTX incentivized the FTX management team to take steps to attract more users onto the trading platform and, therefore, increase demand for, and increase the trading price of, the FTT token."

The SEC made the claim in a complaint filed against FTX co-founder Gary Wang and former Alameda Research CEO Caroline Ellison.

In the complaint, it highlighted that FTX would use proceeds from the token sale to fund the development, marketing, business operations and growth of FTX while using language to emphasize that FTT is an "investment" with profit potential.

"The FTT materials made clear that FTX’s core management team’s efforts would drive the growth and ultimate success of FTX," the complaint read.

FTT's "buy-and-burn" program was also mentioned. This initiative, used by many other exchange tokens, is akin to a stock buyback where revenue from FTX would repurchase and burn FTT, thus increasing its value.

Ellison and Wang have both pled guilty to the various charges brought before them, and are not contesting the SEC's allegations, the agency said in a press release.

The two are also facing Justice Department and Commodity Futures Trading Commission (CFTC) charges related to their conduct at FTX and Alameda, respectively. "FTT investors had a reasonable expectation of profiting from FTX’s efforts to deploy investor funds to create a use for FTT and bring demand and value to their common enterprise." the SEC added.

The price of other exchange tokens don't appear to be moving on the news. The price of Binance's BNB token remained stagnant after the news broke, declining 0.17% during the Asia morning to $248, according to CoinDesk data. Huobi's HT token is down 2% to $5.29, while OKX's OKB token is up 1.3% to $22.82.

No comments:

Post a Comment