FTX founder Sam Bankman-Fried released on massive $250 million bond

Kevin McCoyKevin Johnson

USA TODAY

NEW YORK – Sam Bankman-Fried, founder of the failed cryptocurrency exchange FTX, was released on a $250 million bond following his first appearance in federal court, where he is accused of misappropriating billions of dollars in customer funds in one of the largest fraud schemes in U.S. history.

The enormous personal recognizance bond, which federal prosecutors described as perhaps the largest ever, is to be co-signed by his parents and two other suretors, and will be secured by his parents’ Palo Alto, California, home.

As a further condition of release, Bankman-Fried must live in his parent’s home with electronic bracelet and other electronic monitoring.

He was prohibited from opening new lines of credit, businesses and barred from transactions over $1,000, except to pay lawyers.

Bankman-Fried left the courthouse in lower Manhattan Thursday afternoon.

What happened with FTX?:How Sam Bankman-Fried's alleged scheme unraveled

More:Sam Bankman-Fried's political donations totaled millions. FTX could sue to recover them.

U.S. Magistrate Judge Gabriel Gorenstein said federal law required him to accept the bond package unless he concluded there were no way to ensure Bankman-Fried would appear for trial. That was not the case, said the judge, who noted that the defndant has no history of prior arrests or violence.

"If you fail to appear in court or violate any of the conditions, a warrant will be issued for your arrest" and the bond could be forfeited, the judge warned.

Gorenstein said the release conditions, particularly the electronic monitoring, “will go very far in ensuring the defendant will be kept track of.”

“Mr. Bankman-Fried perpetrated a fraud of epic proportions” and harmed many victims, Assistant U.S. Attorney Nicolas Roos said, describing the government's case as strong and that includes multiple cooperating witnesses.

Referring to Bankman-Fried's steep fall, Roos said: “His financial assets, which were once in the billions, have diminished significantly.”

'Old-fashioned embezzlement':FTX CEO testifies to Congress; founder Sam Bankman-Fried arrested: recap

The defendant, dressed in a dark suit and tie with a light-colored shirt, accented with ankle shackles, spoke just once, to tell the judge he understood the legal proceedings.

“My client voluntarily consented to come to New York and face these charges,” defense lawyer Mark Cohen said. He called the release conditions a “strong package” that the defense accepted.

The 30-year-old one-time mogul had been held in the Bahamas following his arrest earlier this month, but was extradited to the U.S. late Wednesday to face prosecution in New York.

Two former business associates of Bankman-Fried, Caroline Ellison and Gary Wang, also have pleaded guilty to federal charges and agreed to cooperate with prosecutors investigating the alleged fraud scheme, Manhattan U.S. Attorney Damian Williams said.

Like Bankman-Fried, Ellison and Wang also have been accused of civil charges by the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission.

Before the spectacular financial collapse, Bankman-Fried was the face of FTX, a global company with more than 130 affiliates that allowed individual investors to trade cryptocurrencies, growing to be the third-largest exchange by volume. The company's commercials featured prominent celebrities, and its logo appeared on an NBA stadium and on MLB umpire uniforms.

Sam Bankman-Fried:Report: Former billionaire Sam Bankman-Fried says he's down to $100,000 in bank account

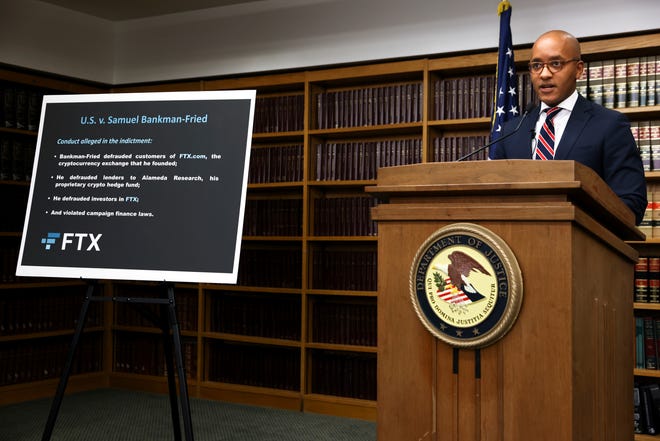

Bankman-Fried is accused of using billions of dollars of FTX funds to make personal investments and millions of dollars in contributions to political campaigns while repaying billions in loans owed by Alameda Research, a cryptocurrency hedge fund that he also founded, according to court documents.

The California man is charged with two counts of wire fraud conspiracy, two separate counts of wire fraud, and one count of conspiracy to commit money laundering.

Each of the charges carry maximum punishments of 20 years in prison.

Bankman-Fried also is charged with conspiracy to commit commodities fraud, conspiracy to commit securities fraud, and conspiracy to defraud the United States and commit campaign finance violations, each of which carries a maximum sentence of five years.

According to the SEC court complaint, Ellison, the former chief executive of Alameda Research, furthered the alleged fraud scheme by following Bankman-Fried's instructions to manipulate the price of FTT, an FTX-issued crypto security token.

Wang, an FTX co-founder and former chief technology officer, created FTX’s software code that allowed Alameda to divert FTX customer funds, and enabled Ellison to misappropriate FTX customer funds for Alameda’s trading activity, the SEC court complaint alleged.

No comments:

Post a Comment