Top 50 mining companies surge to new record near $2 trillion valuation

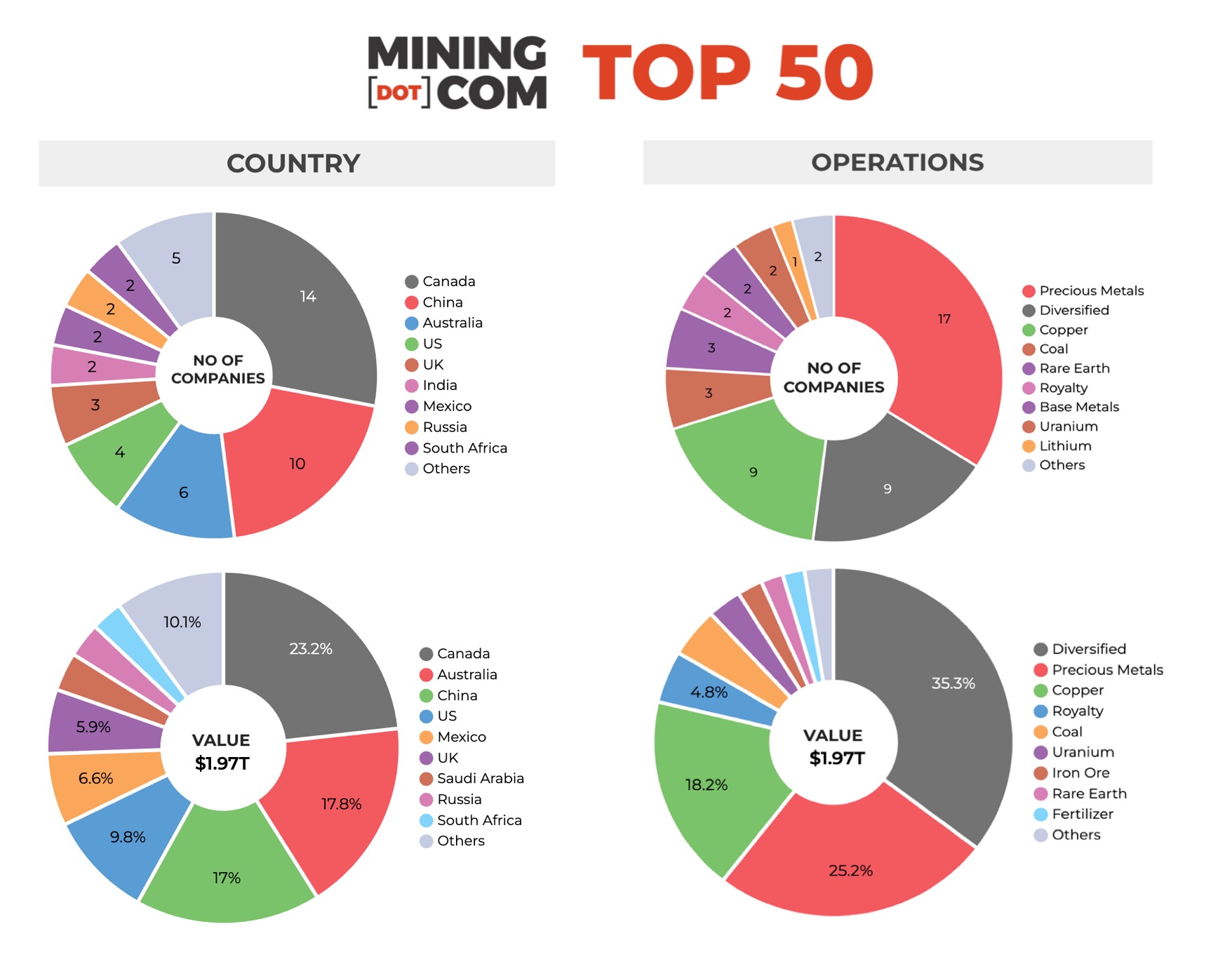

At the end of the third quarter the MINING.COM TOP 50* ranking of the world’s most valuable miners had a combined market capitalization of just under $1.97 trillion, up nearly $700 billion so far in 2025 with most of the gains accumulated in the third quarter.

The total stock market valuation of the world’s biggest mining companies has finally surpassed the previous record high reached more than three years ago and in the process transformed the ranking of the upper echelons.

Trends in the global mining industry that have been documented in these pages for more than a decade have finally broken through to the mainstream with critical minerals suddenly on everybody’s lips – from the US president down to the proverbial taxi driver sharing stock picks.

The weakness in the greenback played a part in the blowout quarter – the ranking is based on a company’s market capitalization in local currency on its primary exchange and then converted to USD where applicable.

Rampant precious metals prices, including the thoroughly revived platinum group metals, can take much of the credit, although amid the general buoyancy the 60-plus percentage gains in PGM prices were not enough to see producers re-enter the ranking.

The best performing list shines with gold and silver counters, including an eye-popping six-fold increase for erstwhile minnows like Coeur Mining (which timed its acquisition of Mexican silver mines to perfection) and a 305% jump for Fresnillo, the London-listed silver miner controlled by Mexico’s Peñoles.

Apart from gold and silver, rare earths have been the standout sector. Squeaking in at no. 49 after soaring by 280%, Perth’s Lynas Rare Earth joins Las Vegas-based MP Materials, which rocketed up the charts in Q2 after a groundbreaking deal with the Pentagon.

MP Materials is now up nearly 500% and China Northern Rare Earth, the only rare earth stock to ever feature in the top 50, in sympathy is up 160% since the start of the year.

Changes in the top tier dominated by diversified giants and gold and copper specialists have also seen a thorough reshuffle.

The global mining industry is trying to consolidate to attract more large-scale investors to the sector but so far the results have been mixed at best.

Since inception, the MINING.COM TOP 50 was headed by two firms – BHP and Rio Tinto – the only miners with consistent market capitalizations above $100 billion (with a wobble here and there). Now there are five firms with the distinction and likely more to come.

Attempted combinations by the two Melbourne-based companies (including of the two of them in 2008) have gone nowhere. BHP’s failure to buy Anglo American last year saw the company pivot to organic copper growth with up to $10B being spent on Escondida alone, the world’s largest copper mine (for now).

The chances of Rio Tinto’s off-again on-again love affair with Glencore being consummated, looks slim and new CEO Simon Trott’s restructuring looks more like preparation for spin-offs than company level M&A, particularly after the head-scratching Arcadium Lithium buy. The now 20-year old Alcan deal probably also still haunts boardrooms in Melbourne.

While BHP still has a clear lead of nearly $30 billion to the nearest competitor, Rio Tinto was for a few trading sessions this week pushed from its usual slot by Chinese champion Zijin Mining.

The diversified giant gained 61% in value over the course of the third quarter alone and is now worth $114.8 billion compared to Rio’s $115.6 billion. In a less frenzied environment Rio Tinto’s more than respectable 14% advance over three months would’ve drawn praise. Now it’s a laggard.

Xiamen-based Zijin, with a string of investments in gold, copper and more recently lithium made over the last few years became only the fourth company to top $100 billion in market value (Vale climbed above that level – briefly – in 2022).

Southern Copper, the NYSE-listed mining arm of Grupo Mexico, also joined the rarified atmosphere of triple digits during the quarter thanks to a 38% jump in Q3.

Like other copper majors Southern Copper is looking to add to its operating assets with an aggressive investment strategy north of $10 billion in Mexico alone, but the company’s valuation is probably now too rich for any would-be acquirer.

Newmont also joined the triple digit club this week. Unlike its acquisitive peers, shortly after swallowing Australia’s Newcrest Mining at the end of 2023 for $17 billion, Newmont embarked on a multi-billion dollar divestiture program.

Agnico Eagle and Kirkland Lake Gold combined in 2022 and the Toronto-based group continues to bolt on assets, making it a candidate for the $100 billion mark should gold continue its death defying rally. Agnico has doubled in value this year and is worth $89.0 billion.

Of the recent mega-deal announcements, the one between Anglo and Teck Resources looks most feasible, but this agreement has also run into trouble, even before regulators get a hold of it.

Teck Resources sharply lowered its 2025 copper guidance due to operational hiccups at its Quebrada Blanca and Highland Valley mines, testing Anglo’s commitment. Particularly after Anglo’s careful concession on headquarters for the merged entity under pressure from Ottawa.

Teck is one of the worst performers for the quarter and as of now, an Anglo-Teck would hardly crack the top 10 with a combined value of a shade under $63 billion, placing it just ahead Freeport-McMoran at number eight.

Freeport, often mentioned as a takeover target, has run into its own copper production problems. Last month a catastrophic mud rush at its Grasberg mine in Indonesia released approximately 800,000 tonnes of material into underground workings, forcing the Phoenix-based company to slash production forecasts.

Freeport is now relatively cheap for a 1.3 million attributable tonnes of copper per year operation (before Grasberg suspension) after being one of only a handful of stocks showing declines over the three months. But companies that have kicked tires, may wait until operations in Indonesia get back on track.

Glencore, which tried and failed to acquire Teck a couple of years ago and only ended up with its coal assets, has also been another perennial underperformer and ended up on the worst performer table again this quarter.

The Swiss miner and commodities trader and no. 4 copper producer behind Freeport, just holds onto the top 10 but is still trading well below its 2011 IPO price in London.

Since the transformative 2013 Glencore–Xstrata merger of equals that was anything but – still the biggest mining deal in history – Baar has always been the bridesmaid but never the bride.

No mining M&A conversation is complete without Glencore. The Ivan Glasenberg and Mick Davis boardroom brawl born out of the mean streets of Johannesburg, was also one of the most entertaining in and outside mining.

Will Glencore and Rio Tinto finally tie the knot? You’d love to see it.

NOTES:

Source: MINING.COM, stock exchange data, company reports. Share data from primary-listed exchange on October 14/15, 2025 close of trading converted to US$ where applicable. Percentage change based on US$ market cap difference, not share price change in local currency.

As with any ranking, criteria for inclusion are contentious. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining (the gold and uranium giant may list later this year), Eurochem, a major potash firm, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry, and how far upstream is the bulk of its revenue, before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or even warrant a seat on the board? This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding were other central considerations. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals on the basis of their deep involvement in the industry.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy or Bayan Resources where power, ports and railways make up a large portion of revenues pose a problem. The revenue mix also tends to change alongside volatile coal prices. Same goes for battery makers like China’s CATL which is increasingly moving upstream, but where mining will continue to represent a small portion of its valuation.

Another consideration is diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking but excluded Kumba Iron Ore in which Anglo has a 70% stake to avoid double counting. Similarly we excluded Hindustan Zinc which is listed separately but majority owned by Vedanta.

With other groups like Mexico’s Penoles where refining and chemicals make up a substantial part of the business where possible the Top 50 would include separately listed operating subsidiaries that are dedicated to mining. This is also why Southern Copper represents Grupo Mexico in the ranking.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia, but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology: email Frik Els at fels@mining.com with Top 50 in the subject line.