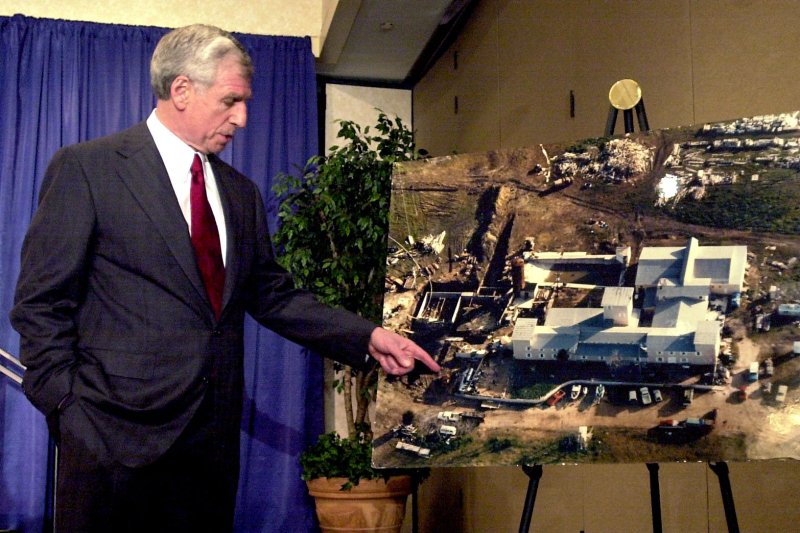

HEY KENNEY HOW'S OUR HERITAGE TRUST FUND DOING

Norway's Johan Sverdrup oil platform is seen in the North Sea on January 7. Norway's wealth fund, established decades ago to invest in oil wealth, reported "historic" earnings for 2019. File Photo by Carina Johansen/EPA-EFE

Feb. 27 (UPI) -- The largest wealth fund in the world said Thursday it achieved "historic" earnings last year that surpassed $180 million.

Norway's sovereign wealth fund said in a report it earned a 20 percent return on investments during 2019 -- the greatest single-year return in its history. Officials said 2019 also saw the second-best return measured as a percentage.

Formally known as the Norges Bank Investment Management, the fund was founded by Norway's central bank in 1990 to invest in the nation's oil wealth.

Oystein Olsen, Norges Bank's chairman of the board, said last year saw the value of its investments surge by $195 billion to a total of almost $1.1 trillion. Investment manager Yngve Slyngstad said the growth was driven by "positive equity returns in all the fund's principal markets."

Fund managers notched a 26 percent return on equity investments, real estate ventures returned almost 7 percent and fixed income investments yielded 7.6 percent.

The wealth fund's total return was 0.23 percentage points higher than the return on the benchmark index.

Norway's Johan Sverdrup oil platform is seen in the North Sea on January 7. Norway's wealth fund, established decades ago to invest in oil wealth, reported "historic" earnings for 2019. File Photo by Carina Johansen/EPA-EFE

Feb. 27 (UPI) -- The largest wealth fund in the world said Thursday it achieved "historic" earnings last year that surpassed $180 million.

Norway's sovereign wealth fund said in a report it earned a 20 percent return on investments during 2019 -- the greatest single-year return in its history. Officials said 2019 also saw the second-best return measured as a percentage.

Formally known as the Norges Bank Investment Management, the fund was founded by Norway's central bank in 1990 to invest in the nation's oil wealth.

Oystein Olsen, Norges Bank's chairman of the board, said last year saw the value of its investments surge by $195 billion to a total of almost $1.1 trillion. Investment manager Yngve Slyngstad said the growth was driven by "positive equity returns in all the fund's principal markets."

Fund managers notched a 26 percent return on equity investments, real estate ventures returned almost 7 percent and fixed income investments yielded 7.6 percent.

The wealth fund's total return was 0.23 percentage points higher than the return on the benchmark index.