Sun, November 6, 2022

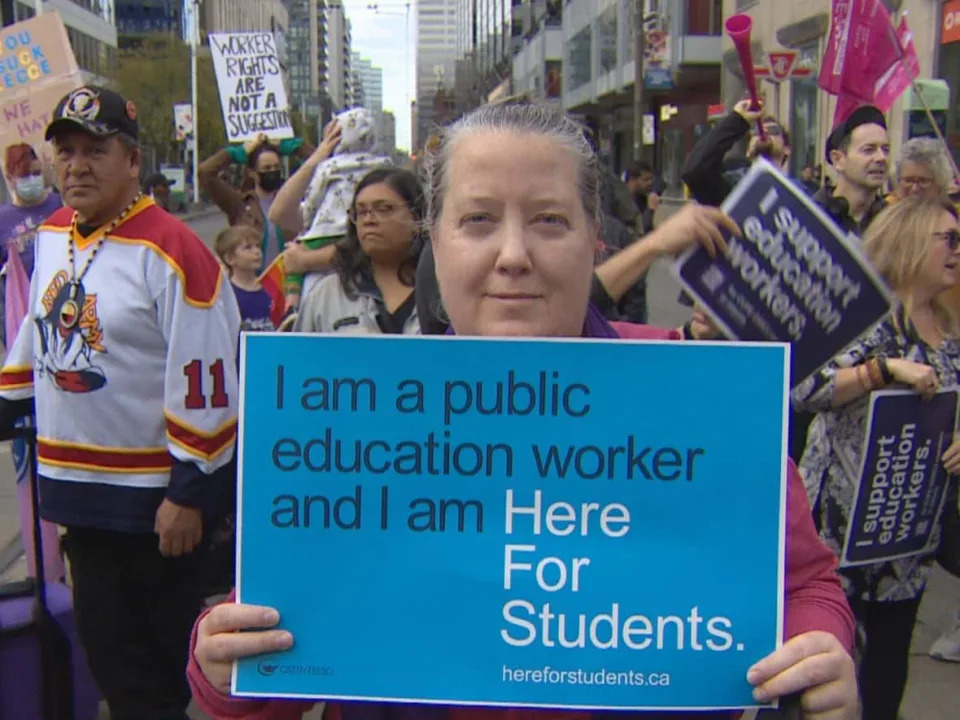

Ned Sharp, a teacher at the York Region District School Board, joined hundreds of supporters who took over Toronto's downtown core Saturday in solidarity with striking CUPE workers. (Alexis Raymon/CBC - image credit)

Ontario education workers will be off the job on Monday and in the days following even if an Ontario labour board determines their strike is illegal, the Canadian Union of Public Employees (CUPE) confirmed to CBC News.

Members of the union are off the job and political protests will continue into next week, a CUPE spokesperson said in an email to CBC Sunday night.

Thousands of education workers, including education assistants, custodians and librarians, walked off the job on Friday to protest the provincial government passing legislation that banned strikes and imposed a four-year contract, using the notwithstanding clause to avoid constitutional challenges.

A hearing at the Ontario Labour Relations Board (OLRB) to determine the legality of the strike concluded Sunday after three days of arguments between lawyers for the provincial government and CUPE.

CUPE's intention to continue their job action regardless of what the board rules was first reported by The Globe and Mail.

OLRB chair Brian O'Byrne said he hopes to render a decision before the school week begins, but he's not sure it can be done.

"I honestly cannot tell you when I will get you a bottom line," O'Byrne said. "I'm going to try and do it by today. Hopefully I'll succeed."

A government lawyer argued before the board that it doesn't matter whether the contract that now binds 55,000 employees was negotiated with their input or imposed upon them.

Ferina Murji said strikes are prohibited in the midst of any contract, not just one that was ratified by union membership.

"A collective agreement is a collective agreement is a collective agreement," she said.

WATCH | CUPE to continue job action this week, regardless of ruling:

The government is seeking a ruling that their walkout is illegal, while CUPE — which represents education workers — contends the job action is a form of legitimate political protest.

The strike closed numerous schools across the province Friday, with even more set to shut on Monday.

"With 55,000 people not attending schools across the province, that means millions of students and their parents are left with nowhere to go, are left not learning, not getting the education that the Education Act ensures they will get," Murji said, stressing the importance of the board's intervention.

Several Ontario school boards said they will move to remote learning next week indefinitely if the education workers' strike continues. Some boards, including the Toronto District School Board, said they will move online as soon as Monday. In-person classes at northern Ontario's largest school board will resume Monday after they were cancelled Friday, the Rainbow District School Board confirmed in a letter to parents.

'Frenzied and sleep-deprived'

O'Byrne heard arguments over the course of 16 hours on Saturday, with the hearing stretching into early Sunday morning, before resuming just hours later, at 7 a.m.

As Day 3 of the hearing got underway, O'Byrne noted the "frenzied and sleep-deprived context of the hearings."

Earlier in the proceedings, CUPE's lawyer argued that an imposed contract should not be treated the same way as one that was negotiated through collective bargaining.

"I do accept that Bill 28 is in writing. But it is not a voluntarily negotiated agreement," Steven Barrett said on Saturday.

"It is deemed to be a collective agreement under Section 5 ... but to call this a mid-contract withdrawal of services, as if this was a collective agreement freely negotiated, is a fundamental absurdity."

Barrett told O'Byrne that should he deem the strike legal, the job action could continue until the government repeals its new legislation or until the union and government negotiate its end.

The province's new law has set fines for violating the ban on strikes of up to $4,000 per employee per day — which could amount to $220 million for all 55,000 workers — and up to $500,000 per day for the union.

CUPE has said it will fight the fines, but will also pay them if it has to.

Poll finds majority blame Ford government

Meanwhile, Ontario residents appear to be placing blame on Premier Doug Ford's Progressive Conservative government for the contract dispute, according to a new public opinion poll released Sunday.

The online poll from Abacus Data found that 62 per cent of respondents blame the provincial government for schools closing after education workers walked off the job Friday. Thirty-eight per cent point the finger at the workers.

Sixty-eight per cent of parents of school-aged children believe the Ford government bears the most responsibility, the survey found, while 71 per cent of respondents want the province to negotiate a "fair deal" with education workers, rather than continue with its current strategy.

The poll, conducted on Nov. 4 and 5, surveyed 1,000 adults and comes with a margin of error of 3.1 per cent, 19 times out of 20, according to Abacus Data.

WATCH | Education Minister Stephen Lecce says province will continue to use every tool to open schools:

The union had been seeking annual salary increases of 11.7 per cent for its workers, who make on average $39,000 a year, but the imposed contract would give 2.5 per cent annual raises to workers making less than $43,000 and 1.5 per cent raises for all others.

Laura Walton, president of CUPE's Ontario School Boards' Council of Unions, said the results of the poll show Ontarians support the education workers in their job action.

"This poll confirms what we already knew: that the majority of people support education workers, that they see through the Ford government's lies about working for workers and students, that they know $39,000 isn't enough, and that they believe workers' rights to freely bargain and strike if necessary must always be protected," Walton said in a statement.

"Seven out of 10 Ontarians want the government to negotiate a fair deal. That starts with repealing Bill 28, an unjust law which Ontarians know is like giving a schoolyard bully a sledgehammer."

CBC News has reached out to the office of the premier and the education minister for comment but did not immediately receive a response.

.png)