President Trump stated that he received a letter from President Zelenskyy expressing Ukraine’s readiness to negotiate with Russia and proposed a deal on Ukraine’s mineral resources.

European leaders, including President Macron, are considering a joint visit to Washington with Zelenskyy and British Prime Minister Starmer to promote peace talks.

European leaders jumped to renew a push for an end to Russia's invasion of Ukraine after US President Donald Trump said President Volodymyr Zelenskyy wrote a letter stating he's ready for talks with Moscow while also offering to sign a deal on Ukraine's mineral resources "at any time."

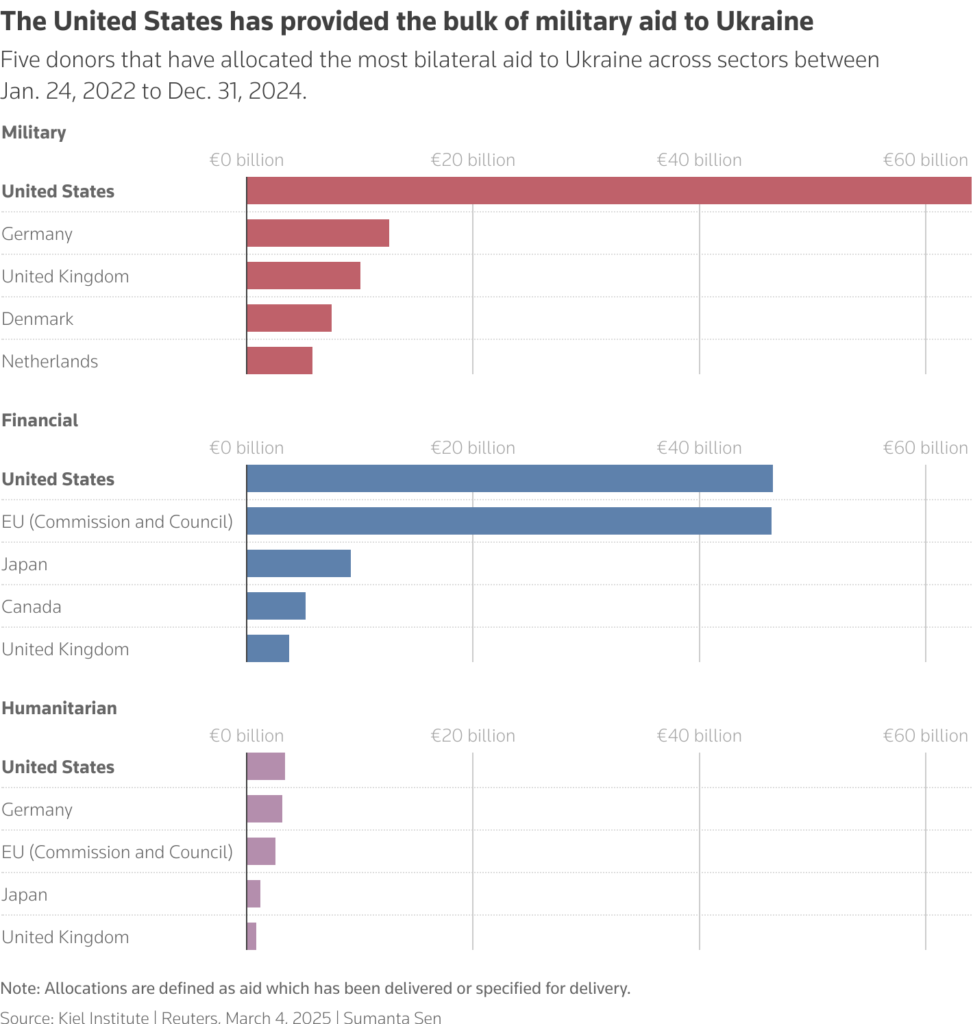

After a week of tumult that culminated with the United States announcing a suspension of military aid to Ukraine after a heated exchange between the two leaders, Trump told a joint session of Congress on March 4 that Zelenskyy sent him a letter expressing a willingness to come to the negotiating table.

That glimmer of hope was all European leaders -- rattled by the disastrous and very public clash between Trump and Zelenskyy at the White House last week -- needed to try to launch a new initiative to get peace talks back on track.

A spokeswoman for the French government told reporters on March 5 that President Emmanuel Macron is mulling a joint visit to Washington with Zelenskyy and British Prime Minister Keir Starmer, all three of whom were in the US capital last week.

"Earlier today, I received an important letter from President Zelenskyy of Ukraine. The letter reads, 'Ukraine is ready to come to the negotiating table as soon as possible to bring lasting peace closer. Nobody wants peace more than the Ukrainians,' he said," Trump quoted the letter as saying.

That came after Zelenskyy said earlier in the day that "none of us wants an endless war," adding Ukraine was "ready to return to the negotiating table as soon as possible to bring long-term peace closer."

"My team and I are ready to work under President Trump's strong leadership to achieve long-term peace," he added.

The Kremlin called Zelenskyy's talk of peace negotiations "positive," though spokesman Dmitry Peskov tamped down the enthusiasm by adding that Ukraine has legally barred negotiations with Russian President Vladimir Putin through a decree the Ukrainian leader signed in 2022.

"So, in general, the approach is positive, but the nuances have not yet changed," Peskov said. "For the time being, there's still a legal ban on the president of Ukraine negotiating with the Russian side."

No Mention Of The Oval Office Disaster

Trump's speech to Congress followed statements from White House officials that there would be a pause on all US military support for Ukraine in its battle to repel invading Russian forces and after the highly public argument in the Oval Office.

Zelenskyy left the White House on February 28 following the dispute and the two did not sign the critical minerals agreement. During a press conference on March 3, Trump said he did not think the deal was dead.

Trump did not mention his public spat with Zelenskyy last week in the Oval Office, flipping the narrative by saying: "We are getting along very well with them and lots of things are happening."

In quoting Zelenskyy, Trump "signaled that he put the conversation in the White House on the sidelines," Mikhail Alexeev, a professor of political science at San Diego State University, told RFE/RL.

"There was no call for Zelenskyy to resign. There was no talk about Ukraine being ungrateful."

Trump has made ending the war a priority and flipped three years of US policy on its head by reaching out directly to Putin, whom his predecessor had isolated politically since the start of the war in February 2022.

US-Ukraine Critical Minerals Deal Back In Focus

Daniel Vajdich, president of Yorktown Solutions, which lobbies on behalf of Kyiv, said the agreement on minerals would be good for both Ukraine and the United States.

"It gives the US concrete equities in Ukraine that should now be protected," said Vajdich.

The fund created by the agreement will be an important mechanism for getting the US private sector to invest in Ukraine’s reconstruction, added Vajdich, a former adviser to several Republican presidential candidates.

Trump had promoted the deal as a way to recoup the billions of dollars in US support since the war began and justify continuing the aid.

Ukrainian political analyst Ihor Reiterovych said Trump's remarks appeared to suggest that the spat with Zelenskyy was over and both are ready to move on.

"It is really very noteworthy that Trump did not say anything specifically about the suspension of military aid to Ukraine," Reiterovych told RFE/RL's Ukrainian Service. "We hope that this issue will be resolved positively in the near future, perhaps not even days, but hours."

'The Longest Ever' Address To Congress

The address was Trump's first to a joint session of Congress since taking office less than 50 days ago.

The US president began his speech by saying "America is back" and touting his policies on immigration, crime, and the efforts of the Department of Government Efficiency (DOGE) led by billionaire Elon Musk to cut government spending.

Trump has pursued a "shock and awe" strategy since being inaugurated on January 20, announcing drastic changes to domestic and foreign policy, often using executive orders to bypass Congress, as he seeks to fulfill his campaign promises.

Rebecca Gill, a political science professor at the University of Nevada Las Vegas, told RFE/RL that the more than 100-minute address, the longest ever by a president to a joint session of Congress, was "typical Trump."

"I don't think anybody would be surprised that it was pretty aggressive and combative," she said.

By RFE/RL